Second Quarter 2019 Earnings Presentation August 06, 2019

Safe Harbor Statement This presentation contains, in addition to historical information, certain forward-looking statements that are based on our current assumptions, expectations and projections about future performance and events. In particular, statements regarding future economic performance, finances, and expectations and objectives of management constitute forward-looking statements. Forward-looking statements are not historical in nature and can be identified by words such as "believes," "expects," "may," "will," "should," "seeks," "approximately," "intends," "plans," "estimates," "anticipates," “targets,” “goals,” “future,” “likely” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters. Although the forward-looking statements contained in this presentation are based upon information available at the time the statements are made and reflect the best judgment of our senior management, forward-looking statements inherently involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements to differ materially from anticipated future results. Important factors that could cause actual results to differ materially from expected results, including, among other things, those described in our filings with the Securities and Exchange Commission (“SEC”), including our annual report on form 10-K for the year ended December 31, 2018, and any subsequent Quarterly Reports on Form 10-Q under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: the state of the U.S. economy generally or in specific geographic regions; the general political, economic, and competitive conditions in the markets in which we invest; defaults by borrowers in paying debt service on outstanding indebtedness and borrowers' abilities to manage and stabilize properties; our ability to obtain financing arrangements on terms favorable to us or at all; the level and volatility of prevailing interest rates and credit spreads; reductions in the yield on our investments and an increase in the cost of our financing; general volatility of the securities markets in which we participate; the return or impact of current or future investments; allocation of investment opportunities to us by our Manager; increased competition from entities investing in our target assets; effects of hedging instruments on our target investments; changes in governmental regulations, tax law and rates, and similar matters; our ability to maintain our qualification as a REIT for U.S. federal income tax purposes and our exclusion from registration under the Investment Company Act; availability of desirable investment opportunities; availability of qualified personnel and our relationship with our Manager; estimates relating to our ability to make distributions to our stockholders in the future; hurricanes, earthquakes, and other natural disasters, acts of war and/or terrorism and other events that may cause unanticipated and uninsured performance declines and/or losses to us or the owners and operators of the real estate securing our investments; deterioration in the performance of the properties securing our investments that may cause deterioration in the performance of our investments and, potentially, principal losses to us; and difficulty or delays in redeploying the proceeds from repayments of our existing investments. These forward-looking statements apply only as of the date of this press release. We are under no duty to update any of these forward-looking statements after the date of this presentation to conform these statements to actual results or revised expectations. You should, therefore, not rely on these forward-looking statements as predictions of future events. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. 2

Company Overview(1) LEADING COMMERCIAL REAL ESTATE FINANCE COMPANY FOCUSED ON DIRECTLY ORIGINATING AND MANAGING SENIOR FLOATING RATE COMMERCIAL MORTGAGE LOANS EXPERIENCED AND CYCLE -TE STE D ATTRACTIVE AND SUSTAINABLE SENIOR CRE TEAM MARKET OPPORTUNITY • Over 20 years of experience each in the commercial real • Structural changes create an enduring, sectoral shift in estate debt markets flows of debt capital into U.S. commercial real estate • Extensive experience in investment management and • Borrower demand for debt capital for both acquisition and structured finance refinancing activity remains strong • Broad and longstanding direct relationships within the • Senior floating rate loans remain an attractive value commercial real estate lending industry proposition within the commercial real estate debt markets DIFFERENTIATED DIRECT HIGH CREDIT QUALITY ORIGINATION PLATFORM INVESTMENT PORTFOLIO • Direct origination of senior floating rate commercial real • Principal balance of $3.6 billion and well diversified estate loans across property types and geographies • Target top 25 and (generally) up to the top 50 MSAs in the • Senior loans comprise over 98% of the portfolio U.S. • Over 98% of portfolio is floating rate and well positioned • Fundamental value-driven investing combined with credit for rising short term interest rates intensive underwriting • Focus on cash flow as one of our key underwriting criteria • Diversified financing profile with a mix of non-recourse, non-mark-to-market, term-matched CLO debt; secured • Prioritize income-producing, institutional-quality properties credit facilities; and unsecured convertible bonds and sponsors 3 (1) Except as otherwise indicated in this presentation, reported data is as of or for the period ended June 30, 2019.

Second Quarter 2019 Highlights FINANCIAL . GAAP EPS of $0.34 and Core Earnings(1) of $0.36 per basic share, based on 54.0 million wtd. avg. shares SUMMARY . Book value of $18.74 per common share; declared and paid a dividend of $0.42 per common share . Closed on $422.6 million of senior commercial real estate loan commitments and funded $416.0 million PORTFOLIO in UPB (over $320 million in June) ACTIVITY . Received prepayments and principal amortization of $152.2 million . Principal balance of $3.6 billion (plus an additional $588.7 million of future funding commitments) PORTFOLIO . Over 98% floating rate and comprised of over 98% senior loans OVERVIEW . Weighted average stabilized LTV of 63% and weighted average yield at origination of LIBOR + 4.58%(2) . 5 secured repurchase agreements with a total outstanding balance of $1.3 billion and an aggregate borrowing capacity of up to $2.2 billion(3) . Closed a new term-matched, non-mark-to-market credit facility with an initial borrowing capacity of up to $150.0 million CAPITALIZATION . Issued over 2.66 million shares of common stock at a weighted average price of $19.11 per share through the company's at-the-market equity issuance program . Extended the maturity of our financing facilities with Goldman Sachs, Wells Fargo and JPMorgan to 2020, 2021 and 2022, respectively. These facilities also include extension options that range from 1 to 3 years . Generated a pipeline of senior CRE loans with total commitments of over $770 million and initial fundings of over $575 million, which have either closed or are in the closing process, subject to fallout. THIRD QUARTER Funded over $150 million of principal balance of loans so far in the third quarter of 2019 ACTIVITY . Extended the maturity of the Citi financing facility to 2022 and upsized borrowing capacity to $400 million . Extended the maturity of the $75 million Citi secured revolving financing facility to 2021, reduced its cost by 50bps and amended other terms 4 (1) Core Earnings is a non-GAAP measure. Please see slide 8 for a definition of Core Earnings and a reconciliation of GAAP to non-GAAP financial information. (2) See footnote (3) and (4) on p. 12. (3) See footnote (2) on p. 9.

