Third Quarter 2019 Earnings Presentation November 06, 2019

Safe Harbor Statement This presentation contains, in addition to historical information, certain forward-looking statements that are based on our current assumptions, expectations and projections about future performance and events. In particular, statements regarding future economic performance, finances, and expectations and objectives of management constitute forward-looking statements. Forward-looking statements are not historical in nature and can be identified by words such as "believes," "expects," "may," "will," "should," "seeks," "approximately," "intends," "plans," "estimates," "anticipates," “targets,” “goals,” “future,” “likely” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters. Although the forward-looking statements contained in this presentation are based upon information available at the time the statements are made and reflect the best judgment of our senior management, forward-looking statements inherently involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements to differ materially from anticipated future results. Important factors that could cause actual results to differ materially from expected results, including, among other things, those described in our filings with the Securities and Exchange Commission (“SEC”), including our annual report on Form 10-K for the year ended December 31, 2018, and any subsequent Quarterly Reports on Form 10-Q under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: the state of the U.S. economy generally or in specific geographic regions; the general political, economic and competitive conditions in the markets in which we invest; defaults by borrowers in paying debt service on outstanding indebtedness and borrowers' abilities to manage and stabilize properties; our ability to obtain financing arrangements on terms favorable to us or at all; the level and volatility of prevailing interest rates and credit spreads; reductions in the yield on our investments and an increase in the cost of our financing; general volatility of the securities markets in which we participate; the return or impact of current or future investments; allocation of investment opportunities to us by our Manager; increased competition from entities investing in our target assets; effects of hedging instruments on our target investments; changes in governmental regulations, tax law and rates, and similar matters; our ability to maintain our qualification as a REIT for U.S. federal income tax purposes and our exclusion from registration under the Investment Company Act; availability of desirable investment opportunities; availability of qualified personnel and our relationship with our Manager; estimates relating to our ability to make distributions to our stockholders in the future; hurricanes, earthquakes and other natural disasters, acts of war and/or terrorism and other events that may cause unanticipated and uninsured performance declines and/or losses to us or the owners and operators of the real estate securing our investments; deterioration in the performance of the properties securing our investments that may cause deterioration in the performance of our investments and, potentially, principal losses to us; and difficulty or delays in redeploying the proceeds from repayments of our existing investments. These forward-looking statements apply only as of the date of this press release. We are under no duty to update any of these forward-looking statements after the date of this presentation to conform these statements to actual results or revised expectations. You should, therefore, not rely on these forward-looking statements as predictions of future events. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. 2

Company Overview(1) LEADING COMMERCIAL REAL ESTATE FINANCE COMPANY FOCUSED ON DIRECTLY ORIGINATING AND MANAGING SENIOR FLOATING RATE COMMERCIAL MORTGAGE LOANS EXPERIENCED AND CYCLE -TE STE D ATTRACTIVE AND SUSTAINABLE SENIOR CRE TEAM MARKET OPPORTUNITY • Over 20 years of experience each in the commercial real • Structural changes create an enduring, sectoral shift in estate debt markets flows of debt capital into U.S. commercial real estate • Extensive experience in investment management and • Borrower demand for debt capital for both acquisition and structured finance refinancing activity remains strong • Broad and longstanding direct relationships within the • Senior floating rate loans remain an attractive value commercial real estate lending industry proposition within the commercial real estate debt markets DIFFERENTIATED DIRECT HIGH CREDIT QUALITY ORIGINATION PLATFORM INVESTMENT PORTFOLIO • Direct origination of senior floating rate commercial real • Principal balance of $4.0 billion and well diversified estate loans across property types and geographies • Target top 25 and (generally) up to the top 50 MSAs in the • Senior loans comprise over 98% of the portfolio U.S. • Over 98% of portfolio is floating rate • Fundamental value-driven investing combined with credit intensive underwriting • Diversified financing profile with a mix of non-recourse, • Focus on cash flow as one of our key underwriting criteria non-mark-to-market, term-matched CLO debt; secured credit facilities; and unsecured convertible bonds • Prioritize income-producing, institutional-quality properties and sponsors 3 (1) Except as otherwise indicated in this presentation, reported data is as of or for the period ended September 30, 2019.

Third Quarter 2019 Highlights FINANCIAL . GAAP EPS of $0.32 and Core Earnings(1) of $0.34 per basic share SUMMARY . Book value of $18.65 per common share; declared and paid a dividend of $0.42 per common share . Closed on $636.7 million of senior commercial real estate loan commitments and funded $535.0 million PORTFOLIO in UPB ACTIVITY . Received prepayments and principal amortization of $167.2 million . Principal balance of $4.0 billion (plus an additional $667.0 million of future funding commitments) PORTFOLIO . Over 98% floating rate and comprised of over 98% senior loans OVERVIEW . Weighted average stabilized LTV of 64% and weighted average yield at origination of LIBOR + 4.40%(2) . 6 secured financing facilities(3) with a total outstanding balance of $1.8 billion and an aggregate borrowing capacity of up to $2.5 billion . Extended the maturity of the Citibank repurchase facility to 2022 and upsized borrowing capacity from $250 to $400 million CAPITALIZATION . Extended the maturity of the Citibank revolving credit facility to 2021, reduced its cost by 50bps and amended other terms . Upsized the JPMorgan repurchase facility borrowing capacity from $350 to $425 million . Extended the maturity of the Morgan Stanley repurchase facility to 2021 . Current forward pipeline of senior CRE loans with total commitments of over $650 million and initial FOURTH QUARTER fundings of over $500 million, which have either closed or are in the closing process, subject to fallout ACTIVITY . Funded over $325 million of principal balance of loans so far in the fourth quarter of 2019 . Upsized the Wells Fargo repurchase facility from $200 to $275 million (1) Core Earnings is a non-GAAP measure. See slide 8 for a definition of Core Earnings and a reconciliation of GAAP to non-GAAP financial information. (2) See footnote (2) and (3) on p. 13. 4 (3) Includes repurchase facilities and asset-specific financings.

