1

Granite Point Mortgage Trust Inc. Provides Second Quarter 2017 Financial Results

and Post-Quarter End Business Update

NEW YORK, August 7, 2017 – Granite Point Mortgage Trust Inc. (NYSE: GPMT), a commercial real estate

investment trust (REIT) focused on directly originating, investing in and managing senior floating rate commercial

mortgage loans and other debt and debt-like commercial real estate investments, today announced its financial

results for the quarter ended June 30, 2017 and provided an update on its activities subsequent to quarter-end. A

presentation containing second quarter 2017 highlights and an investment update can be viewed at

www.gpmortgagetrust.com.

Summary

Completed initial public offering (“IPO”) on June 28, 2017, raising net proceeds of $181.9 million,

resulting in an equity base of $832.4 million.

Acquired a portfolio of commercial real estate debt investments with an aggregate carrying value of

approximately $1.8 billion from Two Harbors Investment Corp. (NYSE: TWO) in exchange for

approximately 33.1 million shares of Granite Point common stock, concurrent with the closing of the IPO.

Reported book value of $19.25 per common share at June 30, 2017.

Originated 6 senior floating rate commercial real estate loans representing aggregate loan amounts,

including future fundings, of approximately $272.1 million during the quarter ended June 30, 2017.

Funded $238.7 million of principal balance of loans during the quarter ended June 30, 2017.

Activity Post Quarter-End

Generated a pipeline of senior floating rate commercial real estate loans representing aggregate loan

amounts, including any future fundings, of approximately $320 million, which have either closed or are in

the closing process, subject to fallout, as of July 31, 2017.

Increased the maximum borrowing capacity under the Wells Fargo credit facility by approximately $97

million, for a total maximum borrowing capacity of approximately $473 million.

2

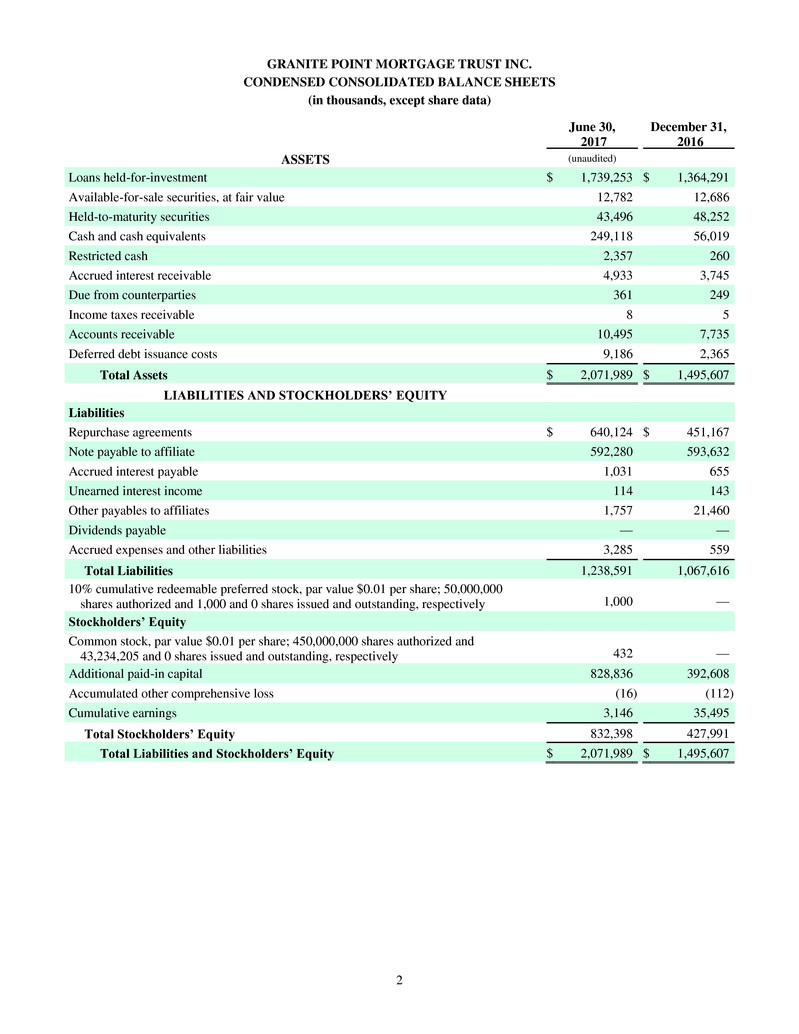

GRANITE POINT MORTGAGE TRUST INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

June 30,

2017

December 31,

2016

ASSETS (unaudited)

