November 2021Investor Presentation

This presentation contains, or incorporates by reference, not only historical information, but also forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve numerous risks and uncertainties. Our actual results may differ from our beliefs, expectations, estimates and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will,” “should,” “expect,” “target,” “believe,” “outlook,” “potential,” “continue,” “intend,” “seek,” “plan,” “goals,” “future,” “likely,” “may” and similar expressions or their negative forms, or by references to strategy, plans or intentions. By their nature, forward-looking statements speak only as of the date they are made, are not statements of historical facts or guarantees of future performance and are subject to risks, uncertainties, assumptions or changes in circumstances that are difficult to predict or quantify, in particular those related to the COVID-19 pandemic, including the ultimate impact of COVID-19 on our business, financial performance and operating results. Our expectations, beliefs and estimates are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that management's expectations, beliefs and estimates will prove to be correct or be achieved, and actual results may vary materially from what is expressed in or indicated by the forward-looking statements. These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2020 and any subsequent Form 10-Q and Form 8-K filings made with the SEC, under the caption “Risk Factors.” These risks may also be further heightened by the continued and evolving impact of the COVID-19 pandemic. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update or revise any such forward-looking statements, whether as a result of new information, future events or otherwise. This presentation is for informational purposes only and shall not constitute, or form a part of, an offer to sell or buy or the solicitation of an offer to sell or the solicitation of an offer to buy any securities. 2 Safe Harbor Statement

Company Overview

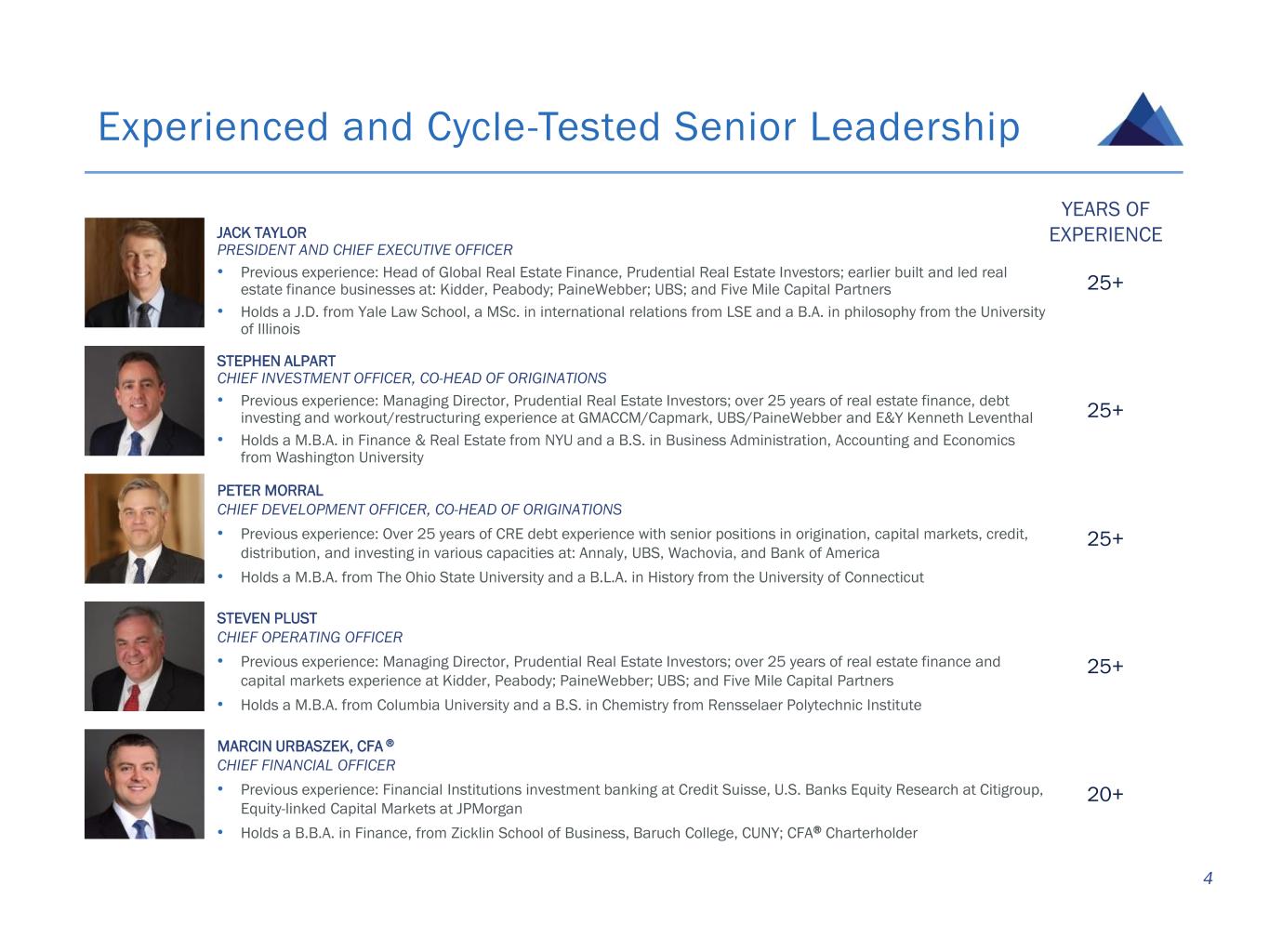

Experienced and Cycle-Tested Senior Leadership 4 JACK TAYLOR PRESIDENT AND CHIEF EXECUTIVE OFFICER • Previous experience: Head of Global Real Estate Finance, Prudential Real Estate Investors; earlier built and led real estate finance businesses at: Kidder, Peabody; PaineWebber; UBS; and Five Mile Capital Partners • Holds a J.D. from Yale Law School, a MSc. in international relations from LSE and a B.A. in philosophy from the University of Illinois 25+ YEARS OF EXPERIENCE STEPHEN ALPART CHIEF INVESTMENT OFFICER, CO-HEAD OF ORIGINATIONS • Previous experience: Managing Director, Prudential Real Estate Investors; over 25 years of real estate finance, debt investing and workout/restructuring experience at GMACCM/Capmark, UBS/PaineWebber and E&Y Kenneth Leventhal • Holds a M.B.A. in Finance & Real Estate from NYU and a B.S. in Business Administration, Accounting and Economics from Washington University 25+ 25+ 25+ 20+ STEVEN PLUST CHIEF OPERATING OFFICER • Previous experience: Managing Director, Prudential Real Estate Investors; over 25 years of real estate finance and capital markets experience at Kidder, Peabody; PaineWebber; UBS; and Five Mile Capital Partners • Holds a M.B.A. from Columbia University and a B.S. in Chemistry from Rensselaer Polytechnic Institute PETER MORRAL CHIEF DEVELOPMENT OFFICER, CO-HEAD OF ORIGINATIONS • Previous experience: Over 25 years of CRE debt experience with senior positions in origination, capital markets, credit, distribution, and investing in various capacities at: Annaly, UBS, Wachovia, and Bank of America • Holds a M.B.A. from The Ohio State University and a B.L.A. in History from the University of Connecticut MARCIN URBASZEK, CFA ® CHIEF FINANCIAL OFFICER • Previous experience: Financial Institutions investment banking at Credit Suisse, U.S. Banks Equity Research at Citigroup, Equity-linked Capital Markets at JPMorgan • Holds a B.B.A. in Finance, from Zicklin School of Business, Baruch College, CUNY; CFA® Charterholder

Company Overview(1) • An internally-managed (2) commercial real estate finance company operating as a REIT and focused on direct origination of floating-rate, senior first mortgage loans secured by institutional-quality, transitional properties. • Investment objective emphasizes preservation of capital while generating attractive risk-adjusted returns over the long-term, primarily through dividends derived from current income produced by the loan portfolio. • $4.1 billion(3) defensively-positioned nationwide investment portfolio that is broadly-diversified across property types, geographies and sponsors. • Senior investment team with decades of real estate lending experience across economic, credit and interest rate cycles. • Conservatively managed balance sheet with a well-balanced financing profile, moderate leverage and $932 million of equity capital. • GPMT is a member of the S&P 600 Small Cap index. 5(1) Except as otherwise indicated in this presentation, reported data is as of, or for the period ended, September 30, 2021. (2) Finalized the transition to an internally-managed REIT by completing the internalization of the management function on December 31, 2020. (3) Includes maximum loan commitments. Outstanding principal balance of $3.7 billion.