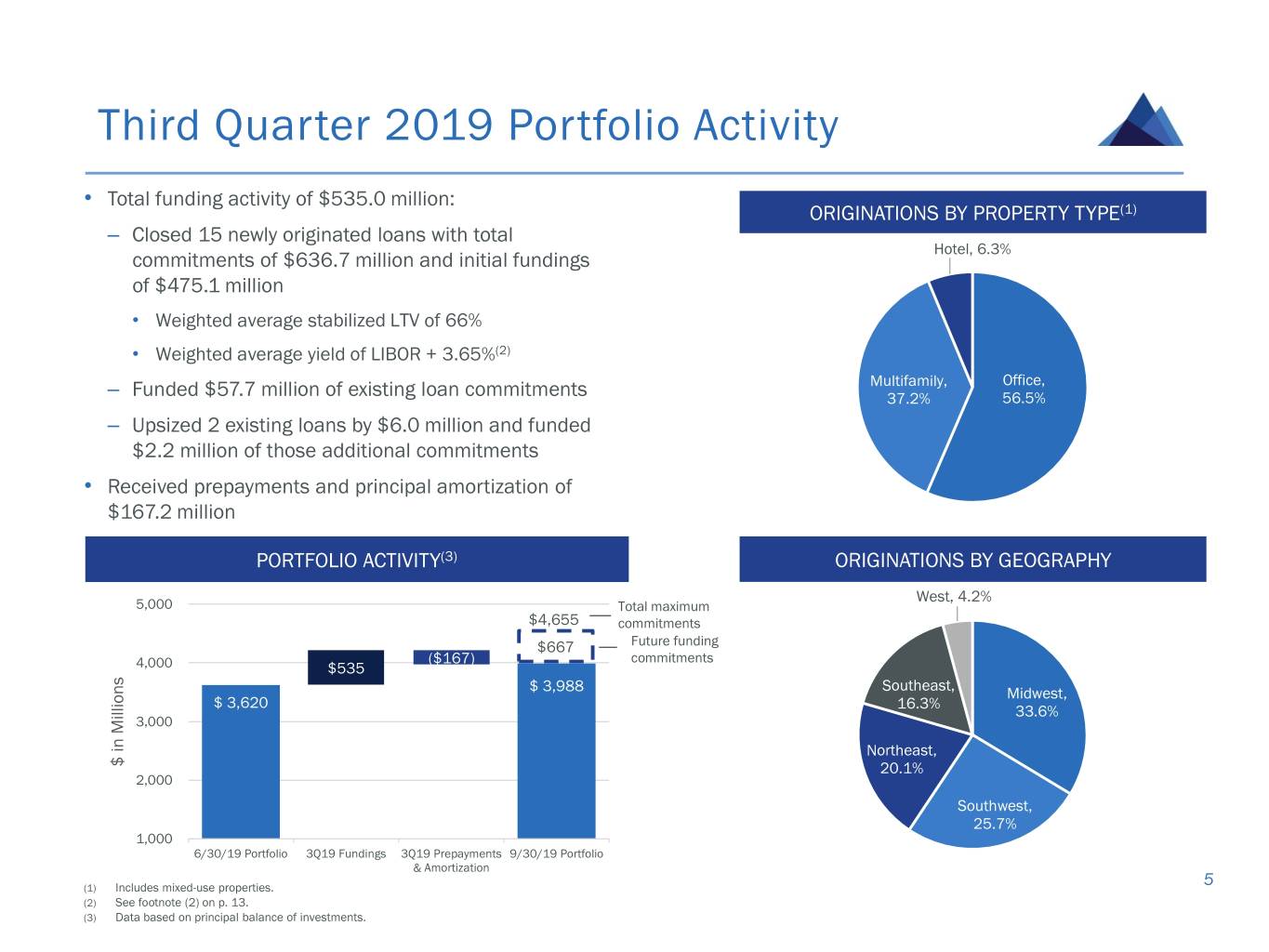

Third Quarter 2019 Portfolio Activity • Total funding activity of $535.0 million: ORIGINATIONS BY PROPERTY TYPE(1) – Closed 15 newly originated loans with total Hotel, 6.3% commitments of $636.7 million and initial fundings of $475.1 million • Weighted average stabilized LTV of 66% • Weighted average yield of LIBOR + 3.65%(2) Multifamily, Office, – Funded $57.7 million of existing loan commitments 37.2% 56.5% – Upsized 2 existing loans by $6.0 million and funded $2.2 million of those additional commitments • Received prepayments and principal amortization of $167.2 million PORTFOLIO ACTIVITY(3) ORIGINATIONS BY GEOGRAPHY West, 4.2% 5,000 Total maximum $4,655 commitments $667 Future funding ($167) commitments 4,000 $535 Southeast, $ 3,988 Midwest, $ 3,620 16.3% 33.6% 3,000 Northeast, $ in Millions 20.1% 2,000 Southwest, 25.7% 1,000 6/30/19 Portfolio 3Q19 Fundings 3Q19 Prepayments 9/30/19 Portfolio & Amortization 5 (1) Includes mixed-use properties. (2) See footnote (2) on p. 13. (3) Data based on principal balance of investments.

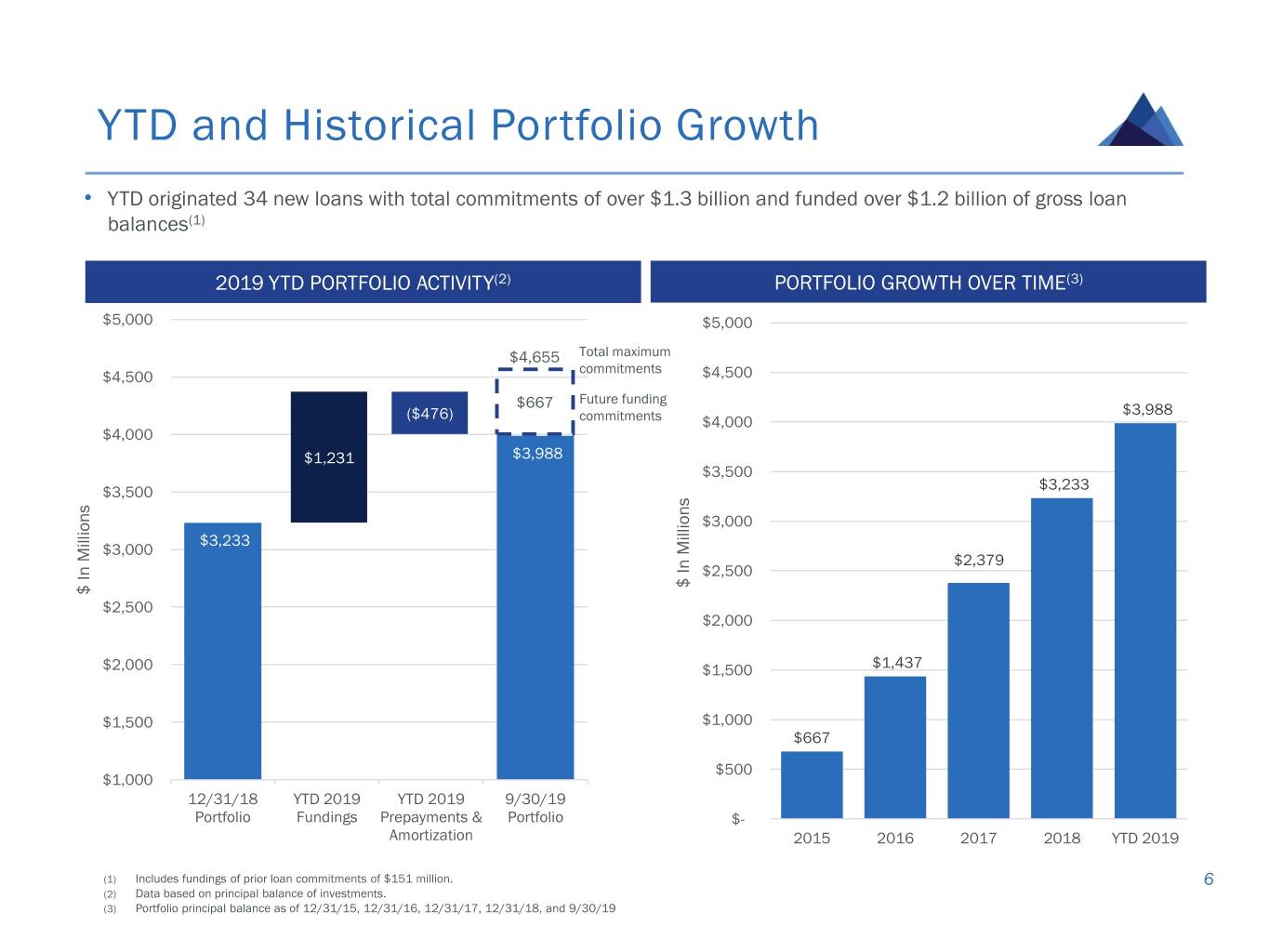

YTD and Historical Portfolio Growth • YTD originated 34 new loans with total commitments of over $1.3 billion and funded over $1.2 billion of gross loan balances(1) 2019 YTD PORTFOLIO ACTIVITY(2) PORTFOLIO GROWTH OVER TIME(3) $5,000 $5,000 $4,655 Total maximum commitments $4,500 $4,500 $667 Future funding ($476) $3,988 commitments $4,000 $4,000 $1,231 $3,988 $3,500 $3,500 $3,233 $3,000 $3,233 $3,000 $2,379 $2,500 $ In Millions $ In Millions $2,500 $2,000 $2,000 $1,500 $1,437 $1,500 $1,000 $667 $500 $1,000 12/31/18 YTD 2019 YTD 2019 9/30/19 Portfolio Fundings Prepayments & Portfolio $- Amortization 2015 2016 2017 2018 YTD 2019 (1) Includes fundings of prior loan commitments of $151 million. 6 (2) Data based on principal balance of investments. (3) Portfolio principal balance as of 12/31/15, 12/31/16, 12/31/17, 12/31/18, and 9/30/19