Loans held-for-investment $ 1,739,253 $ 1,364,291

Available-for-sale securities, at fair value 12,782 12,686

Held-to-maturity securities 43,496 48,252

Cash and cash equivalents 249,118 56,019

Restricted cash 2,357 260

Accrued interest receivable 4,933 3,745

Due from counterparties 361 249

Income taxes receivable 8 5

Accounts receivable 10,495 7,735

Deferred debt issuance costs 9,186 2,365

Total Assets $ 2,071,989 $ 1,495,607

LIABILITIES AND STOCKHOLDERS’ EQUITY

Liabilities

Repurchase agreements $ 640,124 $ 451,167

Note payable to affiliate 592,280 593,632

Accrued interest payable 1,031 655

Unearned interest income 114 143

Other payables to affiliates 1,757 21,460

Dividends payable — —

Accrued expenses and other liabilities 3,285 559

Total Liabilities 1,238,591 1,067,616

10% cumulative redeemable preferred stock, par value $0.01 per share; 50,000,000

shares authorized and 1,000 and 0 shares issued and outstanding, respectively 1,000

—

Stockholders’ Equity

Common stock, par value $0.01 per share; 450,000,000 shares authorized and

43,234,205 and 0 shares issued and outstanding, respectively 432

—

Additional paid-in capital 828,836 392,608

Accumulated other comprehensive loss (16 ) (112 )

Cumulative earnings 3,146 35,495

Total Stockholders’ Equity 832,398 427,991

Total Liabilities and Stockholders’ Equity $ 2,071,989 $ 1,495,607

3

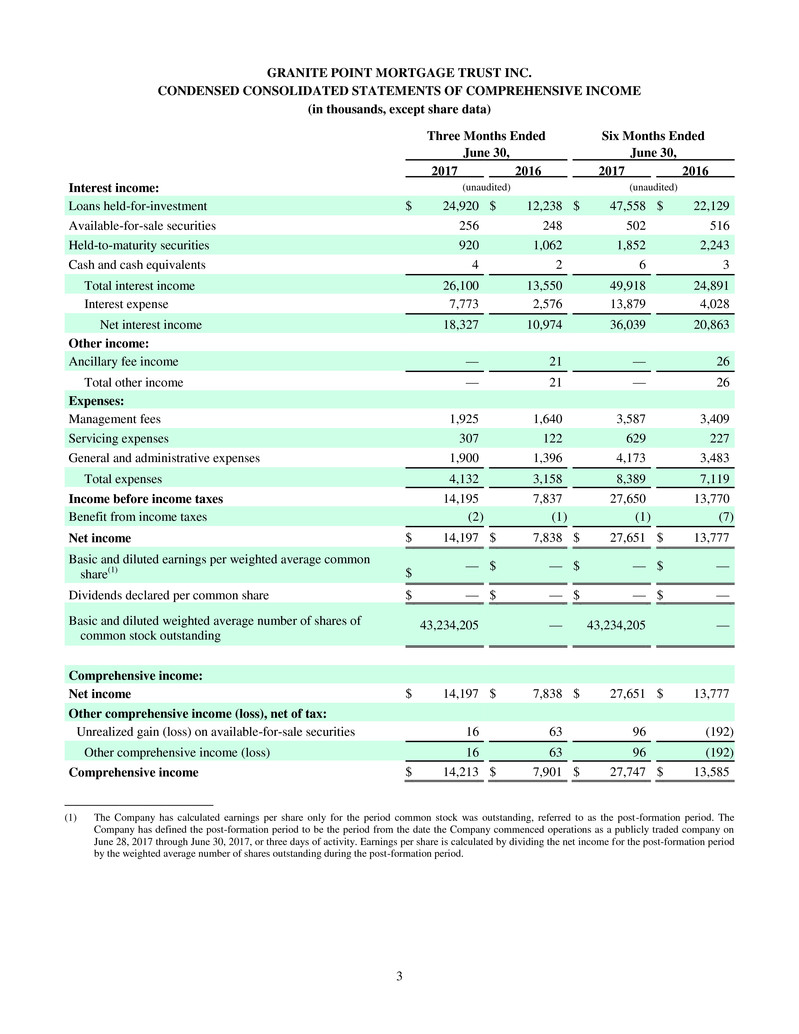

GRANITE POINT MORTGAGE TRUST INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in thousands, except share data)

Three Months Ended Six Months Ended

June 30, June 30,

2017 2016 2017 2016

Interest income: (unaudited) (unaudited)

Loans held-for-investment $ 24,920 $ 12,238 $ 47,558 $ 22,129

Available-for-sale securities 256 248 502 516

Held-to-maturity securities 920 1,062 1,852 2,243

Cash and cash equivalents 4 2 6 3

Total interest income 26,100 13,550 49,918 24,891

Interest expense 7,773 2,576 13,879 4,028

Net interest income 18,327 10,974 36,039 20,863

Other income:

