Third Quarter 2018 Earnings Presentation November 6, 2018

Safe Harbor Statement This presentation contains, in addition to historical information, certain forward-looking statements that are based on our current assumptions, expectations and projections about future performance and events. In particular, statements regarding future economic performance, finances, and expectations and objectives of management constitute forward-looking statements. Forward-looking statements are not historical in nature and can be identified by words such as "believes," "expects," "may," "will," "should," "seeks," "approximately," "intends," "plans," "estimates," "anticipates," “targets,” “goals,” “future,” “likely” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters. Although the forward-looking statements contained in this presentation are based upon information available at the time the statements are made and reflect the best judgment of our senior management, forward-looking statements inherently involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements to differ materially from anticipated future results. Important factors that could cause actual results to differ materially from expected results, including, among other things, those described in our filings with the Securities and Exchange Commission (“SEC”), including our annual report on form 10-K for the year ended December 31, 2017, and any subsequent Quarterly Reports on Form 10-Q under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: the state of the U.S. economy generally or in specific geographic regions; the general political, economic, and competitive conditions in the markets in which we invest; defaults by borrowers in paying debt service on outstanding indebtedness and borrowers' abilities to manage and stabilize properties; our ability to obtain financing arrangements on terms favorable to us or at all; the level and volatility of prevailing interest rates and credit spreads; reductions in the yield on our investments and an increase in the cost of our financing; general volatility of the securities markets in which we participate; the return or impact of current or future investments; allocation of investment opportunities to us by our Manager; increased competition from entities investing in our target assets; effects of hedging instruments on our target investments; changes in governmental regulations, tax law and rates, and similar matters; our ability to maintain our qualification as a REIT for U.S. federal income tax purposes and our exclusion from registration under the Investment Company Act; availability of desirable investment opportunities; availability of qualified personnel and our relationship with our Manager; estimates relating to our ability to make distributions to our stockholders in the future; hurricanes, earthquakes, and other natural disasters, acts of war and/or terrorism and other events that may cause unanticipated and uninsured performance declines and/or losses to us or the owners and operators of the real estate securing our investments; deterioration in the performance of the properties securing our investments that may cause deterioration in the performance of our investments and, potentially, principal losses to us; and difficulty or delays in redeploying the proceeds from repayments of our existing investments. These forward-looking statements apply only as of the date of this press release. We are under no duty to update any of these forward-looking statements after the date of this presentation to conform these statements to actual results or revised expectations. You should, therefore, not rely on these forward-looking statements as predictions of future events. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. 2

Company Overview(1) LEADING COMMERCIAL REAL ESTATE FINANCE COMPANY FOCUSED ON DIRECTLY ORIGINATING AND MANAGING SENIOR FLOATING RATE COMMERCIAL MORTGAGE LOANS E XPEX PE RIE NNCE CE D A N D CYCLEC YCLE-TE STE D AT T RAC TIVE A N D S U STAINABLE S E N IOR C RER E T E AAM M MAM A RKRKE E T OPO P P ORTORTUNIT U N IT Y • Over 20 years of experience each in the commercial real • Structural changes create an enduring, sectoral shift in estate debt markets flows of debt capital into U.S. commercial real estate • Extensive experience in investment management and • Borrower demand for debt capital for both acquisition and structured finance refinancing activity remains strong • Broad and longstanding direct relationships within the • Senior floating rate loans remain an attractive value commercial real estate lending industry proposition within the commercial real estate debt markets D IF F EERE RE NT IATE D D IRE C T HIGH I G H C RER E D IT QUAQ UA LIT Y ORIGO R IG ININATION ATION P LATLATFORM FORM INI N V E STSTME ME NT P ORTO RT FOLIO • Direct origination of senior floating rate commercial real • Carrying value of $2.8 billion and well diversified across estate loans property types and geographies • Target top 25 and (generally) up to the top 50 MSAs in the • Senior loans comprise over 96% of the portfolio U.S. • Over 98% of portfolio is floating rate and well positioned • Fundamental value-driven investing combined with credit for rising short term interest rates intensive underwriting • Focus on cash flow as one of our key underwriting criteria • Diversified financing profile with a mix of secured credit facilities, non-recourse term-matched CLO debt and • Prioritize income-producing, institutional-quality properties unsecured convertible bonds and sponsors 3 (1) Except as otherwise indicated in this presentation, reported data is as of or for the period ended September 30, 2018.