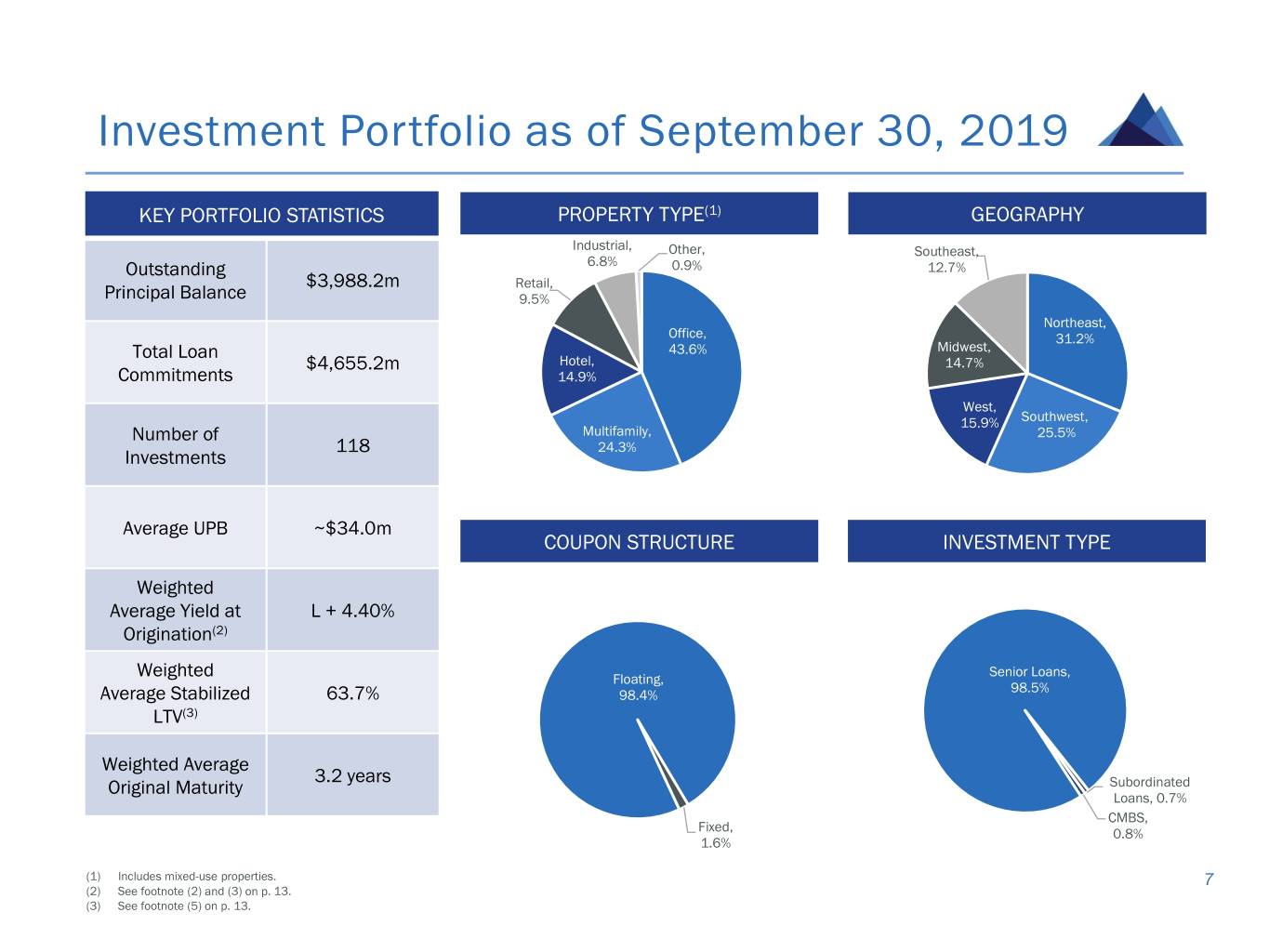

Investment Portfolio as of September 30, 2019 KEY PORTFOLIO STATISTICS PROPERTY TYPE(1) GEOGRAPHY Industrial, Other, Southeast, Outstanding 6.8% 0.9% 12.7% $3,988.2m Retail, Principal Balance 9.5% Northeast, Office, 31.2% Total Loan 43.6% Midwest, $4,655.2m Hotel, 14.7% Commitments 14.9% West, 15.9% Southwest, Number of Multifamily, 25.5% 118 24.3% Investments Average UPB ~$34.0m COUPON STRUCTURE INVESTMENT TYPE Weighted Average Yield at L + 4.40% Origination(2) Senior Loans, Weighted Floating, 98.5% Average Stabilized 63.7% 98.4% LTV(3) Weighted Average 3.2 years Original Maturity Subordinated Loans, 0.7% CMBS, Fixed, 0.8% 1.6% (1) Includes mixed-use properties. 7 (2) See footnote (2) and (3) on p. 13. (3) See footnote (5) on p. 13.

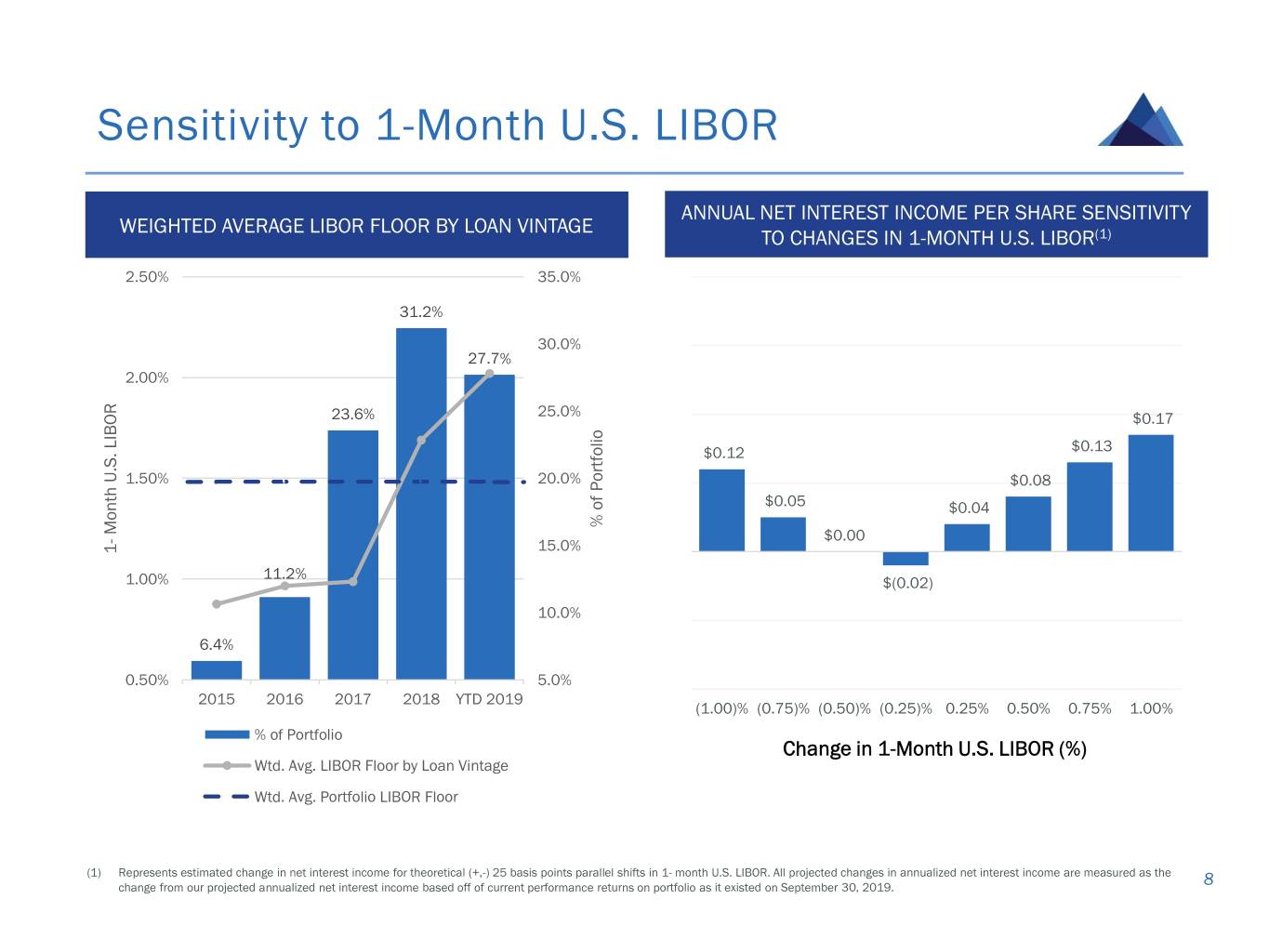

Sensitivity to 1-Month U.S. LIBOR ANNUAL NET INTEREST INCOME PER SHARE SENSITIVITY WEIGHTED AVERAGE LIBOR FLOOR BY LOAN VINTAGE TO CHANGES IN 1-MONTH U.S. LIBOR(1) 2.50% 35.0% 31.2% 30.0% 27.7% 2.00% 23.6% 25.0% $0.17 $0.12 $0.13 1.50% 20.0% $0.08 $0.05 $0.04 % % Portfolio of Month Month LIBOR U.S. $0.00 - 15.0% 1 11.2% 1.00% $(0.02) 10.0% 6.4% 0.50% 5.0% 2015 2016 2017 2018 YTD 2019 (1.00)% (0.75)% (0.50)% (0.25)% 0.25% 0.50% 0.75% 1.00% % of Portfolio Change in 1-Month U.S. LIBOR (%) Wtd. Avg. LIBOR Floor by Loan Vintage Wtd. Avg. Portfolio LIBOR Floor (1) Represents estimated change in net interest income for theoretical (+,-) 25 basis points parallel shifts in 1- month U.S. LIBOR. All projected changes in annualized net interest income are measured as the change from our projected annualized net interest income based off of current performance returns on portfolio as it existed on September 30, 2019. 8

