Investor Presentation Third Quarter 2018

Safe Harbor Statement This presentation contains, in addition to historical information, certain forward-looking statements that are based on our current assumptions, expectations and projections about future performance and events. In particular, statements regarding future economic performance, finances, and expectations and objectives of management constitute forward-looking statements. Forward-looking statements are not historical in nature and can be identified by words such as "believes," "expects," "may," "will," "should," "seeks," "approximately," "intends," "plans," "estimates," "anticipates," “targets,” “goals,” “future,” “likely” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters. Although the forward-looking statements contained in this presentation are based upon information available at the time the statements are made and reflect the best judgment of our senior management, forward-looking statements inherently involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements to differ materially from anticipated future results. Important factors that could cause actual results to differ materially from expected results, including, among other things, those described in our filings with the Securities and Exchange Commission (“SEC”), including our annual report on form 10-K for the year ended December 31, 2017, and any subsequent Quarterly Reports on Form 10-Q under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: the state of the U.S. economy generally or in specific geographic regions; the general political, economic, and competitive conditions in the markets in which we invest; defaults by borrowers in paying debt service on outstanding indebtedness and borrowers' abilities to manage and stabilize properties; our ability to obtain financing arrangements on terms favorable to us or at all; the level and volatility of prevailing interest rates and credit spreads; reductions in the yield on our investments and an increase in the cost of our financing; general volatility of the securities markets in which we participate; the return or impact of current or future investments; allocation of investment opportunities to us by our Manager; increased competition from entities investing in our target assets; effects of hedging instruments on our target investments; changes in governmental regulations, tax law and rates, and similar matters; our ability to maintain our qualification as a REIT for U.S. federal income tax purposes and our exclusion from registration under the Investment Company Act; availability of desirable investment opportunities; availability of qualified personnel and our relationship with our Manager; estimates relating to our ability to make distributions to our stockholders in the future; hurricanes, earthquakes, and other natural disasters, acts of war and/or terrorism and other events that may cause unanticipated and uninsured performance declines and/or losses to us or the owners and operators of the real estate securing our investments; deterioration in the performance of the properties securing our investments that may cause deterioration in the performance of our investments and, potentially, principal losses to us; and difficulty or delays in redeploying the proceeds from repayments of our existing investments. These forward-looking statements apply only as of the date of this press release. We are under no duty to update any of these forward-looking statements after the date of this presentation to conform these statements to actual results or revised expectations. You should, therefore, not rely on these forward-looking statements as predictions of future events. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. 2

Company Overview • Business formed in early 2015 to establish a commercial real estate lending platform for Two Harbors Investment Corp. (NYSE:TWO) • Investment strategy focused on direct origination of floating- rate, senior loans secured by institutional quality properties • To capitalize on the expanding opportunity in commercial real estate, Granite Point completed its IPO in June 2017 • Loan portfolio is: – Well-positioned to benefit from rising short-term interest rates – Well-diversified across property types, and – Well-diversified across geographies • Granite Point is externally managed by Pine River Capital Management L.P., a diversified alternative asset management firm with experience in sponsoring and managing public companies • GPMT is a member of the S&P 600 Small Cap index 3