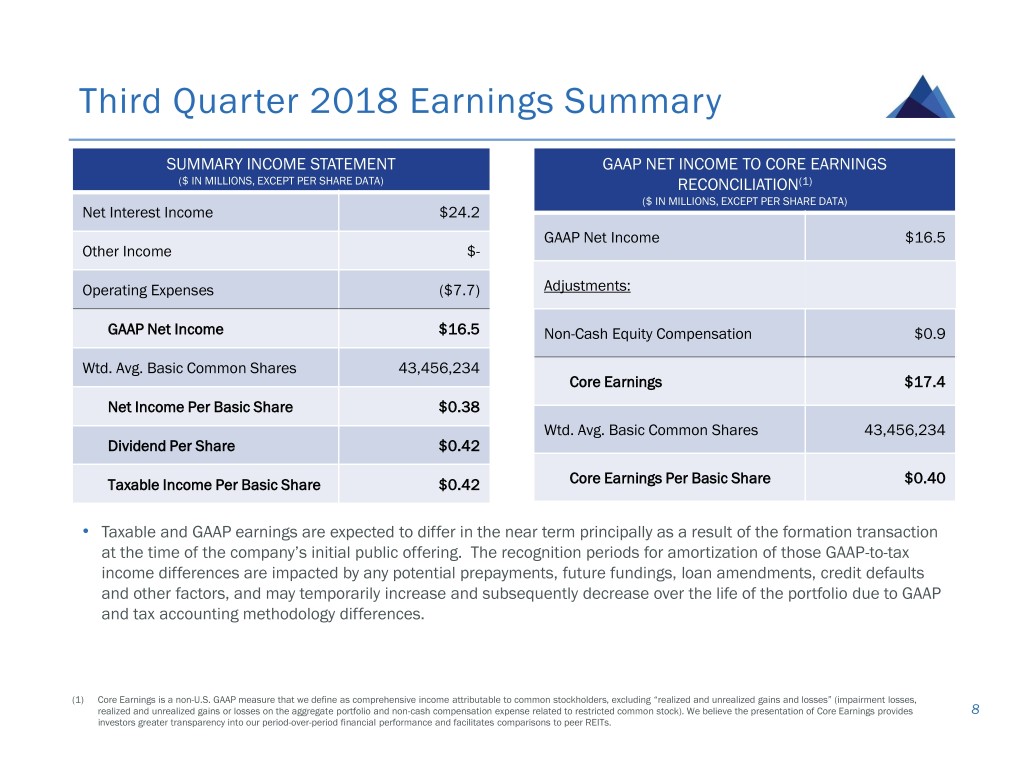

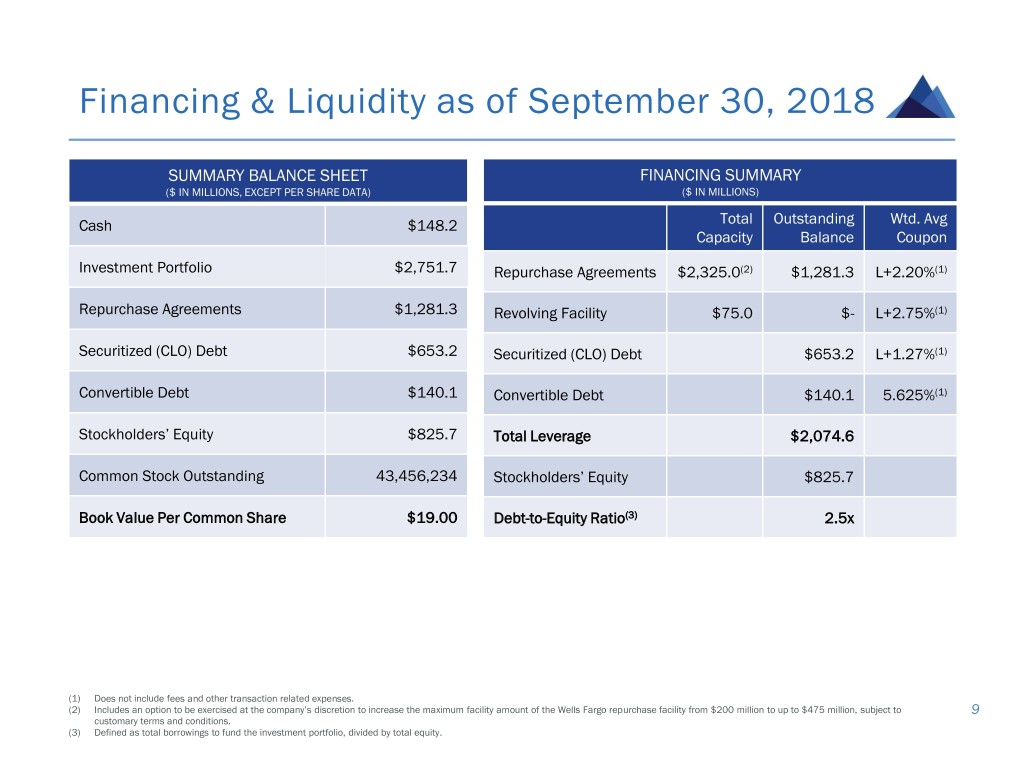

Third Quarter 2018 Business Highlights . GAAP net income of $16.5 million or $0.38 per basic share; Core Earnings(1) of $17.4 million or $0.40 FINANCIAL per basic share SUMMARY . Taxable income of $18.4 million or $0.42 per basic share; dividend of $0.42 per common share; and book value of $19.00 per common share . Closed on $297.9 million of senior floating rate loan commitments with a weighted average stabilized LTV of 59% and a weighted average yield of LIBOR + 4.02%(2) PORTFOLIO . Funded $249.5 million in UPB during the quarter including $33.6 million on existing loan commitments ACTIVITY and $1.6 million to upsize 3 existing loans, whose total commitments were increased by $16.5 million . Received prepayments and principal amortization of $27.3 million . Principal balance of $2.8 billion (plus an additional $441.5 million of future funding commitments) PORTFOLIO . Over 98% floating rate and comprised of over 96% senior loans OVERVIEW . Weighted average stabilized LTV of 63% and weighted average yield of LIBOR + 5.00%(2) . 5 secured repurchase agreements with a total outstanding balance of $1.3 billion and an aggregate borrowing capacity of up to $2.3 billion(3) . CAPITALIZATION $660.2 million principal balance of secured CLO debt financing $826.6 million of senior loans . $144 million principal balance senior unsecured convertible notes . A secured revolving financing facility with borrowing capacity of up to $75 million . In October 2018, issued over $130 million of 5-year, 6.375% senior unsecured convertible notes FOURTH QUARTER . Generated a pipeline of senior floating rate CRE loans with total commitments of approximately $600 ACTIVITY million, and initial funding loan amounts of approximately $400 million, which have either closed or are expected to close later in the fourth quarter of 2018 or in the first quarter of 2019, subject to fallout (1) Core Earnings is a non-GAAP measure. Please see slide 9 for a definition of Core Earnings and a reconciliation of GAAP to non-GAAP financial information. (2) Yield includes net origination fees and exit fees, but does not include future fundings, and is expressed as a monthly equivalent yield. 4 (3) Includes an option to be exercised at the company’s discretion to increase the maximum facility amount of the Wells Fargo repurchase facility from $200 million to up to $475 million, subject to customary terms and conditions.

