EXECUTED FIRST AMENDMENT TO CREDIT AGREEMENT This FIRST AMENDMENT TO CREDIT AGREEMENT, dated as of December 19, 2018 (this “Amendment”), is made by and among GP COMMERCIAL CB SL LLC, a Delaware limited liability company (the “Borrower”), GP COMMERCIAL CB SL HOLDINGS LLC, a Delaware limited liability company (the “Parent Guarantor”), GRANITE POINT MORTGAGE TRUST INC., a Maryland corporation (the “REIT”), GRANITE POINT OPERATING COMPANY LLC, a Delaware limited liability company (“GPOC LLC”), TH COMMERCIAL HOLDINGS LLC, a Delaware limited liability company (the “HoldCo” and, together with the Parent Guarantor, the REIT and GPOC LLC, the “Guarantors”), the banks, financial institutions and other institutional lenders listed on the signature pages hereof as the lenders (the “Lenders”), CITIBANK, N.A. (“Citibank”), as administrative agent (the “Administrative Agent”) for the Lenders, and CITIGROUP GLOBAL MARKETS INC. (“CGMI”), as sole lead arranger and sole lead book running manager (the “Arranger”). RECITALS WHEREAS, the parties hereto entered into that certain Credit Agreement, dated as of April 13, 2018 (as amended, supplemented or otherwise modified prior to the date hereof, the “Credit Agreement”); WHEREAS, the parties hereto wish to make certain changes to the Credit Agreement as further described herein. NOW, THEREFORE, in consideration of the premises and the mutual agreements contained herein and in the Credit Agreement, the parties hereto agree as follows: SECTION 1. Definitions. All capitalized terms not otherwise defined herein are used as defined in the Credit Agreement. SECTION 2. Amendments to Credit Agreement. Effective as of the Effective Date (as defined below), the Credit Agreement is hereby amended as follows: 2.1. The following new definitions are hereby added to Section 1.1 of the Credit Agreement in their appropriate alphabetical order: ““First Amendment Effective Date” means December 19, 2018.”. ““Temporary Increase Termination Date” means the earliest of: (a) March 29, 2019 and (b) the date of termination in whole of the Commitments pursuant to Section 2.05 or 6.01.”. 2.2. Section 2.06(b)(iv) of the Credit Agreement is hereby amended by deleting “[Reserved.]” and adding the following sentence: “The unpaid principal amount of the Obligations in excess of $75,000,000 outstanding on the Temporary Increase Termination Date, together with all accrued but unpaid interest thereon, shall be due and payable on the Temporary Increase Termination Date.”

2.3. Schedule I to the Credit Agreement is hereby deleted in its entirety and replaced with Schedule I attached hereto. SECTION 3. Conditions Precedent. This Amendment shall become effective on the date (the “Effective Date”) when the Administrative Agent shall have received (each in form and substance reasonably satisfactory to the Administrative Agent): (i) Counterparts of this Amendment duly executed by the Borrower, the Guarantors, each Lender party hereto and the Administrative Agent; (ii) the Amended and Restated Note duly completed and executed by the Borrower and payable to the Lender; (iii) UCC, judgment, tax, litigation and bankruptcy searches with respect to each applicable Loan Party, and, in the case of UCC searches, listing all effective financing statements filed in the jurisdictions specified by the Administrative Agent that name any Loan Party as debtor, together with copies of such financing statements, and such searches shall reveal no Liens on any of the assets of the Loan Parties; (iv) (x) a certificate of a Responsible Officer of each Loan Party, dated the Effective Date, with appropriate insertions and attachments (including organizational authorizations, incumbency certifications, the certificate of incorporation or other similar organizational