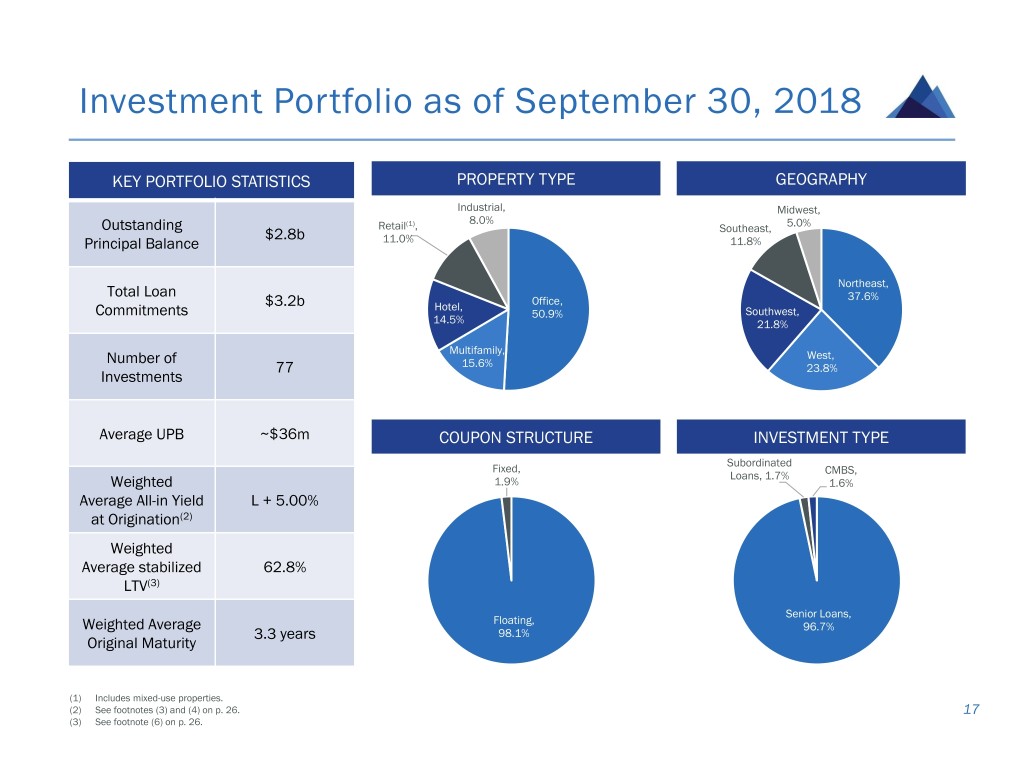

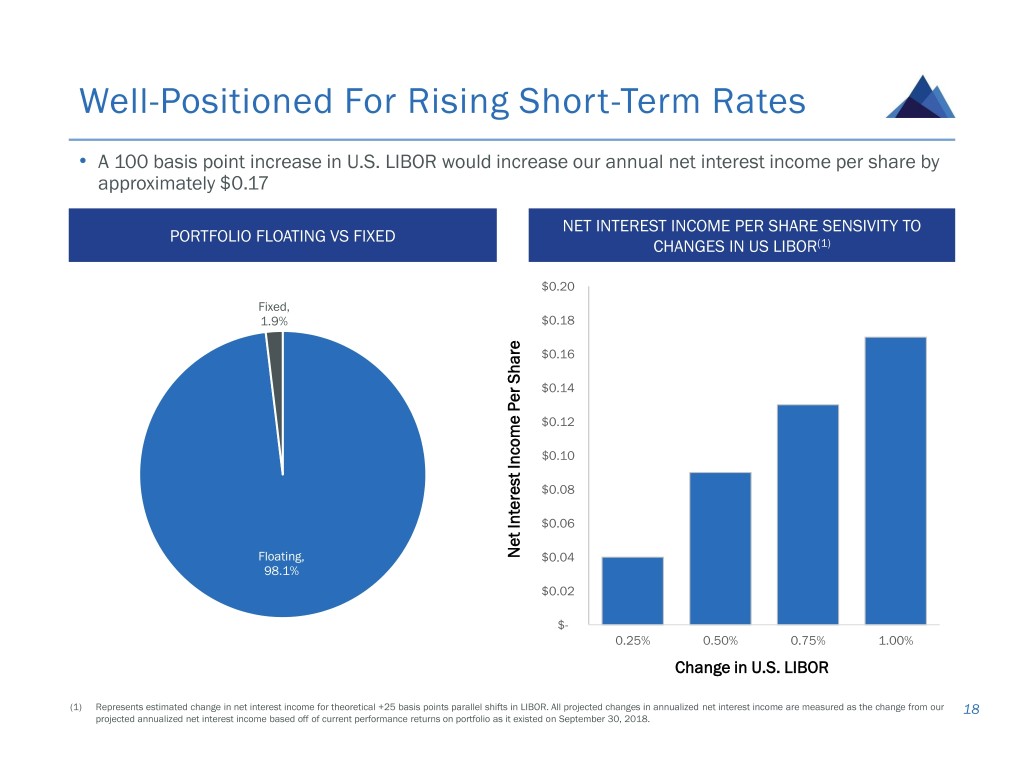

Granite Point Investment Highlights . EXPERIENCED AND Each senior CRE team member has over 20 years of experience in the commercial real estate debt markets CYCLE-TESTED . Extensive experience in investment management and structured finance SENIOR CRE TEAM . Broad and long-standing direct relationships within the commercial real estate lending industry . ATTRACTIVE AND Structural changes have created an enduring opportunity for specialty finance companies in U.S. commercial SUSTAINABLE real estate MARKET . Borrower demand for debt capital remains strong OPPORUNITY . Senior floating rate loans represent a particularly attractive value proposition . Direct origination of floating rate senior loans secured by institutional quality commercial real estate in the DIFFERENTIATED top 25 and (generally) up to the top 50 MSAs in the U.S. DIRECT . Fundamental value-driven investing combined with credit intensive underwriting ORIGINATION . Focus on cash flow as a key underwriting criteria PLATFORM . Prioritize income-producing, institutional-quality properties and sponsors . Carrying value of $2.8 billion and well diversified across property types and geographies HIGH CREDIT . QUALITY Weighted average stabilized LTV(1) of 63% and weighted average all-in yield at origination(2) of LIBOR + 5.00% INVESTMENT . Over 96% of portfolio is invested in senior loans PORTOFOLIO . Over 98% of portfolio is floating rate and well-positioned for rising short-term interest rates . Modest level of leverage through a diversified financing mix including secured credit facilities, CLO debt, ATTRACTIVE unsecured convertible notes and a revolving bridge financing facility FINANCIAL . Attractive common stock dividend yield PROFILE . Ample liquidity to organically grow the portfolio and earnings over time (1) See footnote (6) on p. 26. (2) See footnotes (3) and (4) on p. 26. 4

Commercial Real Estate Market Overview

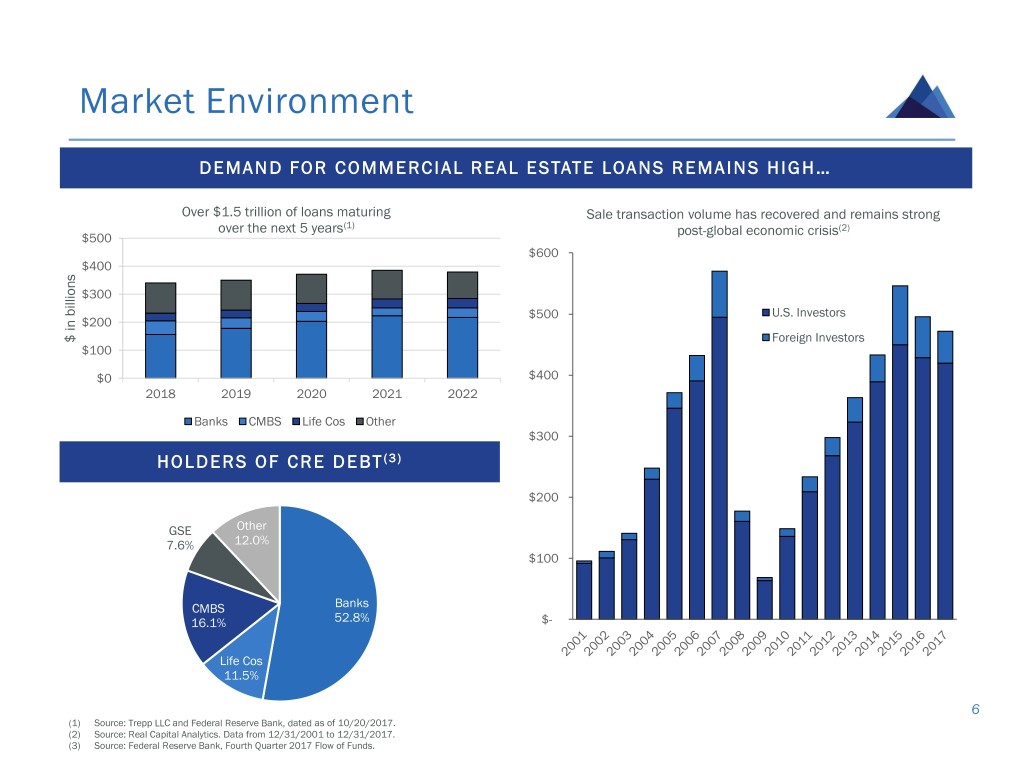

Market Environment DEMAND FOR COMMERCIAL REAL ESTATE LOANS REMAINS HIGH… Over $1.5 trillion of loans maturing Sale transaction volume has recovered and remains strong over the next 5 years(1) post-global economic crisis(2) $500 $600 $400 $300 $500 U.S. Investors $200 $ $ billions in Foreign Investors $100 $0 $400 2018 2019 2020 2021 2022 Banks CMBS Life Cos Other $300 HOLDERS OF CRE DEBT (3) $200 GSE Other 7.6% 12.0% $100 CMBS Banks 16.1% 52.8% $- Life Cos 11.5% Total CRE Debt: ~$3 trillion 6 (1) Source: Trepp LLC and Federal Reserve Bank, dated as of 10/20/2017. (2) Source: Real Capital Analytics. Data from 12/31/2001 to 12/31/2017. (3) Source: Federal Reserve Bank, Fourth Quarter 2017 Flow of Funds.

