November 7, 2017

Third Quarter 2017

Earnings Presentation

Company Overview(1)

2

C YC LE -T EST ED S E N IO R

I N V E STM E NT T E A M

AT T RAC T I VE A N D S U STA I NABLE

M A R KE T O P P O RTUNI T Y

H I G H C R E D IT Q UA L IT Y

I N V E STM E NT P O RT FO L IO

D I F F ER E NT IATE D D I R E C T

O R I G INAT I O N P L ATFO R M

LEADING COMMERCIAL REAL ESTATE FINANCE COMPANY FOCUSED ON DIRECTLY

ORIGINATING AND MANAGING SENIOR FLOATING RATE COMMERCIAL MORTGAGE LOANS

• Over 25 years of experience leading commercial real

estate lending platforms through multiple credit and real

estate cycles

• Extensive experience in investment management

• Broad and longstanding direct relationships within the

commercial real estate lending industry

• Structural changes create an enduring, sectoral shift in

flows of debt capital into U.S. commercial real estate

• Borrower demand for debt capital for both acquisition and

refinancing activity remains strong

• Senior floating rate loans remain an attractive value

proposition within the commercial real estate debt

markets

• Carrying value of $2.2 billion

• Well diversified across property types and geographies

• Senior loans comprise over 90% of the portfolio

• Over 97% of loans are floating rate; well positioned for

rising short term interest rates

• Direct origination of senior floating rate commercial real

estate loans

• Target top 25 and (generally) up to the top 50 MSAs in the

U.S.

• Fundamental value-driven investing combined with credit

intensive underwriting

• Focus on cash flow as one of our key underwriting criteria

• Prioritize income-producing, institutional-quality properties

and sponsors

1) Except as otherwise indicated in this presentation, reported data is as of or for the period ended September 30, 2017.

Investment Strategy and Target Assets

3

INVESTMENT STRATEGY TARGET INVESTMENTS

• Focus on generating stable and attractive cash flows

while preserving capital base

– Primarily direct-originated investments funding property

acquisition, refinancing, recapitalization, restructuring and

repositioning purposes with high credit-quality owners

– Asset-by-asset portfolio construction focused on property

and local market fundamentals and relative value across

property types and markets, as well as within the capital

structure

• Actively participate in primary and secondary markets(1)

Primary target investments

• Senior floating rate commercial real estate loans

• Transitional loans on a variety of property types located in

primary and secondary markets in the U.S.

• Generally sized between $25 million and $150 million

• Stabilized LTV generally ranging from 55% to 70%(2)

• Loan yields generally ranging from LIBOR + 4.00% to

5.50%

Secondary target investments

• Subordinated interests (or B-notes), mezzanine loans,

debt-like preferred equity and real estate-related

securities

1) Primary markets are defined as the top 5 MSAs. Secondary markets are defined as MSAs 6 and above.

2) Except as otherwise indicated in this presentation, stabilized loan-to-value ratio (LTV) is calculated as the fully funded loan amount (plus any financing that is pari passu with or senior to such loan),

including all contractually provided for future fundings, divided by the as stabilized value (as determined in conformance with USPAP) set forth in the original appraisal. As stabilized value may be based

on certain assumptions, such as future construction completion, projected re-tenanting, payment of tenant improvement or leasing commissions allowances or free or abated rent periods, or increased

tenant occupancies.

Primary

Markets, 42%Secondary

Markets, 58%

Business Highlights

THIRD QUARTER FINANCIAL HIGHLIGHTS

• Delivered GAAP net income of $11.5 million or $0.27 per common share; Core Earnings of $11.9 million or $0.28 per

common share(1); taxable income of $14.3 million or $0.33 per common share; and book value of $19.22 per

common share.

• Closed 11 senior floating rate commercial real estate loans with total commitments of approximately $450.4 million

having a weighted average stabilized LTV of 66% and weighted average yield of LIBOR + 4.89%(2); funded $379.8

million of principal balance of loans and an additional $13.6 million of existing loan commitments, bringing total

fundings to $393.4 million.

• Owned a portfolio with a principal balance of $2.2 billion, which was 97% floating rate in predominantly senior

commercial mortgage loans with a weighted average stabilized LTV of 64%.

FOURTH QUARTER ACTIVITY

• Generated a pipeline of senior floating rate commercial real estate loans with total commitments of over $320

million, and initial funding loan amounts of over $240 million, which have either closed or are in the closing process,

subject to fallout.

• Amended one financing facility to increase borrowing capacity by $100 million, bringing total borrowing capacity to

$2.1 billion; in negotiations to amend a second financing facility to increase borrowing capacity by $250 million,

bringing total borrowing capacity to $2.3 billion, subject to closing conditions.

41) Core Earnings is a non-GAAP measure. Please see slide 5 for a definition of Core Earnings and a reconciliation of GAAP to non-GAAP financial information.

2) Yield includes net origination fees and exit fees, but does not include future fundings, and is expressed as a monthly equivalent yield.