Ancillary fee income — 21 — 26

Total other income — 21 — 26

Expenses:

Management fees 1,925 1,640 3,587 3,409

Servicing expenses 307 122 629 227

General and administrative expenses 1,900 1,396 4,173 3,483

Total expenses 4,132 3,158 8,389 7,119

Income before income taxes 14,195 7,837 27,650 13,770

Benefit from income taxes (2 ) (1 ) (1 ) (7 )

Net income $ 14,197 $ 7,838 $ 27,651 $ 13,777

Basic and diluted earnings per weighted average common

share(1) $

— $ — $ — $ —

Dividends declared per common share $ — $ — $ — $ —

Basic and diluted weighted average number of shares of

common stock outstanding

43,234,205 — 43,234,205 —

Comprehensive income:

Net income $ 14,197 $ 7,838 $ 27,651 $ 13,777

Other comprehensive income (loss), net of tax:

Unrealized gain (loss) on available-for-sale securities 16 63 96 (192 )

Other comprehensive income (loss) 16 63 96 (192 )

Comprehensive income $ 14,213 $ 7,901 $ 27,747 $ 13,585

___________________

(1) The Company has calculated earnings per share only for the period common stock was outstanding, referred to as the post-formation period. The

Company has defined the post-formation period to be the period from the date the Company commenced operations as a publicly traded company on

June 28, 2017 through June 30, 2017, or three days of activity. Earnings per share is calculated by dividing the net income for the post-formation period

by the weighted average number of shares outstanding during the post-formation period.

4

About Granite Point Mortgage Trust Inc.

Granite Point Mortgage Trust Inc. is a Maryland corporation focused on directly originating, investing in

and managing senior floating rate commercial mortgage loans and other debt and debt-like commercial

real estate investments. Granite Point intends to elect and qualify to be taxed as a REIT. Granite Point is

headquartered in New York, New York, and is externally managed by Pine River Capital Management

L.P. Additional information is available at www.gpmortgagetrust.com.

Granite Point is a majority owned subsidiary of Two Harbors Investment Corp. (NYSE: TWO) (“Two

Harbors”), as a result of a formation transaction with Two Harbors pursuant to which Granite Point

acquired from Two Harbors its portfolio of commercial real estate assets. In exchange, Granite Point

issued Two Harbors approximately 33.1 million shares of common stock, representing approximately

76.5% of outstanding common stock. Following the expiration of a 120-day lock-up period following the

closing of Granite Point’s initial public offering, Two Harbors intends to make a distribution of these

shares by means of a special pro rata dividend to Two Harbors’ common stockholders.

Forward-Looking Statements

This press release may include “forward-looking statements” within the meaning of the federal securities

laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies,

anticipated events or trends and similar expressions concerning matters that are not historical facts. In

some cases, you can identify forward-looking statements by the use of forward-looking terminology such

as ‘‘may,’’ ‘‘will,’’ ‘‘should,’’ ‘‘expects,’’ ‘‘intends,’’ ‘‘plans,’’ ‘‘anticipates,’’ ‘‘believes,’’ ‘‘estimates,’’

‘‘predicts,’’ or ‘‘potential’’ or the negative of these words and phrases or similar words or phrases which

are predictions of or indicate future events or trends and which do not relate solely to historical matters.

You can also identify forward-looking statements by discussions of strategy, plans or intentions. All

forward-looking statements address matters that involve risks and uncertainties, many of which are

beyond our control. These risks and uncertainties include, but are not limited to, (i) the state of the U.S.

economy generally or in specific geographic regions; (ii) the state of the commercial real estate market

and the availability and cost of our target assets; (iii) defaults by borrowers in paying debt service on

outstanding items and borrowers’ abilities to manage and stabilize properties; (iv) actions and initiatives

of the U.S. Government and changes to U.S. Government policies; (v) our ability to obtain financing

arrangement on favorable terms if at all; (vi) general volatility of the securities markets in which we

invest; (vii) changes in interest rates and the market value of our investments; (viii) rates of default or

decreased recovery rates on our target investments; (ix) the degree to which our hedging strategies may or

may not protect us from interest rate volatility; (x) changes in governmental regulations, tax law and rates,

and similar matters; and (xi) our ability to qualify as a REIT for U.S. federal income tax purposes. These

forward-looking statements apply only as of the date of this press release. Except as required by law, we

undertake no obligation to update publicly or revise any forward-looking statement, whether as a result of

new information, future developments or otherwise.

Contact

Investors: Marcin Urbaszek, Chief Financial Officer, Granite Point Mortgage Trust Inc., 212-364-3718,

marcin.urbaszek@prcm.com.