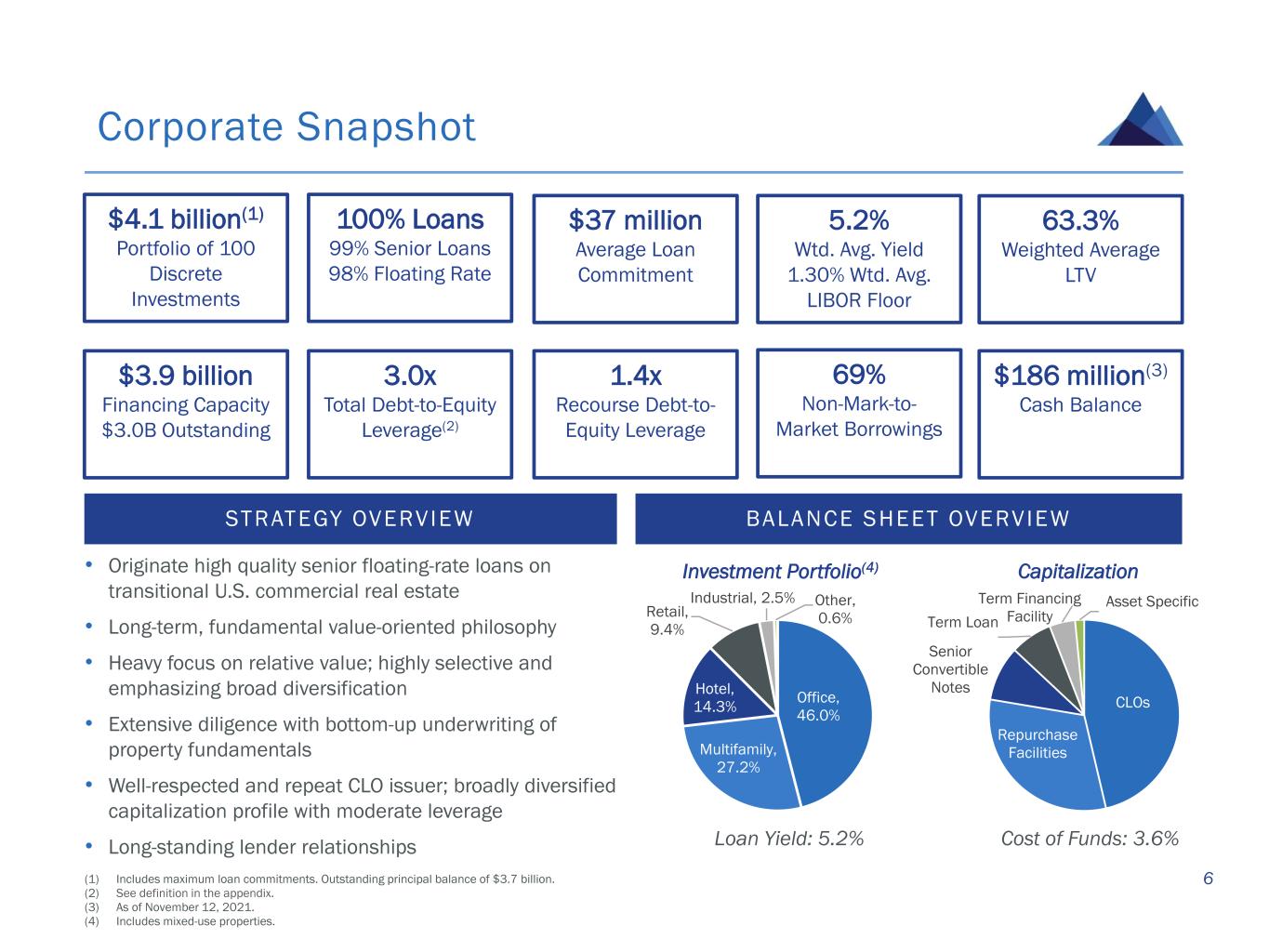

Corporate Snapshot • Originate high quality senior floating-rate loans on transitional U.S. commercial real estate • Long-term, fundamental value-oriented philosophy • Heavy focus on relative value; highly selective and emphasizing broad diversification • Extensive diligence with bottom-up underwriting of property fundamentals • Well-respected and repeat CLO issuer; broadly diversified capitalization profile with moderate leverage • Long-standing lender relationships BALANCE SHEET OVERVIEWSTRATEGY OVERVIEW Loan Yield: 5.2% Cost of Funds: 3.6% Investment Portfolio(4) Capitalization (1) Includes maximum loan commitments. Outstanding principal balance of $3.7 billion. (2) See definition in the appendix. (3) As of November 12, 2021. (4) Includes mixed-use properties. 6 $4.1 billion(1) Portfolio of 100 Discrete Investments 100% Loans 99% Senior Loans 98% Floating Rate $37 million Average Loan Commitment 1.4x Recourse Debt-to- Equity Leverage 63.3% Weighted Average LTV 69% Non-Mark-to- Market Borrowings 3.0x Total Debt-to-Equity Leverage(2) $3.9 billion Financing Capacity $3.0B Outstanding $186 million(3) Cash Balance 5.2% Wtd. Avg. Yield 1.30% Wtd. Avg. LIBOR Floor Office, 46.0% Multifamily, 27.2% Hotel, 14.3% Retail, 9.4% Industrial, 2.5% Other, 0.6% CLOs Repurchase Facilities Senior Convertible Notes Term Loan Term Financing Facility Asset Specific

Investment Highlights 7 EXPERIENCED AND CYCLE-TESTED SENIOR CRE TEAM ▪ Each senior investment team member has over 20 years of experience in the commercial real estate debt markets. Includes extensive background in investment management and structured finance. ▪ Broad and long-standing direct relationships within the commercial real estate lending market participants. ATTRACTIVE AND SUSTAINABLE MARKET OPPORTUNITY ▪ The U.S. CRE lending markets continue to offer an enduring opportunity for non-bank specialty finance companies, which are expected to gain market share over time. ▪ Senior floating-rate loans remain an attractive value proposition. DIFFERENTIATED DIRECT ORIGINATION PLATFORM ▪ Nationwide lending program targeting income-producing, institutional-quality properties and high quality, experienced sponsors across the top institutional markets. ▪ Geographic diversification helps mitigate concentrated event risk. ▪ Fundamental, value-driven investing, combined with credit intensive underwriting and focus on cash flow, as key underwriting criteria. HIGH CREDIT QUALITY INVESTMENT PORTFOLIO ▪ Portfolio with total loan commitments of $4.1 billion, a weighted average stabilized LTV of 63.3%(1) and weighted average all-in yield at origination of LIBOR + 4.11%.(1) ▪ 100% loan portfolio well-diversified across property types, geographies and sponsors. ▪ Earnings benefit from in-the-money LIBOR floors with a weighted average rate of 1.30%. DIVERSIFIED FINANCING PROFILE ▪ Moderate level of balance sheet leverage and a well-diversified funding mix including CLO securitizations, senior secured credit facilities, asset-specific financings, senior secured term loan facilities and senior unsecured convertible notes. ▪ Emphasis on term-matched, non-recourse and non-mark-to-market types of financing such as CLO securitizations and certain other types of funding facilities. (1) See definition in the appendix.

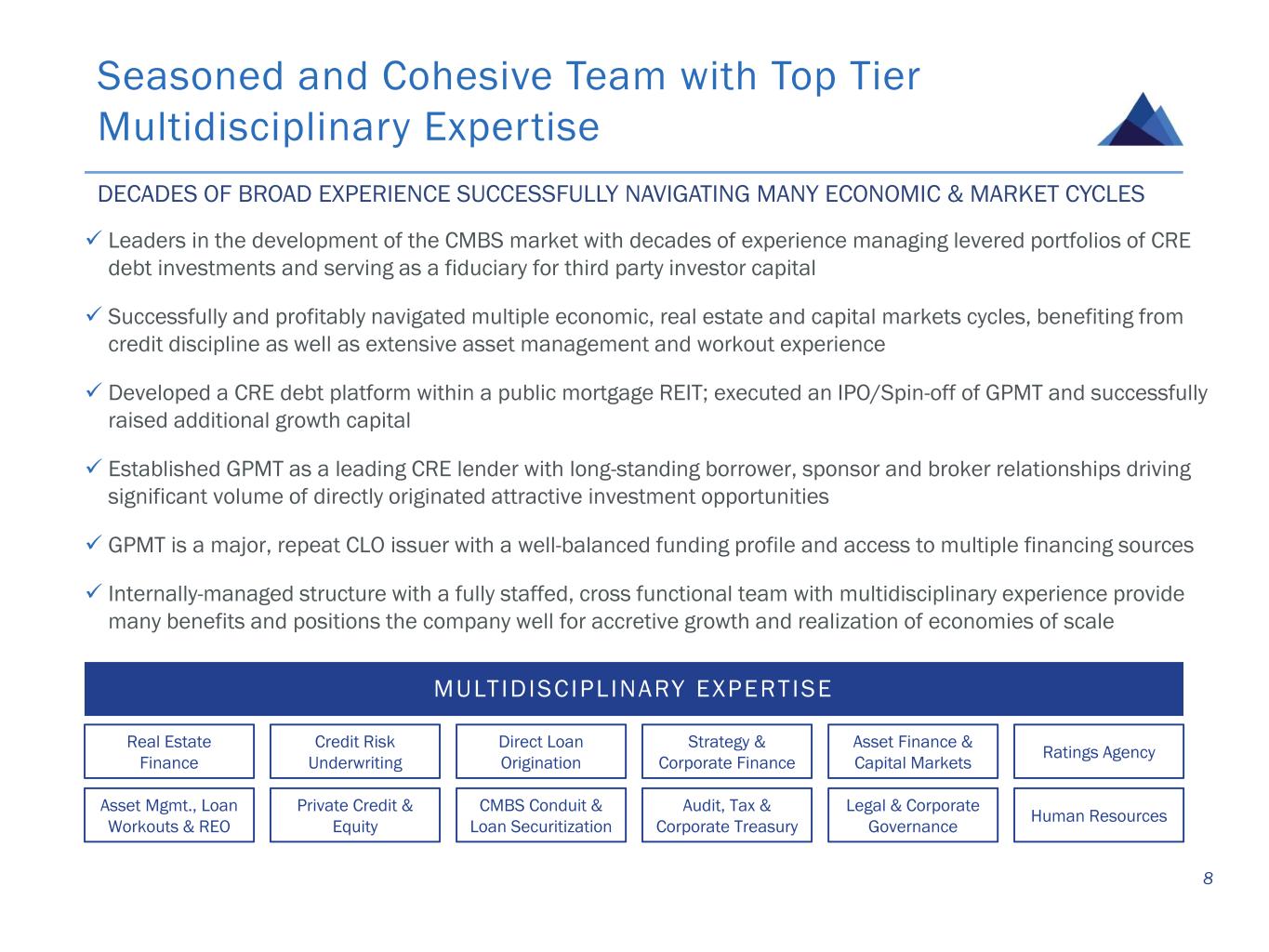

Seasoned and Cohesive Team with Top Tier Multidisciplinary Expertise 8 DECADES OF BROAD EXPERIENCE SUCCESSFULLY NAVIGATING MANY ECONOMIC & MARKET CYCLES ✓ Leaders in the development of the CMBS market with decades of experience managing levered portfolios of CRE debt investments and serving as a fiduciary for third party investor capital ✓ Successfully and profitably navigated multiple economic, real estate and capital markets cycles, benefiting from credit discipline as well as extensive asset management and workout experience ✓ Developed a CRE debt platform within a public mortgage REIT; executed an IPO/Spin-off of GPMT and successfully raised additional growth capital ✓ Established GPMT as a leading CRE lender with long-standing borrower, sponsor and broker relationships driving significant volume of directly originated attractive investment opportunities ✓ GPMT is a major, repeat CLO issuer with a well-balanced funding profile and access to multiple financing sources ✓ Internally-managed structure with a fully staffed, cross functional team with multidisciplinary experience provide many benefits and positions the company well for accretive growth and realization of economies of scale Real Estate Finance Credit Risk Underwriting Direct Loan Origination Asset Finance & Capital Markets Ratings Agency Asset Mgmt., Loan Workouts & REO Private Credit & Equity CMBS Conduit & Loan Securitization Legal & Corporate Governance Human Resources Strategy & Corporate Finance Audit, Tax & Corporate Treasury MULTIDISCIPLINARY EXPERTISE