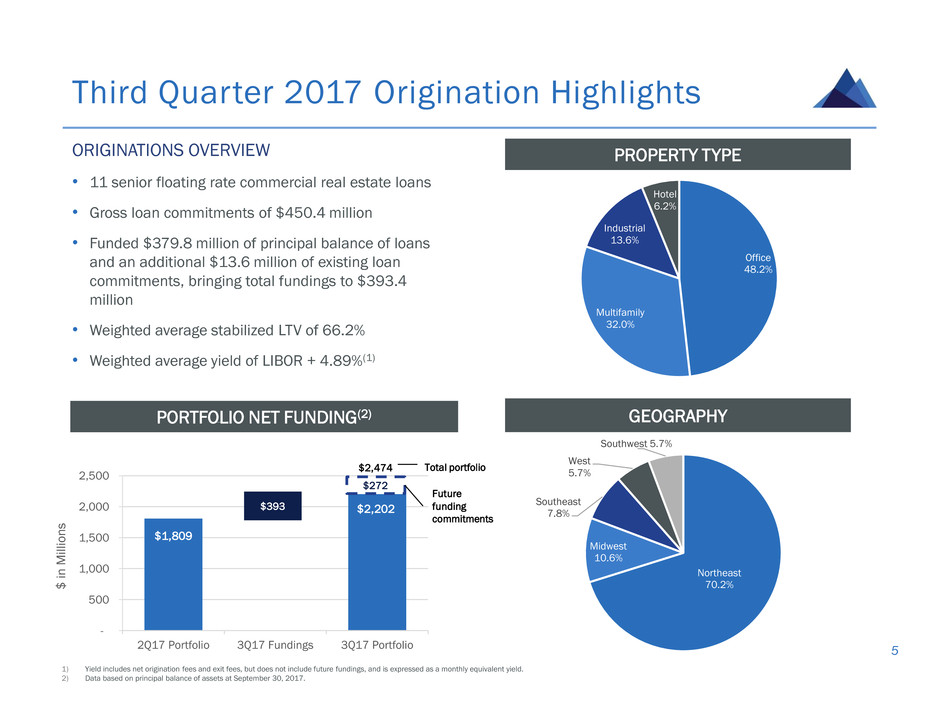

Third Quarter 2017 Origination Highlights

ORIGINATIONS OVERVIEW

• 11 senior floating rate commercial real estate loans

• Gross loan commitments of $450.4 million

• Funded $379.8 million of principal balance of loans

and an additional $13.6 million of existing loan

commitments, bringing total fundings to $393.4

million

• Weighted average stabilized LTV of 66.2%

• Weighted average yield of LIBOR + 4.89%(1)

5

PROPERTY TYPE

GEOGRAPHYPORTFOLIO NET FUNDING(2)

$1,809

$2,202

-

500

1,000

1,500

2,000

2,500

2Q17 Portfolio 3Q17 Fundings 3Q17 Portfolio

$

in

Mi

lli

o

n

s

$393

$272

$2,474

Future

funding

commitments

Total portfolio

Office

48.2%

Multifamily

32.0%

Industrial

13.6%

Hotel

6.2%

Northeast

70.2%

Midwest

10.6%

Southeast

7.8%

West

5.7%

Southwest 5.7%

1) Yield includes net origination fees and exit fees, but does not include future fundings, and is expressed as a monthly equivalent yield.

2) Data based on principal balance of assets at September 30, 2017.

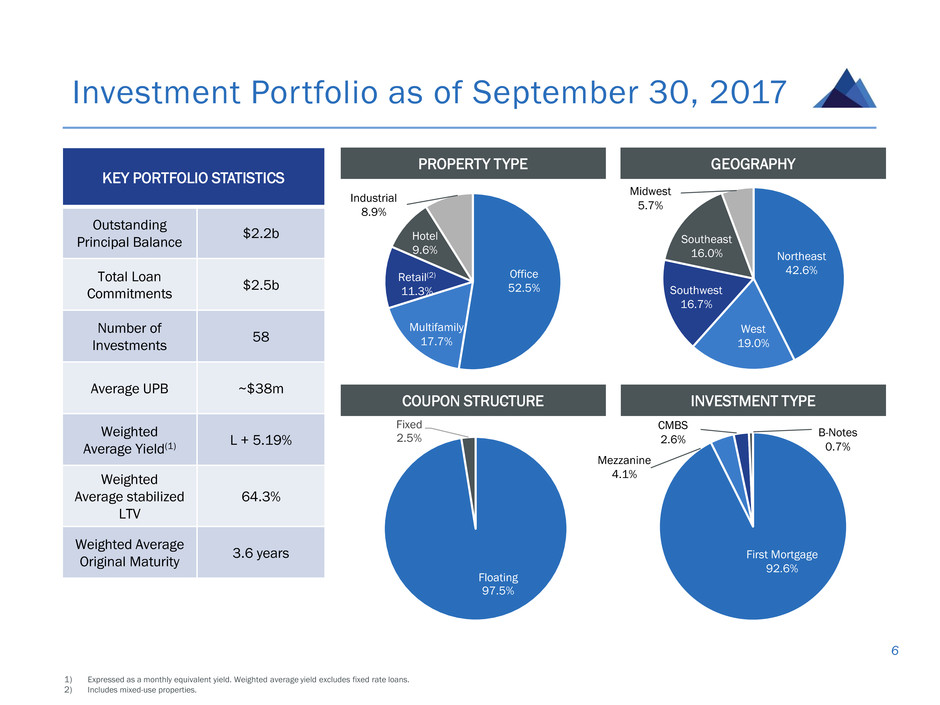

Investment Portfolio as of September 30, 2017

6

PROPERTY TYPE GEOGRAPHY

COUPON STRUCTURE INVESTMENT TYPE

1) Expressed as a monthly equivalent yield. Weighted average yield excludes fixed rate loans.

2) Includes mixed-use properties.

