UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No.1)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended: December 31, 2018

Commission File Number 001-38124

______________________________

GRANITE POINT MORTGAGE TRUST INC.

(Exact Name of Registrant as Specified in Its Charter)

|

| | |

Maryland | | 61-1843143 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

|

| | |

590 Madison Avenue, 38th Floor New York, New York | | 10022 |

(Address of Principal Executive Offices) | | (Zip Code) |

(212) 364-3200

(Registrant’s Telephone Number, Including Area Code)

Securities Registered Pursuant to Section 12(b) of the Act:

|

| | |

Title of Each Class: | | Name of Exchange on Which Registered: |

Common Stock, par value $0.01 per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer x | | | Accelerated filer o |

Non-accelerated filer o | | | Smaller reporting company o |

| | | Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

As of June 30, 2018, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $780.3 million based on the closing sale price as reported on the NYSE on that date.

As of February 26, 2019 there were 51,144,421 shares of common stock, par value $.01 per share, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for the 2019 Annual Meeting of Stockholders, which will be filed with the Securities and Exchange Commission under Regulation 14A within 120 days after the end of registrant’s fiscal year covered by this Annual Report, are incorporated by reference into Part III.

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (“Amendment No. 1”) to the Annual Report on Form 10-K for the year ended December 31, 2018, as filed with the Securities and Exchange Commission on February 27, 2019 (the “Original Filing”), of Granite Point Mortgage Trust Inc. (the “Company”), is being filed for the sole purpose of correcting an error in the number of shares of the Company’s common stock issued and outstanding as of February 26, 2019 reported on the cover page of the Original Filing and in Item 5 of Part II of the Original Filing. There are no changes to the disclosures in the Original Filing, except that this Amendment No. 1 amends the number of shares of the Company’s common stock issued and outstanding as of February 26, 2019 reported on the cover page of the Original Filing, from 50,885,503 shares to 51,144,421 shares and restates Item 5 of Part II of the Original Filing in its entirety.

Except for the foregoing, this Amendment No. 1 does not update or modify any of the information contained in the Original Filing. Other than as specifically set forth herein, this Amendment No. 1 continues to speak as of the date of the Original Filing. No attempt has been made in this Amendment No. 1 to modify or update the disclosures presented in the Original Filing or to modify or update those disclosures that may be affected by subsequent events. Accordingly, this Amendment No. 1 should be read in conjunction with the Original Filing and the Company’s other filings with the Securities and Exchange Commission. As required by Rule 12b-15 under the Securities and Exchange Act of 1934, as amended, this Amendment No. 1 includes updated certifications from the Company’s principal executive officer and principal financial officer as Exhibits 31.1 and 31.2.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

Market Information

Prior to our formation on June 28, 2017, there had been no public trading market for our common stock. Following June 28, 2017, our common stock has been listed on the NYSE under the symbol “GPMT”. As of February 26, 2019, 51,144,421 shares of common stock were issued and outstanding.

Holders

As of February 20, 2019, there were 290 registered holders and approximately 57,199 beneficial owners of our common stock.

Our stock transfer agent and registrar is Equiniti Trust Company. Requests for information from Equiniti Trust Company can be sent to Equiniti Trust Company, P.O. Box 64856, St. Paul, MN 55164-0856 and their telephone number is 1-800-468-9716.

Securities Authorized for Issuance under Equity Compensation Plans

Our Equity Incentive Plan was adopted by our board of directors and approved by our stockholders on June 14, 2017 for the purpose of enabling us to provide equity compensation to attract and retain qualified directors, officers, advisers, consultants and other personnel, including affiliates and personnel of our Manager and its affiliates, and any joint venture affiliates of ours. The Plan is administered by the compensation committee of our board of directors and permits the granting of restricted shares of common stock, phantom shares, dividend equivalent rights and other equity-based awards.