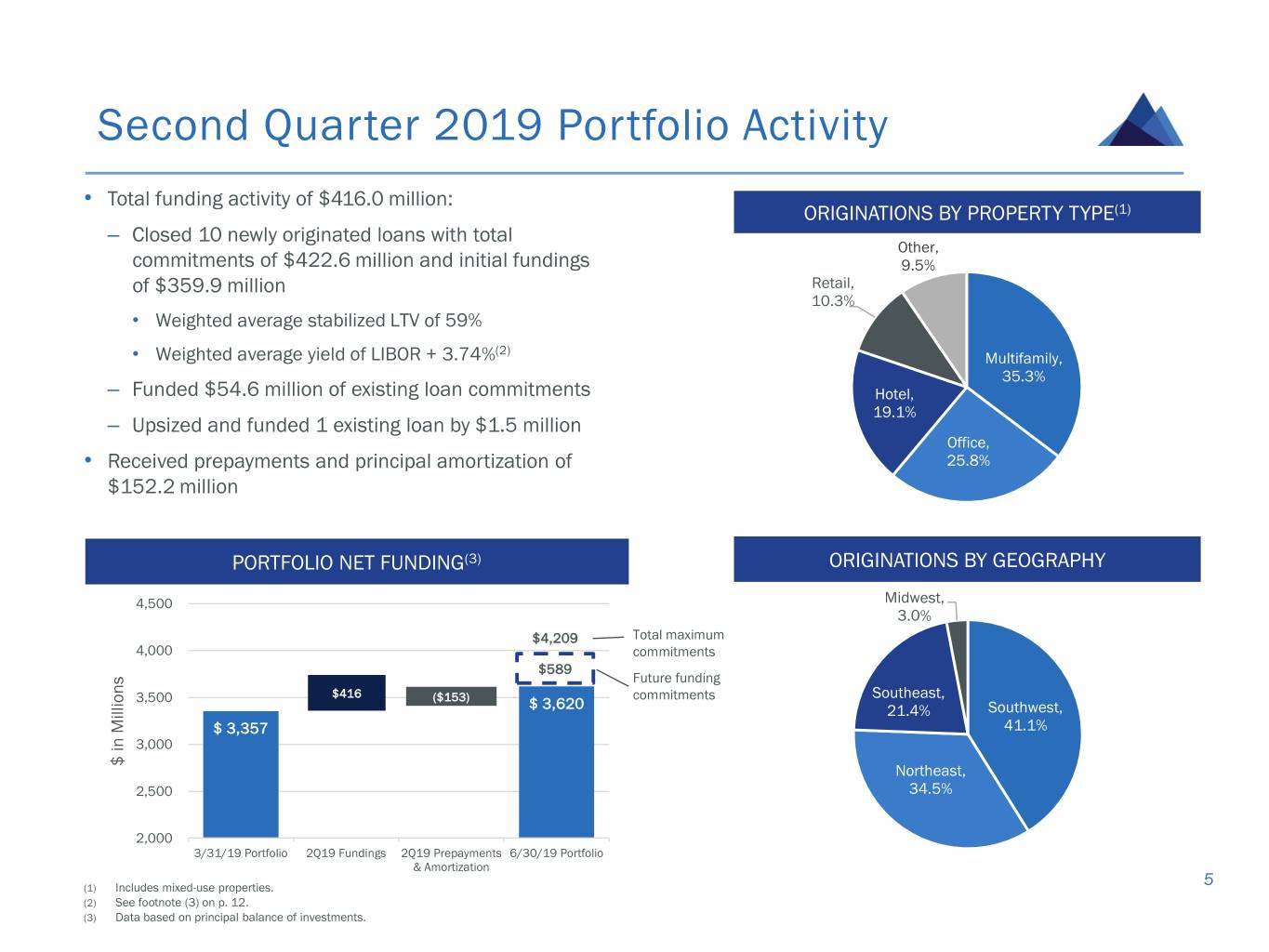

Second Quarter 2019 Portfolio Activity • Total funding activity of $416.0 million: ORIGINATIONS BY PROPERTY TYPE(1) – Closed 10 newly originated loans with total Other, commitments of $422.6 million and initial fundings 9.5% of $359.9 million Retail, 10.3% • Weighted average stabilized LTV of 59% (2) • Weighted average yield of LIBOR + 3.74% Multifamily, 35.3% – Funded $54.6 million of existing loan commitments Hotel, 19.1% – Upsized and funded 1 existing loan by $1.5 million Office, • Received prepayments and principal amortization of 25.8% $152.2 million PORTFOLIO NET FUNDING(3) ORIGINATIONS BY GEOGRAPHY 4,500 Midwest, 3.0% $4,209 Total maximum 4,000 commitments $589 Future funding 3,500 $416 ($153) commitments Southeast, $ 3,620 21.4% Southwest, $ 3,357 41.1% 3,000 $ in Millions Northeast, 2,500 34.5% 2,000 3/31/19 Portfolio 2Q19 Fundings 2Q19 Prepayments 6/30/19 Portfolio & Amortization 5 (1) Includes mixed-use properties. (2) See footnote (3) on p. 12. (3) Data based on principal balance of investments.

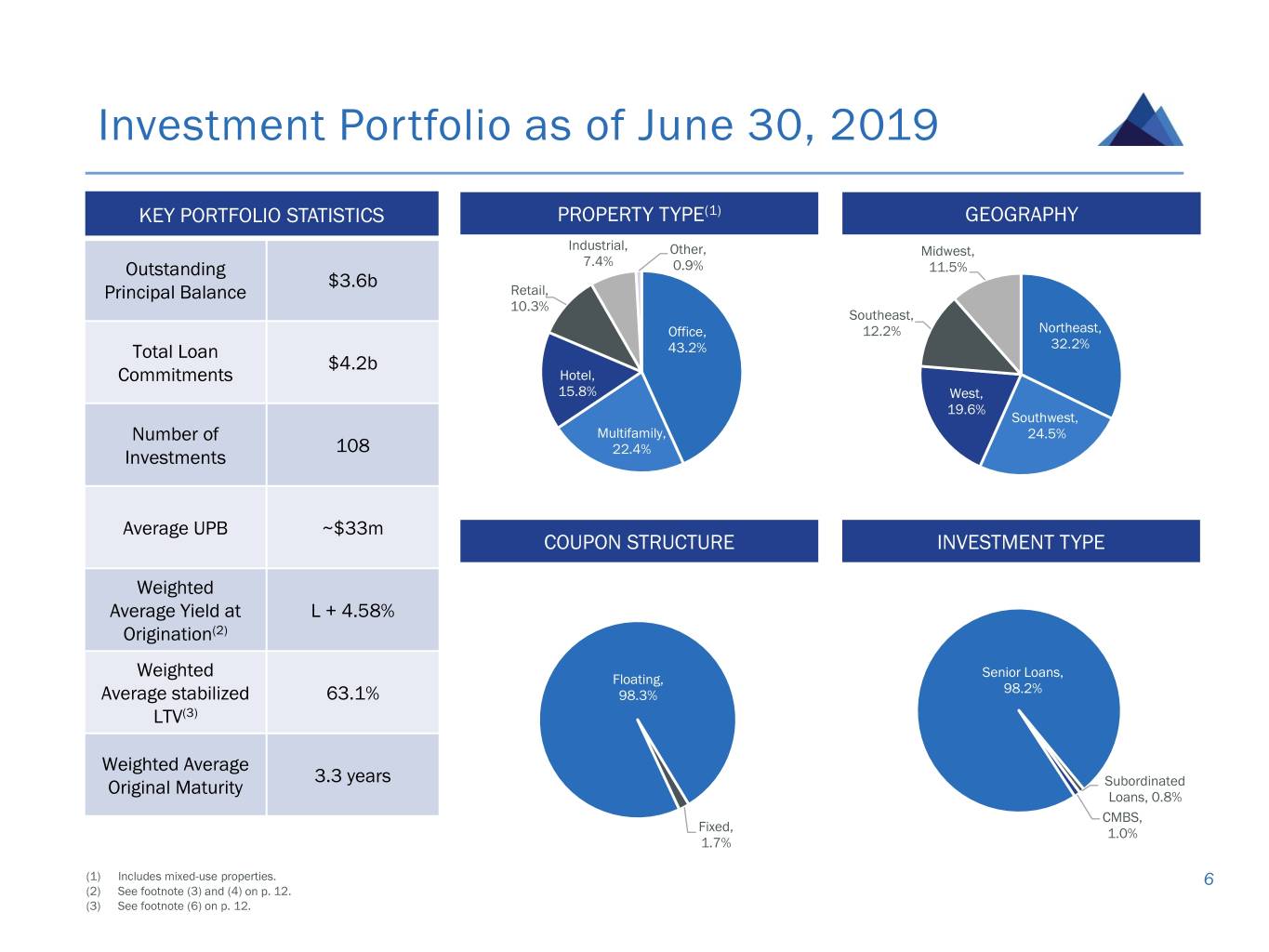

Investment Portfolio as of June 30, 2019 KEY PORTFOLIO STATISTICS PROPERTY TYPE(1) GEOGRAPHY Industrial, Other, Midwest, Outstanding 7.4% 0.9% 11.5% $3.6b Principal Balance Retail, 10.3% Southeast, Office, 12.2% Northeast, Total Loan 43.2% 32.2% $4.2b Commitments Hotel, 15.8% West, 19.6% Southwest, Number of Multifamily, 24.5% 108 Investments 22.4% Average UPB ~$33m COUPON STRUCTURE INVESTMENT TYPE Weighted Average Yield at L + 4.58% Origination(2) Senior Loans, Weighted Floating, 98.2% Average stabilized 63.1% 98.3% LTV(3) Weighted Average 3.3 years Subordinated Original Maturity Loans, 0.8% CMBS, Fixed, 1.0% 1.7% (1) Includes mixed-use properties. 6 (2) See footnote (3) and (4) on p. 12. (3) See footnote (6) on p. 12.