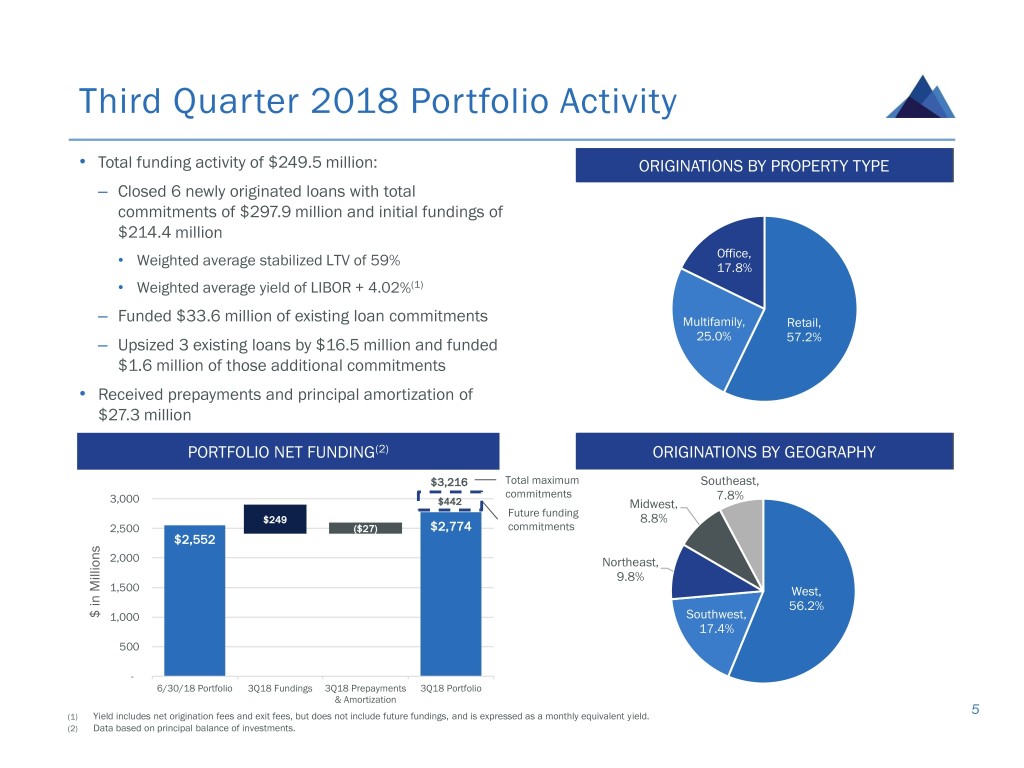

Third Quarter 2018 Portfolio Activity • Total funding activity of $249.5 million: ORIGINATIONSPROPERTY BY PROPERTY TYPE TYPE – Closed 6 newly originated loans with total commitments of $297.9 million and initial fundings of $214.4 million Office, • Weighted average stabilized LTV of 59% 17.8% • Weighted average yield of LIBOR + 4.02%(1) – Funded $33.6 million of existing loan commitments Multifamily, Retail, 25.0% – Upsized 3 existing loans by $16.5 million and funded 57.2% $1.6 million of those additional commitments • Received prepayments and principal amortization of $27.3 million PORTFOLIO NET FUNDING(2) ORIGINATIONSGEOGRAPHY BY GEOGRAPHY $3,216 Total maximum Southeast, commitments 7.8% 3,000 $442 Midwest, Future funding $249 8.8% 2,500 ($27) $2,774 commitments $2,552 2,000 Northeast, 9.8% 1,500 West, 56.2% $ in Millions 1,000 Southwest, 17.4% 500 - 6/30/18 Portfolio 3Q18 Fundings 3Q18 Prepayments 3Q18 Portfolio & Amortization 5 (1) Yield includes net origination fees and exit fees, but does not include future fundings, and is expressed as a monthly equivalent yield. (2) Data based on principal balance of investments.