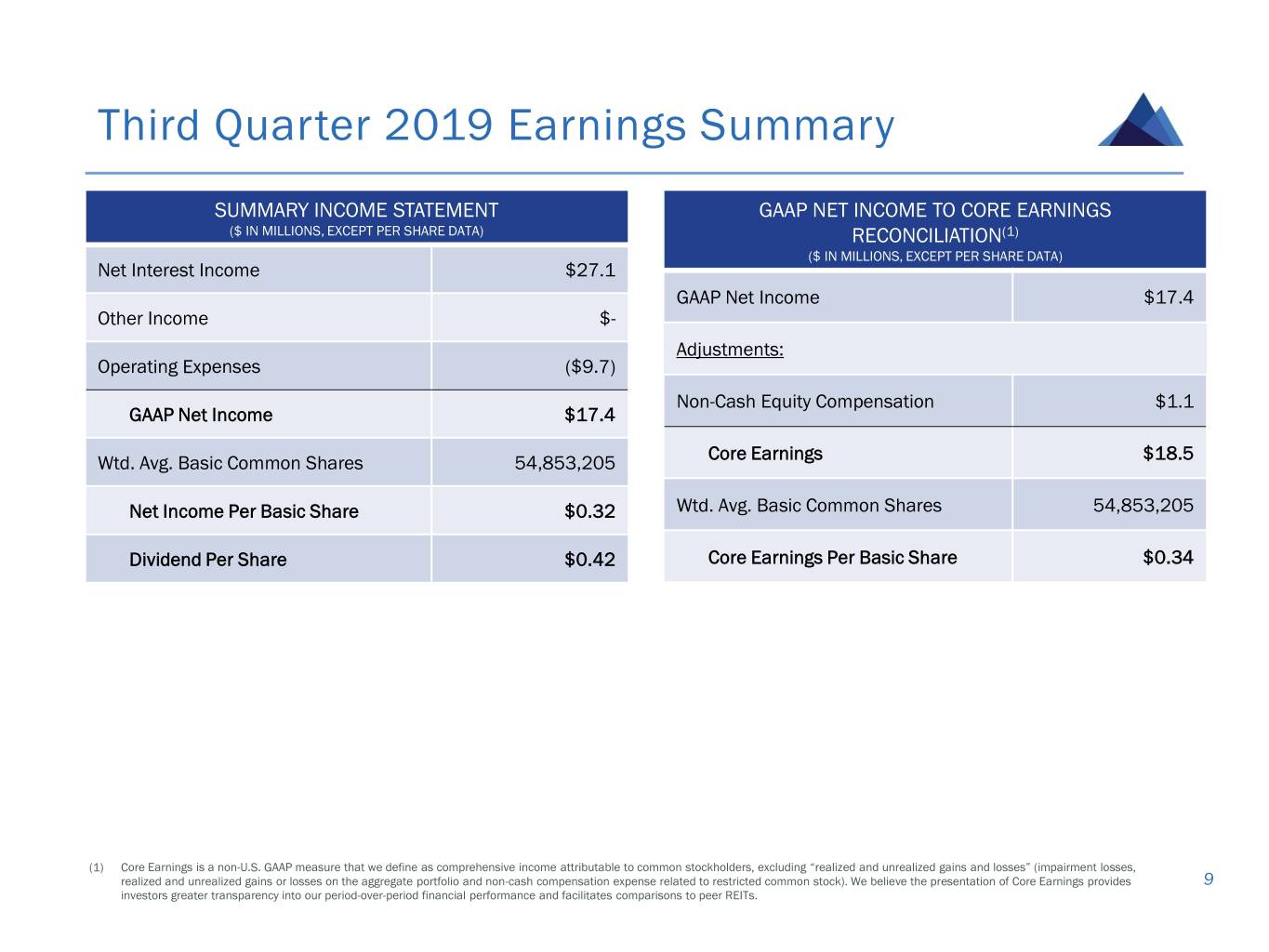

Third Quarter 2019 Earnings Summary SUMMARY INCOME STATEMENT GAAP NET INCOME TO CORE EARNINGS ($ IN MILLIONS, EXCEPT PER SHARE DATA) RECONCILIATION(1) ($ IN MILLIONS, EXCEPT PER SHARE DATA) Net Interest Income $27.1 GAAP Net Income $17.4 Other Income $- Adjustments: Operating Expenses ($9.7) Non-Cash Equity Compensation $1.1 GAAP Net Income $17.4 Wtd. Avg. Basic Common Shares 54,853,205 Core Earnings $18.5 Net Income Per Basic Share $0.32 Wtd. Avg. Basic Common Shares 54,853,205 Dividend Per Share $0.42 Core Earnings Per Basic Share $0.34 (1) Core Earnings is a non-U.S. GAAP measure that we define as comprehensive income attributable to common stockholders, excluding “realized and unrealized gains and losses” (impairment losses, realized and unrealized gains or losses on the aggregate portfolio and non-cash compensation expense related to restricted common stock). We believe the presentation of Core Earnings provides 9 investors greater transparency into our period-over-period financial performance and facilitates comparisons to peer REITs.