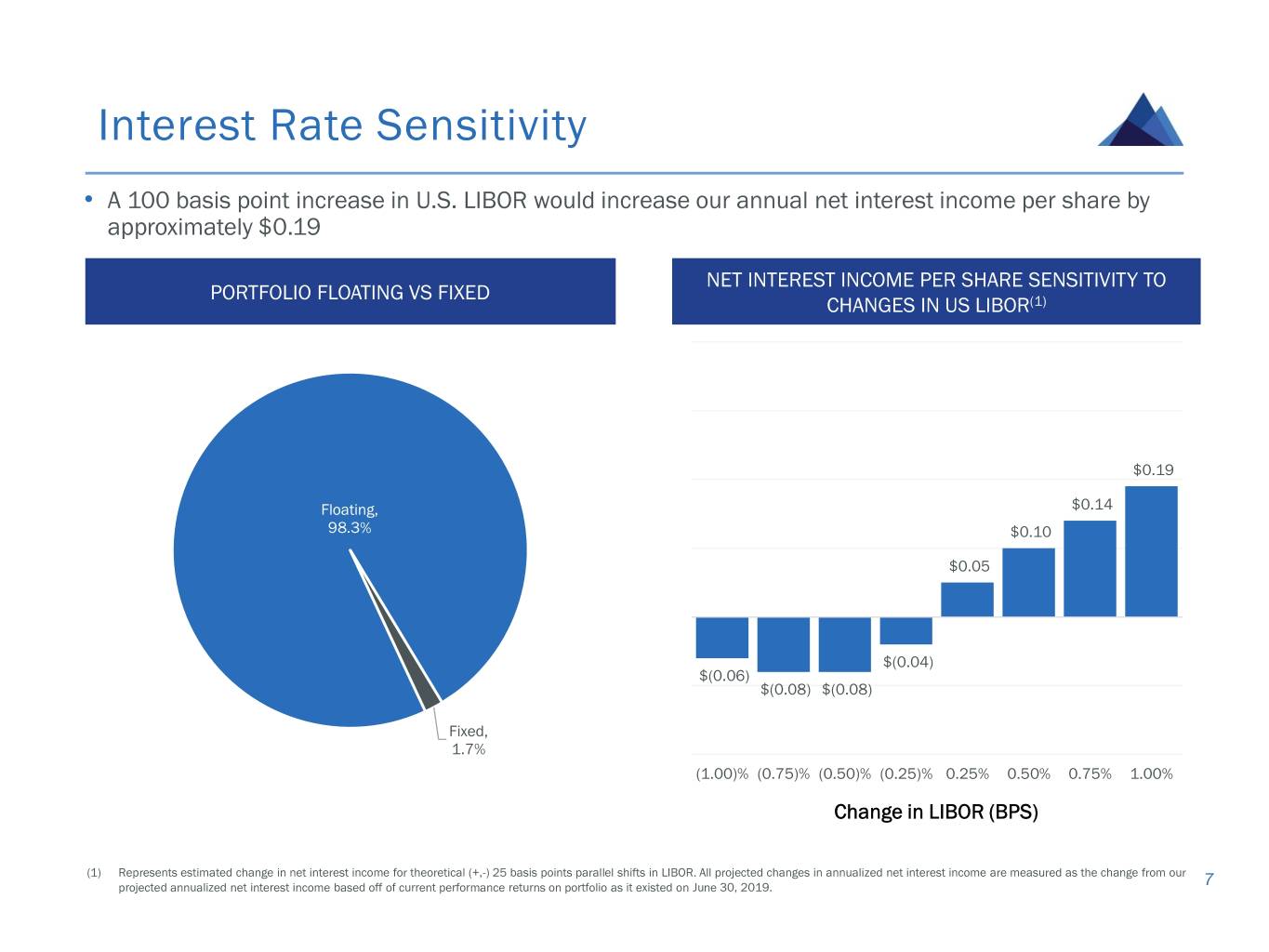

Interest Rate Sensitivity • A 100 basis point increase in U.S. LIBOR would increase our annual net interest income per share by approximately $0.19 NET INTEREST INCOME PER SHARE SENSITIVITY TO PORTFOLIO FLOATING VS FIXED CHANGES IN US LIBOR(1) $0.19 Floating, $0.14 98.3% $0.10 $0.05 $(0.04) $(0.06) $(0.08) $(0.08) Fixed, 1.7% (1.00)% (0.75)% (0.50)% (0.25)% 0.25% 0.50% 0.75% 1.00% Change in LIBOR (BPS) (1) Represents estimated change in net interest income for theoretical (+,-) 25 basis points parallel shifts in LIBOR. All projected changes in annualized net interest income are measured as the change from our projected annualized net interest income based off of current performance returns on portfolio as it existed on June 30, 2019. 7