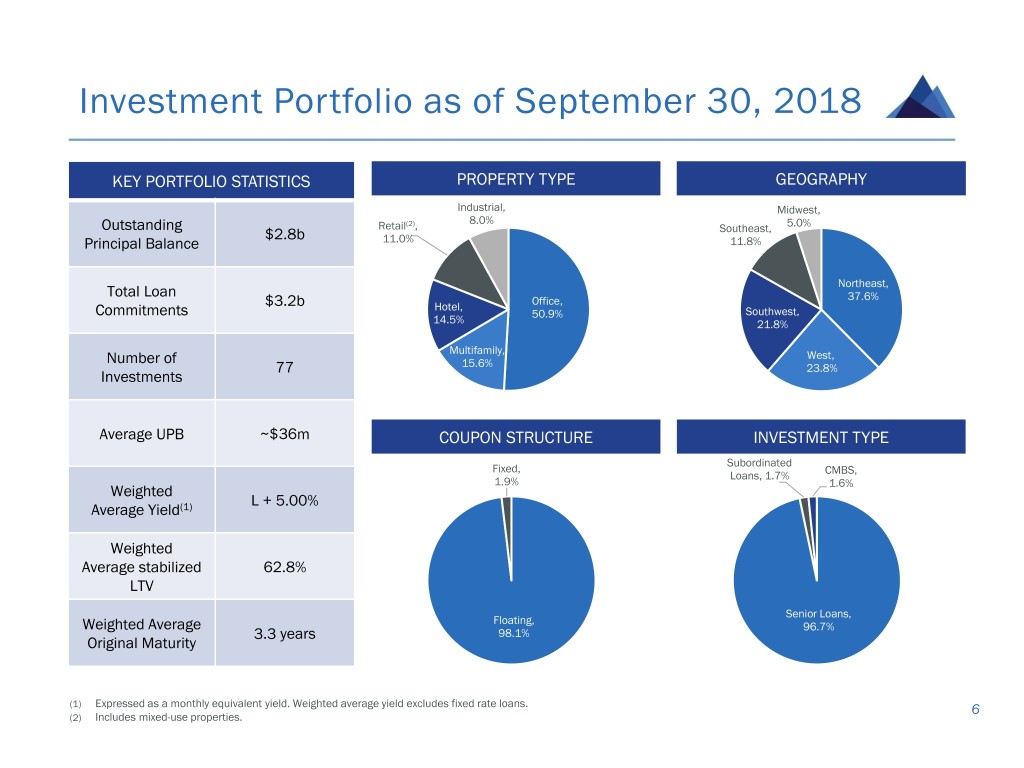

Investment Portfolio as of September 30, 2018 KEY PORTFOLIO STATISTICS PROPERTY TYPE GEOGRAPHY Industrial, Midwest, Outstanding Retail(2), 8.0% 5.0% $2.8b Southeast, Principal Balance 11.0% 11.8% Northeast, Total Loan Office, 37.6% $3.2b Hotel, Commitments 50.9% Southwest, 14.5% 21.8% Number of Multifamily, West, 77 15.6% 23.8% Investments Average UPB ~$36m COUPON STRUCTURE INVESTMENT TYPE Subordinated Fixed, Loans, 1.7% CMBS, 1.9% 1.6% Weighted L + 5.00% Average Yield(1) Weighted Average stabilized 62.8% LTV Senior Loans, Floating, Weighted Average 96.7% 3.3 years 98.1% Original Maturity (1) Expressed as a monthly equivalent yield. Weighted average yield excludes fixed rate loans. 6 (2) Includes mixed-use properties.

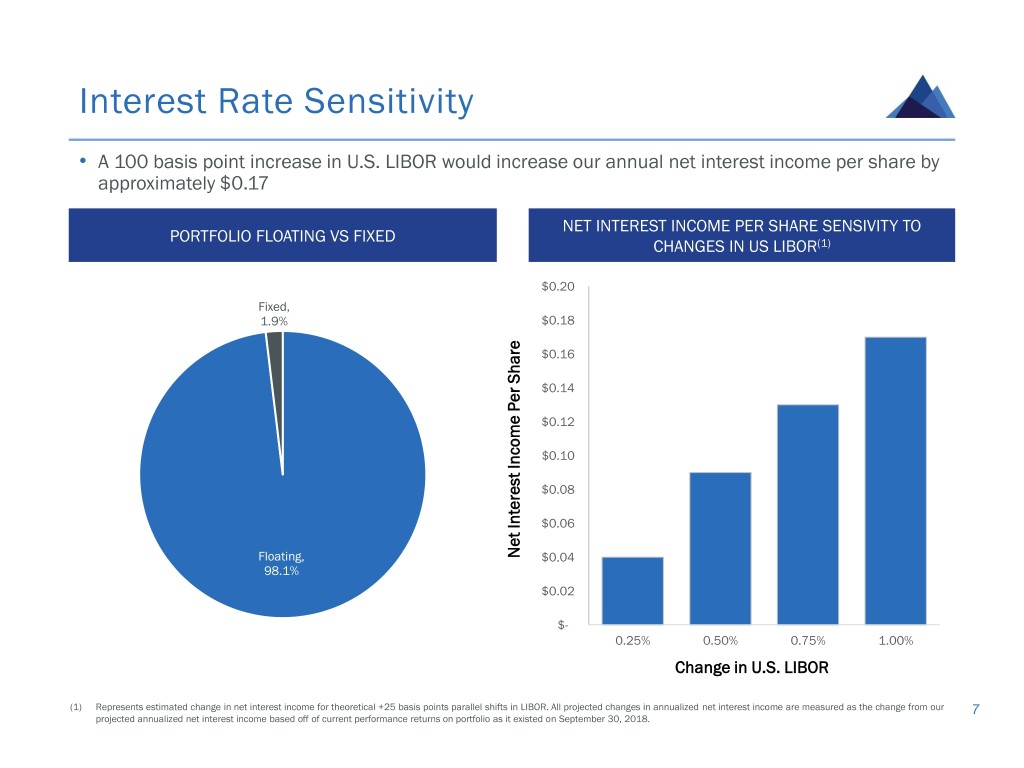

Interest Rate Sensitivity • A 100 basis point increase in U.S. LIBOR would increase our annual net interest income per share by approximately $0.17 NET INTEREST INCOME PER SHARE SENSIVITY TO PORTFOLIO FLOATING VS FIXED CHANGES IN US LIBOR(1) $0.20 Fixed, 1.9% $0.18 $0.16 $0.14 $0.12 $0.10 $0.08 $0.06 Floating, SharePerInterestIncomeNet $0.04 98.1% $0.02 $- 0.25% 0.50% 0.75% 1.00% Change in U.S. LIBOR (1) Represents estimated change in net interest income for theoretical +25 basis points parallel shifts in LIBOR. All projected changes in annualized net interest income are measured as the change from our 7 projected annualized net interest income based off of current performance returns on portfolio as it existed on September 30, 2018.

Third Quarter 2018 Earnings Summary SUMMARY INCOME STATEMENT GAAP NET INCOME TO CORE EARNINGS ($ IN MILLIONS, EXCEPT PER SHARE DATA) RECONCILIATION(1) ($ IN MILLIONS, EXCEPT PER SHARE DATA) Net Interest Income $24.2 GAAP Net Income $16.5 Other Income $- Operating Expenses ($7.7) Adjustments: GAAP Net Income $16.5 Non-Cash Equity Compensation $0.9 Wtd. Avg. Basic Common Shares 43,456,234 Core Earnings $17.4 Net Income Per Basic Share $0.38 Wtd. Avg. Basic Common Shares 43,456,234 Dividend Per Share $0.42 Taxable Income Per Basic Share $0.42 Core Earnings Per Basic Share $0.40 • Taxable and GAAP earnings are expected to differ in the near term principally as a result of the formation transaction at the time of the company’s initial public offering. The recognition periods for amortization of those GAAP-to-tax income differences are impacted by any potential prepayments, future fundings, loan amendments, credit defaults and other factors, and may temporarily increase and subsequently decrease over the life of the portfolio due to GAAP and tax accounting methodology differences. (1) Core Earnings is a non-U.S. GAAP measure that we define as comprehensive income attributable to common stockholders, excluding “realized and unrealized gains and losses” (impairment losses, realized and unrealized gains or losses on the aggregate portfolio and non-cash compensation expense related to restricted common stock). We believe the presentation of Core Earnings provides 8 investors greater transparency into our period-over-period financial performance and facilitates comparisons to peer REITs.