Investment Strategy and Origination Platform

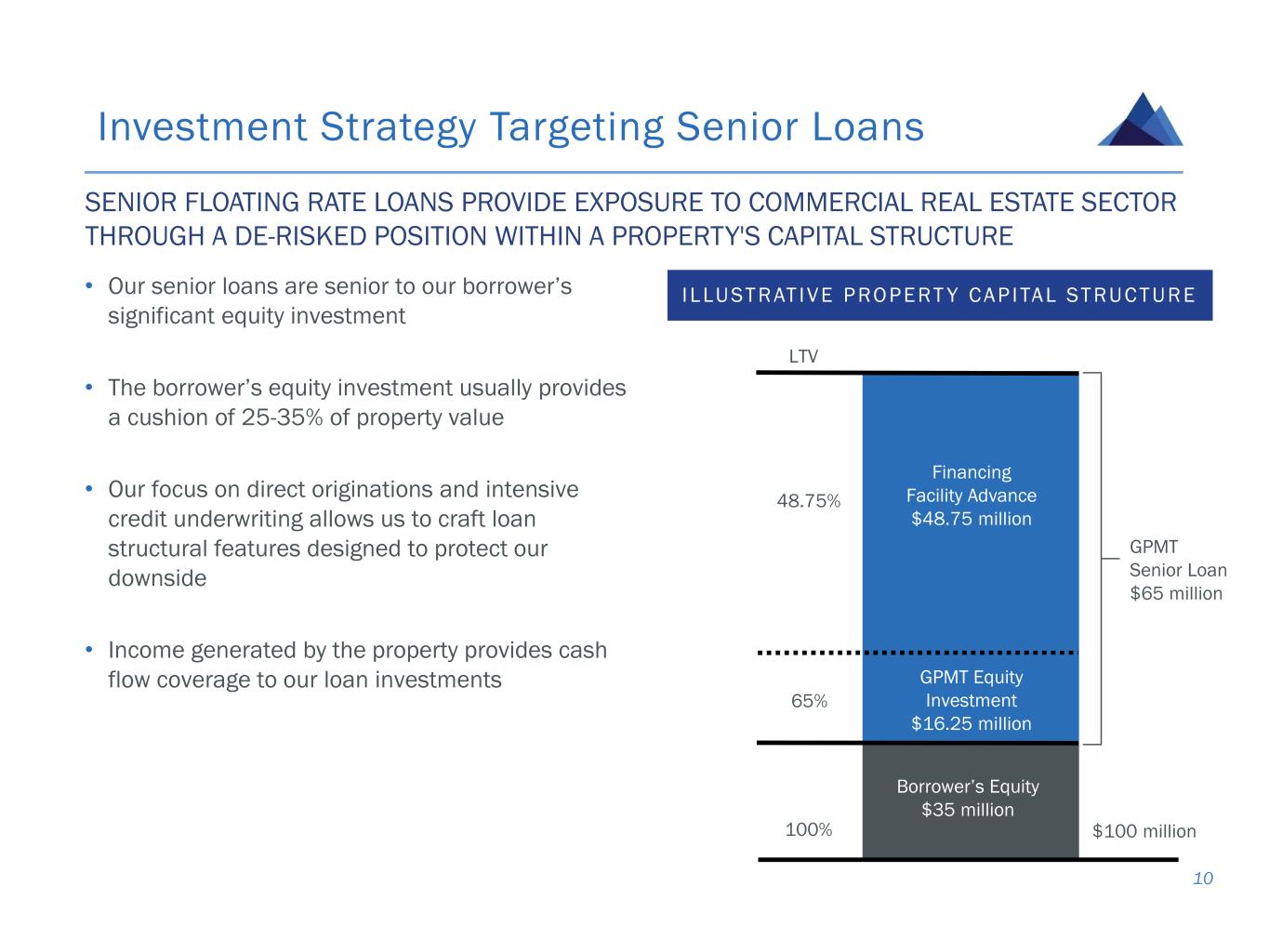

$100 million GPMT Senior Loan $65 million 100% 65% 48.75% GPMT Equity Investment $16.25 million Financing Facility Advance $48.75 million Borrower’s Equity $35 million LTV Investment Strategy Targeting Senior Loans 10 I LLUSTR AT IVE PROPE RT Y CAP ITAL STRUCTUR E SENIOR FLOATING RATE LOANS PROVIDE EXPOSURE TO COMMERCIAL REAL ESTATE SECTOR THROUGH A DE-RISKED POSITION WITHIN A PROPERTY'S CAPITAL STRUCTURE • Our senior loans are senior to our borrower’s significant equity investment • The borrower’s equity investment usually provides a cushion of 25-35% of property value • Our focus on direct originations and intensive credit underwriting allows us to craft loan structural features designed to protect our downside • Income generated by the property provides cash flow coverage to our loan investments

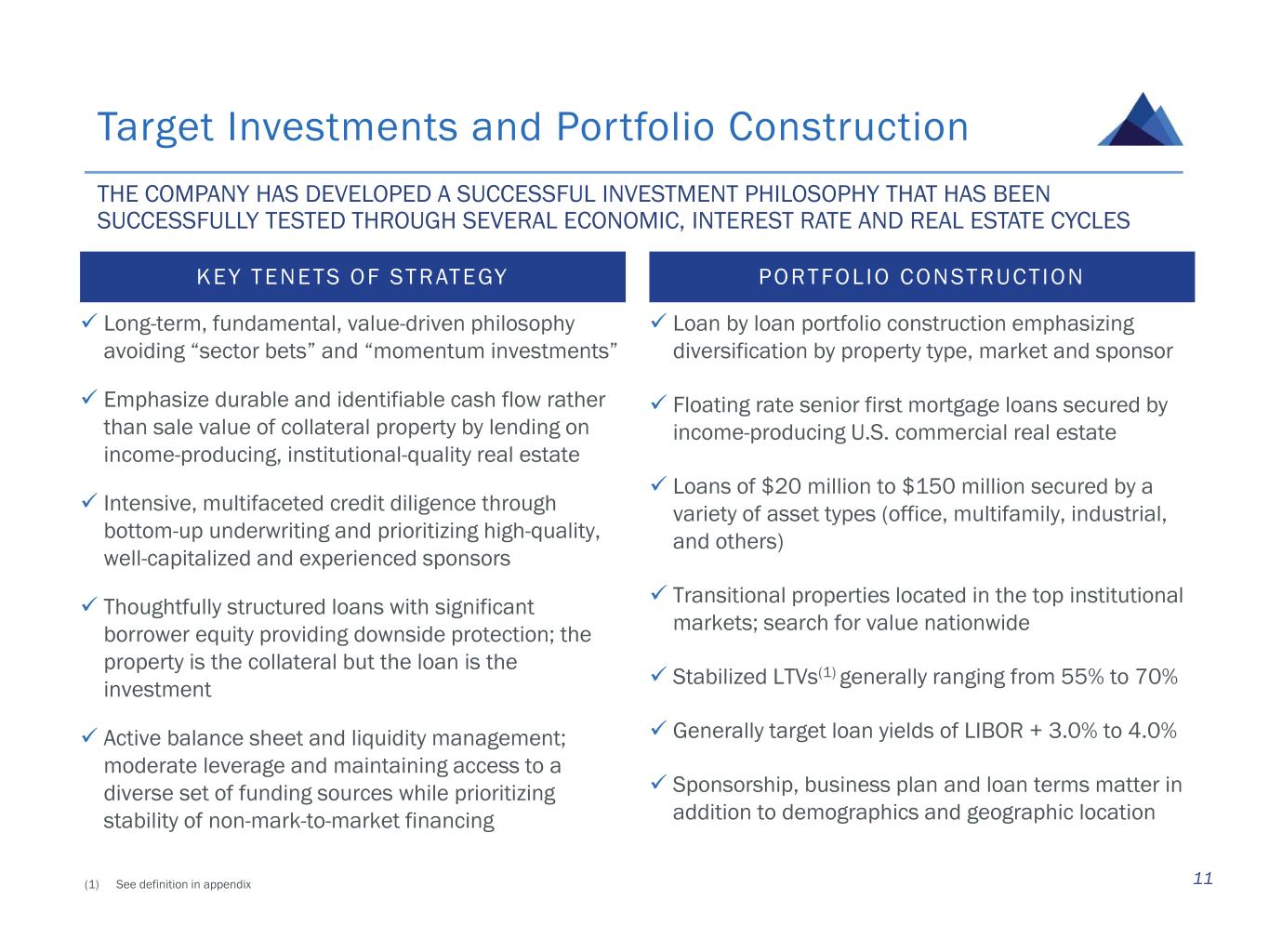

(1) See definition in appendix Target Investments and Portfolio Construction 11 KEY TENETS OF STRATEGY PORTFOLIO CONSTRUCTION ✓ Long-term, fundamental, value-driven philosophy avoiding “sector bets” and “momentum investments” ✓ Emphasize durable and identifiable cash flow rather than sale value of collateral property by lending on income-producing, institutional-quality real estate ✓ Intensive, multifaceted credit diligence through bottom-up underwriting and prioritizing high-quality, well-capitalized and experienced sponsors ✓ Thoughtfully structured loans with significant borrower equity providing downside protection; the property is the collateral but the loan is the investment ✓ Active balance sheet and liquidity management; moderate leverage and maintaining access to a diverse set of funding sources while prioritizing stability of non-mark-to-market financing ✓ Loan by loan portfolio construction emphasizing diversification by property type, market and sponsor ✓ Floating rate senior first mortgage loans secured by income-producing U.S. commercial real estate ✓ Loans of $20 million to $150 million secured by a variety of asset types (office, multifamily, industrial, and others) ✓ Transitional properties located in the top institutional markets; search for value nationwide ✓ Stabilized LTVs(1) generally ranging from 55% to 70% ✓ Generally target loan yields of LIBOR + 3.0% to 4.0% ✓ Sponsorship, business plan and loan terms matter in addition to demographics and geographic location THE COMPANY HAS DEVELOPED A SUCCESSFUL INVESTMENT PHILOSOPHY THAT HAS BEEN SUCCESSFULLY TESTED THROUGH SEVERAL ECONOMIC, INTEREST RATE AND REAL ESTATE CYCLES