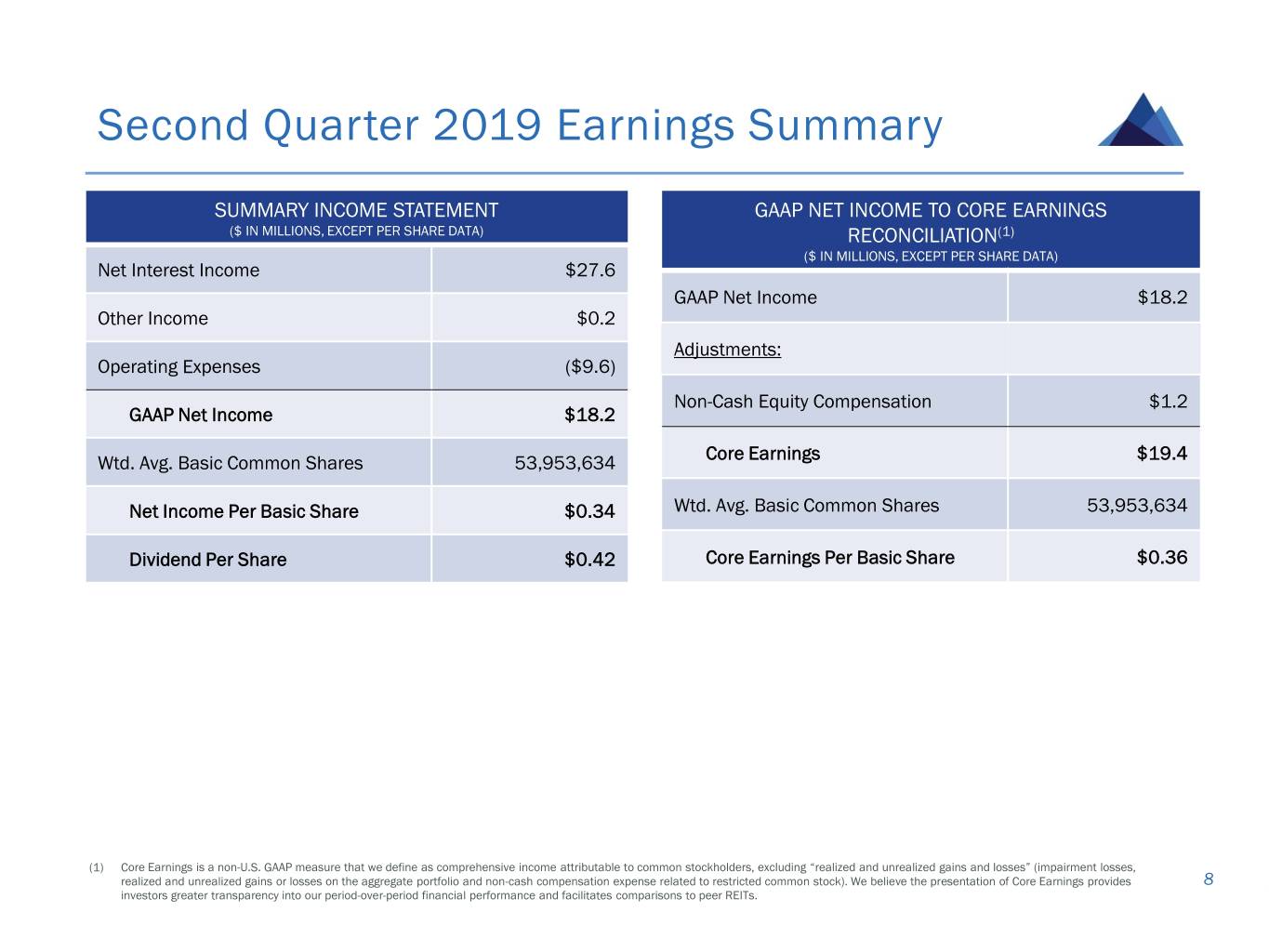

Second Quarter 2019 Earnings Summary SUMMARY INCOME STATEMENT GAAP NET INCOME TO CORE EARNINGS ($ IN MILLIONS, EXCEPT PER SHARE DATA) RECONCILIATION(1) ($ IN MILLIONS, EXCEPT PER SHARE DATA) Net Interest Income $27.6 GAAP Net Income $18.2 Other Income $0.2 Adjustments: Operating Expenses ($9.6) Non-Cash Equity Compensation $1.2 GAAP Net Income $18.2 Wtd. Avg. Basic Common Shares 53,953,634 Core Earnings $19.4 Net Income Per Basic Share $0.34 Wtd. Avg. Basic Common Shares 53,953,634 Dividend Per Share $0.42 Core Earnings Per Basic Share $0.36 (1) Core Earnings is a non-U.S. GAAP measure that we define as comprehensive income attributable to common stockholders, excluding “realized and unrealized gains and losses” (impairment losses, realized and unrealized gains or losses on the aggregate portfolio and non-cash compensation expense related to restricted common stock). We believe the presentation of Core Earnings provides 8 investors greater transparency into our period-over-period financial performance and facilitates comparisons to peer REITs.

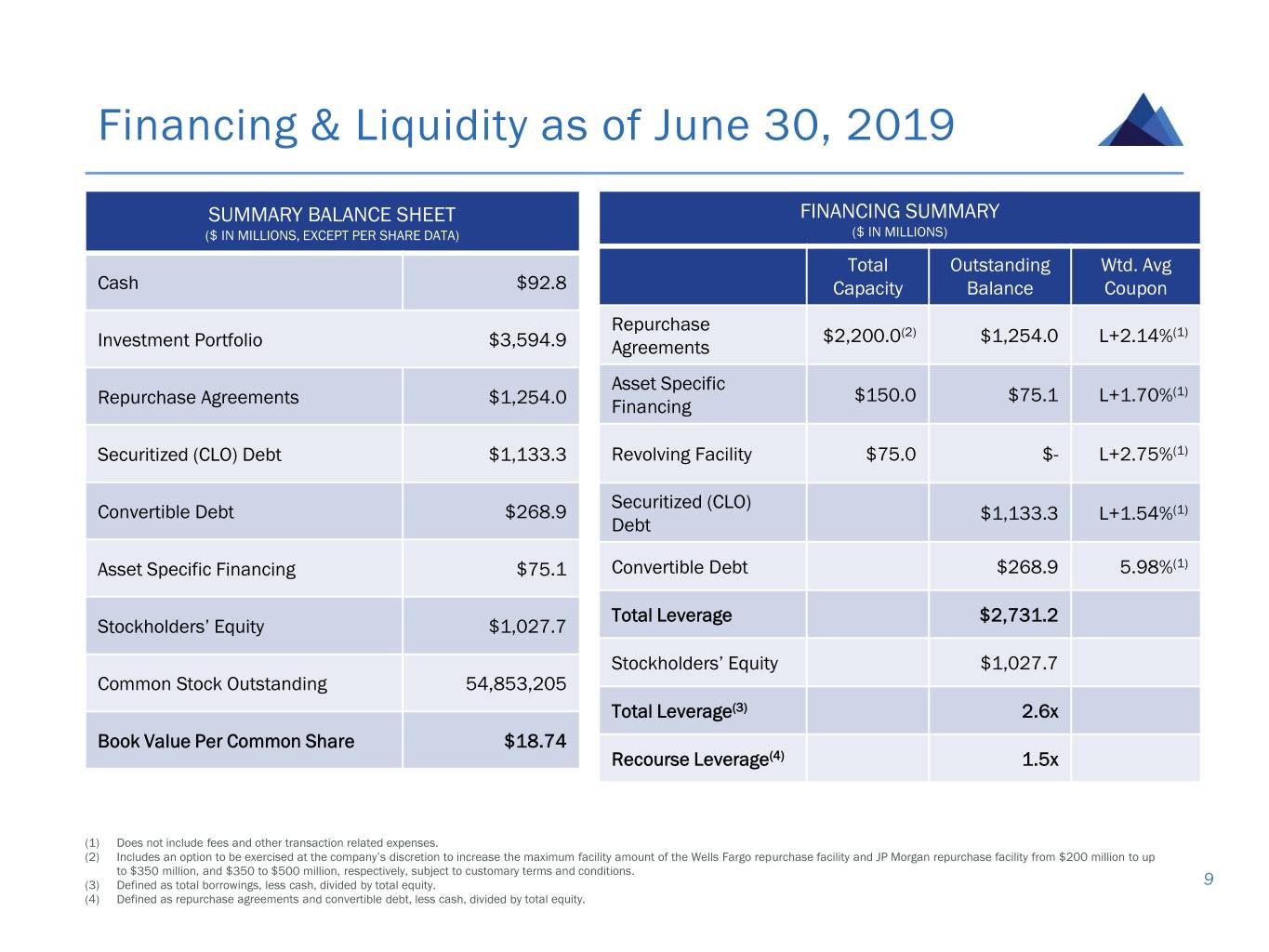

Financing & Liquidity as of June 30, 2019 SUMMARY BALANCE SHEET FINANCING SUMMARY ($ IN MILLIONS, EXCEPT PER SHARE DATA) ($ IN MILLIONS) Total Outstanding Wtd. Avg Cash $92.8 Capacity Balance Coupon Repurchase $2,200.0(2) $1,254.0 L+2.14%(1) Investment Portfolio $3,594.9 Agreements Asset Specific $150.0 $75.1 L+1.70%(1) Repurchase Agreements $1,254.0 Financing Securitized (CLO) Debt $1,133.3 Revolving Facility $75.0 $- L+2.75%(1) Securitized (CLO) Convertible Debt $268.9 $1,133.3 L+1.54%(1) Debt Asset Specific Financing $75.1 Convertible Debt $268.9 5.98%(1) Total Leverage $2,731.2 Stockholders’ Equity $1,027.7 Stockholders’ Equity $1,027.7 Common Stock Outstanding 54,853,205 Total Leverage(3) 2.6x Book Value Per Common Share $18.74 Recourse Leverage(4) 1.5x (1) Does not include fees and other transaction related expenses. (2) Includes an option to be exercised at the company’s discretion to increase the maximum facility amount of the Wells Fargo repurchase facility and JP Morgan repurchase facility from $200 million to up to $350 million, and $350 to $500 million, respectively, subject to customary terms and conditions. (3) Defined as total borrowings, less cash, divided by total equity. 9 (4) Defined as repurchase agreements and convertible debt, less cash, divided by total equity.