document of each Loan Party certified by the relevant authority of the jurisdiction of organization of such Loan Party and bylaws or other similar organizational document of each Loan Party (or, in the case of the certificate of incorporation, bylaws or similar organizational document, a certification from such Responsible Officer that such documents have not changed since previously delivered to the Administrative Agent)) and (y) a good standing certificate for each Loan Party from its jurisdiction of organization; (v) favorable written opinions of counsel from (x) Sidley Austin LLP, (y) Holland & Knight and (z) Stinson Leonard Street, or such other special counsel for the Loan Parties, each in form and substance satisfactory to the Administrative Agent in its reasonable discretion, dated as of the Effective Date; (vi) a certificate substantially in the form of Exhibit K of the Credit Agreement from the Chief Financial Officer (or other Responsible Officer performing similar functions) of the REIT certifying that the REIT and its Subsidiaries, considered as a whole, after giving effect to the transactions contemplated hereby to occur on the Effective Date, are Solvent; (vii) the Administrative Agent shall have received a certificate, dated as of the Effective Date and signed by a Responsible Officer of the Borrower, confirming satisfaction of the conditions set forth in Sections 3.02(b) of the Credit Agreement; 2

(viii) evidence that before and after giving effect to the transactions contemplated by this Amendment, there shall have occurred no Material Adverse Change since December 31, 2017; (ix) evidence that no action, investigation, litigation or proceeding affecting any Loan Party or any of its Subsidiaries pending or threatened before any court, governmental agency or arbitrator that (i) could reasonably be expected to result in a Material Adverse Effect or (ii) purports to affect the legality, validity or enforceability of this Amendment or any Loan Document or the consummation of the transactions contemplated hereby or thereby; (x) evidence that all governmental and third party consents and approvals necessary in connection with the transactions contemplated by this Amendment or any Loan Documents shall have been obtained (without the imposition of any conditions that are not acceptable to the Lenders) and evidence of such approvals shall have been provided to the Administrative Agent, and shall remain in effect, and no law or regulation shall be applicable in the reasonable judgment of the Lenders that restrains, prevents or imposes materially adverse conditions upon the transactions contemplated by this Amendment or the Loan Documents; (xi) payment of all fees and other amounts due and payable on or prior to the Effective Date in accordance with the Credit Agreement, including, without limitation, (A) payment of all fees set forth in any Fee Letter, which fees are, in each case, fully-earned as of the date hereof, non- refundable and (except as otherwise expressly set forth therein) not creditable against any other fees, and (B) the fees and disbursements invoiced through the Effective Date of the Administrative Agent’s special counsel, Fried, Frank, Harris, Shriver & Jacobson LLP; and (xii) such other approvals, opinions, certificates, instruments and documents as it may have reasonably requested in advance from the Loan Parties. SECTION 4. Reaffirmation. Each Loan Party hereby acknowledges and confirms to Administrative Agent and each Lender that (a) the Collateral Documents and each other Loan Document to which it is a party are each hereby reaffirmed and ratified without qualification and are and remain in full force and effect in accordance with their respective terms and (b) the Liens and security interests of the Administrative Agent under the Collateral Documents and the other Loan Documents that secure all the Obligations, continue in full force and effect in accordance with their respective terms and have the same priority as before this Amendment. SECTION 5. Miscellaneous. 3