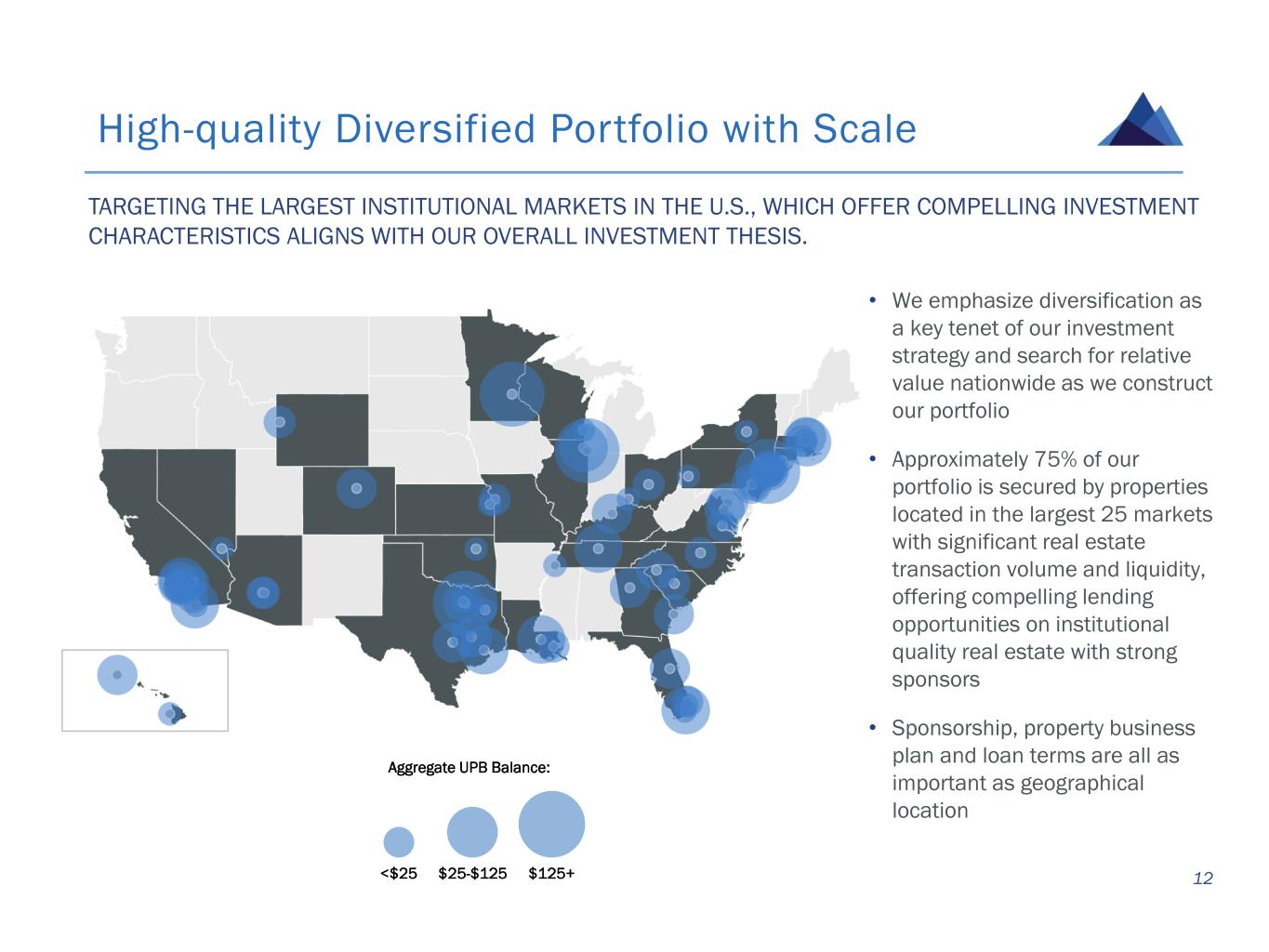

High-quality Diversified Portfolio with Scale 12 • We emphasize diversification as a key tenet of our investment strategy and search for relative value nationwide as we construct our portfolio • Approximately 75% of our portfolio is secured by properties located in the largest 25 markets with significant real estate transaction volume and liquidity, offering compelling lending opportunities on institutional quality real estate with strong sponsors • Sponsorship, property business plan and loan terms are all as important as geographical location TARGETING THE LARGEST INSTITUTIONAL MARKETS IN THE U.S., WHICH OFFER COMPELLING INVESTMENT CHARACTERISTICS ALIGNS WITH OUR OVERALL INVESTMENT THESIS. $125+ Aggregate UPB Balance: <$25 $25-$125

Relationships •Directly source a large volume of investment opportunities through strong relationships, excellent reputation and extensive lending market experience •Because most deals have multiple counterparties, both operating and capital partners, and brokers, multiple touch points help drive transaction volume Process •Employ a highly-disciplined sourcing, screening and underwriting process focused on resource efficiency, selecting the best investments and providing reliable, timely feedback to borrower counterparties •Origination process is combined with the financing and capital markets function, driving an efficient feedback loop during underwriting and structuring Results •Many transactions are time of the essence, creating a need for reliability and reputation for fair dealing, which has led to multiple investment opportunities with repeat borrowers •Since inception of the business in 2015, the team has sourced and evaluated tens of billions of dollars of opportunities and closed on over $6 billion Direct Origination Platform Supported by Strong Reputation and Deep, Longstanding Relationships DIFFERENTIATED ORIGINATION STRATEGY TARGETING HIGH-QUALITY LOANS ON INSTITUTIONAL-QUALITY PROPERTIES WITH WELL-CAPITALIZED, EXPERIENCED SPONSORS, ACROSS ATTRACTIVE MARKETS • Borrowers range from large private equity firms and national operating platforms to regional and local owners/operators with extensive local market and property type expertise • Team of 7 seasoned originators with an average of over 15 years of experience and longstanding relationships with various market participants 13

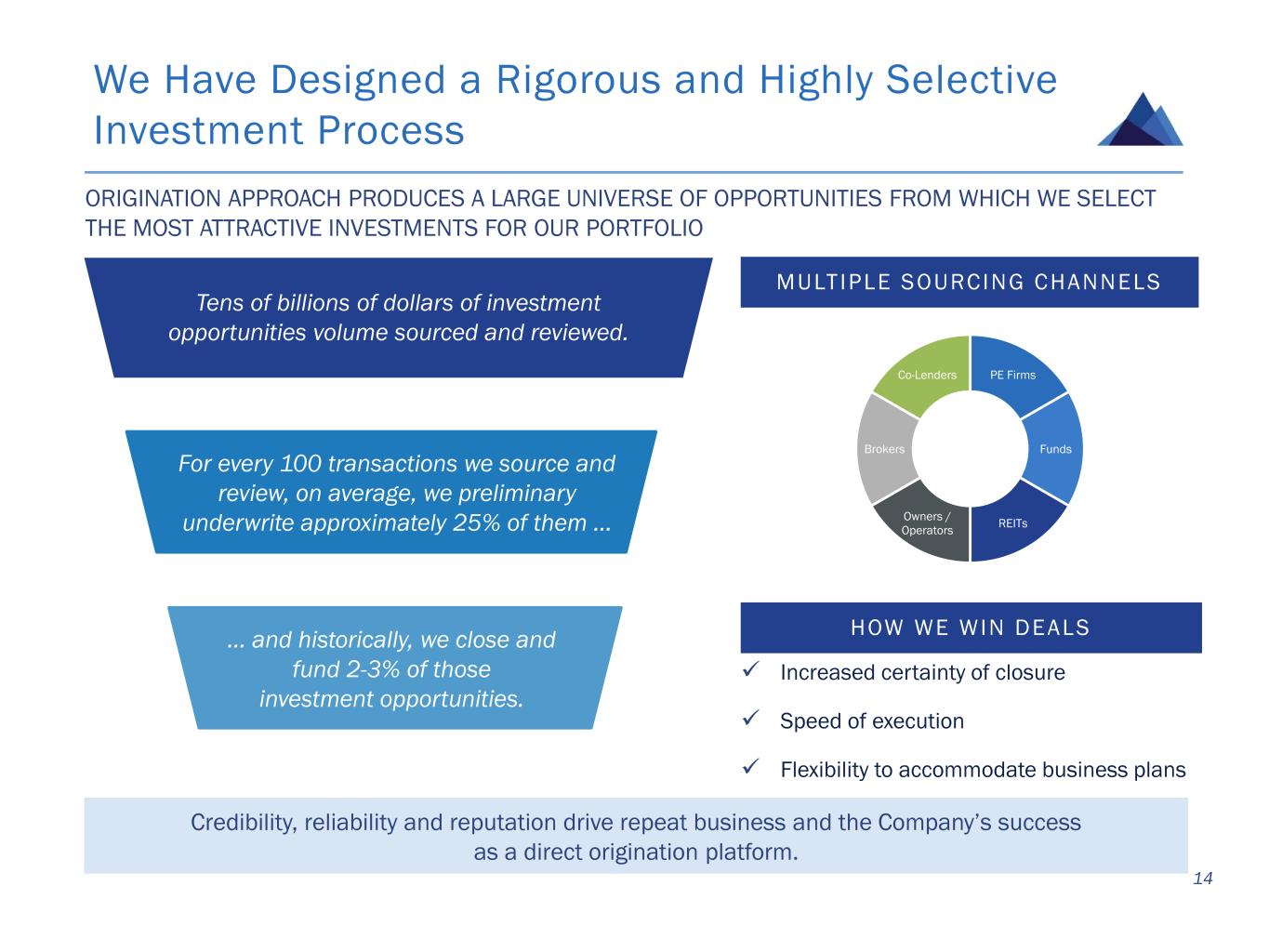

We Have Designed a Rigorous and Highly Selective Investment Process 14 ORIGINATION APPROACH PRODUCES A LARGE UNIVERSE OF OPPORTUNITIES FROM WHICH WE SELECT THE MOST ATTRACTIVE INVESTMENTS FOR OUR PORTFOLIO Tens of billions of dollars of investment opportunities volume sourced and reviewed. For every 100 transactions we source and review, on average, we preliminary underwrite approximately 25% of them … … and historically, we close and fund 2-3% of those investment opportunities. ✓ Increased certainty of closure ✓ Speed of execution ✓ Flexibility to accommodate business plans HOW WE WIN DEALS PE Firms Funds REITs Owners / Operators Brokers Co-Lenders MULTIPLE SOURCING CHANNELS Credibility, reliability and reputation drive repeat business and the Company’s success as a direct origination platform.