Appendix

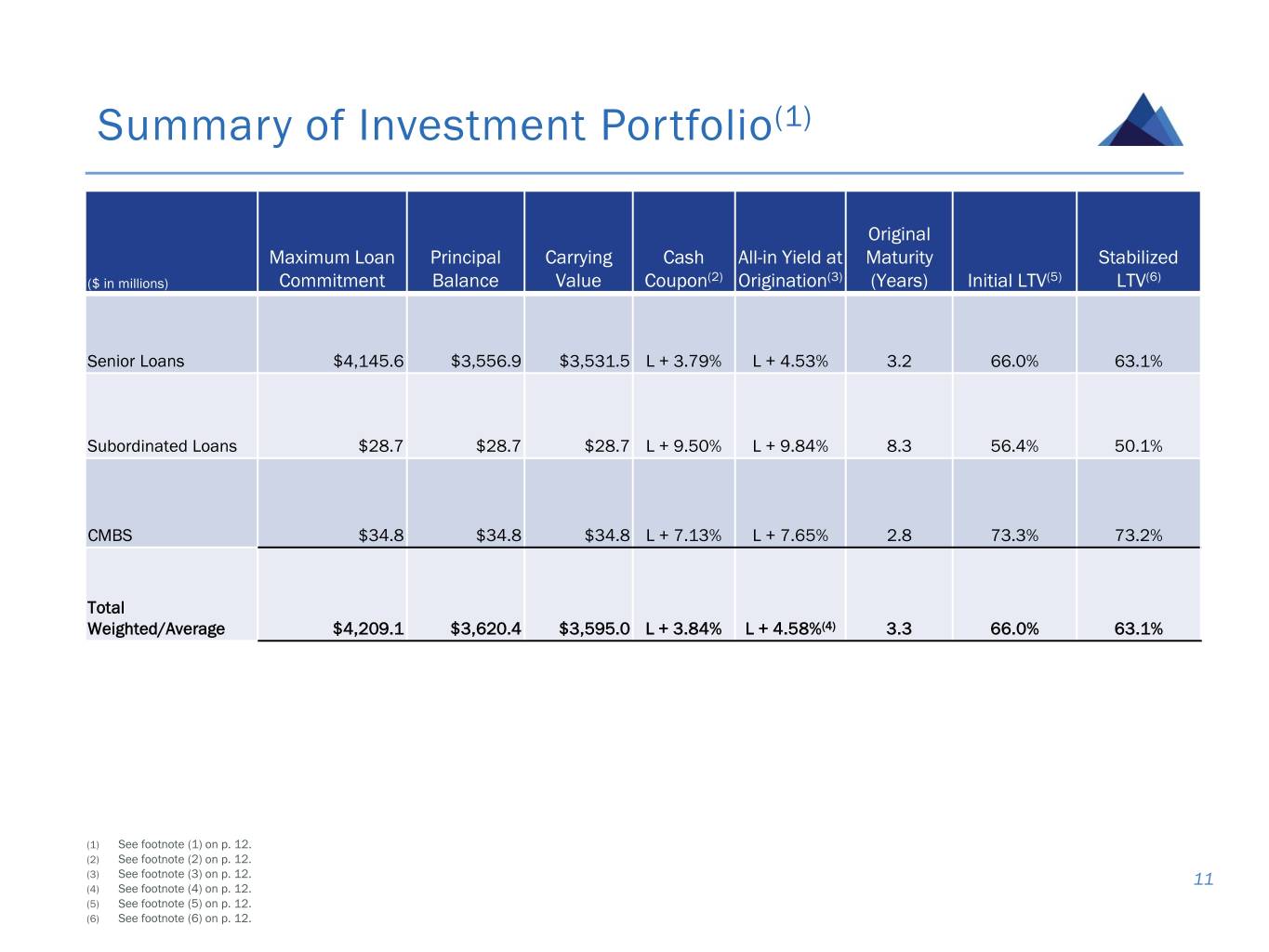

Summary of Investment Portfolio(1) Original Maximum Loan Principal Carrying Cash All-in Yield at Maturity Stabilized ($ in millions) Commitment Balance Value Coupon(2) Origination(3) (Years) Initial LTV(5) LTV(6) Senior Loans $4,145.6 $3,556.9 $3,531.5 L + 3.79% L + 4.53% 3.2 66.0% 63.1% Subordinated Loans $28.7 $28.7 $28.7 L + 9.50% L + 9.84% 8.3 56.4% 50.1% CMBS $34.8 $34.8 $34.8 L + 7.13% L + 7.65% 2.8 73.3% 73.2% Total Weighted/Average $4,209.1 $3,620.4 $3,595.0 L + 3.84% L + 4.58%(4) 3.3 66.0% 63.1% (1) See footnote (1) on p. 12. (2) See footnote (2) on p. 12. (3) See footnote (3) on p. 12. 11 (4) See footnote (4) on p. 12. (5) See footnote (5) on p. 12. (6) See footnote (6) on p. 12.