KEY PORTFOLIO STATISTICS

Outstanding

Principal Balance

$2.2b

Total Loan

Commitments

$2.5b

Number of

Investments

58

Average UPB ~$38m

Weighted

Average Yield(1)

L + 5.19%

Weighted

Average stabilized

LTV

64.3%

Weighted Average

Original Maturity

3.6 years

Office

52.5%

Multifamily

17.7%

Retail(2)

11.3%

Hotel

9.6%

Industrial

8.9%

First Mortgage

92.6%

Mezzanine

4.1%

B-Notes

0.7%

Northeast

42.6%

West

19.0%

Southwest

16.7%

Southeast

16.0%

Midwest

5.7%

CMBS

2.6%

Floating

97.5%

Fixed

2.5%

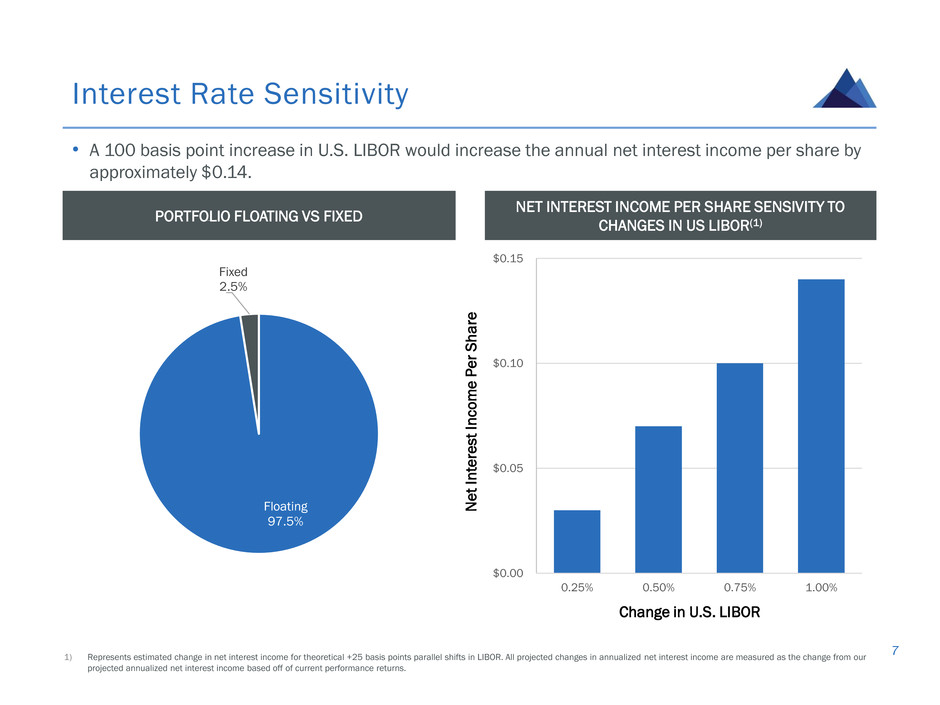

Interest Rate Sensitivity

• A 100 basis point increase in U.S. LIBOR would increase the annual net interest income per share by

approximately $0.14.

7

PORTFOLIO FLOATING VS FIXED

Floating

97.5%

Fixed

2.5%

$0.00

$0.05

$0.10

$0.15

0.25% 0.50% 0.75% 1.00%

NET INTEREST INCOME PER SHARE SENSIVITY TO

CHANGES IN US LIBOR(1)

1) Represents estimated change in net interest income for theoretical +25 basis points parallel shifts in LIBOR. All projected changes in annualized net interest income are measured as the change from our

projected annualized net interest income based off of current performance returns.

Change in U.S. LIBOR

N

e

t

In

te

re

st

I

n

c

o

m

e

P

e

r

S

h

a

re

8

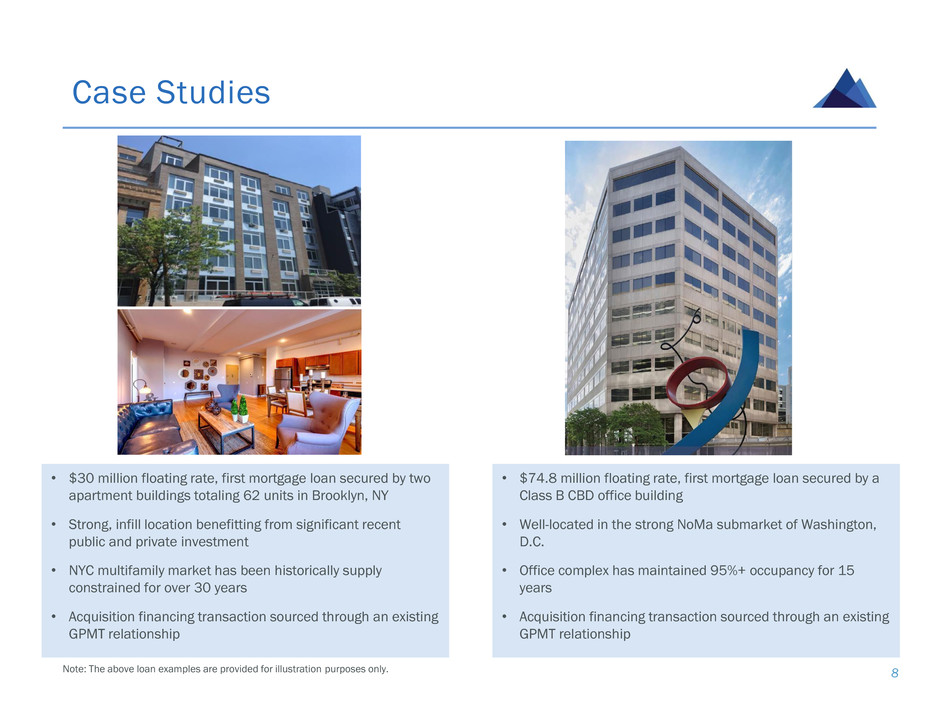

Case Studies

Note: The above loan examples are provided for illustration purposes only.