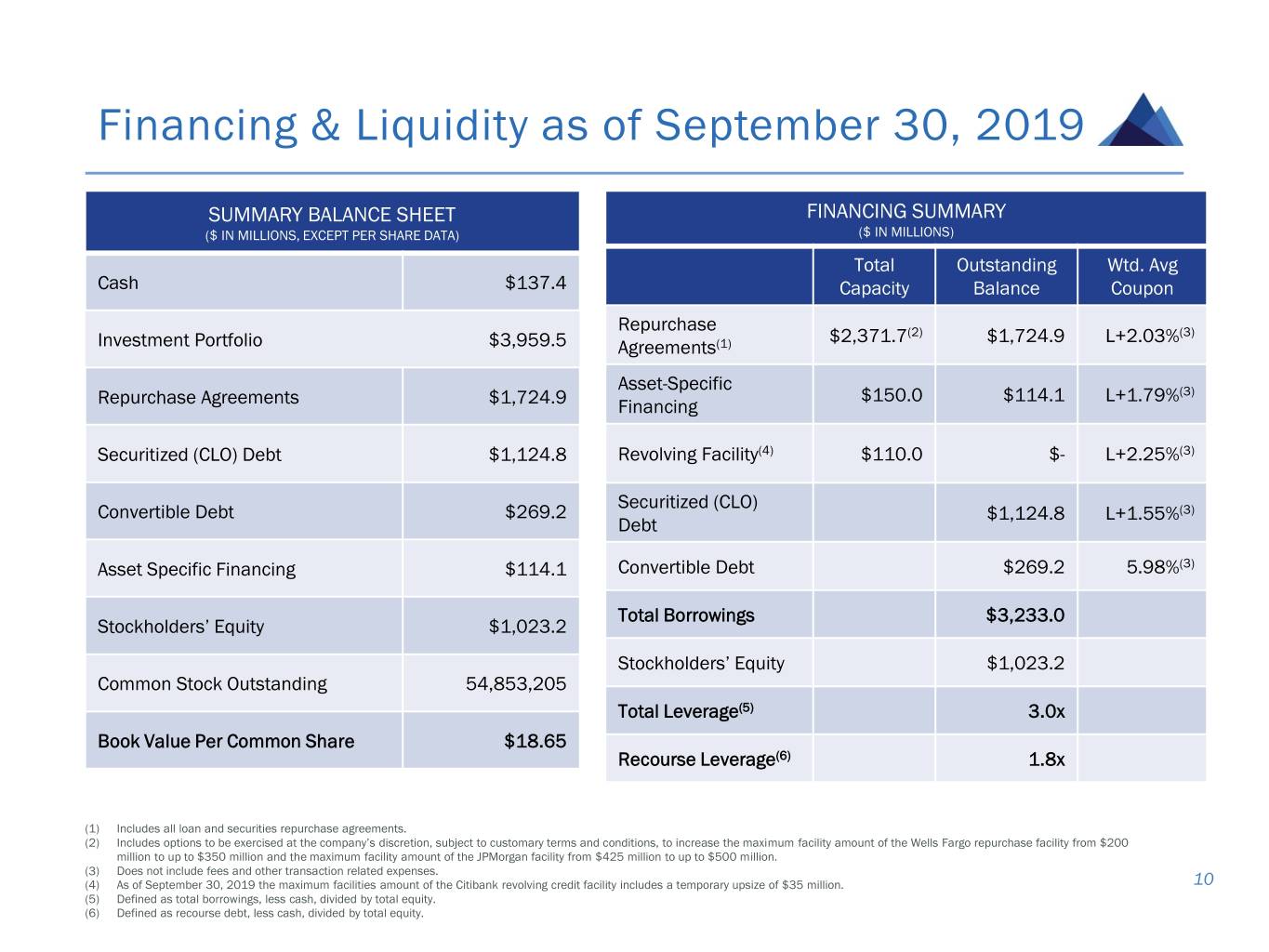

Financing & Liquidity as of September 30, 2019 SUMMARY BALANCE SHEET FINANCING SUMMARY ($ IN MILLIONS, EXCEPT PER SHARE DATA) ($ IN MILLIONS) Total Outstanding Wtd. Avg Cash $137.4 Capacity Balance Coupon Repurchase $2,371.7(2) $1,724.9 L+2.03%(3) Investment Portfolio $3,959.5 Agreements(1) Asset-Specific $150.0 $114.1 L+1.79%(3) Repurchase Agreements $1,724.9 Financing Securitized (CLO) Debt $1,124.8 Revolving Facility(4) $110.0 $- L+2.25%(3) Securitized (CLO) Convertible Debt $269.2 $1,124.8 L+1.55%(3) Debt Asset Specific Financing $114.1 Convertible Debt $269.2 5.98%(3) Total Borrowings $3,233.0 Stockholders’ Equity $1,023.2 Stockholders’ Equity $1,023.2 Common Stock Outstanding 54,853,205 Total Leverage(5) 3.0x Book Value Per Common Share $18.65 Recourse Leverage(6) 1.8x (1) Includes all loan and securities repurchase agreements. (2) Includes options to be exercised at the company’s discretion, subject to customary terms and conditions, to increase the maximum facility amount of the Wells Fargo repurchase facility from $200 million to up to $350 million and the maximum facility amount of the JPMorgan facility from $425 million to up to $500 million. (3) Does not include fees and other transaction related expenses. (4) As of September 30, 2019 the maximum facilities amount of the Citibank revolving credit facility includes a temporary upsize of $35 million. 10 (5) Defined as total borrowings, less cash, divided by total equity. (6) Defined as recourse debt, less cash, divided by total equity.

Appendix

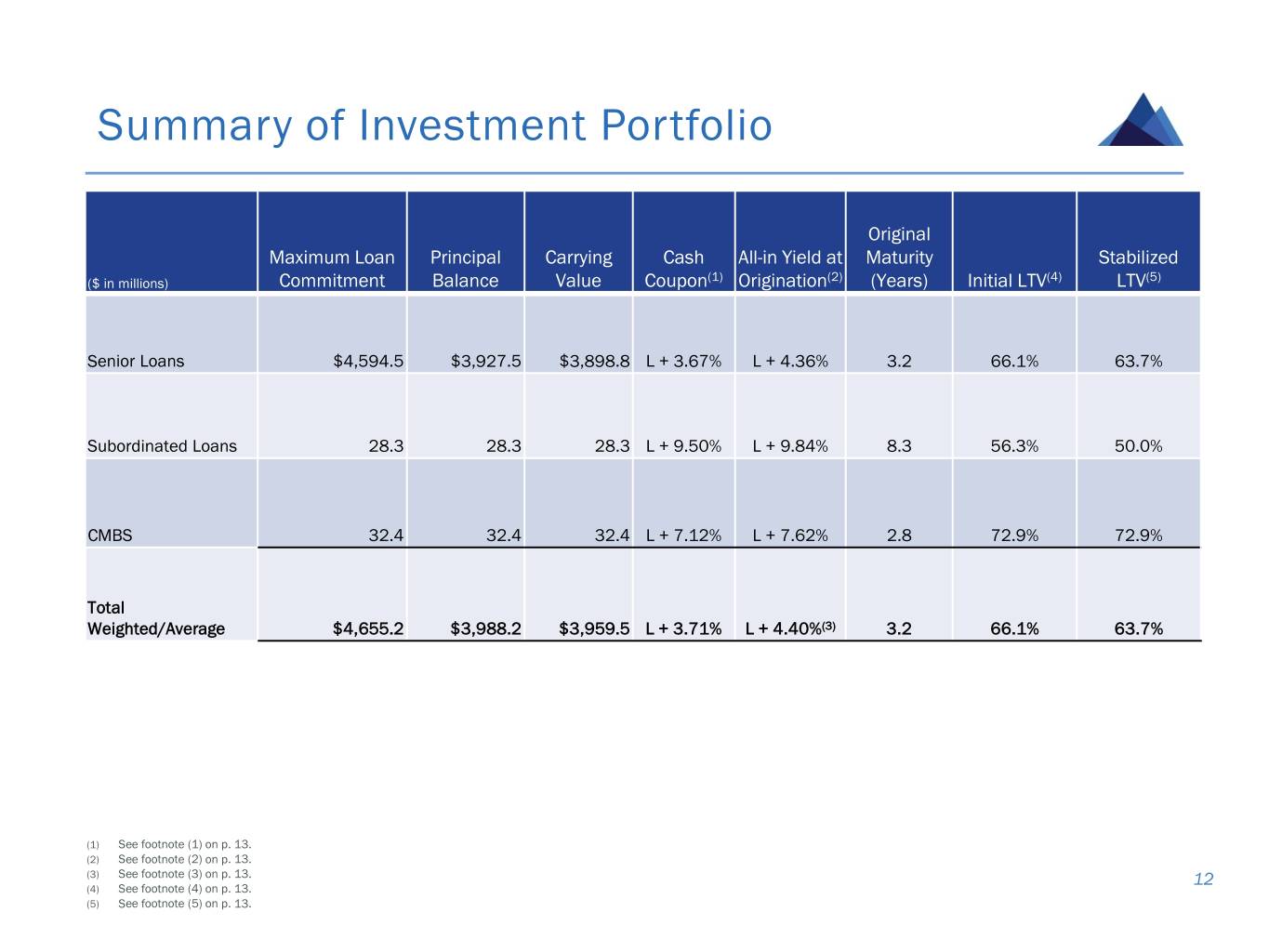

Summary of Investment Portfolio Original Maximum Loan Principal Carrying Cash All-in Yield at Maturity Stabilized ($ in millions) Commitment Balance Value Coupon(1) Origination(2) (Years) Initial LTV(4) LTV(5) Senior Loans $4,594.5 $3,927.5 $3,898.8 L + 3.67% L + 4.36% 3.2 66.1% 63.7% Subordinated Loans 28.3 28.3 28.3 L + 9.50% L + 9.84% 8.3 56.3% 50.0% CMBS 32.4 32.4 32.4 L + 7.12% L + 7.62% 2.8 72.9% 72.9% Total Weighted/Average $4,655.2 $3,988.2 $3,959.5 L + 3.71% L + 4.40%(3) 3.2 66.1% 63.7% (1) See footnote (1) on p. 13. (2) See footnote (2) on p. 13. (3) See footnote (3) on p. 13. 12 (4) See footnote (4) on p. 13. (5) See footnote (5) on p. 13.