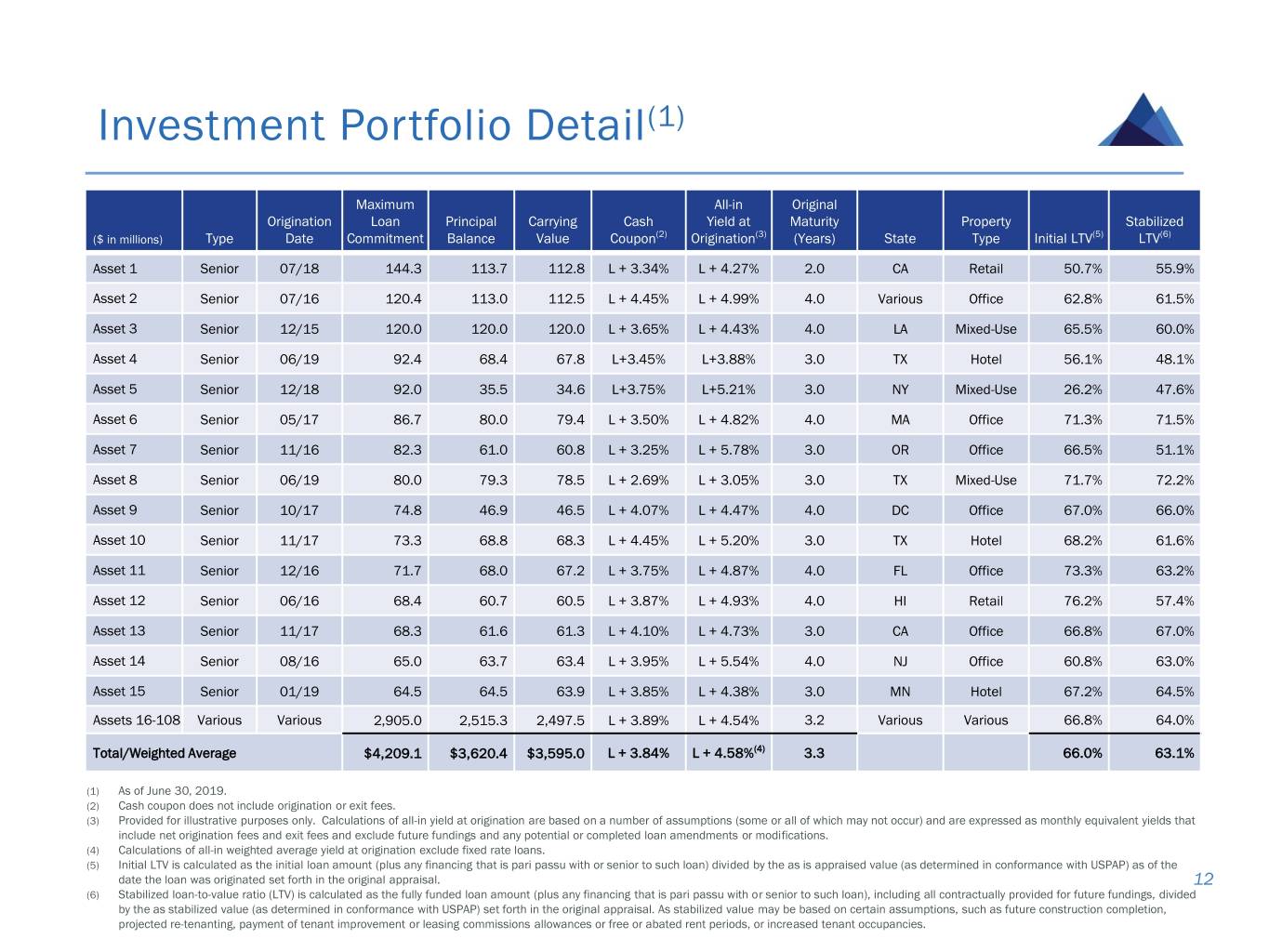

Investment Portfolio Detail(1) Maximum All-in Original Origination Loan Principal Carrying Cash Yield at Maturity Property Stabilized ($ in millions) Type Date Commitment Balance Value Coupon(2) Origination(3) (Years) State Type Initial LTV(5) LTV(6) Asset 1 Senior 07/18 144.3 113.7 112.8 L + 3.34% L + 4.27% 2.0 CA Retail 50.7% 55.9% Asset 2 Senior 07/16 120.4 113.0 112.5 L + 4.45% L + 4.99% 4.0 Various Office 62.8% 61.5% Asset 3 Senior 12/15 120.0 120.0 120.0 L + 3.65% L + 4.43% 4.0 LA Mixed-Use 65.5% 60.0% Asset 4 Senior 06/19 92.4 68.4 67.8 L+3.45% L+3.88% 3.0 TX Hotel 56.1% 48.1% Asset 5 Senior 12/18 92.0 35.5 34.6 L+3.75% L+5.21% 3.0 NY Mixed-Use 26.2% 47.6% Asset 6 Senior 05/17 86.7 80.0 79.4 L + 3.50% L + 4.82% 4.0 MA Office 71.3% 71.5% Asset 7 Senior 11/16 82.3 61.0 60.8 L + 3.25% L + 5.78% 3.0 OR Office 66.5% 51.1% Asset 8 Senior 06/19 80.0 79.3 78.5 L + 2.69% L + 3.05% 3.0 TX Mixed-Use 71.7% 72.2% Asset 9 Senior 10/17 74.8 46.9 46.5 L + 4.07% L + 4.47% 4.0 DC Office 67.0% 66.0% Asset 10 Senior 11/17 73.3 68.8 68.3 L + 4.45% L + 5.20% 3.0 TX Hotel 68.2% 61.6% Asset 11 Senior 12/16 71.7 68.0 67.2 L + 3.75% L + 4.87% 4.0 FL Office 73.3% 63.2% Asset 12 Senior 06/16 68.4 60.7 60.5 L + 3.87% L + 4.93% 4.0 HI Retail 76.2% 57.4% Asset 13 Senior 11/17 68.3 61.6 61.3 L + 4.10% L + 4.73% 3.0 CA Office 66.8% 67.0% Asset 14 Senior 08/16 65.0 63.7 63.4 L + 3.95% L + 5.54% 4.0 NJ Office 60.8% 63.0% Asset 15 Senior 01/19 64.5 64.5 63.9 L + 3.85% L + 4.38% 3.0 MN Hotel 67.2% 64.5% Assets 16-108 Various Various 2,905.0 2,515.3 2,497.5 L + 3.89% L + 4.54% 3.2 Various Various 66.8% 64.0% Total/Weighted Average $4,209.1 $3,620.4 $3,595.0 L + 3.84% L + 4.58%(4) 3.3 66.0% 63.1% (1) As of June 30, 2019. (2) Cash coupon does not include origination or exit fees. (3) Provided for illustrative purposes only. Calculations of all-in yield at origination are based on a number of assumptions (some or all of which may not occur) and are expressed as monthly equivalent yields that include net origination fees and exit fees and exclude future fundings and any potential or completed loan amendments or modifications. (4) Calculations of all-in weighted average yield at origination exclude fixed rate loans. (5) Initial LTV is calculated as the initial loan amount (plus any financing that is pari passu with or senior to such loan) divided by the as is appraised value (as determined in conformance with USPAP) as of the date the loan was originated set forth in the original appraisal. 12 (6) Stabilized loan-to-value ratio (LTV) is calculated as the fully funded loan amount (plus any financing that is pari passu with or senior to such loan), including all contractually provided for future fundings, divided by the as stabilized value (as determined in conformance with USPAP) set forth in the original appraisal. As stabilized value may be based on certain assumptions, such as future construction completion, projected re-tenanting, payment of tenant improvement or leasing commissions allowances or free or abated rent periods, or increased tenant occupancies.