Financing & Liquidity as of September 30, 2018 SUMMARY BALANCE SHEET FINANCING SUMMARY ($ IN MILLIONS, EXCEPT PER SHARE DATA) ($ IN MILLIONS) Cash $148.2 Total Outstanding Wtd. Avg Capacity Balance Coupon Investment Portfolio $2,751.7 Repurchase Agreements $2,325.0(2) $1,281.3 L+2.20%(1) Repurchase Agreements $1,281.3 Revolving Facility $75.0 $- L+2.75%(1) Securitized (CLO) Debt $653.2 Securitized (CLO) Debt $653.2 L+1.27%(1) Convertible Debt $140.1 Convertible Debt $140.1 5.625%(1) Stockholders’ Equity $825.7 Total Leverage $2,074.6 Common Stock Outstanding 43,456,234 Stockholders’ Equity $825.7 Book Value Per Common Share $19.00 Debt-to-Equity Ratio(3) 2.5x (1) Does not include fees and other transaction related expenses. (2) Includes an option to be exercised at the company’s discretion to increase the maximum facility amount of the Wells Fargo repurchase facility from $200 million to up to $475 million, subject to 9 customary terms and conditions. (3) Defined as total borrowings to fund the investment portfolio, divided by total equity.

Appendix

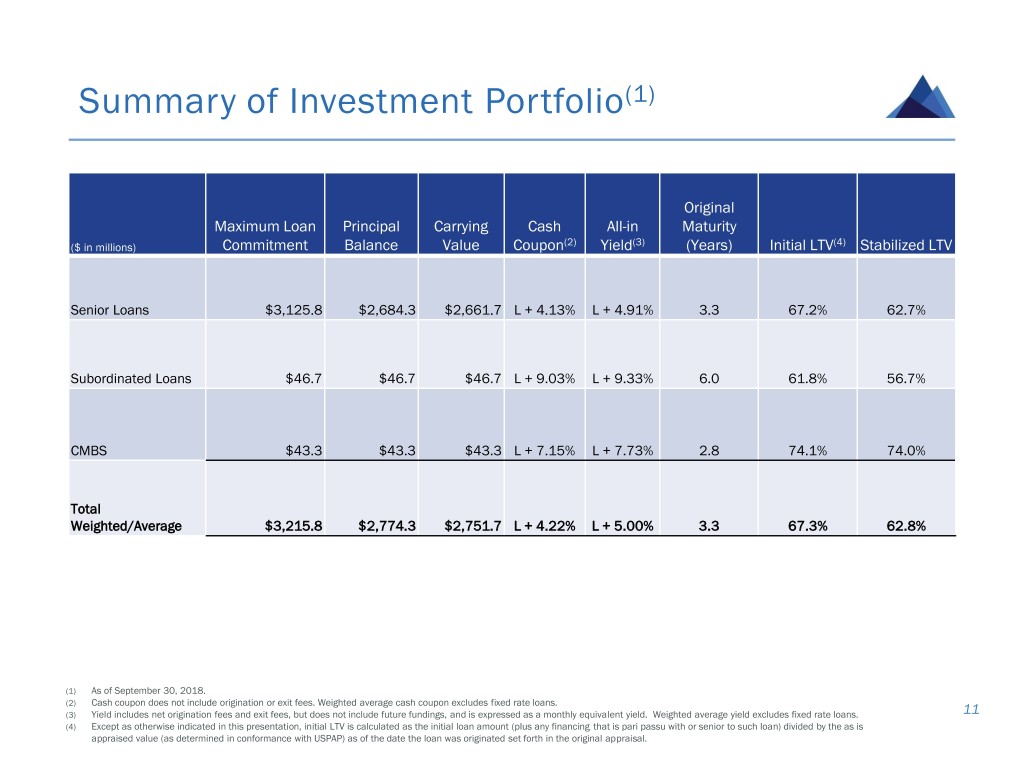

Summary of Investment Portfolio(1) Original Maximum Loan Principal Carrying Cash All-in Maturity ($ in millions) Commitment Balance Value Coupon(2) Yield(3) (Years) Initial LTV(4) Stabilized LTV Senior Loans $3,125.8 $2,684.3 $2,661.7 L + 4.13% L + 4.91% 3.3 67.2% 62.7% Subordinated Loans $46.7 $46.7 $46.7 L + 9.03% L + 9.33% 6.0 61.8% 56.7% CMBS $43.3 $43.3 $43.3 L + 7.15% L + 7.73% 2.8 74.1% 74.0% Total Weighted/Average $3,215.8 $2,774.3 $2,751.7 L + 4.22% L + 5.00% 3.3 67.3% 62.8% (1) As of September 30, 2018. (2) Cash coupon does not include origination or exit fees. Weighted average cash coupon excludes fixed rate loans. (3) Yield includes net origination fees and exit fees, but does not include future fundings, and is expressed as a monthly equivalent yield. Weighted average yield excludes fixed rate loans. 11 (4) Except as otherwise indicated in this presentation, initial LTV is calculated as the initial loan amount (plus any financing that is pari passu with or senior to such loan) divided by the as is appraised value (as determined in conformance with USPAP) as of the date the loan was originated set forth in the original appraisal.