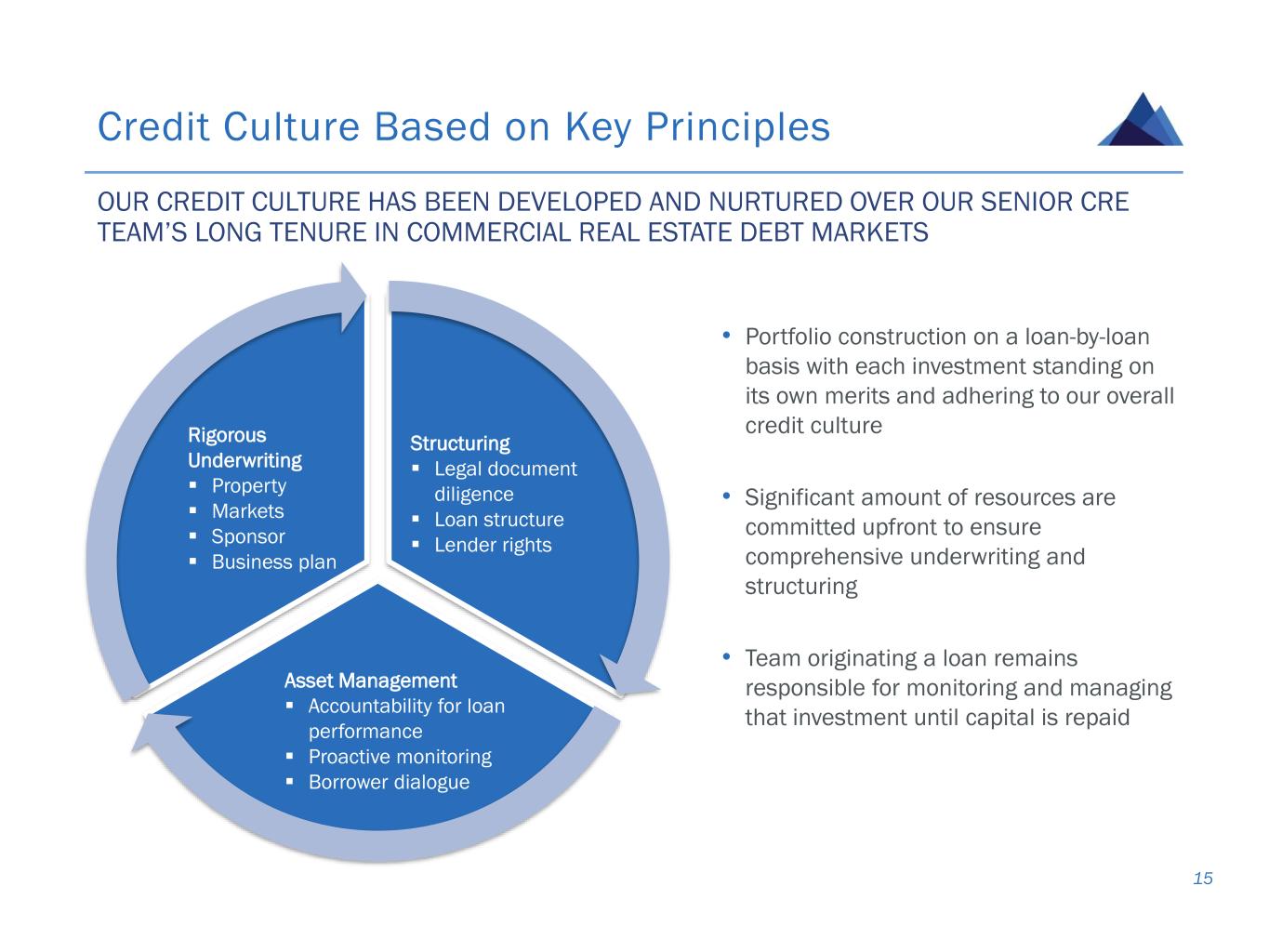

Credit Culture Based on Key Principles 15 • Portfolio construction on a loan-by-loan basis with each investment standing on its own merits and adhering to our overall credit culture • Significant amount of resources are committed upfront to ensure comprehensive underwriting and structuring • Team originating a loan remains responsible for monitoring and managing that investment until capital is repaid Rigorous Underwriting ▪ Property ▪ Markets ▪ Sponsor ▪ Business plan Structuring ▪ Legal document diligence ▪ Loan structure ▪ Lender rights Asset Management ▪ Accountability for loan performance ▪ Proactive monitoring ▪ Borrower dialogue OUR CREDIT CULTURE HAS BEEN DEVELOPED AND NURTURED OVER OUR SENIOR CRE TEAM’S LONG TENURE IN COMMERCIAL REAL ESTATE DEBT MARKETS

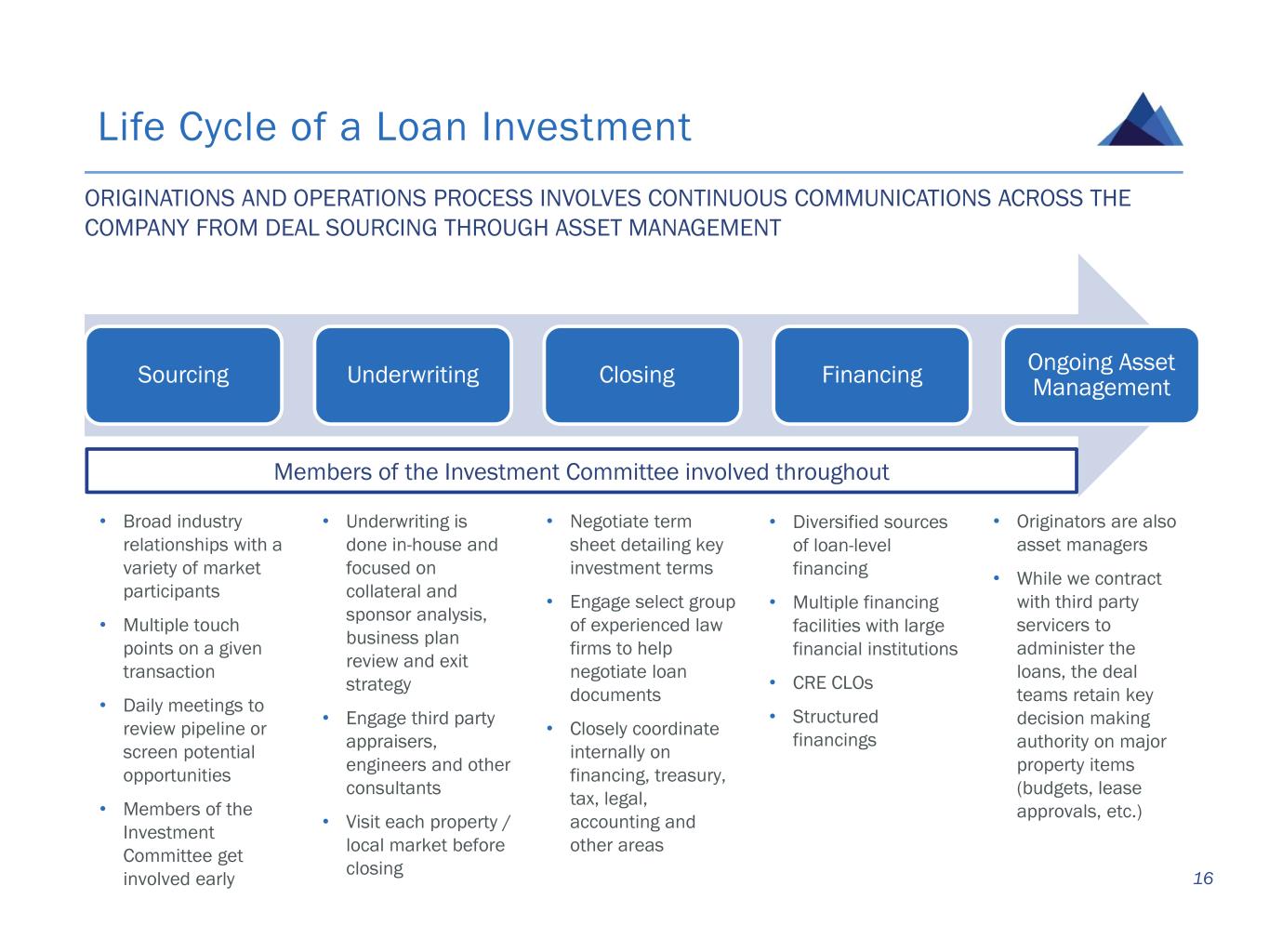

Life Cycle of a Loan Investment ORIGINATIONS AND OPERATIONS PROCESS INVOLVES CONTINUOUS COMMUNICATIONS ACROSS THE COMPANY FROM DEAL SOURCING THROUGH ASSET MANAGEMENT 16 Sourcing Underwriting Closing Financing Ongoing Asset Management • Broad industry relationships with a variety of market participants • Multiple touch points on a given transaction • Daily meetings to review pipeline or screen potential opportunities • Members of the Investment Committee get involved early • Underwriting is done in-house and focused on collateral and sponsor analysis, business plan review and exit strategy • Engage third party appraisers, engineers and other consultants • Visit each property / local market before closing • Negotiate term sheet detailing key investment terms • Engage select group of experienced law firms to help negotiate loan documents • Closely coordinate internally on financing, treasury, tax, legal, accounting and other areas • Diversified sources of loan-level financing • Multiple financing facilities with large financial institutions • CRE CLOs • Structured financings • Originators are also asset managers • While we contract with third party servicers to administer the loans, the deal teams retain key decision making authority on major property items (budgets, lease approvals, etc.) Members of the Investment Committee involved throughout