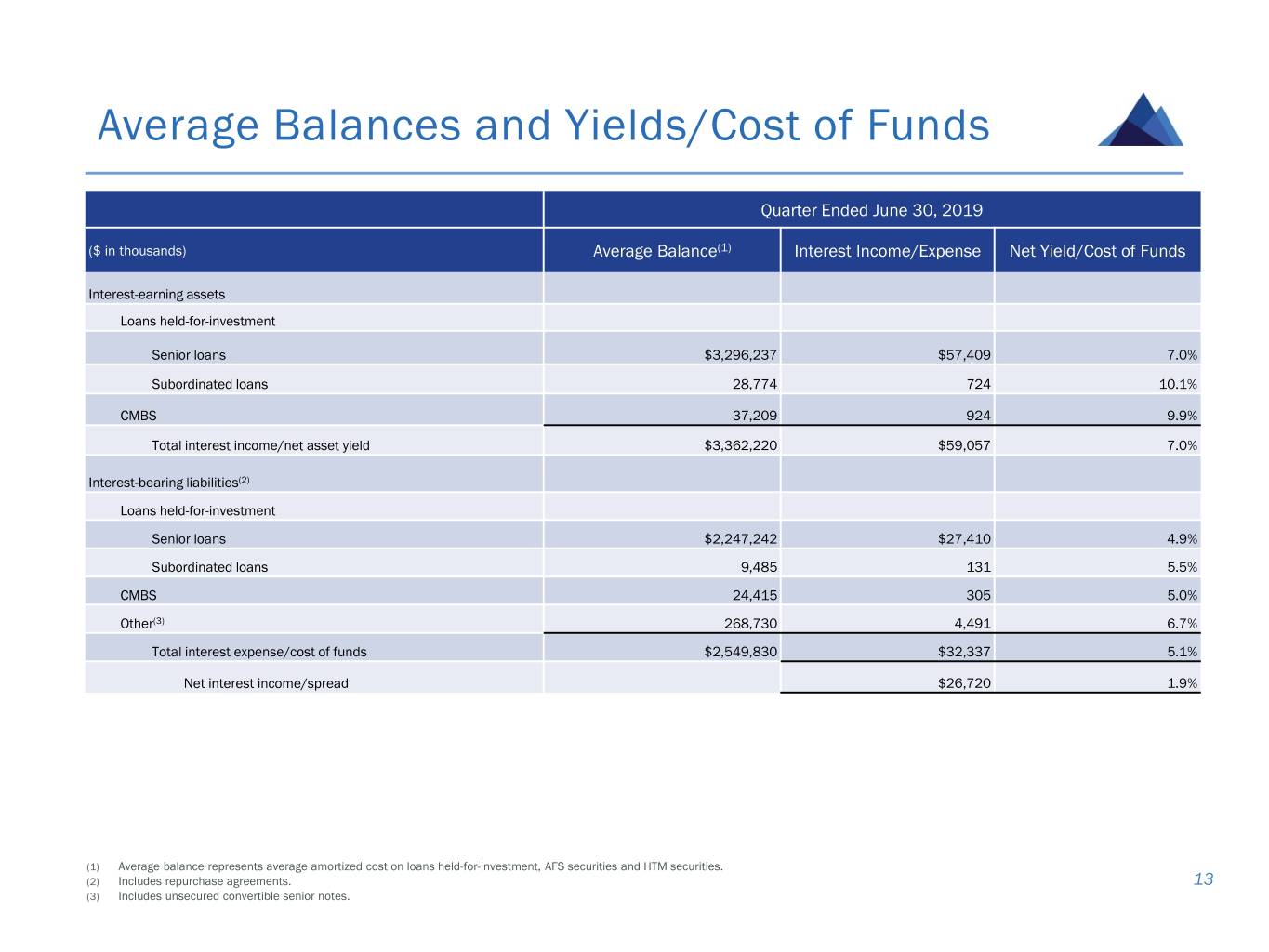

Average Balances and Yields/Cost of Funds Quarter Ended June 30, 2019 ($ in thousands) Average Balance(1) Interest Income/Expense Net Yield/Cost of Funds Interest-earning assets Loans held-for-investment Senior loans $3,296,237 $57,409 7.0% Subordinated loans 28,774 724 10.1% CMBS 37,209 924 9.9% Total interest income/net asset yield $3,362,220 $59,057 7.0% Interest-bearing liabilities(2) Loans held-for-investment Senior loans $2,247,242 $27,410 4.9% Subordinated loans 9,485 131 5.5% CMBS 24,415 305 5.0% Other(3) 268,730 4,491 6.7% Total interest expense/cost of funds $2,549,830 $32,337 5.1% Net interest income/spread $26,720 1.9% (1) Average balance represents average amortized cost on loans held-for-investment, AFS securities and HTM securities. (2) Includes repurchase agreements. 13 (3) Includes unsecured convertible senior notes.