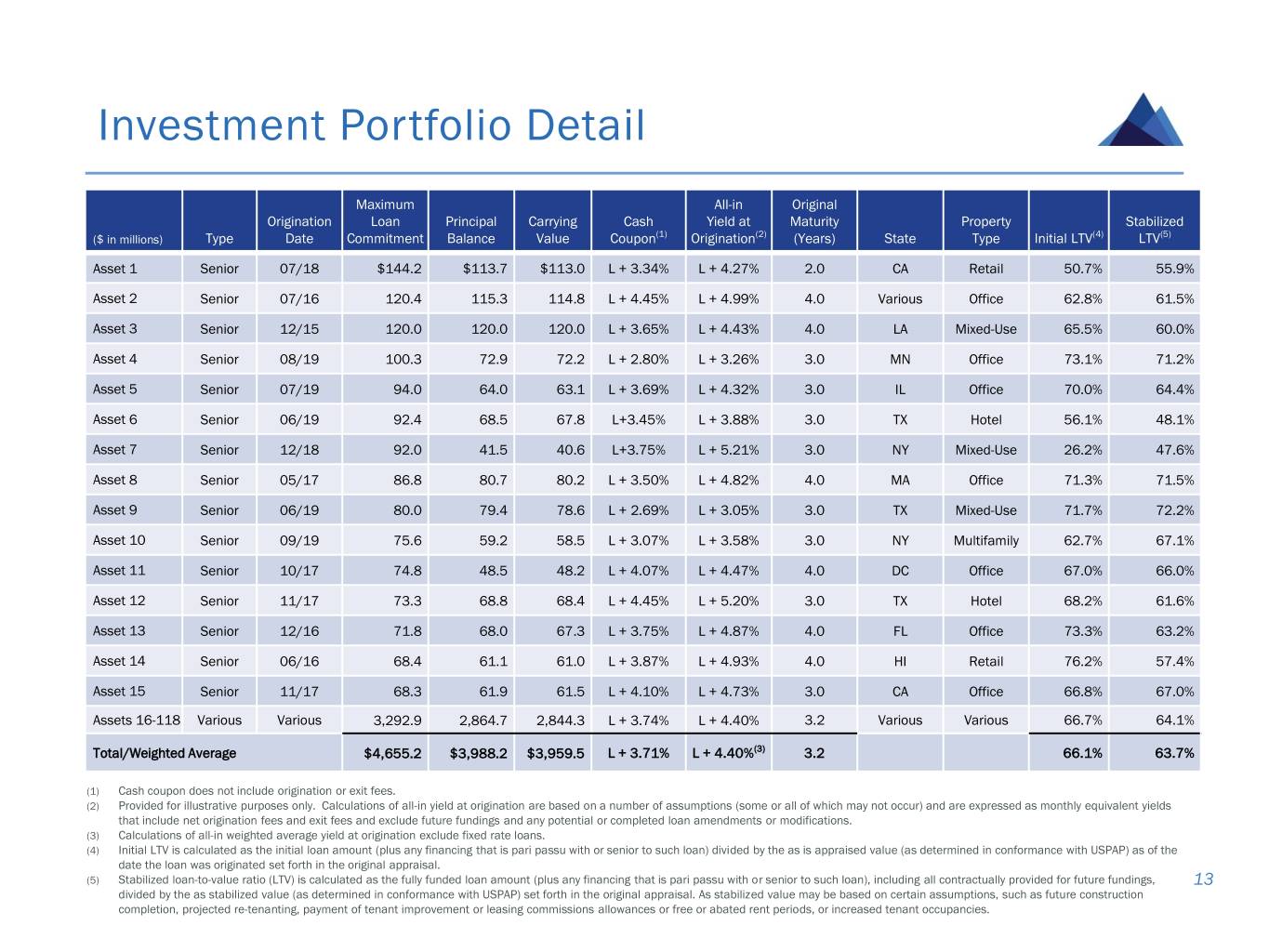

Investment Portfolio Detail Maximum All-in Original Origination Loan Principal Carrying Cash Yield at Maturity Property Stabilized ($ in millions) Type Date Commitment Balance Value Coupon(1) Origination(2) (Years) State Type Initial LTV(4) LTV(5) Asset 1 Senior 07/18 $144.2 $113.7 $113.0 L + 3.34% L + 4.27% 2.0 CA Retail 50.7% 55.9% Asset 2 Senior 07/16 120.4 115.3 114.8 L + 4.45% L + 4.99% 4.0 Various Office 62.8% 61.5% Asset 3 Senior 12/15 120.0 120.0 120.0 L + 3.65% L + 4.43% 4.0 LA Mixed-Use 65.5% 60.0% Asset 4 Senior 08/19 100.3 72.9 72.2 L + 2.80% L + 3.26% 3.0 MN Office 73.1% 71.2% Asset 5 Senior 07/19 94.0 64.0 63.1 L + 3.69% L + 4.32% 3.0 IL Office 70.0% 64.4% Asset 6 Senior 06/19 92.4 68.5 67.8 L+3.45% L + 3.88% 3.0 TX Hotel 56.1% 48.1% Asset 7 Senior 12/18 92.0 41.5 40.6 L+3.75% L + 5.21% 3.0 NY Mixed-Use 26.2% 47.6% Asset 8 Senior 05/17 86.8 80.7 80.2 L + 3.50% L + 4.82% 4.0 MA Office 71.3% 71.5% Asset 9 Senior 06/19 80.0 79.4 78.6 L + 2.69% L + 3.05% 3.0 TX Mixed-Use 71.7% 72.2% Asset 10 Senior 09/19 75.6 59.2 58.5 L + 3.07% L + 3.58% 3.0 NY Multifamily 62.7% 67.1% Asset 11 Senior 10/17 74.8 48.5 48.2 L + 4.07% L + 4.47% 4.0 DC Office 67.0% 66.0% Asset 12 Senior 11/17 73.3 68.8 68.4 L + 4.45% L + 5.20% 3.0 TX Hotel 68.2% 61.6% Asset 13 Senior 12/16 71.8 68.0 67.3 L + 3.75% L + 4.87% 4.0 FL Office 73.3% 63.2% Asset 14 Senior 06/16 68.4 61.1 61.0 L + 3.87% L + 4.93% 4.0 HI Retail 76.2% 57.4% Asset 15 Senior 11/17 68.3 61.9 61.5 L + 4.10% L + 4.73% 3.0 CA Office 66.8% 67.0% Assets 16-118 Various Various 3,292.9 2,864.7 2,844.3 L + 3.74% L + 4.40% 3.2 Various Various 66.7% 64.1% Total/Weighted Average $4,655.2 $3,988.2 $3,959.5 L + 3.71% L + 4.40%(3) 3.2 66.1% 63.7% (1) Cash coupon does not include origination or exit fees. (2) Provided for illustrative purposes only. Calculations of all-in yield at origination are based on a number of assumptions (some or all of which may not occur) and are expressed as monthly equivalent yields that include net origination fees and exit fees and exclude future fundings and any potential or completed loan amendments or modifications. (3) Calculations of all-in weighted average yield at origination exclude fixed rate loans. (4) Initial LTV is calculated as the initial loan amount (plus any financing that is pari passu with or senior to such loan) divided by the as is appraised value (as determined in conformance with USPAP) as of the date the loan was originated set forth in the original appraisal. (5) Stabilized loan-to-value ratio (LTV) is calculated as the fully funded loan amount (plus any financing that is pari passu with or senior to such loan), including all contractually provided for future fundings, 13 divided by the as stabilized value (as determined in conformance with USPAP) set forth in the original appraisal. As stabilized value may be based on certain assumptions, such as future construction completion, projected re-tenanting, payment of tenant improvement or leasing commissions allowances or free or abated rent periods, or increased tenant occupancies.