Coordinated and Comprehensive Approach to Asset Management 17 • 5-point loan risk rating system • Deal teams retain key decision-making authority on asset management (budgets, lease approvals, monitoring, tracking business plan, etc.) – Frequent communication and feedback with property owners • While key decision-making authority is held by the Company, third party servicers are used to increase efficiency and leverage internal resources – Longstanding relationship with Trimont Real Estate Advisors – Handpicked team at Trimont of fully-dedicated and experienced asset management and servicing professionals • Asset management provides a key early warning system for credit issues, and in many cases can prevent them from occurring – Monitor to ensure compliance with loan terms – Review draw requests for leases and capital items – Remain proactive when business plans begin to slip • Transitional business plans are by nature organic and are expected to evolve over time – Ongoing proactive asset management is a critical component of risk management and in meeting the ongoing needs of borrowers as their business plans evolve ORIGINATION TEAM THAT SOURCES A LOAN REMAINS RESPONSIBLE FOR ASSET MANAGING IT THROUGHOUT ITS LIFECYCLE UNTIL REPAYMENT

Portfolio Overview

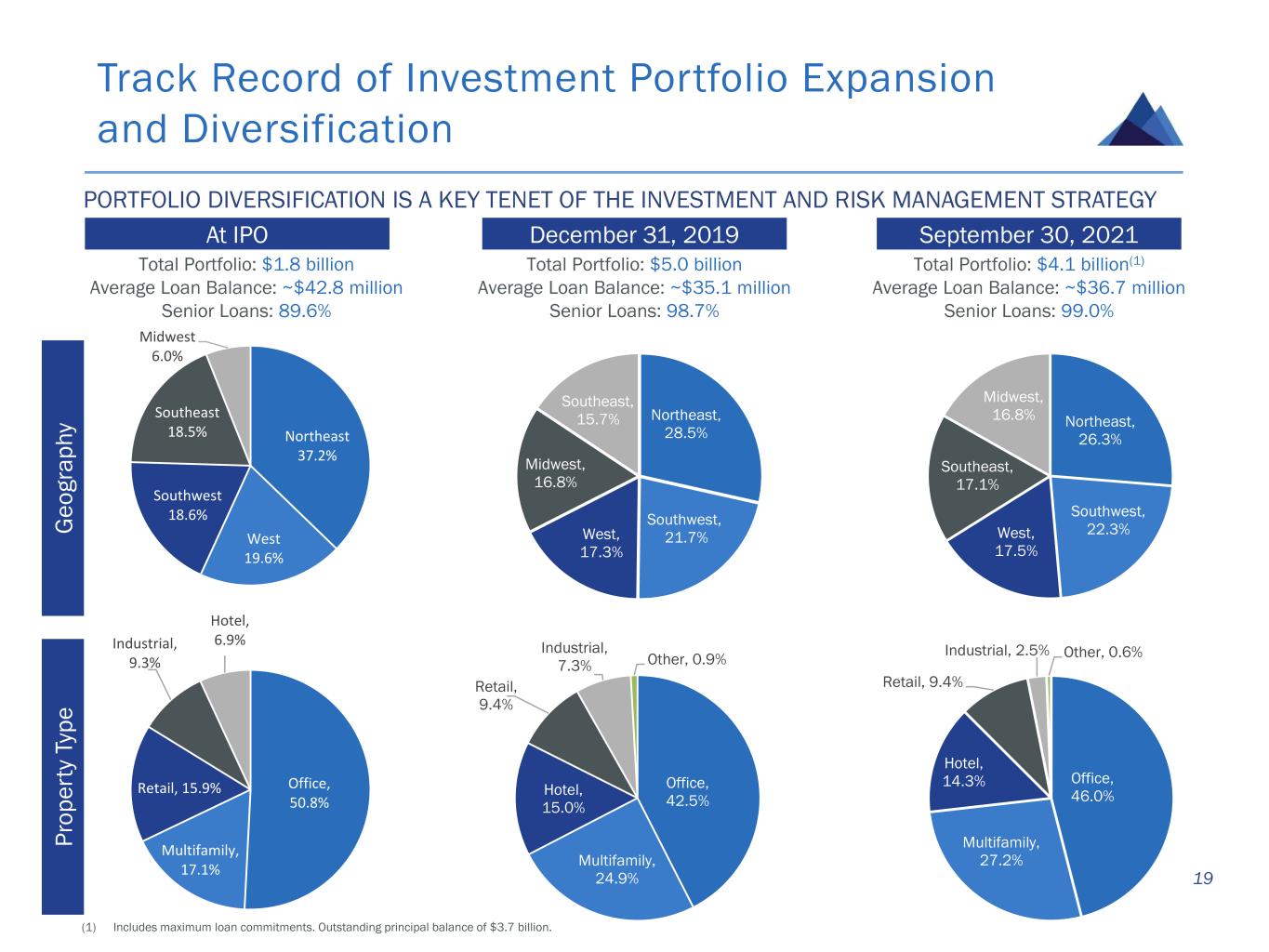

Northeast 37.2% West 19.6% Southwest 18.6% Southeast 18.5% Midwest 6.0% Total Portfolio: $1.8 billion Average Loan Balance: ~$42.8 million Senior Loans: 89.6% Office, 50.8% Multifamily, 17.1% Retail, 15.9% Industrial, 9.3% Hotel, 6.9% Track Record of Investment Portfolio Expansion and Diversification 19 At IPO September 30, 2021 G e o g ra p h y Total Portfolio: $4.1 billion(1) Average Loan Balance: ~$36.7 million Senior Loans: 99.0% P ro p e rt y Ty p e December 31, 2019 Total Portfolio: $5.0 billion Average Loan Balance: ~$35.1 million Senior Loans: 98.7% Northeast, 28.5% Southwest, 21.7%West, 17.3% Midwest, 16.8% Southeast, 15.7% Office, 42.5% Multifamily, 24.9% Hotel, 15.0% Retail, 9.4% Industrial, 7.3% Other, 0.9% PORTFOLIO DIVERSIFICATION IS A KEY TENET OF THE INVESTMENT AND RISK MANAGEMENT STRATEGY (1) Includes maximum loan commitments. Outstanding principal balance of $3.7 billion. Northeast, 26.3% Southwest, 22.3%West, 17.5% Southeast, 17.1% Midwest, 16.8% Office, 46.0% Multifamily, 27.2% Hotel, 14.3% Retail, 9.4% Industrial, 2.5% Other, 0.6%