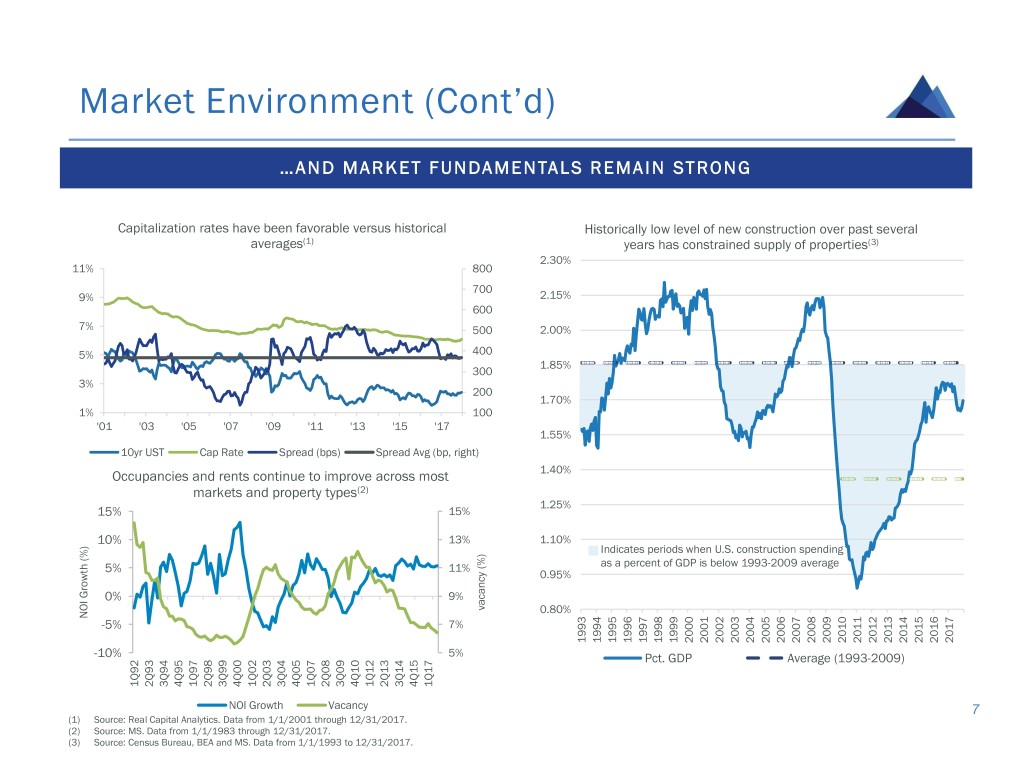

Market Environment (Cont’d) …AND MARKET FUNDAMENTALS REMAIN STRONG Capitalization rates have been favorable versus historical Historically low level of new construction over past several averages(1) years has constrained supply of properties(3) 2.30% 11% 800 700 9% 2.15% 600 7% 500 2.00% 5% 400 1.85% 300 3% 200 1.70% 1% 100 '01 '03 '05 '07 '09 '11 '13 '15 '17 1.55% 10yr UST Cap Rate Spread (bps) Spread Avg (bp, right) Occupancies and rents continue to improve across most 1.40% markets and property types(2) 1.25% 15% 15% 10% 13% 1.10% Indicates periods when U.S. construction spending 5% 11% as a percent of GDP is below 1993-2009 average 0.95% 0% 9% vacancy (%) vacancy 0.80% NOI Growth (%) Growth NOI -5% 7% 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 -10% 5% Pct. GDP Average (1993-2009) 1Q92 2Q93 3Q94 4Q95 1Q97 2Q98 3Q99 4Q00 1Q02 2Q03 3Q04 4Q05 1Q07 2Q08 3Q09 4Q10 1Q12 2Q13 3Q14 4Q15 1Q17 NOI Growth Vacancy 7 (1) Source: Real Capital Analytics. Data from 1/1/2001 through 12/31/2017. (2) Source: MS. Data from 1/1/1983 through 12/31/2017. (3) Source: Census Bureau, BEA and MS. Data from 1/1/1993 to 12/31/2017.

Investment Strategy and Origination Platform

Investment Philosophy OUR TEAM HAS DEVELOPED A SUCCESSFUL INVESTMENT PHILOSOPHY THAT HAS BEEN TESTED THROUGH SEVERAL ECONOMIC, INTEREST RATE AND REAL ESTATE CYCLES • Long-term, fundamental value-oriented investing philosophy; focus on relative value • Emphasize selectivity and diversification • Prioritize income-producing, institutional quality properties and owners/sponsors • Cash flow is a key underwriting metric • Intensive diligence with a focus on bottom-up underwriting of property fundamentals • Avoid “sector bets” and “momentum investments” • The property is our collateral; the loan is our investment 9

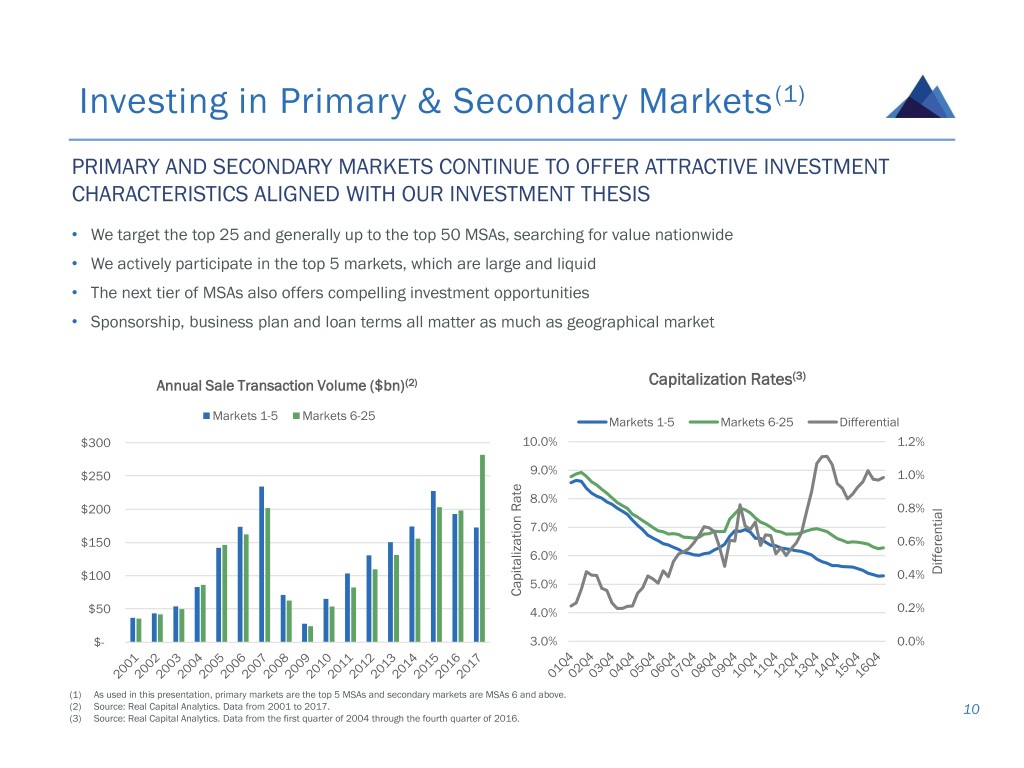

Investing in Primary & Secondary Markets(1) PRIMARY AND SECONDARY MARKETS CONTINUE TO OFFER ATTRACTIVE INVESTMENT CHARACTERISTICS ALIGNED WITH OUR INVESTMENT THESIS • We target the top 25 and generally up to the top 50 MSAs, searching for value nationwide • We actively participate in the top 5 markets, which are large and liquid • The next tier of MSAs also offers compelling investment opportunities • Sponsorship, business plan and loan terms all matter as much as geographical market (3) Annual Sale Transaction Volume ($bn)(2) Capitalization Rates Markets 1-5 Markets 6-25 Markets 1-5 Markets 6-25 Differential $300 10.0% 1.2% $250 9.0% 1.0% 8.0% $200 0.8% 7.0% $150 0.6% 6.0% $100 0.4% Differential 5.0% Capitalization Rate $50 4.0% 0.2% $- 3.0% 0.0% (1) As used in this presentation, primary markets are the top 5 MSAs and secondary markets are MSAs 6 and above. (2) Source: Real Capital Analytics. Data from 2001 to 2017. 10 (3) Source: Real Capital Analytics. Data from the first quarter of 2004 through the fourth quarter of 2016.