• $30 million floating rate, first mortgage loan secured by two

apartment buildings totaling 62 units in Brooklyn, NY

• Strong, infill location benefitting from significant recent

public and private investment

• NYC multifamily market has been historically supply

constrained for over 30 years

• Acquisition financing transaction sourced through an existing

GPMT relationship

• $74.8 million floating rate, first mortgage loan secured by a

Class B CBD office building

• Well-located in the strong NoMa submarket of Washington,

D.C.

• Office complex has maintained 95%+ occupancy for 15

years

• Acquisition financing transaction sourced through an existing

GPMT relationship

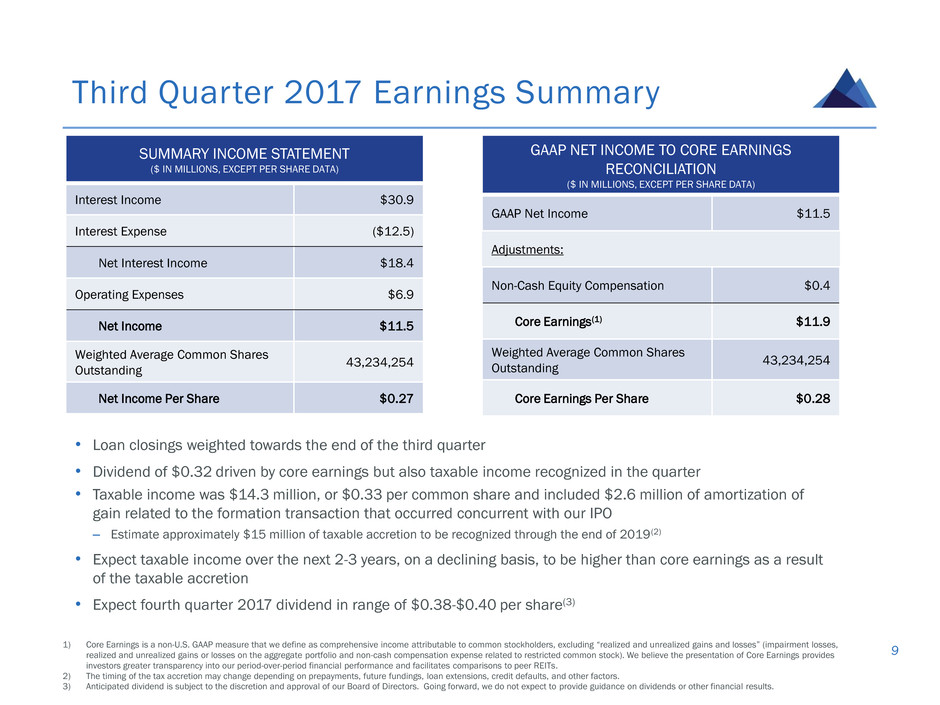

Third Quarter 2017 Earnings Summary

• Loan closings weighted towards the end of the third quarter

• Dividend of $0.32 driven by core earnings but also taxable income recognized in the quarter

• Taxable income was $14.3 million, or $0.33 per common share and included $2.6 million of amortization of

gain related to the formation transaction that occurred concurrent with our IPO

– Estimate approximately $15 million of taxable accretion to be recognized through the end of 2019(2)

• Expect taxable income over the next 2-3 years, on a declining basis, to be higher than core earnings as a result

of the taxable accretion

• Expect fourth quarter 2017 dividend in range of $0.38-$0.40 per share(3)

9

SUMMARY INCOME STATEMENT

($ IN MILLIONS, EXCEPT PER SHARE DATA)

Interest Income $30.9

Interest Expense ($12.5)

Net Interest Income $18.4

Operating Expenses $6.9

Net Income $11.5

Weighted Average Common Shares

Outstanding

43,234,254

Net Income Per Share $0.27

GAAP NET INCOME TO CORE EARNINGS

RECONCILIATION

($ IN MILLIONS, EXCEPT PER SHARE DATA)

GAAP Net Income $11.5

Adjustments:

Non-Cash Equity Compensation $0.4

Core Earnings(1) $11.9

Weighted Average Common Shares

Outstanding

43,234,254

Core Earnings Per Share $0.28

1) Core Earnings is a non-U.S. GAAP measure that we define as comprehensive income attributable to common stockholders, excluding “realized and unrealized gains and losses” (impairment losses,

realized and unrealized gains or losses on the aggregate portfolio and non-cash compensation expense related to restricted common stock). We believe the presentation of Core Earnings provides

investors greater transparency into our period-over-period financial performance and facilitates comparisons to peer REITs.

2) The timing of the tax accretion may change depending on prepayments, future fundings, loan extensions, credit defaults, and other factors.

3) Anticipated dividend is subject to the discretion and approval of our Board of Directors. Going forward, we do not expect to provide guidance on dividends or other financial results.

Third Quarter 2017 Capitalization and Liquidity

10

• Amended financing facility with Morgan Stanley to increase borrowing capacity by $100 million, bringing

total borrowing capacity to $2.1 billion; in negotiations to amend a second financing facility to increase

borrowing capacity by $250 million, bringing total borrowing capacity to $2.3 billion, subject to closing

conditions.