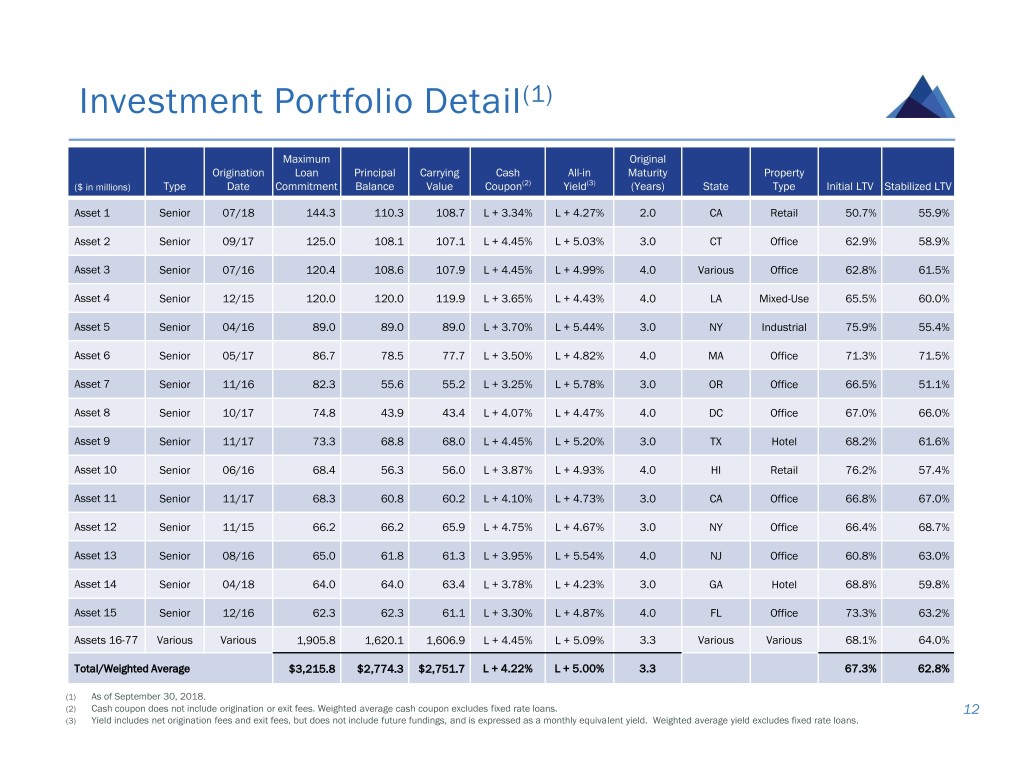

Investment Portfolio Detail(1) Maximum Original Origination Loan Principal Carrying Cash All-in Maturity Property ($ in millions) Type Date Commitment Balance Value Coupon(2) Yield(3) (Years) State Type Initial LTV Stabilized LTV Asset 1 Senior 07/18 144.3 110.3 108.7 L + 3.34% L + 4.27% 2.0 CA Retail 50.7% 55.9% Asset 2 Senior 09/17 125.0 108.1 107.1 L + 4.45% L + 5.03% 3.0 CT Office 62.9% 58.9% Asset 3 Senior 07/16 120.4 108.6 107.9 L + 4.45% L + 4.99% 4.0 Various Office 62.8% 61.5% Asset 4 Senior 12/15 120.0 120.0 119.9 L + 3.65% L + 4.43% 4.0 LA Mixed-Use 65.5% 60.0% Asset 5 Senior 04/16 89.0 89.0 89.0 L + 3.70% L + 5.44% 3.0 NY Industrial 75.9% 55.4% Asset 6 Senior 05/17 86.7 78.5 77.7 L + 3.50% L + 4.82% 4.0 MA Office 71.3% 71.5% Asset 7 Senior 11/16 82.3 55.6 55.2 L + 3.25% L + 5.78% 3.0 OR Office 66.5% 51.1% Asset 8 Senior 10/17 74.8 43.9 43.4 L + 4.07% L + 4.47% 4.0 DC Office 67.0% 66.0% Asset 9 Senior 11/17 73.3 68.8 68.0 L + 4.45% L + 5.20% 3.0 TX Hotel 68.2% 61.6% Asset 10 Senior 06/16 68.4 56.3 56.0 L + 3.87% L + 4.93% 4.0 HI Retail 76.2% 57.4% Asset 11 Senior 11/17 68.3 60.8 60.2 L + 4.10% L + 4.73% 3.0 CA Office 66.8% 67.0% Asset 12 Senior 11/15 66.2 66.2 65.9 L + 4.75% L + 4.67% 3.0 NY Office 66.4% 68.7% Asset 13 Senior 08/16 65.0 61.8 61.3 L + 3.95% L + 5.54% 4.0 NJ Office 60.8% 63.0% Asset 14 Senior 04/18 64.0 64.0 63.4 L + 3.78% L + 4.23% 3.0 GA Hotel 68.8% 59.8% Asset 15 Senior 12/16 62.3 62.3 61.1 L + 3.30% L + 4.87% 4.0 FL Office 73.3% 63.2% Assets 16-77 Various Various 1,905.8 1,620.1 1,606.9 L + 4.45% L + 5.09% 3.3 Various Various 68.1% 64.0% Total/Weighted Average $3,215.8 $2,774.3 $2,751.7 L + 4.22% L + 5.00% 3.3 67.3% 62.8% (1) As of September 30, 2018. (2) Cash coupon does not include origination or exit fees. Weighted average cash coupon excludes fixed rate loans. 12 (3) Yield includes net origination fees and exit fees, but does not include future fundings, and is expressed as a monthly equivalent yield. Weighted average yield excludes fixed rate loans.