Investment Strategy Overview INVESTMENT STRATEGY PRIMARY VS SECONDARY MARKETS • Focus on generating stable and attractive • Active lender in both the primary and secondary earnings while maintaining a conservative markets risk profile • Direct origination of senior loans funding: • Property acquisitions • Refinancings PORTFOLIO AS OF September 30, 2018 • Recapitalizations / restructurings • Repositioning and renovation – Asset-by-asset portfolio construction focused on: Primary • Relative value across property types and markets Markets, 45% stressing geographic diversity Secondary Markets, 55% • Relative value within the capital structure • Comprehensive, “bottom-up” underwriting of property and local market fundamentals 11

Target Investments PRIMARY TARGET INVESTMENTS • Floating rate senior loans secured by income-producing U.S. commercial real estate • Loans of $25 million to $150 million (averaging $35-40 million) • Institutional-quality properties located in the primary and secondary markets • Secured by major property types (office, apartment, industrial, retail, hospitality) • Institutional sponsors with transitional business plans that may include capital improvements and / or lease-up • Stabilized LTVs(1) generally ranging from 55% to 70% • Loan yields generally ranging from LIBOR + 3.5% to 4.5% SECONDARY TARGET INVESTMENTS • Subordinated interests (or B-notes), mezzanine loans, debt-like preferred equity and real estate-related securities secured by comparable properties with similar business plans (1) See footnote (6) on p. 26. 12

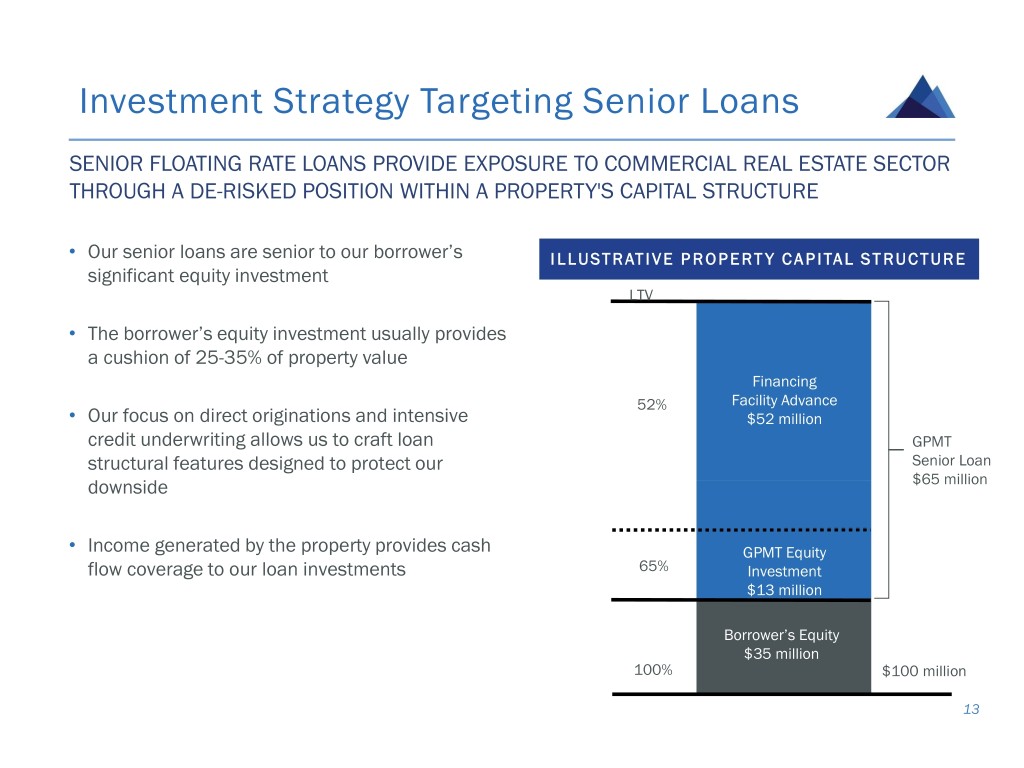

Investment Strategy Targeting Senior Loans SENIOR FLOATING RATE LOANS PROVIDE EXPOSURE TO COMMERCIAL REAL ESTATE SECTOR THROUGH A DE-RISKED POSITION WITHIN A PROPERTY'S CAPITAL STRUCTURE • Our senior loans are senior to our borrower’s I LLUSTRATIVE P ROP E RT Y C A P ITAL ST RUC TURE significant equity investment LTV • The borrower’s equity investment usually provides a cushion of 25-35% of property value Financing 52% Facility Advance • Our focus on direct originations and intensive $52 million credit underwriting allows us to craft loan GPMT structural features designed to protect our Senior Loan downside $65 million • Income generated by the property provides cash GPMT Equity flow coverage to our loan investments 65% Investment $13 million Borrower’s Equity $35 million 100% $100 million 13

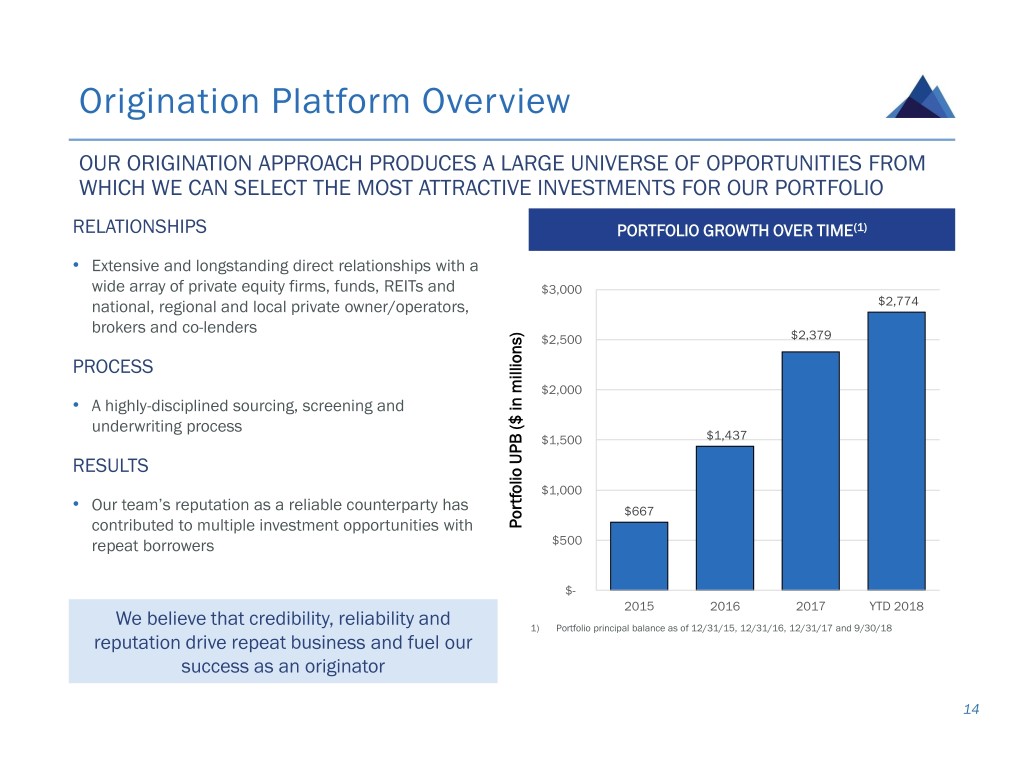

Origination Platform Overview OUR ORIGINATION APPROACH PRODUCES A LARGE UNIVERSE OF OPPORTUNITIES FROM WHICH WE CAN SELECT THE MOST ATTRACTIVE INVESTMENTS FOR OUR PORTFOLIO RELATIONSHIPS PORTFOLIO GROWTH OVER TIME(1) • Extensive and longstanding direct relationships with a wide array of private equity firms, funds, REITs and $3,000 national, regional and local private owner/operators, $2,774 brokers and co-lenders $2,500 $2,379 PROCESS $2,000 • A highly-disciplined sourcing, screening and underwriting process $1,500 $1,437 RESULTS $1,000 • Our team’s reputation as a reliable counterparty has $667 contributed to multiple investment opportunities with millions)inPortfolio($UPB repeat borrowers $500 $- 2015 2016 2017 YTD 2018 We believe that credibility, reliability and 1) Portfolio principal balance as of 12/31/15, 12/31/16, 12/31/17 and 9/30/18 reputation drive repeat business and fuel our success as an originator 14