SUMMARY BALANCE SHEET

($ IN MILLIONS, EXCEPT PER SHARE DATA)

Cash $142.4

Investment Portfolio $2,184.2

Repurchase Facilities Outstanding $1,475.3

Stockholders’ Equity $830.8

Debt-to-Equity Ratio(2) 1.8x

Common Stock Outstanding 43,235,103

Book Value Per Common Share $19.22

SUMMARY FINANCING(1)

($ IN MILLIONS)

Maximum Borrowing Capacity $1,973.8

Outstanding Balance $1,475.3

Remaining Borrowing Capacity $498.5

1) Excludes short-term bridge financing facility with UBS.

2) Defined as total borrowings to fund the investment portfolio, divided by total equity.

Appendix

Formation Summary

COMPANY FORMATION SUMMARY

• Granite Point was formed by Two Harbors Investment Corp. (NYSE: TWO) in a spin-out transaction in

order to continue the commercial real estate lending business established by Two Harbors in 2015

• As part of the formation transaction in June 2017, we:

– Completed an initial public offering (IPO), raising net proceeds of $181.9 million

– Issued 33,071,000 shares of common stock to Two Harbors in exchange for the $1.8 billion commercial real

estate portfolio that we originated while part of Two Harbors

– Established significant borrowing capacity of approximately $2.0 billion

• Two Harbors completed the spin-out on November 1, 2017 by distributing its shares of Granite Point

common stock to its stockholders, allowing our market capitalization to be fully floating

12

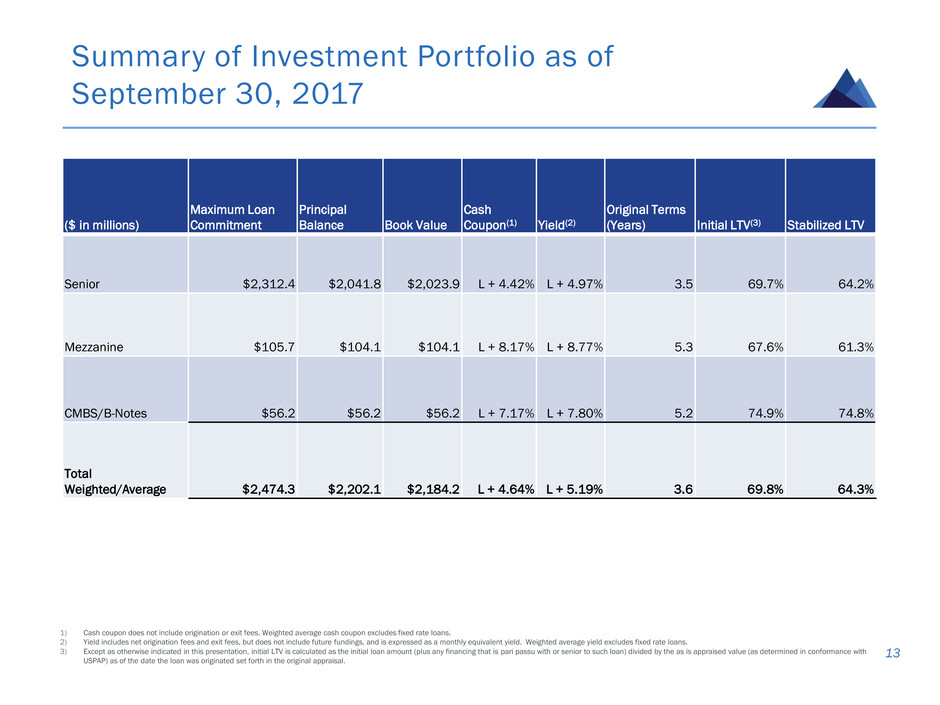

Summary of Investment Portfolio as of

September 30, 2017

13

($ in millions)

Maximum Loan

Commitment

Principal

Balance Book Value

Cash

Coupon(1) Yield(2)

Original Terms

(Years) Initial LTV(3) Stabilized LTV

Senior $2,312.4 $2,041.8 $2,023.9 L + 4.42% L + 4.97% 3.5 69.7% 64.2%

Mezzanine $105.7 $104.1 $104.1 L + 8.17% L + 8.77% 5.3 67.6% 61.3%

CMBS/B-Notes $56.2 $56.2 $56.2 L + 7.17% L + 7.80% 5.2 74.9% 74.8%

Total

Weighted/Average $2,474.3 $2,202.1 $2,184.2 L + 4.64% L + 5.19% 3.6 69.8% 64.3%

1) Cash coupon does not include origination or exit fees. Weighted average cash coupon excludes fixed rate loans.

2) Yield includes net origination fees and exit fees, but does not include future fundings, and is expressed as a monthly equivalent yield. Weighted average yield excludes fixed rate loans.

3) Except as otherwise indicated in this presentation, initial LTV is calculated as the initial loan amount (plus any financing that is pari passu with or senior to such loan) divided by the as is appraised value (as determined in conformance with

USPAP) as of the date the loan was originated set forth in the original appraisal.