5.1. Representations and Warranties. Each Loan Party hereby represents and warrants that (a) this Amendment has been duly executed and delivered by each Loan Party and general partner or managing member (if any) of each Loan Party party thereto, (b) this Amendment is the legal, valid and binding obligation of each Loan Party and general partner or managing member (if any) of each Loan Party party thereto, enforceable against such Loan Party, general partner or managing member, as the case may be, in accordance with its terms subject to bankruptcy, insolvency, and other limitations on creditors’ rights generally and to general principles of equity, (c) the representations and warranties contained in the Credit Agreement and each other Loan Document are correct and complete in all material respects on and as of such date, before and after giving effect to this Amendment, (d) no Default or Event of Default has occurred and is continuing under the Credit Agreement or any other Loan Document, or would result from this Amendment, (e) the execution and delivery by each Loan Party and of each general partner or managing member (if any) of each Loan Party of this Amendment, and the performance of its obligations hereunder, and the consummation of the transactions contemplated hereby, are within the corporate, limited liability company or partnership powers of such Loan Party, general partner or managing member, have been duly authorized by all necessary corporate, limited liability company or partnership action, and do not (i) contravene the charter or bylaws, operating agreement, partnership agreement or other governing document of such Loan Party, general partner or managing member, (ii) violate any law, rule, regulation (including, without limitation, Regulation X of the Board of Governors of the Federal Reserve System), order, writ, judgment, injunction, decree, determination or award, (iii) conflict with or result in the breach of, or constitute a default or require any payment to be made under, any Material Contract, loan agreement, indenture, mortgage, deed of trust, lease or other instrument binding on or affecting any Loan Party or any of their properties, or any general partner or managing member of any Loan Party or (iv) except for the Liens created under the Loan Documents, result in or require the creation or imposition of any Lien upon or with respect to any of the properties of any Loan Party, (f) no Loan Party is in violation of any such law, rule, regulation, order, writ, judgment, injunction, decree, determination or award or in breach of any such contract, loan agreement, indenture, mortgage, deed of trust, lease or other instrument, the violation or breach of which could reasonably be expected to result in a Material Adverse Effect, (g) no authorization or approval or other action by, and no notice to or filing with, any Governmental Authority or regulatory body or any other third party is required for (i) the due execution, delivery, recordation, filing or performance by any Loan Party or any general partner or managing member of any Loan Party of this Amendment or for the consummation of the transactions contemplated by this Amendment, (ii) the grant by any Loan Party (or the general partner or managing member of such Loan Party) of the Liens granted by it pursuant to the Collateral Documents, (iii) the perfection or maintenance of the Liens created under the Collateral Documents (including the first priority nature thereof) or (iv) the exercise by the