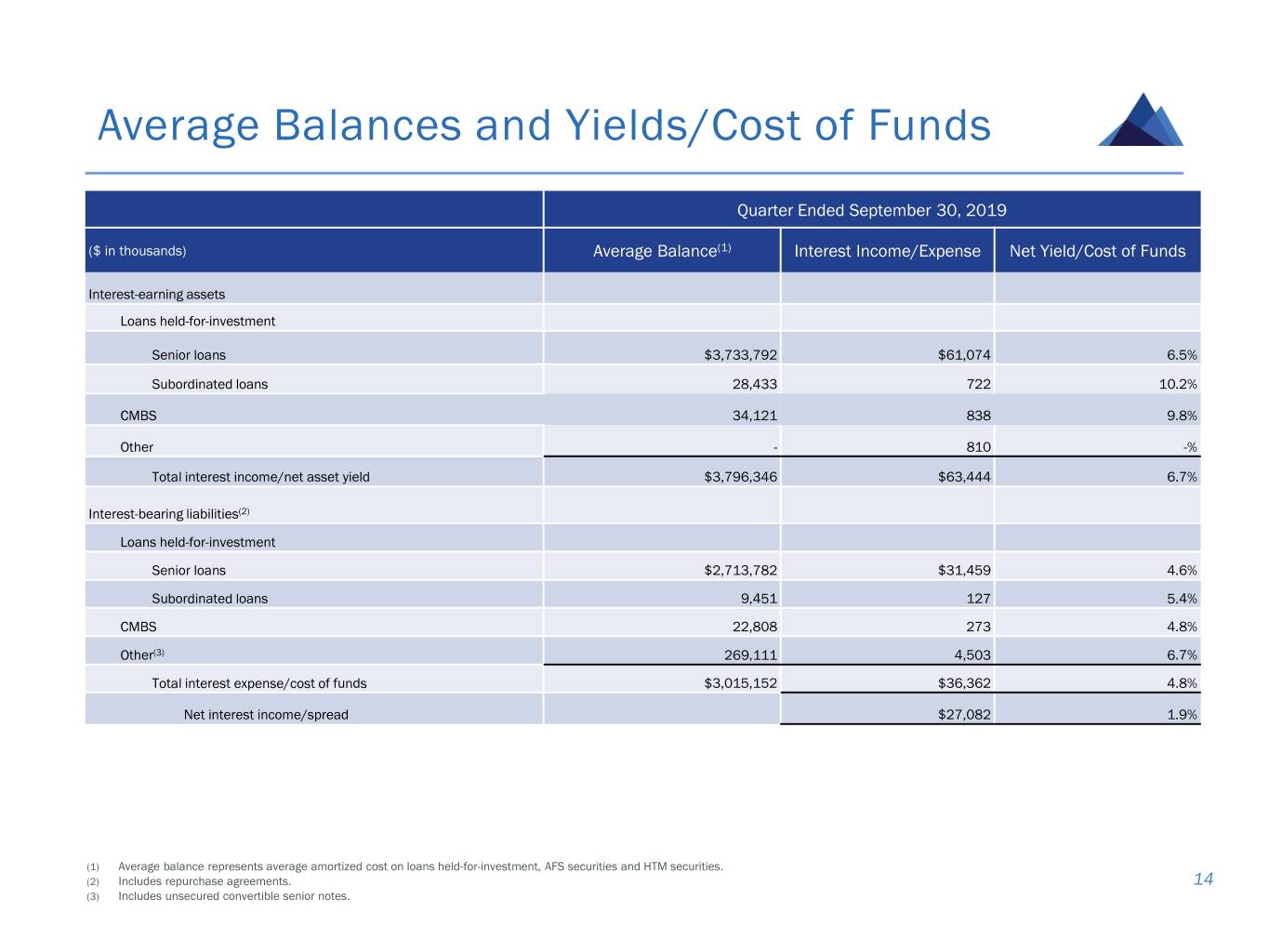

Average Balances and Yields/Cost of Funds Quarter Ended September 30, 2019 ($ in thousands) Average Balance(1) Interest Income/Expense Net Yield/Cost of Funds Interest-earning assets Loans held-for-investment Senior loans $3,733,792 $61,074 6.5% Subordinated loans 28,433 722 10.2% CMBS 34,121 838 9.8% Other - 810 -% Total interest income/net asset yield $3,796,346 $63,444 6.7% Interest-bearing liabilities(2) Loans held-for-investment Senior loans $2,713,782 $31,459 4.6% Subordinated loans 9,451 127 5.4% CMBS 22,808 273 4.8% Other(3) 269,111 4,503 6.7% Total interest expense/cost of funds $3,015,152 $36,362 4.8% Net interest income/spread $27,082 1.9% (1) Average balance represents average amortized cost on loans held-for-investment, AFS securities and HTM securities. (2) Includes repurchase agreements. 14 (3) Includes unsecured convertible senior notes.