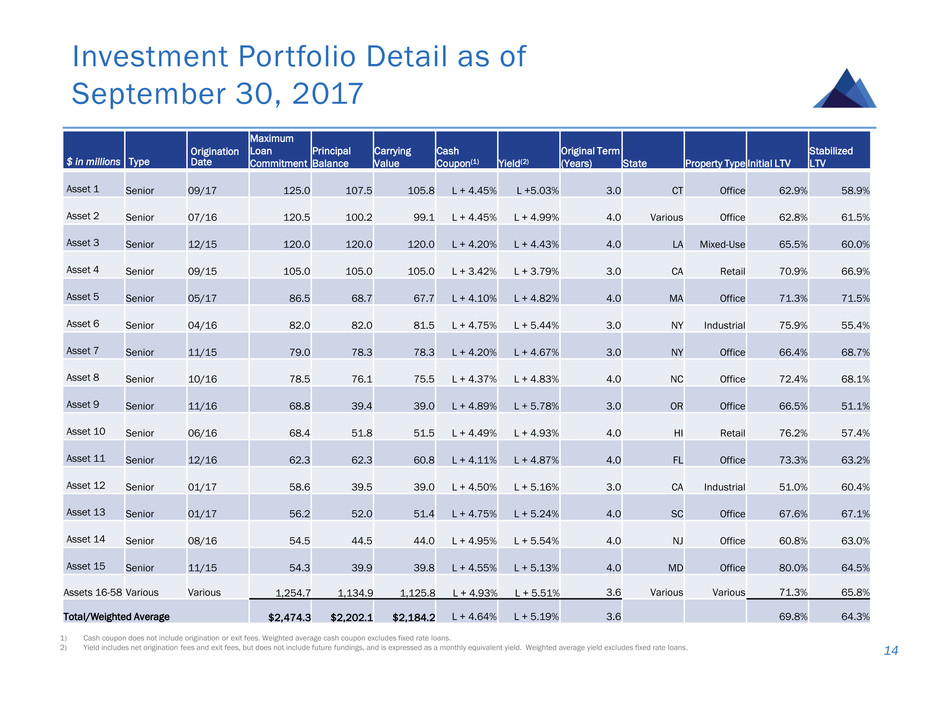

Investment Portfolio Detail as of

September 30, 2017

14

1) Cash coupon does not include origination or exit fees. Weighted average cash coupon excludes fixed rate loans.

2) Yield includes net origination fees and exit fees, but does not include future fundings, and is expressed as a monthly equivalent yield. Weighted average yield excludes fixed rate loans.

$ in millions Type

Origination

Date

Maximum

Loan

Commitment

Principal

Balance

Carrying

Value

Cash

Coupon(1) Yield(2)

Original Term

(Years) State Property Type Initial LTV

Stabilized

LTV

Asset 1 Senior 09/17 125.0 107.5 105.8 L + 4.45% L +5.03% 3.0 CT Office 62.9% 58.9%

Asset 2 Senior 07/16 120.5 100.2 99.1 L + 4.45% L + 4.99% 4.0 Various Office 62.8% 61.5%

Asset 3 Senior 12/15 120.0 120.0 120.0 L + 4.20% L + 4.43% 4.0 LA Mixed-Use 65.5% 60.0%

Asset 4 Senior 09/15 105.0 105.0 105.0 L + 3.42% L + 3.79% 3.0 CA Retail 70.9% 66.9%

Asset 5 Senior 05/17 86.5 68.7 67.7 L + 4.10% L + 4.82% 4.0 MA Office 71.3% 71.5%

Asset 6 Senior 04/16 82.0 82.0 81.5 L + 4.75% L + 5.44% 3.0 NY Industrial 75.9% 55.4%

Asset 7 Senior 11/15 79.0 78.3 78.3 L + 4.20% L + 4.67% 3.0 NY Office 66.4% 68.7%

Asset 8 Senior 10/16 78.5 76.1 75.5 L + 4.37% L + 4.83% 4.0 NC Office 72.4% 68.1%

Asset 9 Senior 11/16 68.8 39.4 39.0 L + 4.89% L + 5.78% 3.0 OR Office 66.5% 51.1%

Asset 10 Senior 06/16 68.4 51.8 51.5 L + 4.49% L + 4.93% 4.0 HI Retail 76.2% 57.4%

Asset 11 Senior 12/16 62.3 62.3 60.8 L + 4.11% L + 4.87% 4.0 FL Office 73.3% 63.2%

Asset 12 Senior 01/17 58.6 39.5 39.0 L + 4.50% L + 5.16% 3.0 CA Industrial 51.0% 60.4%

Asset 13 Senior 01/17 56.2 52.0 51.4 L + 4.75% L + 5.24% 4.0 SC Office 67.6% 67.1%

Asset 14 Senior 08/16 54.5 44.5 44.0 L + 4.95% L + 5.54% 4.0 NJ Office 60.8% 63.0%

Asset 15 Senior 11/15 54.3 39.9 39.8 L + 4.55% L + 5.13% 4.0 MD Office 80.0% 64.5%

Assets 16-58 Various Various 1,254.7 1,134.9 1,125.8 L + 4.93% L + 5.51% 3.6 Various Various 71.3% 65.8%

Total/Weighted Average $2,474.3 $2,202.1 $2,184.2 L + 4.64% L + 5.19% 3.6 69.8% 64.3%