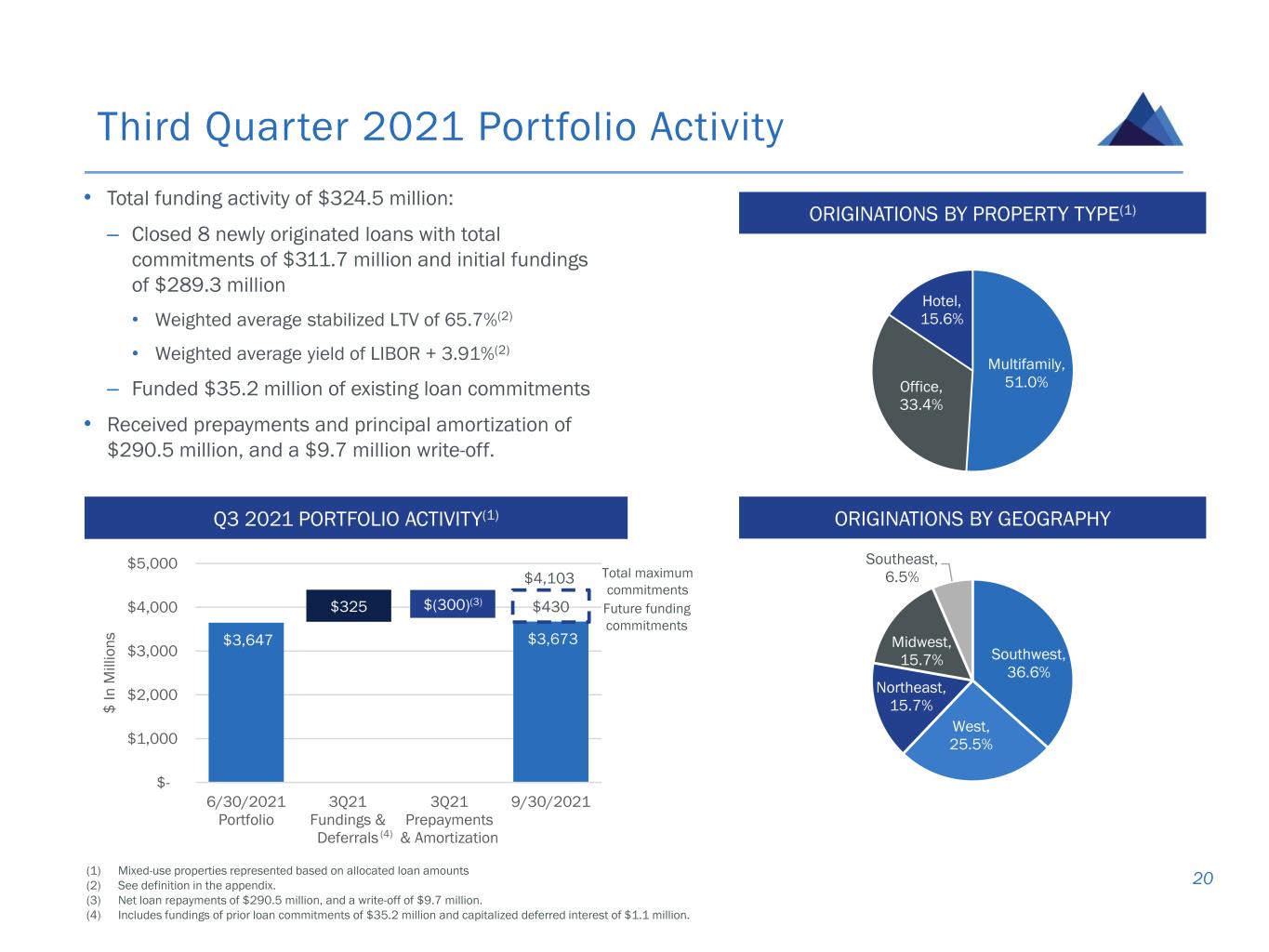

$3,647 $3,673 $- $1,000 $2,000 $3,000 $4,000 $5,000 6/30/2021 Portfolio 3Q21 Fundings & Deferrals 3Q21 Prepayments & Amortization 9/30/2021 $ I n M il li o n s Q3 2021 PORTFOLIO ACTIVITY(1) Third Quarter 2021 Portfolio Activity 20 (1) Mixed-use properties represented based on allocated loan amounts (2) See definition in the appendix. (3) Net loan repayments of $290.5 million, and a write-off of $9.7 million. (4) Includes fundings of prior loan commitments of $35.2 million and capitalized deferred interest of $1.1 million. ORIGINATIONS BY PROPERTY TYPE(1) $325 $(300)(3) $4,103 $430 Total maximum commitments Future funding commitments ORIGINATIONS BY GEOGRAPHY • Total funding activity of $324.5 million: – Closed 8 newly originated loans with total commitments of $311.7 million and initial fundings of $289.3 million • Weighted average stabilized LTV of 65.7%(2) • Weighted average yield of LIBOR + 3.91%(2) – Funded $35.2 million of existing loan commitments • Received prepayments and principal amortization of $290.5 million, and a $9.7 million write-off. Multifamily, 51.0%Office, 33.4% Hotel, 15.6% Southwest, 36.6% West, 25.5% Northeast, 15.7% Midwest, 15.7% Southeast, 6.5% (4)

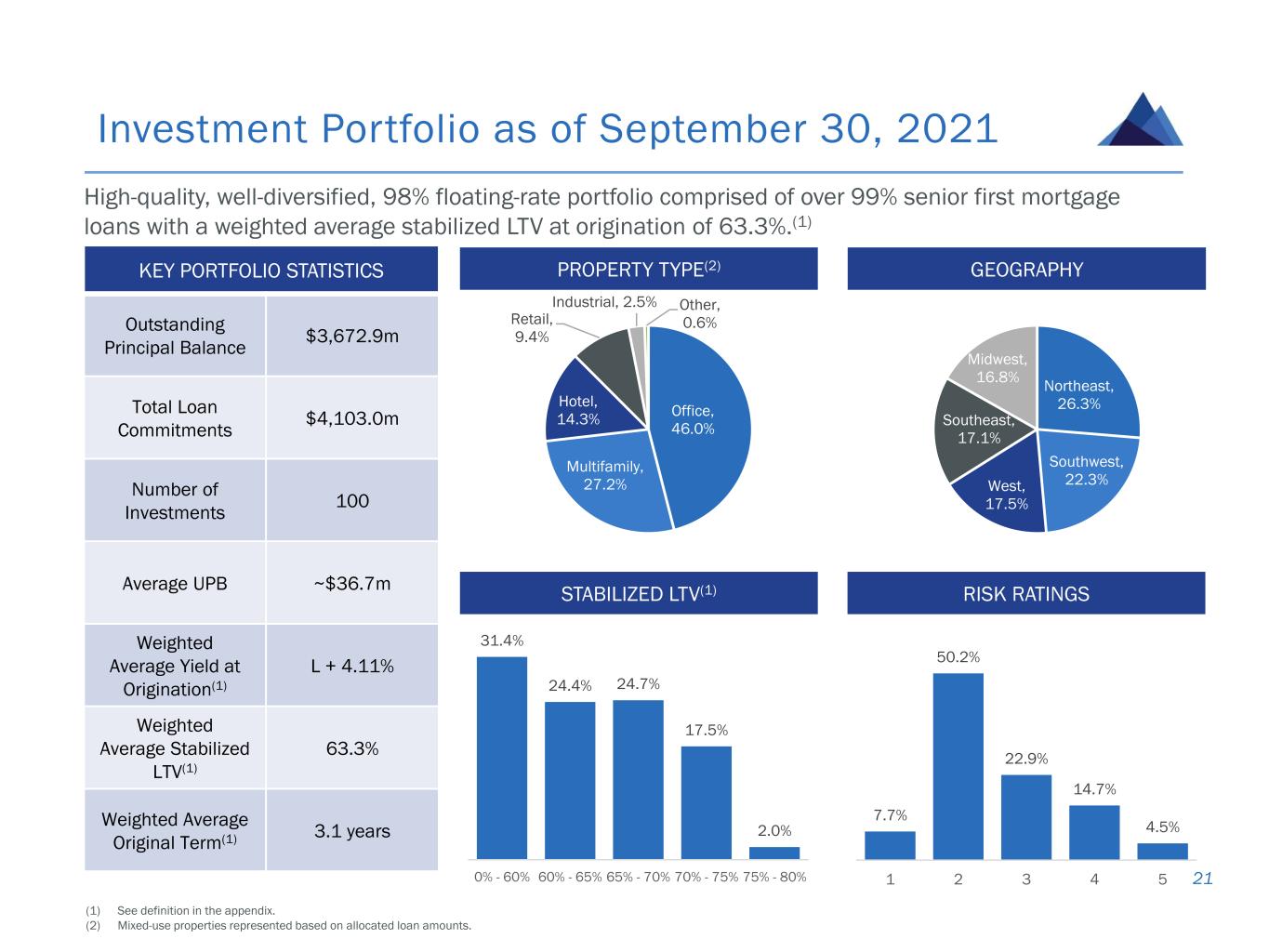

7.7% 50.2% 22.9% 14.7% 4.5% 1 2 3 4 5 Investment Portfolio as of September 30, 2021 21 PROPERTY TYPE(2) GEOGRAPHY STABILIZED LTV(1) RISK RATINGS (1) See definition in the appendix. (2) Mixed-use properties represented based on allocated loan amounts. KEY PORTFOLIO STATISTICS Outstanding Principal Balance $3,672.9m Total Loan Commitments $4,103.0m Number of Investments 100 Average UPB ~$36.7m Weighted Average Yield at Origination(1) L + 4.11% Weighted Average Stabilized LTV(1) 63.3% Weighted Average Original Term(1) 3.1 years High-quality, well-diversified, 98% floating-rate portfolio comprised of over 99% senior first mortgage loans with a weighted average stabilized LTV at origination of 63.3%.(1) 31.4% 24.4% 24.7% 17.5% 2.0% 0% - 60% 60% - 65% 65% - 70% 70% - 75% 75% - 80% Office, 46.0% Multifamily, 27.2% Hotel, 14.3% Retail, 9.4% Industrial, 2.5% Other, 0.6% Northeast, 26.3% Southwest, 22.3%West, 17.5% Southeast, 17.1% Midwest, 16.8%

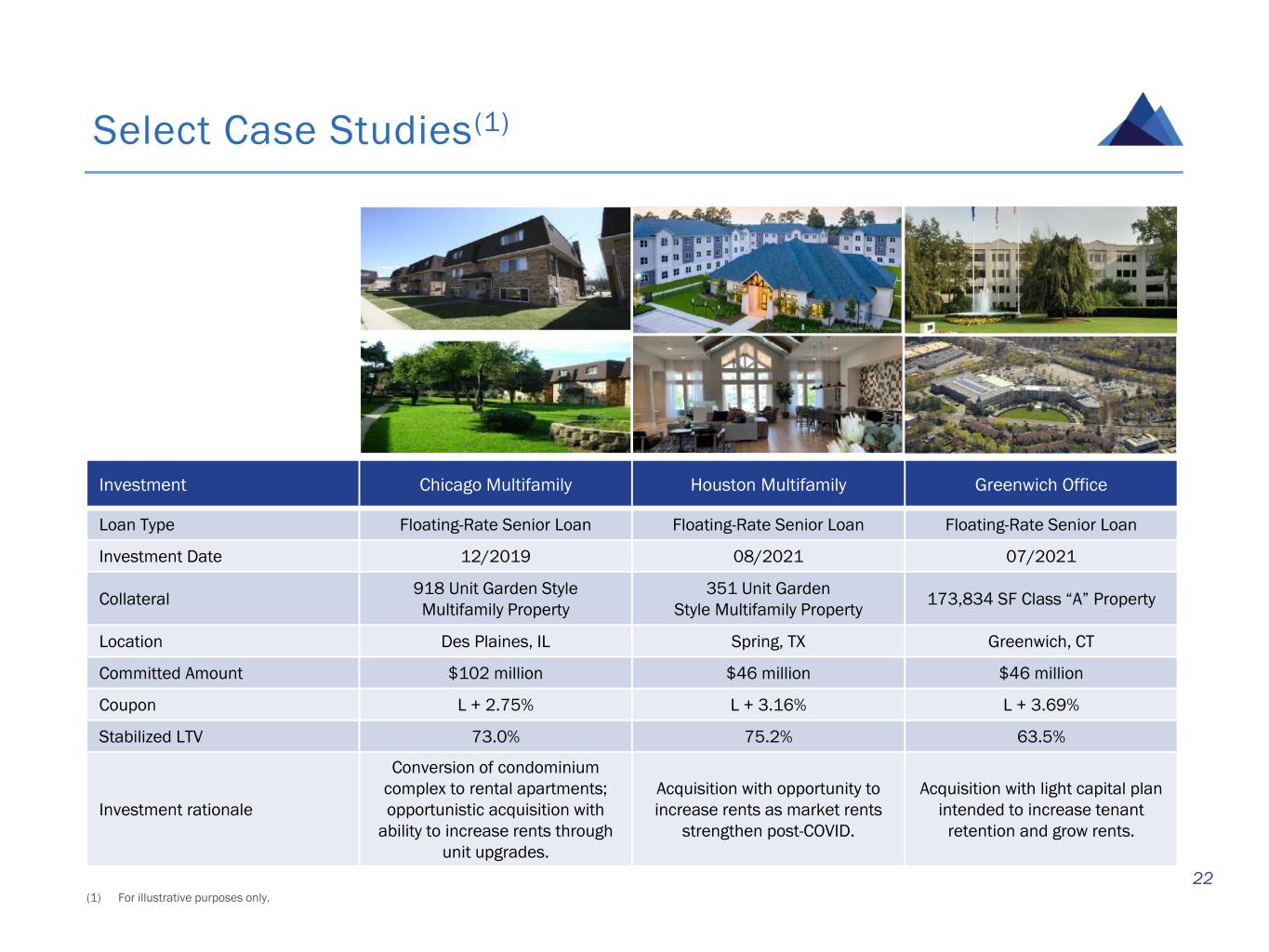

Investment Chicago Multifamily Houston Multifamily Greenwich Office Loan Type Floating-Rate Senior Loan Floating-Rate Senior Loan Floating-Rate Senior Loan Investment Date 12/2019 08/2021 07/2021 Collateral 918 Unit Garden Style Multifamily Property 351 Unit Garden Style Multifamily Property 173,834 SF Class “A” Property Location Des Plaines, IL Spring, TX Greenwich, CT Committed Amount $102 million $46 million $46 million Coupon L + 2.75% L + 3.16% L + 3.69% Stabilized LTV 73.0% 75.2% 63.5% Investment rationale Conversion of condominium complex to rental apartments; opportunistic acquisition with ability to increase rents through unit upgrades. Acquisition with opportunity to increase rents as market rents strengthen post-COVID. Acquisition with light capital plan intended to increase tenant retention and grow rents. Select Case Studies(1) 22 (1) For illustrative purposes only.