The following table presents certain information about the Plan as of December 31, 2018:

|

| | | | | | | | | | |

| | December 31, 2018 |

Plan Category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | Weighted-average exercise price of outstanding options, warrants and rights | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in the first column of this table) |

Equity compensation plans approved by stockholders | | — |

| | $ | — |

| | 2,857,072 |

|

Equity compensation plans not approved by stockholders (1) | | — |

| | — |

| | |

Total | | — |

| | $ | — |

| | 2,857,072 |

|

___________________

| |

(1) | For a detailed description of the Plan, see Note 17 - Equity Incentive Plan of the consolidated financial statements included under Item 8 of this Annual Report on Form 10-K. |

Performance Graph

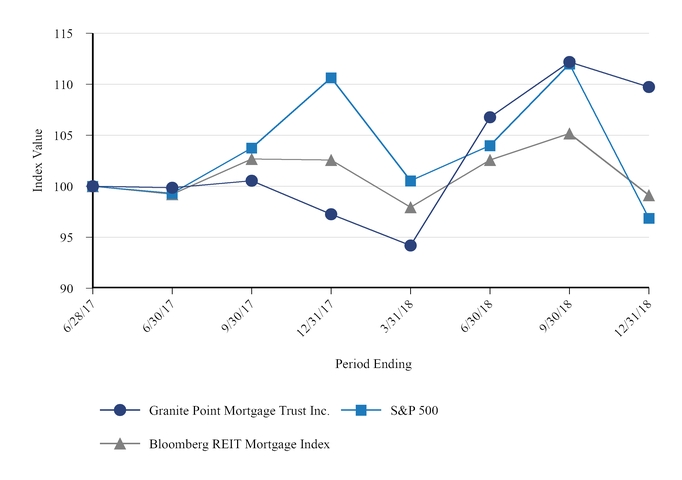

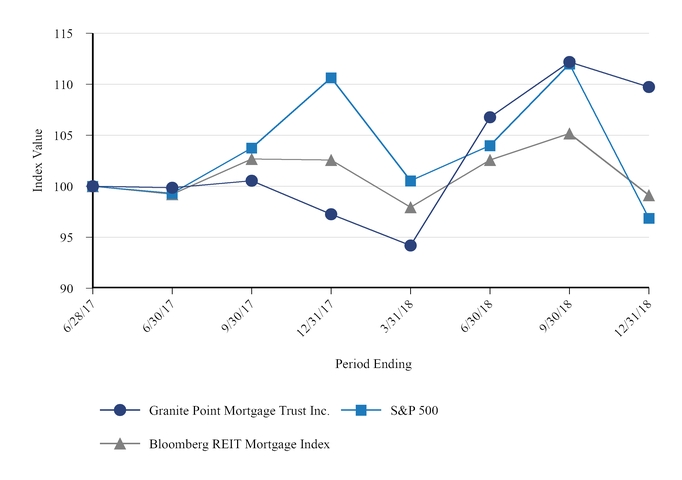

The following graph compares the stockholder’s cumulative total return, assuming $100 invested at June 28, 2017, with all reinvestment of dividends, as if such amounts had been invested in: (i) our common stock; (ii) the stocks included in the Standard and Poor’s 500 Stock Index, or S&P 500; and (iii) the stocks included in the Bloomberg REIT Mortgage Index.

COMPARISON OF CUMULATIVE TOTAL RETURN

Among Granite Point Mortgage Trust Inc.,

S&P 500 and Bloomberg REIT Mortgage Index

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Index | | 6/28/17 | | 6/30/17 | | 9/30/17 |

| | 12/31/17 | | 3/31/18 |

| | 6/30/18 | | 9/30/18 |

| | 12/31/18 |

Granite Point Mortgage Trust Inc. | | $ | 100.00 |

| | $ | 99.84 |

| | $ | 100.53 |

| | $ | 97.25 |

| | $ | 94.19 |

| | $ | 106.77 |

| | $ | 112.18 |

| | $ | 109.74 |

|

S&P 500 | | $ | 100.00 |

| | $ | 99.30 |

| | $ | 103.75 |

| | $ | 110.64 |

| | $ | 100.53 |

| | $ | 103.99 |

| | $ | 112.00 |

| | $ | 96.86 |

|

Bloomberg REIT Mortgage Index | | $ | 100.00 |

| | $ | 99.21 |

| | $ | 102.67 |

| | $ | 102.58 |

| | $ | 97.95 |

| | $ | 102.58 |

| | $ | 105.17 |

| | $ | 99.12 |

|

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

We did not repurchase any of our common stock during the fiscal years ended December 31, 2018 and 2017.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| | | |

| | | GRANITE POINT MORTGAGE TRUST INC. |

Dated: | March 1, 2019 | By: | /s/ John A. Taylor |

| | | John A. Taylor President, Chief Executive Officer and Director (Principal Executive Officer) |

EXHIBIT INDEX

|

| | |

Exhibit Number | | Description |

31.1 | | |

31.2 | | |