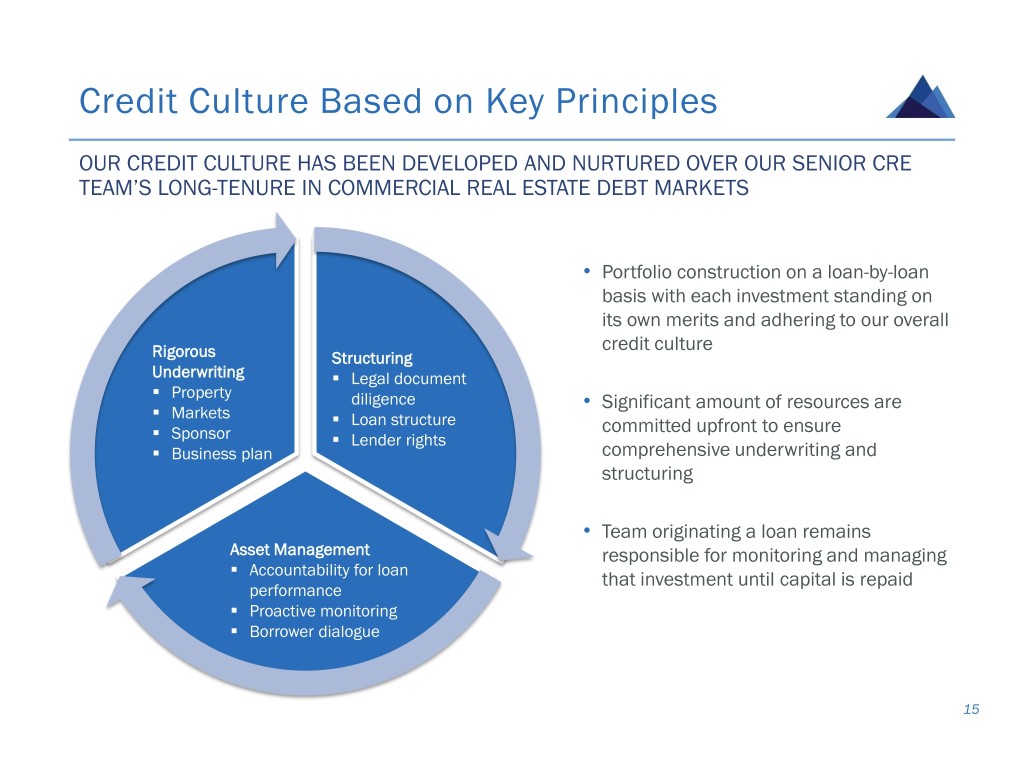

Credit Culture Based on Key Principles OUR CREDIT CULTURE HAS BEEN DEVELOPED AND NURTURED OVER OUR SENIOR CRE TEAM’S LONG-TENURE IN COMMERCIAL REAL ESTATE DEBT MARKETS • Portfolio construction on a loan-by-loan basis with each investment standing on its own merits and adhering to our overall credit culture Rigorous Structuring Underwriting . . Legal document Property diligence • Significant amount of resources are . Markets . . Loan structure committed upfront to ensure Sponsor . Lender rights . Business plan comprehensive underwriting and structuring • Team originating a loan remains Asset Management . responsible for monitoring and managing Accountability for loan that investment until capital is repaid performance . Proactive monitoring . Borrower dialogue 15

Portfolio Overview

Investment Portfolio as of September 30, 2018 KEY PORTFOLIO STATISTICS PROPERTY TYPE GEOGRAPHY Industrial, Midwest, Outstanding Retail(1), 8.0% 5.0% $2.8b Southeast, Principal Balance 11.0% 11.8% Northeast, Total Loan Office, 37.6% $3.2b Hotel, Commitments 50.9% Southwest, 14.5% 21.8% Number of Multifamily, West, 77 15.6% 23.8% Investments Average UPB ~$36m COUPON STRUCTURE INVESTMENT TYPE Subordinated Fixed, Loans, 1.7% CMBS, Weighted 1.9% 1.6% Average All-in Yield L + 5.00% at Origination(2) Weighted Average stabilized 62.8% LTV(3) Senior Loans, Floating, Weighted Average 96.7% 3.3 years 98.1% Original Maturity (1) Includes mixed-use properties. (2) See footnotes (3) and (4) on p. 26. 17 (3) See footnote (6) on p. 26.

Well-Positioned For Rising Short-Term Rates • A 100 basis point increase in U.S. LIBOR would increase our annual net interest income per share by approximately $0.17 NET INTEREST INCOME PER SHARE SENSIVITY TO PORTFOLIO FLOATING VS FIXED CHANGES IN US LIBOR(1) $0.20 Fixed, 1.9% $0.18 $0.16 $0.14 $0.12 $0.10 $0.08 $0.06 Floating, SharePerInterestIncomeNet $0.04 98.1% $0.02 $- 0.25% 0.50% 0.75% 1.00% Change in U.S. LIBOR (1) Represents estimated change in net interest income for theoretical +25 basis points parallel shifts in LIBOR. All projected changes in annualized net interest income are measured as the change from our 18 projected annualized net interest income based off of current performance returns on portfolio as it existed on September 30, 2018.