Administrative Agent or any Lender of its rights under this Amendment and the Loan Documents or the remedies in respect of the Collateral pursuant to the Collateral Documents, except for authorizations, approvals, actions, notices and filings which have been duly obtained, taken, given or made and are in full force and effect, and (h) the he REIT is in compliance with the covenants set forth in Section 5.04 of the Credit Agreement on a pro forma basis as of the last day of the most recently ended fiscal quarter for which the Borrower is required to have delivered quarterly financials pursuant to Section 5.03(c) both immediately before and immediately after giving effect to the Amendment and the transactions contemplated thereby. 4

5.2. References to Credit Agreement. Upon the effectiveness of this Amendment, each reference in the Credit Agreement to “the Credit Agreement”, “this Agreement”, “hereunder”, “hereof”, “herein”, or words of like import shall mean and be a reference to the Credit Agreement as amended hereby, and each reference to the Credit Agreement in any other document, instrument or agreement executed and/or delivered in connection with the Credit Agreement shall mean and be a reference to the Credit Agreement as amended hereby. 5.3. No Effect on Credit Agreement. Except as specifically amended by this Amendment, the Credit Agreement and all other Loan Documents shall remain in full force and effect and are hereby ratified and confirmed. 5.4. No Waiver. The execution, delivery and effectiveness of this Amendment shall not operate as a waiver of any right, power or remedy of any Agent or any Lender under the Credit Agreement or any other document, instrument or agreement executed in connection therewith, nor constitute a waiver of any provision contained therein, except as specifically set forth herein. 5.5. Governing Law. This Amendment, including but not limited to the validity, interpretation, construction, breach, enforcement or termination hereof and thereof, shall be governed by, and construed in accordance with, the law of the State of New York. 5.6. Successors and Assigns. This Amendment shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors and assigns. 5.7. Headings. Section headings in this Amendment are for convenience of reference only and shall in no way affect the interpretation of this Amendment or any provision hereof. 5.8. Counterparts. This Amendment may be executed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed shall be deemed to be an original and all of which taken together shall constitute one and the same agreement. Delivery of an executed counterpart of a signature page to this Amendment by telecopier or by email with a pdf or similar attachment shall be effective as delivery of an original executed counterpart of this Agreement. 5.9. Severability. In case one or more provisions of this Amendment shall be invalid, illegal or unenforceable in any respect under any applicable law, the validity, legality and enforceability of the remaining provisions contained herein or therein shall not be affected or impaired thereby. [Signatures Follow] 5

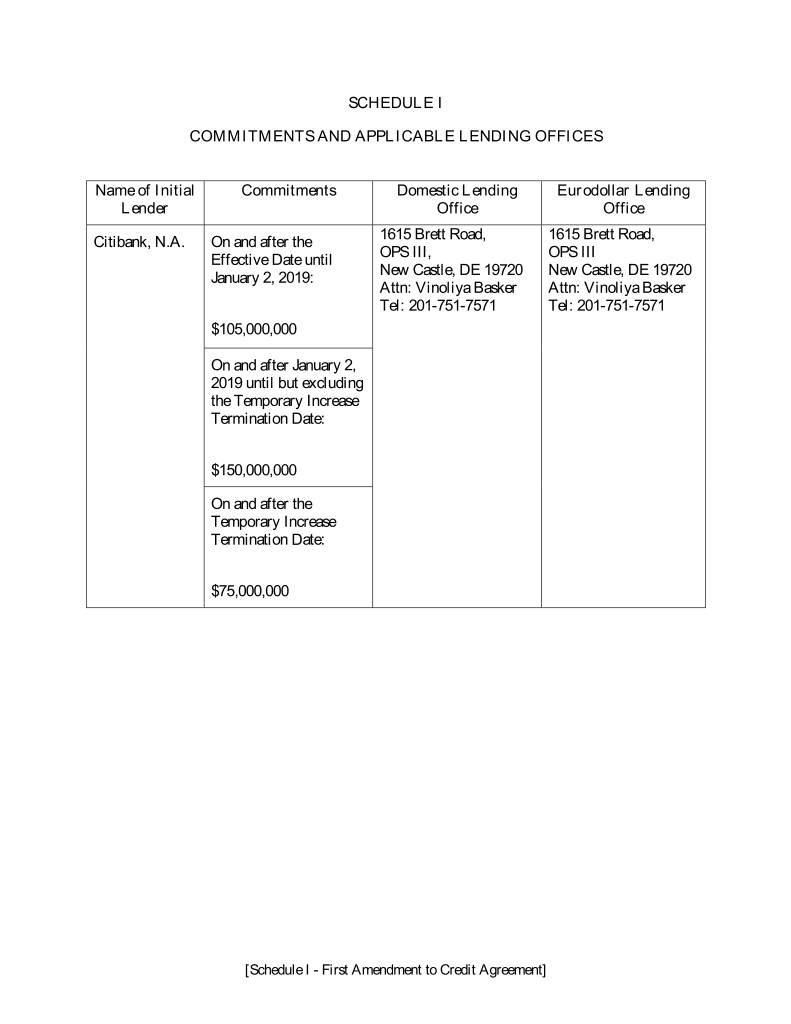

SCHEDULE I COMMITMENTS AND APPLICABLE LENDING OFFICES Name of Initial Commitments Domestic Lending Eurodollar Lending Lender Office Office Citibank, N.A. On and after the 1615 Brett Road, 1615 Brett Road, Effective Date until OPS III, OPS III January 2, 2019: New Castle, DE 19720 New Castle, DE 19720 Attn: Vinoliya Basker Attn: Vinoliya Basker Tel: 201-751-7571 Tel: 201-751-7571 $105,000,000 On and after January 2, 2019 until but excluding the Temporary Increase Termination Date: $150,000,000 On and after the Temporary Increase Termination Date: $75,000,000 [Schedule I - First Amendment to Credit Agreement]