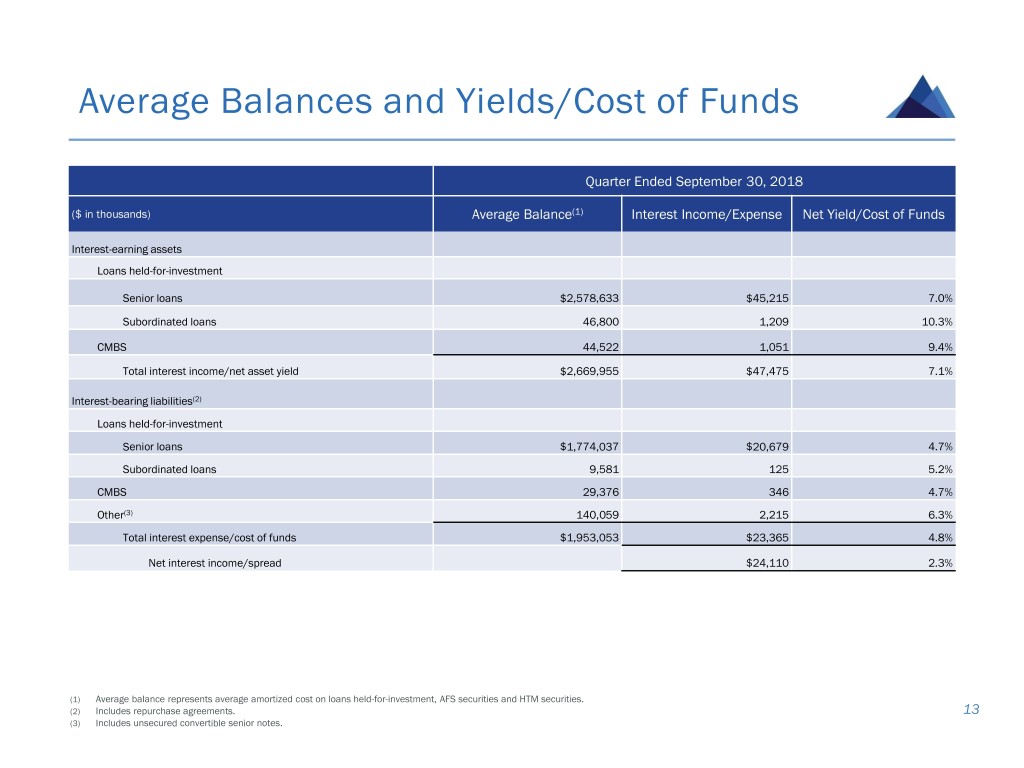

Average Balances and Yields/Cost of Funds Quarter Ended September 30, 2018 ($ in thousands) Average Balance(1) Interest Income/Expense Net Yield/Cost of Funds Interest-earning assets Loans held-for-investment Senior loans $2,578,633 $45,215 7.0% Subordinated loans 46,800 1,209 10.3% CMBS 44,522 1,051 9.4% Total interest income/net asset yield $2,669,955 $47,475 7.1% Interest-bearing liabilities(2) Loans held-for-investment Senior loans $1,774,037 $20,679 4.7% Subordinated loans 9,581 125 5.2% CMBS 29,376 346 4.7% Other(3) 140,059 2,215 6.3% Total interest expense/cost of funds $1,953,053 $23,365 4.8% Net interest income/spread $24,110 2.3% (1) Average balance represents average amortized cost on loans held-for-investment, AFS securities and HTM securities. (2) Includes repurchase agreements. 13 (3) Includes unsecured convertible senior notes.

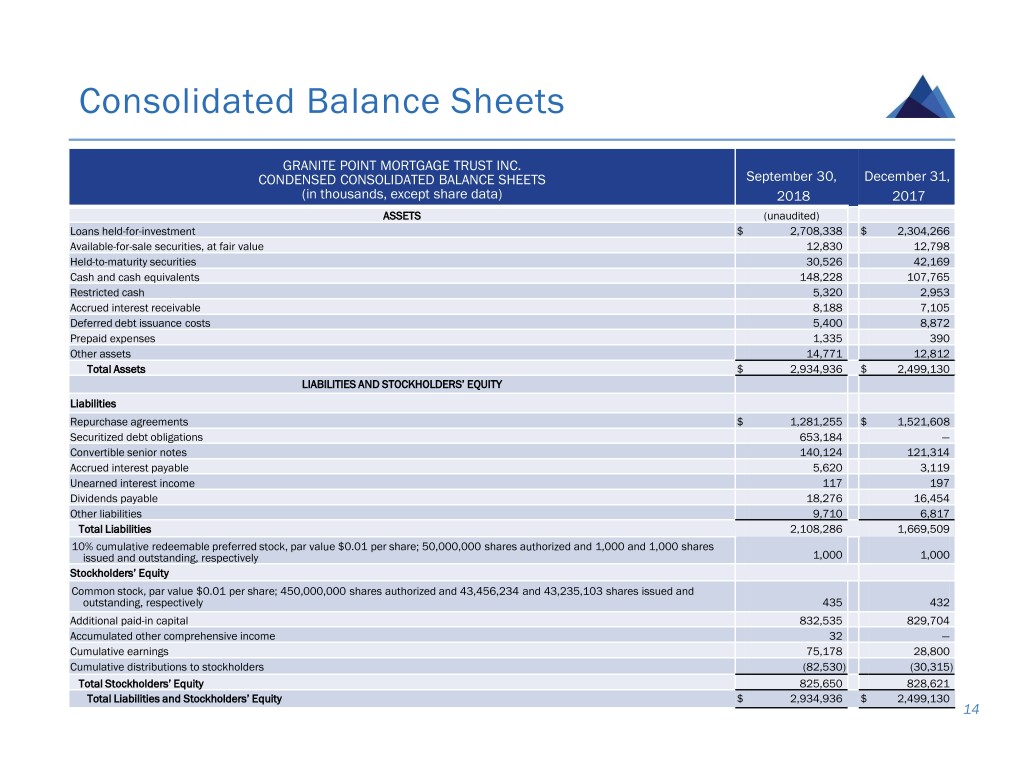

Consolidated Balance Sheets GRANITE POINT MORTGAGE TRUST INC. CONDENSED CONSOLIDATED BALANCE SHEETS September 30, December 31, (in thousands, except share data) 2018 2017 ASSETS (unaudited) Loans held-for-investment $ 2,708,338 $ 2,304,266 Available-for-sale securities, at fair value 12,830 12,798 Held-to-maturity securities 30,526 42,169 Cash and cash equivalents 148,228 107,765 Restricted cash 5,320 2,953 Accrued interest receivable 8,188 7,105 Deferred debt issuance costs 5,400 8,872 Prepaid expenses 1,335 390 Other assets 14,771 12,812 Total Assets $ 2,934,936 $ 2,499,130 LIABILITIES AND STOCKHOLDERS’ EQUITY Liabilities Repurchase agreements $ 1,281,255 $ 1,521,608 Securitized debt obligations 653,184 — Convertible senior notes 140,124 121,314 Accrued interest payable 5,620 3,119 Unearned interest income 117 197 Dividends payable 18,276 16,454 Other liabilities 9,710 6,817 Total Liabilities 2,108,286 1,669,509 10% cumulative redeemable preferred stock, par value $0.01 per share; 50,000,000 shares authorized and 1,000 and 1,000 shares issued and outstanding, respectively 1,000 1,000 Stockholders’ Equity Common stock, par value $0.01 per share; 450,000,000 shares authorized and 43,456,234 and 43,235,103 shares issued and outstanding, respectively 435 432 Additional paid-in capital 832,535 829,704 Accumulated other comprehensive income 32 — Cumulative earnings 75,178 28,800 Cumulative distributions to stockholders (82,530) (30,315) Total Stockholders’ Equity 825,650 828,621 Total Liabilities and Stockholders’ Equity $ 2,934,936 $ 2,499,130 14