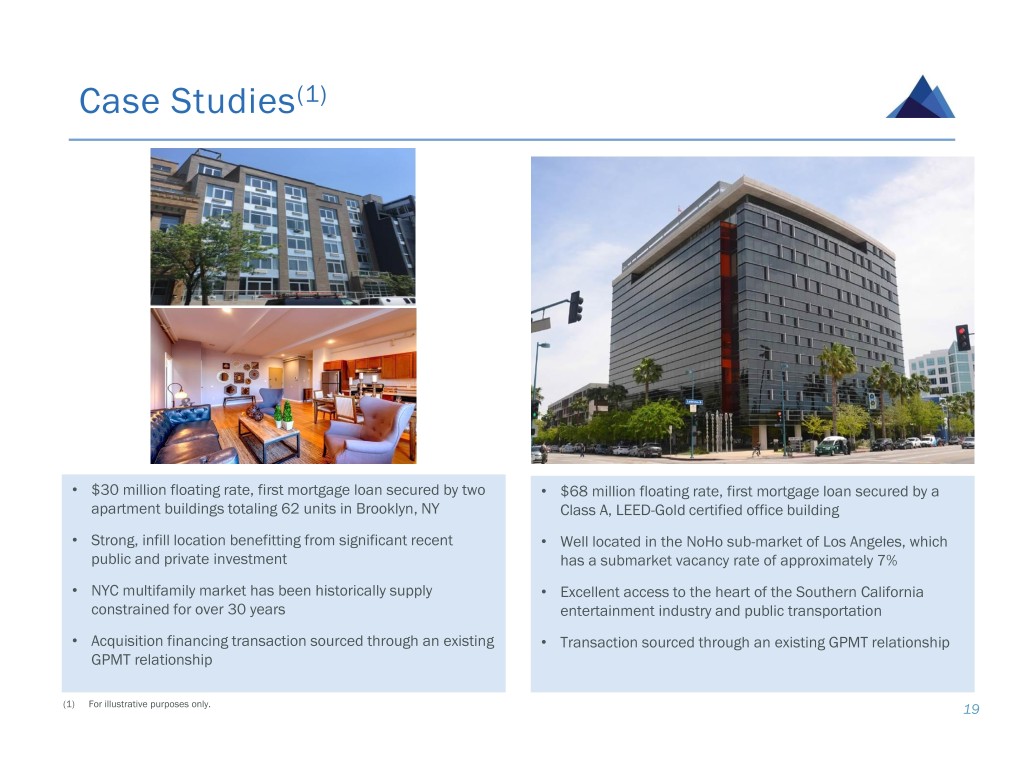

Case Studies(1) • $30 million floating rate, first mortgage loan secured by two • $68 million floating rate, first mortgage loan secured by a apartment buildings totaling 62 units in Brooklyn, NY Class A, LEED-Gold certified office building • Strong, infill location benefitting from significant recent • Well located in the NoHo sub-market of Los Angeles, which public and private investment has a submarket vacancy rate of approximately 7% • NYC multifamily market has been historically supply • Excellent access to the heart of the Southern California constrained for over 30 years entertainment industry and public transportation • Acquisition financing transaction sourced through an existing • Transaction sourced through an existing GPMT relationship GPMT relationship (1) For illustrative purposes only. 19

Financial Highlights

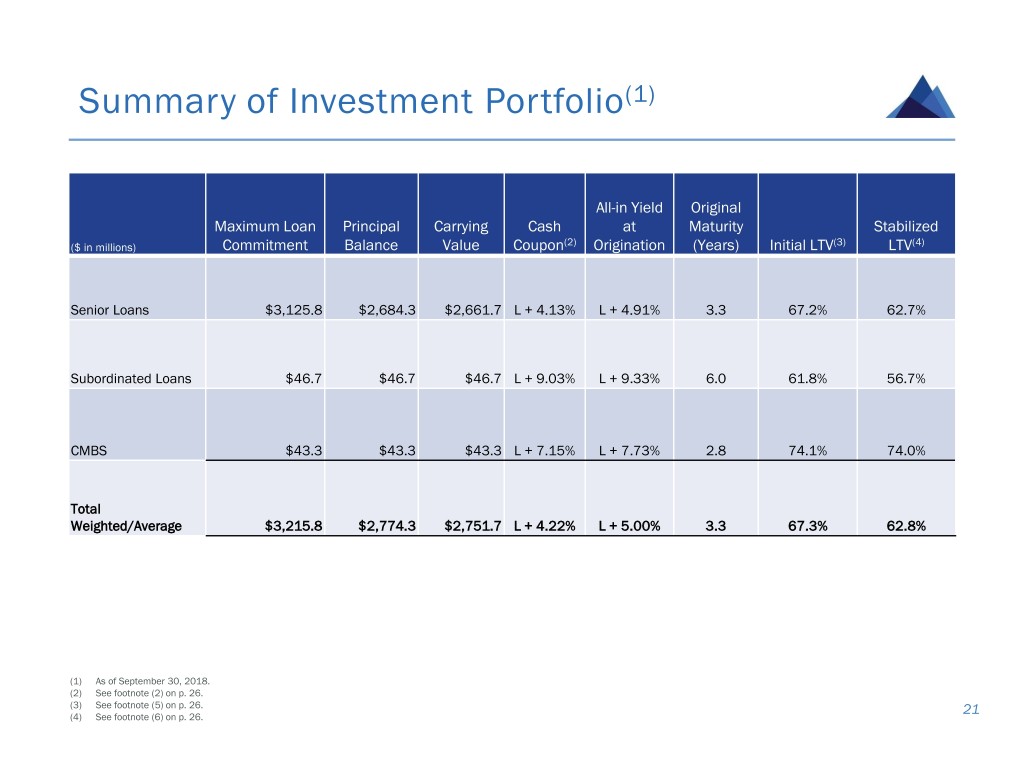

Summary of Investment Portfolio(1) All-in Yield Original Maximum Loan Principal Carrying Cash at Maturity Stabilized ($ in millions) Commitment Balance Value Coupon(2) Origination (Years) Initial LTV(3) LTV(4) Senior Loans $3,125.8 $2,684.3 $2,661.7 L + 4.13% L + 4.91% 3.3 67.2% 62.7% Subordinated Loans $46.7 $46.7 $46.7 L + 9.03% L + 9.33% 6.0 61.8% 56.7% CMBS $43.3 $43.3 $43.3 L + 7.15% L + 7.73% 2.8 74.1% 74.0% Total Weighted/Average $3,215.8 $2,774.3 $2,751.7 L + 4.22% L + 5.00% 3.3 67.3% 62.8% (1) As of September 30, 2018. (2) See footnote (2) on p. 26. (3) See footnote (5) on p. 26. 21 (4) See footnote (6) on p. 26.

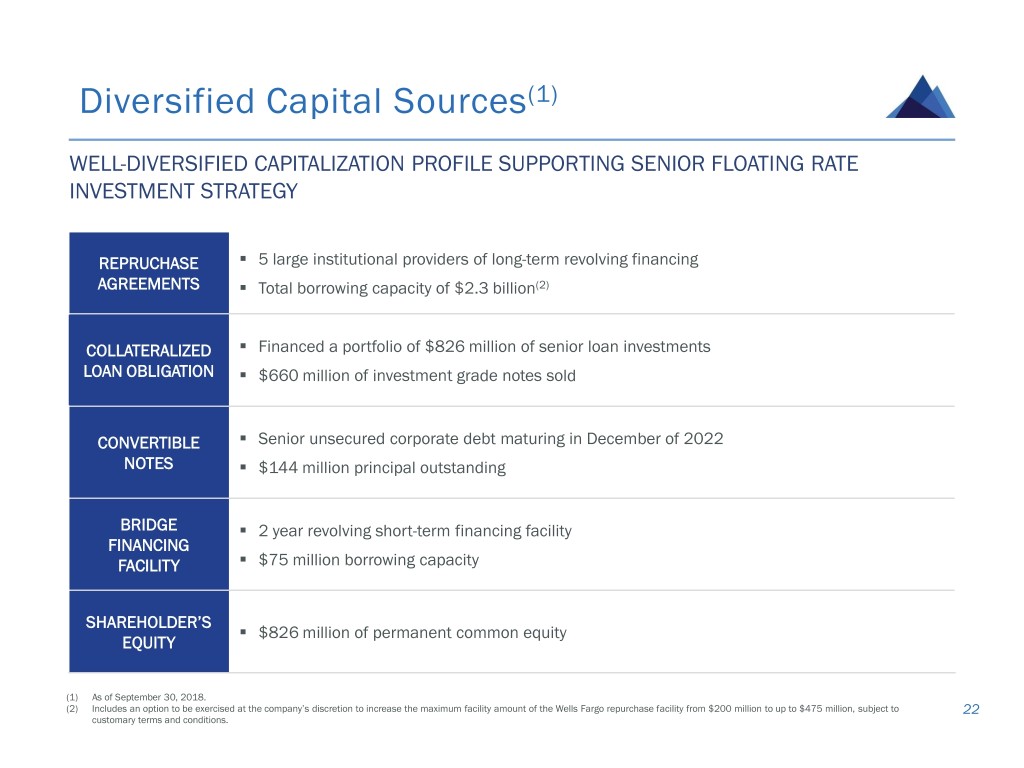

Diversified Capital Sources(1) WELL-DIVERSIFIED CAPITALIZATION PROFILE SUPPORTING SENIOR FLOATING RATE INVESTMENT STRATEGY . REPRUCHASE 5 large institutional providers of long-term revolving financing AGREEMENTS . Total borrowing capacity of $2.3 billion(2) . COLLATERALIZED Financed a portfolio of $826 million of senior loan investments LOAN OBLIGATION . $660 million of investment grade notes sold . CONVERTIBLE Senior unsecured corporate debt maturing in December of 2022 NOTES . $144 million principal outstanding BRIDGE . 2 year revolving short-term financing facility FINANCING . FACILITY $75 million borrowing capacity SHAREHOLDER’S . $826 million of permanent common equity EQUITY (1) As of September 30, 2018. (2) Includes an option to be exercised at the company’s discretion to increase the maximum facility amount of the Wells Fargo repurchase facility from $200 million to up to $475 million, subject to 22 customary terms and conditions.