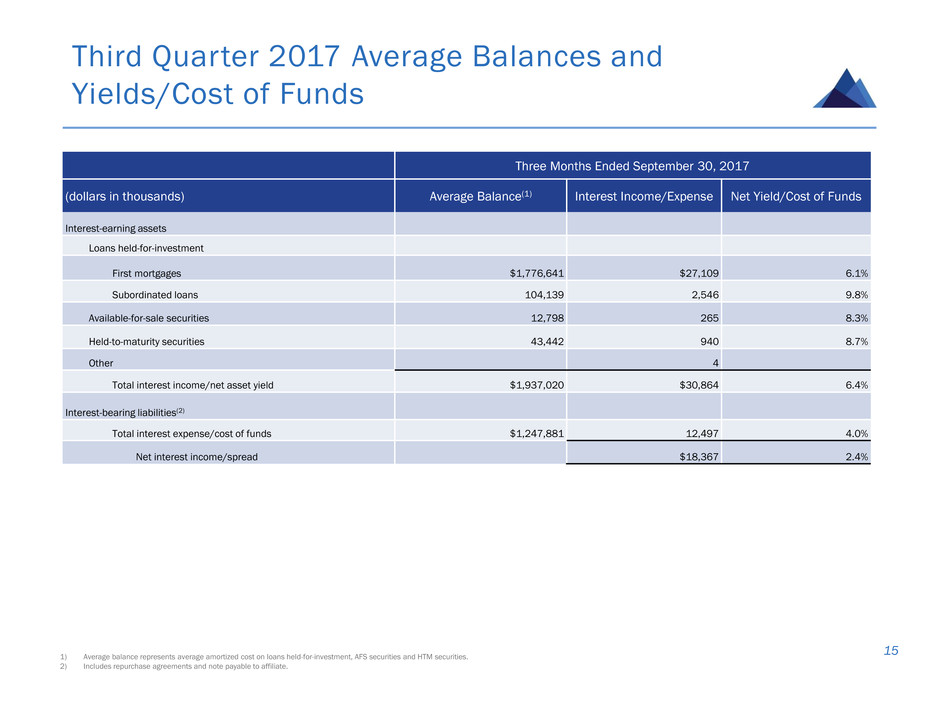

Third Quarter 2017 Average Balances and

Yields/Cost of Funds

15

Three Months Ended September 30, 2017

(dollars in thousands) Average Balance(1) Interest Income/Expense Net Yield/Cost of Funds

Interest-earning assets

Loans held-for-investment

First mortgages $1,776,641 $27,109 6.1%

Subordinated loans 104,139 2,546 9.8%

Available-for-sale securities 12,798 265 8.3%

Held-to-maturity securities 43,442 940 8.7%

Other 4

Total interest income/net asset yield $1,937,020 $30,864 6.4%

Interest-bearing liabilities(2)

Total interest expense/cost of funds $1,247,881 12,497 4.0%

Net interest income/spread $18,367 2.4%

1) Average balance represents average amortized cost on loans held-for-investment, AFS securities and HTM securities.

2) Includes repurchase agreements and note payable to affiliate.

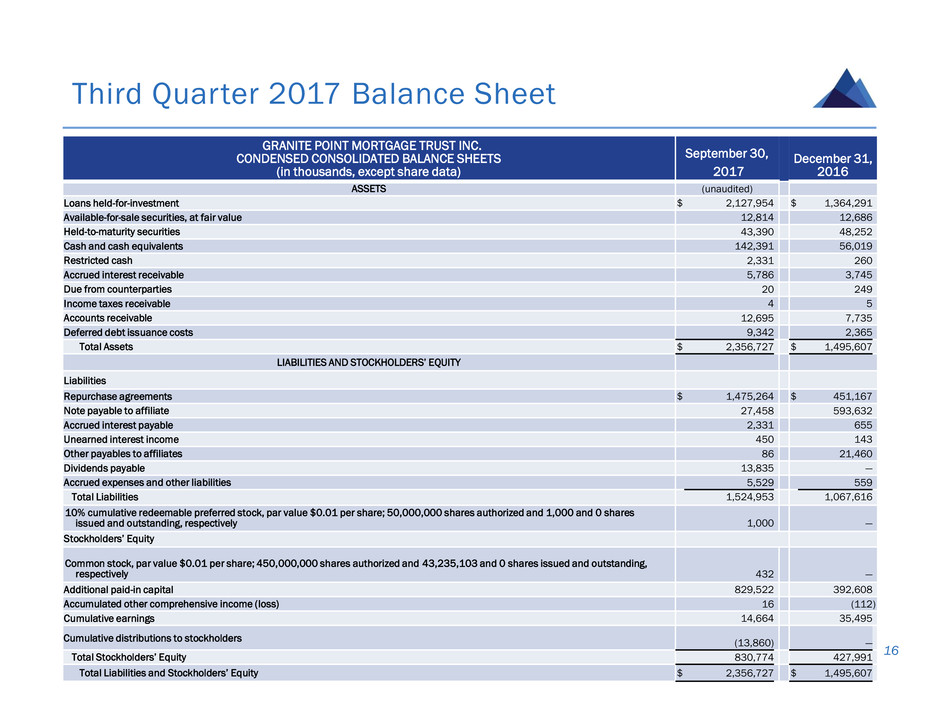

Third Quarter 2017 Balance Sheet

16

GRANITE POINT MORTGAGE TRUST INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

September 30,

2017

December 31,

2016

ASSETS (unaudited)