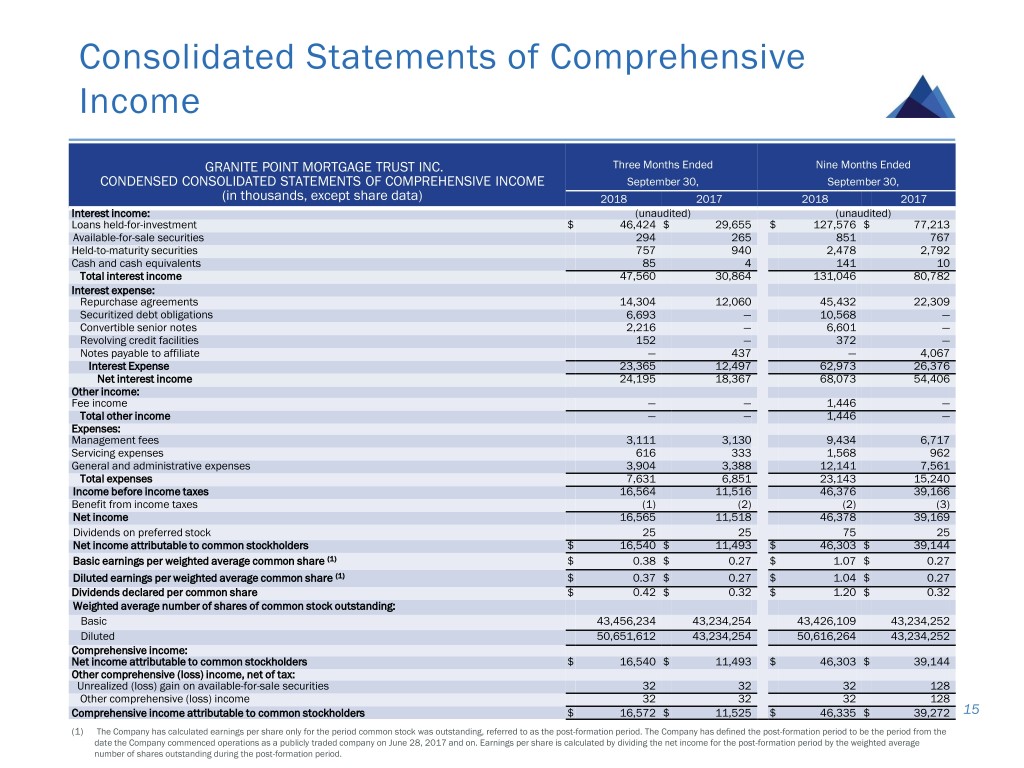

Consolidated Statements of Comprehensive Income GRANITE POINT MORTGAGE TRUST INC. Three Months Ended Nine Months Ended CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME September 30, September 30, (in thousands, except share data) 2018 2017 2018 2017 Interest income: (unaudited) (unaudited) Loans held-for-investment $ 46,424 $ 29,655 $ 127,576 $ 77,213 Available-for-sale securities 294 265 851 767 Held-to-maturity securities 757 940 2,478 2,792 Cash and cash equivalents 85 4 141 10 Total interest income 47,560 30,864 131,046 80,782 Interest expense: Repurchase agreements 14,304 12,060 45,432 22,309 Securitized debt obligations 6,693 — 10,568 — Convertible senior notes 2,216 — 6,601 — Revolving credit facilities 152 — 372 — Notes payable to affiliate — 437 — 4,067 Interest Expense 23,365 12,497 62,973 26,376 Net interest income 24,195 18,367 68,073 54,406 Other income: Fee income — — 1,446 — Total other income — — 1,446 — Expenses: Management fees 3,111 3,130 9,434 6,717 Servicing expenses 616 333 1,568 962 General and administrative expenses 3,904 3,388 12,141 7,561 Total expenses 7,631 6,851 23,143 15,240 Income before income taxes 16,564 11,516 46,376 39,166 Benefit from income taxes (1) (2) (2) (3) Net income 16,565 11,518 46,378 39,169 Dividends on preferred stock 25 25 75 25 Net income attributable to common stockholders $ 16,540 $ 11,493 $ 46,303 $ 39,144 Basic earnings per weighted average common share (1) $ 0.38 $ 0.27 $ 1.07 $ 0.27 Diluted earnings per weighted average common share (1) $ 0.37 $ 0.27 $ 1.04 $ 0.27 Dividends declared per common share $ 0.42 $ 0.32 $ 1.20 $ 0.32 Weighted average number of shares of common stock outstanding: Basic 43,456,234 43,234,254 43,426,109 43,234,252 Diluted 50,651,612 43,234,254 50,616,264 43,234,252 Comprehensive income: Net income attributable to common stockholders $ 16,540 $ 11,493 $ 46,303 $ 39,144 Other comprehensive (loss) income, net of tax: Unrealized (loss) gain on available-for-sale securities 32 32 32 128 Other comprehensive (loss) income 32 32 32 128 Comprehensive income attributable to common stockholders $ 16,572 $ 11,525 $ 46,335 $ 39,272 15 (1) The Company has calculated earnings per share only for the period common stock was outstanding, referred to as the post-formation period. The Company has defined the post-formation period to be the period from the date the Company commenced operations as a publicly traded company on June 28, 2017 and on. Earnings per share is calculated by dividing the net income for the post-formation period by the weighted average number of shares outstanding during the post-formation period.