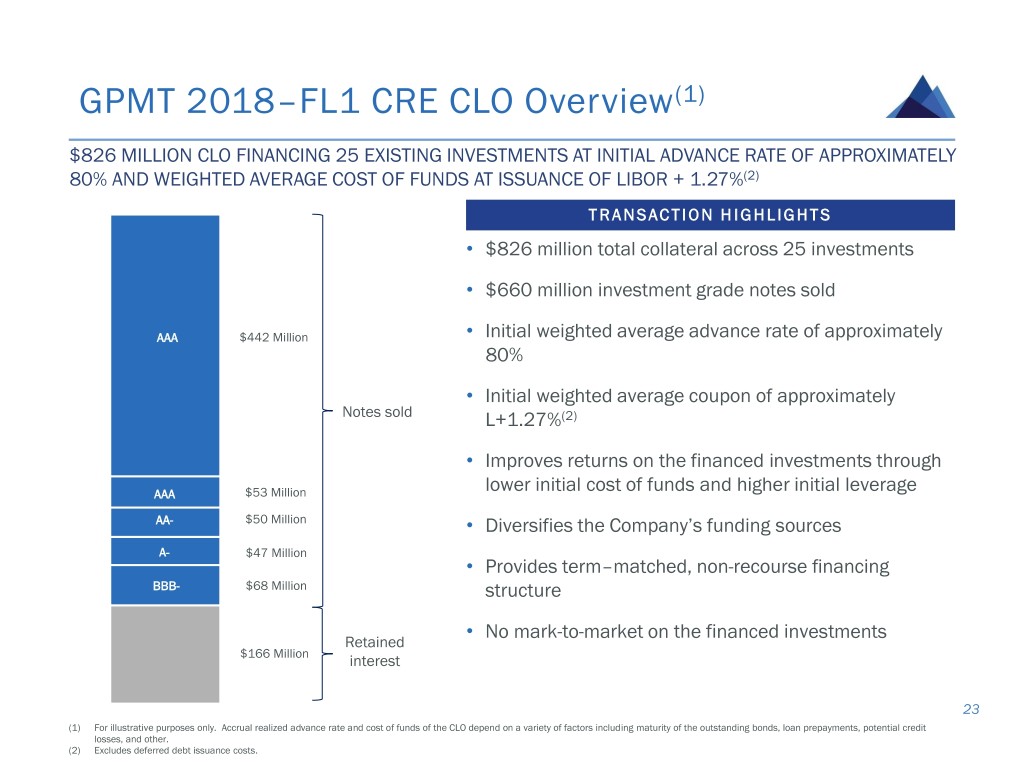

GPMT 2018–FL1 CRE CLO Overview(1) $826 MILLION CLO FINANCING 25 EXISTING INVESTMENTS AT INITIAL ADVANCE RATE OF APPROXIMATELY 80% AND WEIGHTED AVERAGE COST OF FUNDS AT ISSUANCE OF LIBOR + 1.27%(2) T RA NSAC TION H IG HLIGHT S • $826 million total collateral across 25 investments • $660 million investment grade notes sold AAA $442 Million • Initial weighted average advance rate of approximately 80% • Initial weighted average coupon of approximately Notes sold L+1.27%(2) • Improves returns on the financed investments through AAA $53 Million lower initial cost of funds and higher initial leverage AA- $50 Million • Diversifies the Company’s funding sources A- $47 Million • Provides term–matched, non-recourse financing BBB- $68 Million structure • No mark-to-market on the financed investments Retained $166 Million interest 23 (1) For illustrative purposes only. Accrual realized advance rate and cost of funds of the CLO depend on a variety of factors including maturity of the outstanding bonds, loan prepayments, potential credit losses, and other. (2) Excludes deferred debt issuance costs.

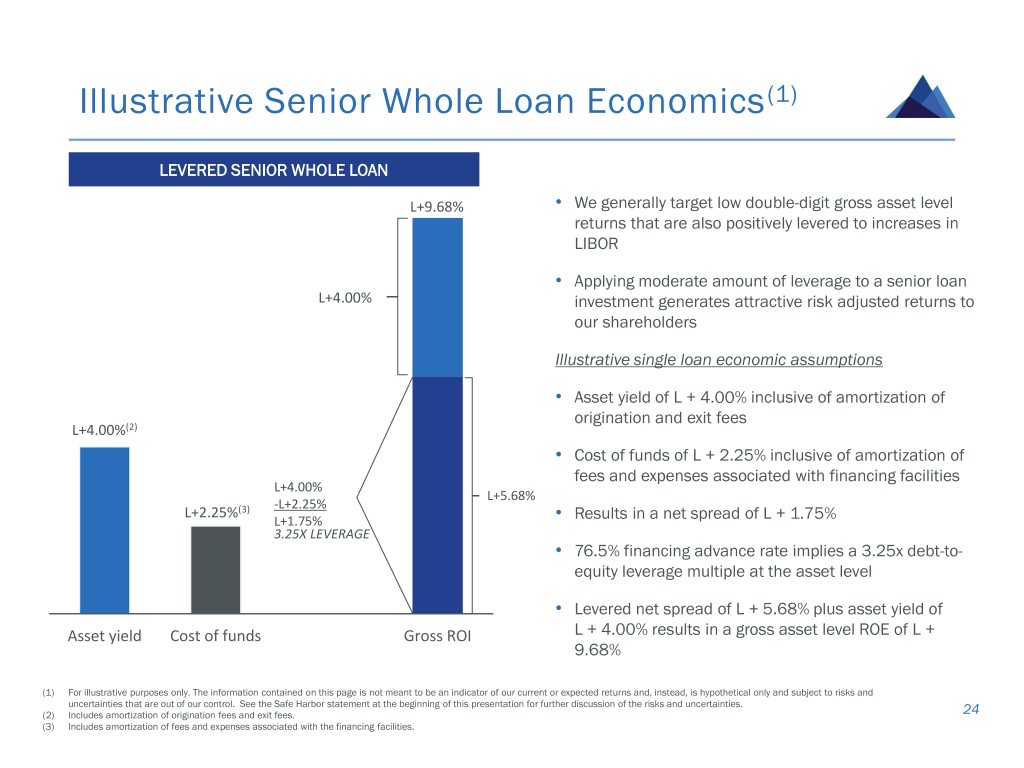

Illustrative Senior Whole Loan Economics(1) LEVERED SENIOR WHOLE LOAN L+9.68% • We generally target low double-digit gross asset level returns that are also positively levered to increases in LIBOR • Applying moderate amount of leverage to a senior loan L+4.00% investment generates attractive risk adjusted returns to our shareholders Illustrative single loan economic assumptions • Asset yield of L + 4.00% inclusive of amortization of origination and exit fees L+4.00%(2) • Cost of funds of L + 2.25% inclusive of amortization of fees and expenses associated with financing facilities L+4.00% L+5.68% -L+2.25% L+2.25%(3) L+1.75% • Results in a net spread of L + 1.75% 3.25X LEVERAGE • 76.5% financing advance rate implies a 3.25x debt-to- equity leverage multiple at the asset level • Levered net spread of L + 5.68% plus asset yield of Asset yield Cost of funds Gross ROI L + 4.00% results in a gross asset level ROE of L + 9.68% (1) For illustrative purposes only. The information contained on this page is not meant to be an indicator of our current or expected returns and, instead, is hypothetical only and subject to risks and uncertainties that are out of our control. See the Safe Harbor statement at the beginning of this presentation for further discussion of the risks and uncertainties. (2) Includes amortization of origination fees and exit fees. 24 (3) Includes amortization of fees and expenses associated with the financing facilities.