Loans held-for-investment $ 2,127,954 $ 1,364,291

Available-for-sale securities, at fair value 12,814 12,686

Held-to-maturity securities 43,390 48,252

Cash and cash equivalents 142,391 56,019

Restricted cash 2,331 260

Accrued interest receivable 5,786 3,745

Due from counterparties 20 249

Income taxes receivable 4 5

Accounts receivable 12,695 7,735

Deferred debt issuance costs 9,342 2,365

Total Assets $ 2,356,727 $ 1,495,607

LIABILITIES AND STOCKHOLDERS’ EQUITY

Liabilities

Repurchase agreements $ 1,475,264 $ 451,167

Note payable to affiliate 27,458 593,632

Accrued interest payable 2,331 655

Unearned interest income 450 143

Other payables to affiliates 86 21,460

Dividends payable 13,835 —

Accrued expenses and other liabilities 5,529 559

Total Liabilities 1,524,953 1,067,616

10% cumulative redeemable preferred stock, par value $0.01 per share; 50,000,000 shares authorized and 1,000 and 0 shares

issued and outstanding, respectively 1,000 —

Stockholders’ Equity

Common stock, par value $0.01 per share; 450,000,000 shares authorized and 43,235,103 and 0 shares issued and outstanding,

respectively 432 —

Additional paid-in capital 829,522 392,608

Accumulated other comprehensive income (loss) 16 (112)

Cumulative earnings 14,664 35,495

Cumulative distributions to stockholders (13,860) —

Total Stockholders’ Equity 830,774 427,991

Total Liabilities and Stockholders’ Equity $ 2,356,727 $ 1,495,607

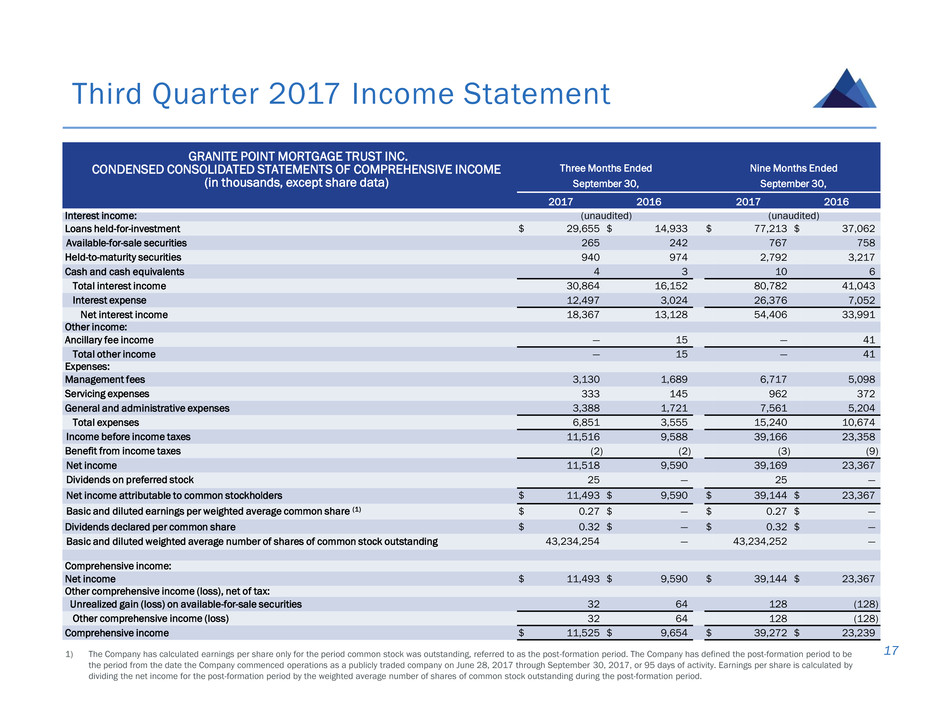

Third Quarter 2017 Income Statement

17

GRANITE POINT MORTGAGE TRUST INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in thousands, except share data)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2017 2016 2017 2016

Interest income: (unaudited) (unaudited)

Loans held-for-investment $ 29,655 $ 14,933 $ 77,213 $ 37,062

Available-for-sale securities 265 242 767 758

Held-to-maturity securities 940 974 2,792 3,217

Cash and cash equivalents 4 3 10 6

Total interest income 30,864 16,152 80,782 41,043

Interest expense 12,497 3,024 26,376 7,052

Net interest income 18,367 13,128 54,406 33,991

Other income:

Ancillary fee income — 15 — 41

Total other income — 15 — 41

Expenses:

Management fees 3,130 1,689 6,717 5,098

Servicing expenses 333 145 962 372

General and administrative expenses 3,388 1,721 7,561 5,204

Total expenses 6,851 3,555 15,240 10,674

Income before income taxes 11,516 9,588 39,166 23,358

Benefit from income taxes (2) (2) (3) (9)

Net income 11,518 9,590 39,169 23,367

Dividends on preferred stock 25 — 25 —

Net income attributable to common stockholders $ 11,493 $ 9,590 $ 39,144 $ 23,367

Basic and diluted earnings per weighted average common share (1) $ 0.27 $ — $ 0.27 $ —

Dividends declared per common share $ 0.32 $ — $ 0.32 $ —

Basic and diluted weighted average number of shares of common stock outstanding 43,234,254 — 43,234,252 —

Comprehensive income:

Net income $ 11,493 $ 9,590 $ 39,144 $ 23,367

Other comprehensive income (loss), net of tax:

Unrealized gain (loss) on available-for-sale securities 32 64 128 (128)

Other comprehensive income (loss) 32 64 128 (128)

Comprehensive income $ 11,525 $ 9,654 $ 39,272 $ 23,239

1) The Company has calculated earnings per share only for the period common stock was outstanding, referred to as the post-formation period. The Company has defined the post-formation period to be

the period from the date the Company commenced operations as a publicly traded company on June 28, 2017 through September 30, 2017, or 95 days of activity. Earnings per share is calculated by

dividing the net income for the post-formation period by the weighted average number of shares of common stock outstanding during the post-formation period.