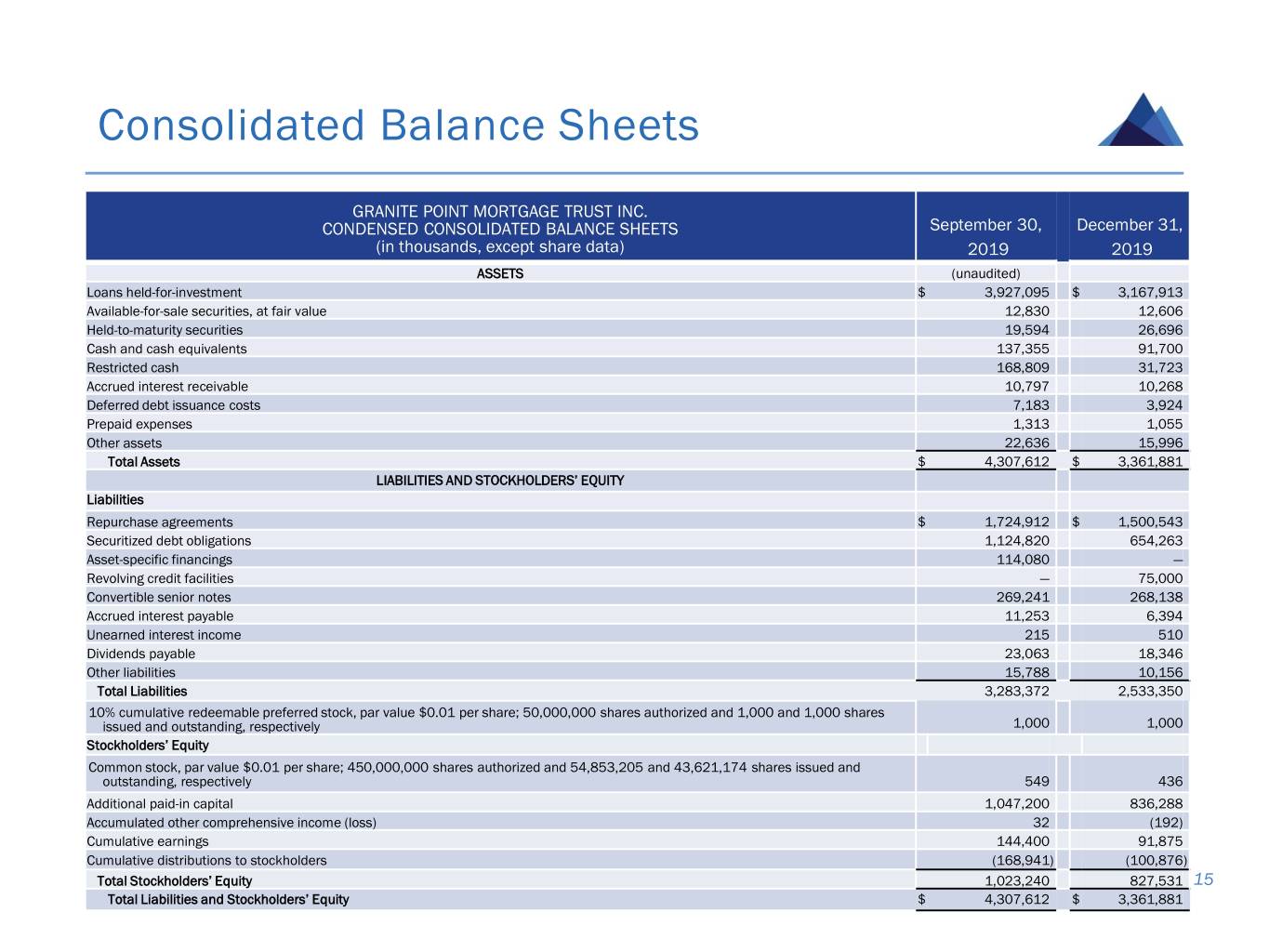

Consolidated Balance Sheets GRANITE POINT MORTGAGE TRUST INC. CONDENSED CONSOLIDATED BALANCE SHEETS September 30, December 31, (in thousands, except share data) 2019 2019 ASSETS (unaudited) Loans held-for-investment $ 3,927,095 $ 3,167,913 Available-for-sale securities, at fair value 12,830 12,606 Held-to-maturity securities 19,594 26,696 Cash and cash equivalents 137,355 91,700 Restricted cash 168,809 31,723 Accrued interest receivable 10,797 10,268 Deferred debt issuance costs 7,183 3,924 Prepaid expenses 1,313 1,055 Other assets 22,636 15,996 Total Assets $ 4,307,612 $ 3,361,881 LIABILITIES AND STOCKHOLDERS’ EQUITY Liabilities Repurchase agreements $ 1,724,912 $ 1,500,543 Securitized debt obligations 1,124,820 654,263 Asset-specific financings 114,080 — Revolving credit facilities — 75,000 Convertible senior notes 269,241 268,138 Accrued interest payable 11,253 6,394 Unearned interest income 215 510 Dividends payable 23,063 18,346 Other liabilities 15,788 10,156 Total Liabilities 3,283,372 2,533,350 10% cumulative redeemable preferred stock, par value $0.01 per share; 50,000,000 shares authorized and 1,000 and 1,000 shares issued and outstanding, respectively 1,000 1,000 Stockholders’ Equity Common stock, par value $0.01 per share; 450,000,000 shares authorized and 54,853,205 and 43,621,174 shares issued and outstanding, respectively 549 436 Additional paid-in capital 1,047,200 836,288 Accumulated other comprehensive income (loss) 32 (192) Cumulative earnings 144,400 91,875 Cumulative distributions to stockholders (168,941) (100,876) Total Stockholders’ Equity 1,023,240 827,531 15 Total Liabilities and Stockholders’ Equity $ 4,307,612 $ 3,361,881

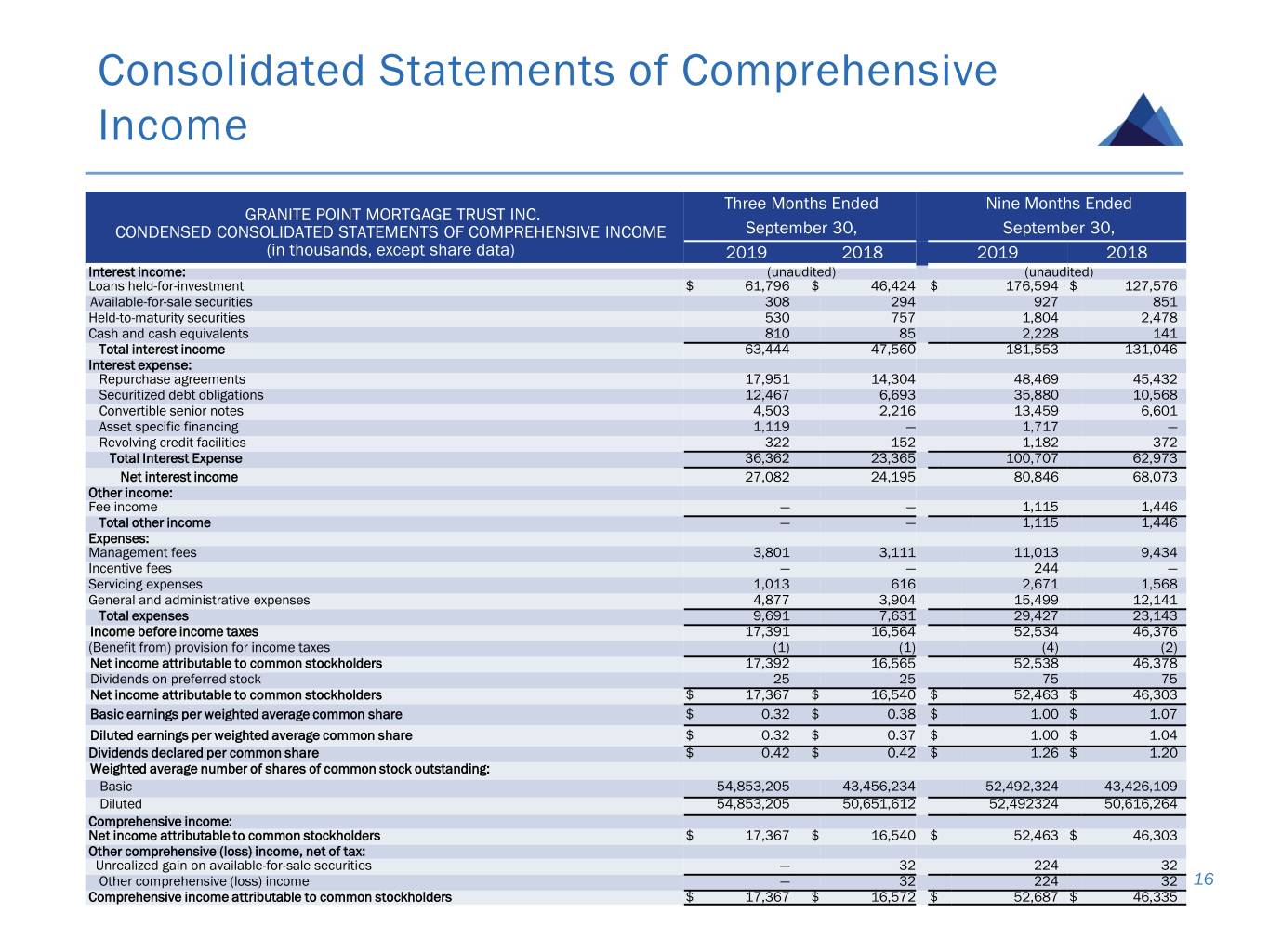

Consolidated Statements of Comprehensive Income Three Months Ended Nine Months Ended GRANITE POINT MORTGAGE TRUST INC. CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME September 30, September 30, (in thousands, except share data) 2019 2018 2019 2018 Interest income: (unaudited) (unaudited) Loans held-for-investment $ 61,796 $ 46,424 $ 176,594 $ 127,576 Available-for-sale securities 308 294 927 851 Held-to-maturity securities 530 757 1,804 2,478 Cash and cash equivalents 810 85 2,228 141 Total interest income 63,444 47,560 181,553 131,046 Interest expense: Repurchase agreements 17,951 14,304 48,469 45,432 Securitized debt obligations 12,467 6,693 35,880 10,568 Convertible senior notes 4,503 2,216 13,459 6,601 Asset specific financing 1,119 — 1,717 — Revolving credit facilities 322 152 1,182 372 Total Interest Expense 36,362 23,365 100,707 62,973 Net interest income 27,082 24,195 80,846 68,073 Other income: Fee income — — 1,115 1,446 Total other income — — 1,115 1,446 Expenses: Management fees 3,801 3,111 11,013 9,434 Incentive fees — — 244 — Servicing expenses 1,013 616 2,671 1,568 General and administrative expenses 4,877 3,904 15,499 12,141 Total expenses 9,691 7,631 29,427 23,143 Income before income taxes 17,391 16,564 52,534 46,376 (Benefit from) provision for income taxes (1) (1) (4) (2) Net income attributable to common stockholders 17,392 16,565 52,538 46,378 Dividends on preferred stock 25 25 75 75 Net income attributable to common stockholders $ 17,367 $ 16,540 $ 52,463 $ 46,303 Basic earnings per weighted average common share $ 0.32 $ 0.38 $ 1.00 $ 1.07 Diluted earnings per weighted average common share $ 0.32 $ 0.37 $ 1.00 $ 1.04 Dividends declared per common share $ 0.42 $ 0.42 $ 1.26 $ 1.20 Weighted average number of shares of common stock outstanding: Basic 54,853,205 43,456,234 52,492,324 43,426,109 Diluted 54,853,205 50,651,612 52,492324 50,616,264 Comprehensive income: Net income attributable to common stockholders $ 17,367 $ 16,540 $ 52,463 $ 46,303 Other comprehensive (loss) income, net of tax: Unrealized gain on available-for-sale securities — 32 224 32 Other comprehensive (loss) income — 32 224 32 16 Comprehensive income attributable to common stockholders $ 17,367 $ 16,572 $ 52,687 $ 46,335