Appendix

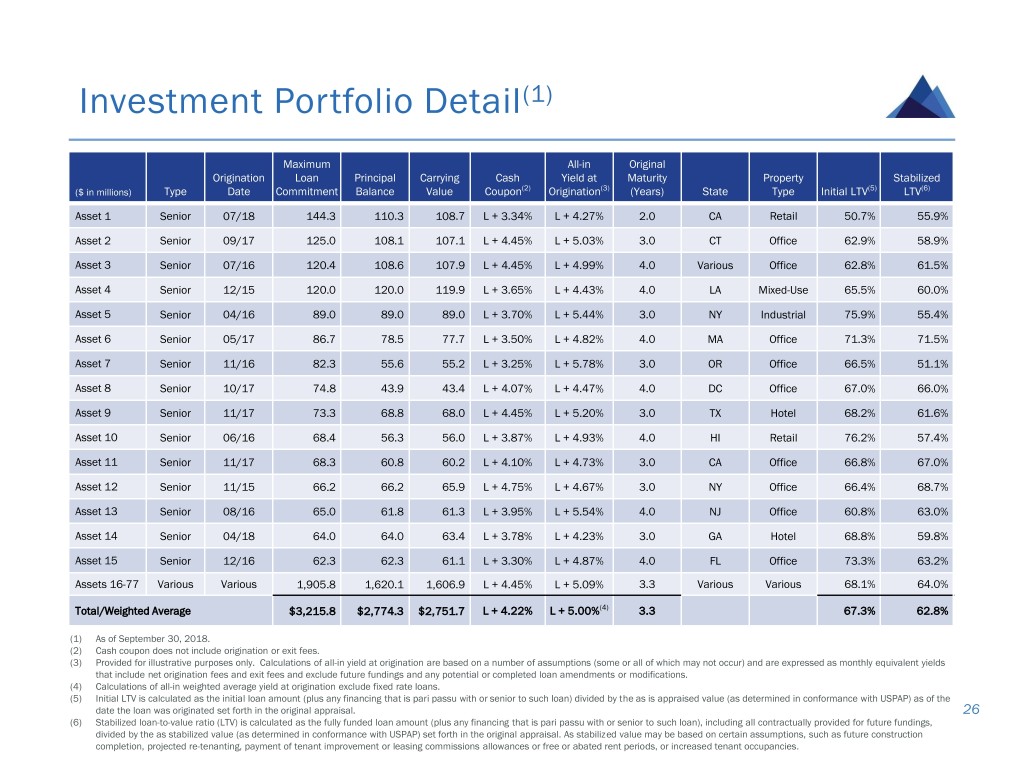

Investment Portfolio Detail(1) Maximum All-in Original Origination Loan Principal Carrying Cash Yield at Maturity Property Stabilized ($ in millions) Type Date Commitment Balance Value Coupon(2) Origination(3) (Years) State Type Initial LTV(5) LTV(6) Asset 1 Senior 07/18 144.3 110.3 108.7 L + 3.34% L + 4.27% 2.0 CA Retail 50.7% 55.9% Asset 2 Senior 09/17 125.0 108.1 107.1 L + 4.45% L + 5.03% 3.0 CT Office 62.9% 58.9% Asset 3 Senior 07/16 120.4 108.6 107.9 L + 4.45% L + 4.99% 4.0 Various Office 62.8% 61.5% Asset 4 Senior 12/15 120.0 120.0 119.9 L + 3.65% L + 4.43% 4.0 LA Mixed-Use 65.5% 60.0% Asset 5 Senior 04/16 89.0 89.0 89.0 L + 3.70% L + 5.44% 3.0 NY Industrial 75.9% 55.4% Asset 6 Senior 05/17 86.7 78.5 77.7 L + 3.50% L + 4.82% 4.0 MA Office 71.3% 71.5% Asset 7 Senior 11/16 82.3 55.6 55.2 L + 3.25% L + 5.78% 3.0 OR Office 66.5% 51.1% Asset 8 Senior 10/17 74.8 43.9 43.4 L + 4.07% L + 4.47% 4.0 DC Office 67.0% 66.0% Asset 9 Senior 11/17 73.3 68.8 68.0 L + 4.45% L + 5.20% 3.0 TX Hotel 68.2% 61.6% Asset 10 Senior 06/16 68.4 56.3 56.0 L + 3.87% L + 4.93% 4.0 HI Retail 76.2% 57.4% Asset 11 Senior 11/17 68.3 60.8 60.2 L + 4.10% L + 4.73% 3.0 CA Office 66.8% 67.0% Asset 12 Senior 11/15 66.2 66.2 65.9 L + 4.75% L + 4.67% 3.0 NY Office 66.4% 68.7% Asset 13 Senior 08/16 65.0 61.8 61.3 L + 3.95% L + 5.54% 4.0 NJ Office 60.8% 63.0% Asset 14 Senior 04/18 64.0 64.0 63.4 L + 3.78% L + 4.23% 3.0 GA Hotel 68.8% 59.8% Asset 15 Senior 12/16 62.3 62.3 61.1 L + 3.30% L + 4.87% 4.0 FL Office 73.3% 63.2% Assets 16-77 Various Various 1,905.8 1,620.1 1,606.9 L + 4.45% L + 5.09% 3.3 Various Various 68.1% 64.0% Total/Weighted Average $3,215.8 $2,774.3 $2,751.7 L + 4.22% L + 5.00%(4) 3.3 67.3% 62.8% (1) As of September 30, 2018. (2) Cash coupon does not include origination or exit fees. (3) Provided for illustrative purposes only. Calculations of all-in yield at origination are based on a number of assumptions (some or all of which may not occur) and are expressed as monthly equivalent yields that include net origination fees and exit fees and exclude future fundings and any potential or completed loan amendments or modifications. (4) Calculations of all-in weighted average yield at origination exclude fixed rate loans. (5) Initial LTV is calculated as the initial loan amount (plus any financing that is pari passu with or senior to such loan) divided by the as is appraised value (as determined in conformance with USPAP) as of the date the loan was originated set forth in the original appraisal. 26 (6) Stabilized loan-to-value ratio (LTV) is calculated as the fully funded loan amount (plus any financing that is pari passu with or senior to such loan), including all contractually provided for future fundings, divided by the as stabilized value (as determined in conformance with USPAP) set forth in the original appraisal. As stabilized value may be based on certain assumptions, such as future construction completion, projected re-tenanting, payment of tenant improvement or leasing commissions allowances or free or abated rent periods, or increased tenant occupancies.