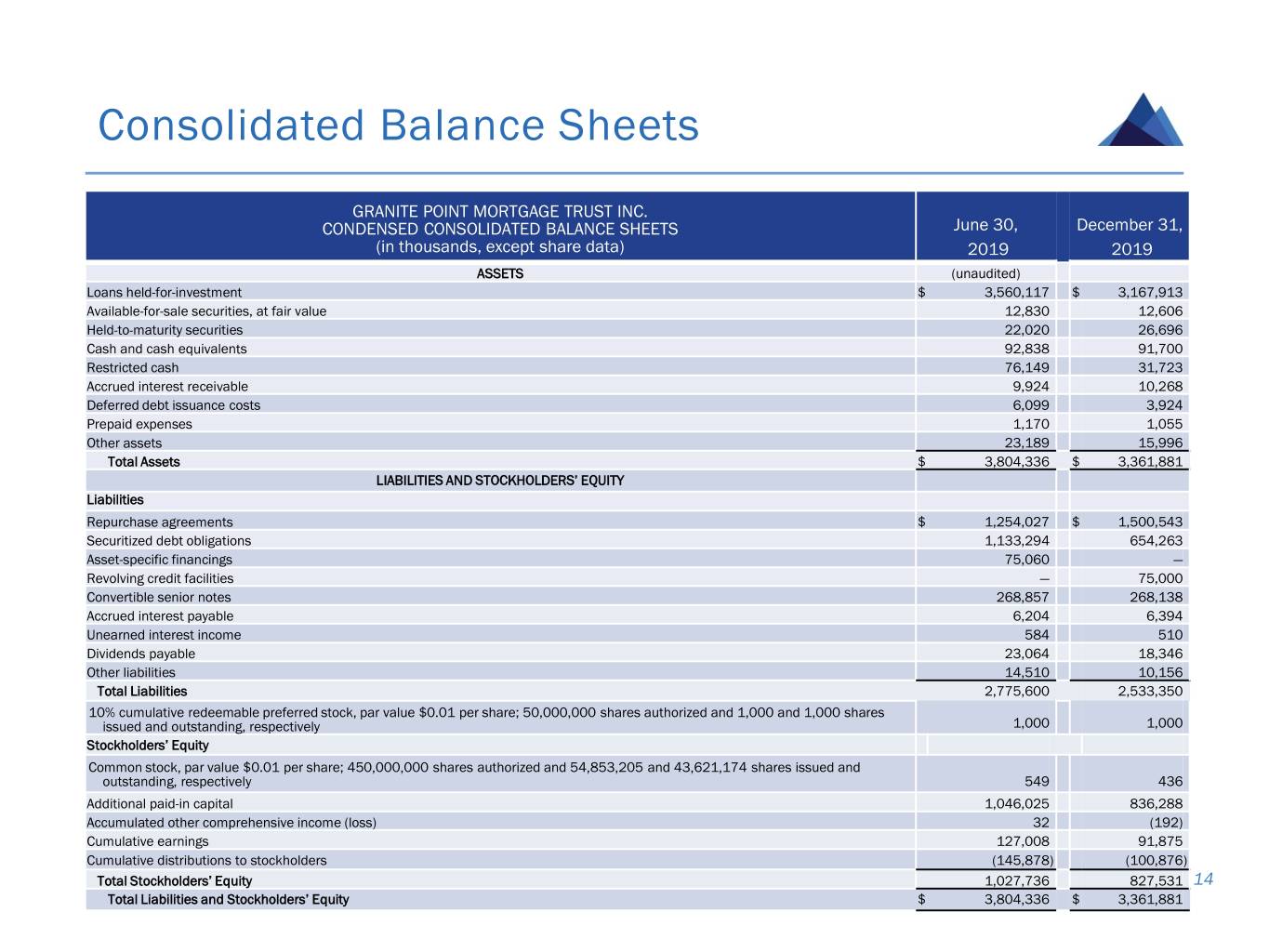

Consolidated Balance Sheets GRANITE POINT MORTGAGE TRUST INC. CONDENSED CONSOLIDATED BALANCE SHEETS June 30, December 31, (in thousands, except share data) 2019 2019 ASSETS (unaudited) Loans held-for-investment $ 3,560,117 $ 3,167,913 Available-for-sale securities, at fair value 12,830 12,606 Held-to-maturity securities 22,020 26,696 Cash and cash equivalents 92,838 91,700 Restricted cash 76,149 31,723 Accrued interest receivable 9,924 10,268 Deferred debt issuance costs 6,099 3,924 Prepaid expenses 1,170 1,055 Other assets 23,189 15,996 Total Assets $ 3,804,336 $ 3,361,881 LIABILITIES AND STOCKHOLDERS’ EQUITY Liabilities Repurchase agreements $ 1,254,027 $ 1,500,543 Securitized debt obligations 1,133,294 654,263 Asset-specific financings 75,060 — Revolving credit facilities — 75,000 Convertible senior notes 268,857 268,138 Accrued interest payable 6,204 6,394 Unearned interest income 584 510 Dividends payable 23,064 18,346 Other liabilities 14,510 10,156 Total Liabilities 2,775,600 2,533,350 10% cumulative redeemable preferred stock, par value $0.01 per share; 50,000,000 shares authorized and 1,000 and 1,000 shares issued and outstanding, respectively 1,000 1,000 Stockholders’ Equity Common stock, par value $0.01 per share; 450,000,000 shares authorized and 54,853,205 and 43,621,174 shares issued and outstanding, respectively 549 436 Additional paid-in capital 1,046,025 836,288 Accumulated other comprehensive income (loss) 32 (192) Cumulative earnings 127,008 91,875 Cumulative distributions to stockholders (145,878) (100,876) Total Stockholders’ Equity 1,027,736 827,531 14 Total Liabilities and Stockholders’ Equity $ 3,804,336 $ 3,361,881

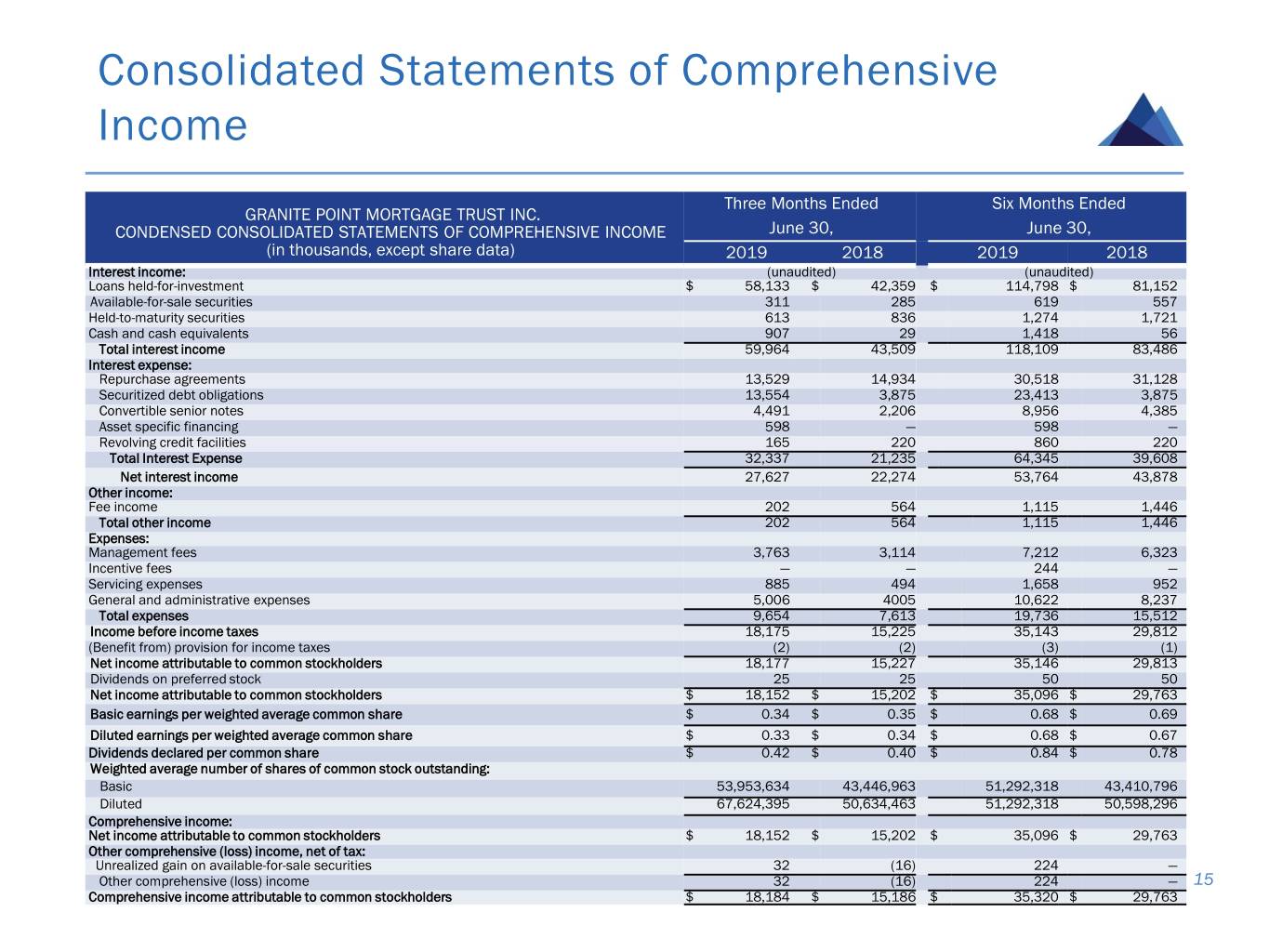

Consolidated Statements of Comprehensive Income Three Months Ended Six Months Ended GRANITE POINT MORTGAGE TRUST INC. CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME June 30, June 30, (in thousands, except share data) 2019 2018 2019 2018 Interest income: (unaudited) (unaudited) Loans held-for-investment $ 58,133 $ 42,359 $ 114,798 $ 81,152 Available-for-sale securities 311 285 619 557 Held-to-maturity securities 613 836 1,274 1,721 Cash and cash equivalents 907 29 1,418 56 Total interest income 59,964 43,509 118,109 83,486 Interest expense: Repurchase agreements 13,529 14,934 30,518 31,128 Securitized debt obligations 13,554 3,875 23,413 3,875 Convertible senior notes 4,491 2,206 8,956 4,385 Asset specific financing 598 — 598 — Revolving credit facilities 165 220 860 220 Total Interest Expense 32,337 21,235 64,345 39,608 Net interest income 27,627 22,274 53,764 43,878 Other income: Fee income 202 564 1,115 1,446 Total other income 202 564 1,115 1,446 Expenses: Management fees 3,763 3,114 7,212 6,323 Incentive fees — — 244 — Servicing expenses 885 494 1,658 952 General and administrative expenses 5,006 4005 10,622 8,237 Total expenses 9,654 7,613 19,736 15,512 Income before income taxes 18,175 15,225 35,143 29,812 (Benefit from) provision for income taxes (2) (2) (3) (1) Net income attributable to common stockholders 18,177 15,227 35,146 29,813 Dividends on preferred stock 25 25 50 50 Net income attributable to common stockholders $ 18,152 $ 15,202 $ 35,096 $ 29,763 Basic earnings per weighted average common share $ 0.34 $ 0.35 $ 0.68 $ 0.69 Diluted earnings per weighted average common share $ 0.33 $ 0.34 $ 0.68 $ 0.67 Dividends declared per common share $ 0.42 $ 0.40 $ 0.84 $ 0.78 Weighted average number of shares of common stock outstanding: Basic 53,953,634 43,446,963 51,292,318 43,410,796 Diluted 67,624,395 50,634,463 51,292,318 50,598,296 Comprehensive income: Net income attributable to common stockholders $ 18,152 $ 15,202 $ 35,096 $ 29,763 Other comprehensive (loss) income, net of tax: Unrealized gain on available-for-sale securities 32 (16) 224 — Other comprehensive (loss) income 32 (16) 224 — 15 Comprehensive income attributable to common stockholders $ 18,184 $ 15,186 $ 35,320 $ 29,763