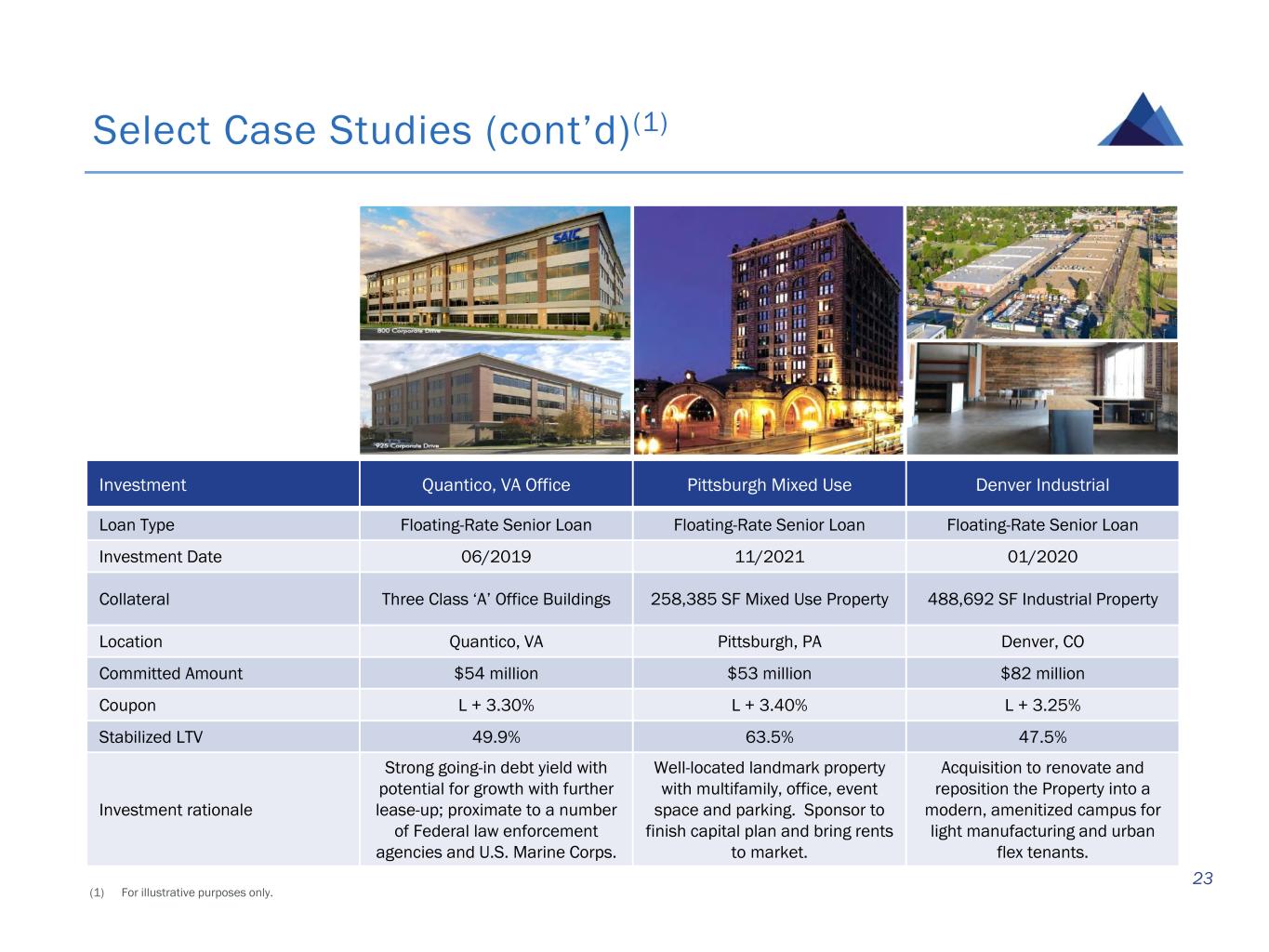

Investment Quantico, VA Office Pittsburgh Mixed Use Denver Industrial Loan Type Floating-Rate Senior Loan Floating-Rate Senior Loan Floating-Rate Senior Loan Investment Date 06/2019 11/2021 01/2020 Collateral Three Class ‘A’ Office Buildings 258,385 SF Mixed Use Property 488,692 SF Industrial Property Location Quantico, VA Pittsburgh, PA Denver, CO Committed Amount $54 million $53 million $82 million Coupon L + 3.30% L + 3.40% L + 3.25% Stabilized LTV 49.9% 63.5% 47.5% Investment rationale Strong going-in debt yield with potential for growth with further lease-up; proximate to a number of Federal law enforcement agencies and U.S. Marine Corps. Well-located landmark property with multifamily, office, event space and parking. Sponsor to finish capital plan and bring rents to market. Acquisition to renovate and reposition the Property into a modern, amenitized campus for light manufacturing and urban flex tenants. Select Case Studies (cont’d)(1) 23 (1) For illustrative purposes only.

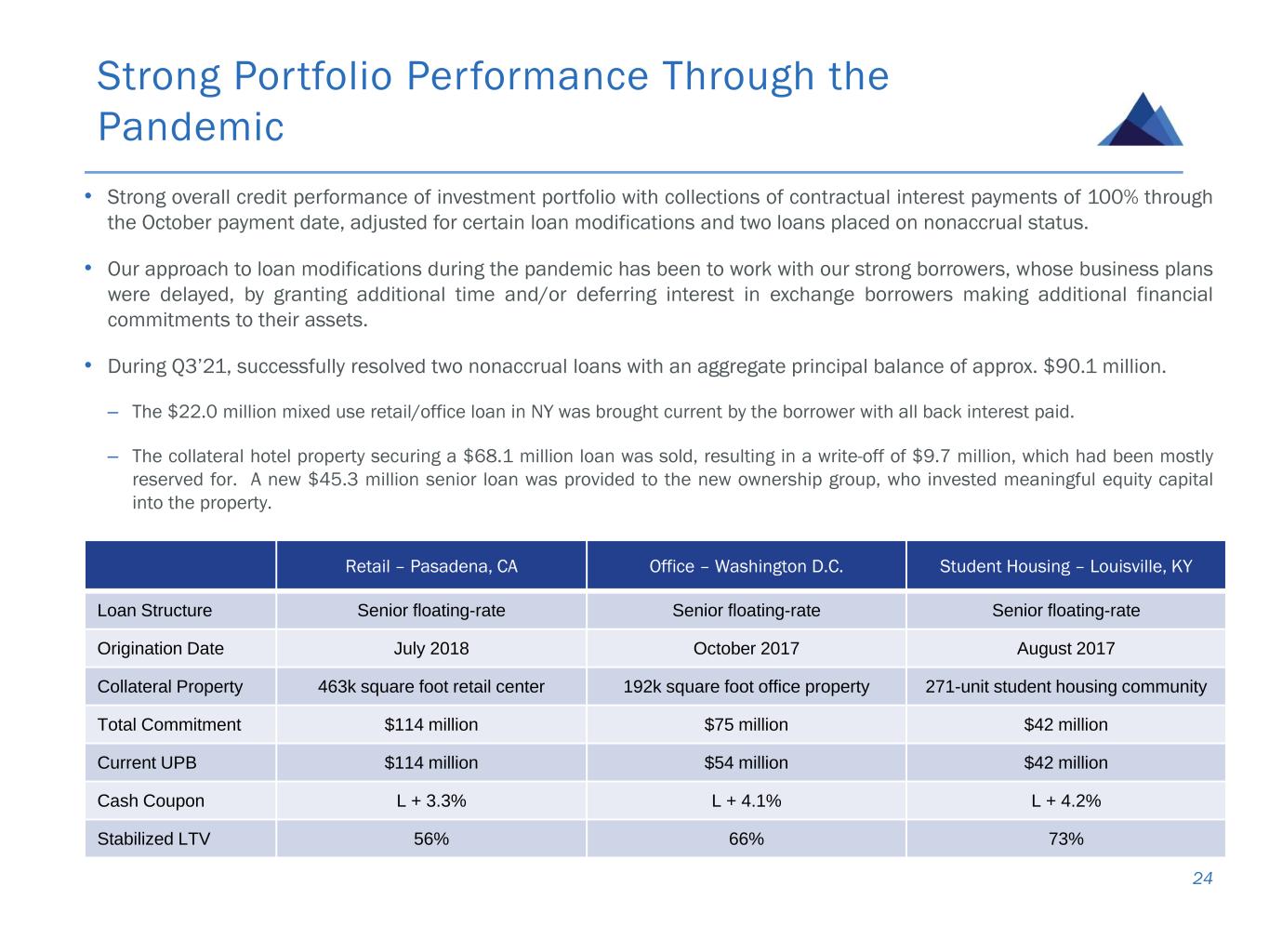

Strong Portfolio Performance Through the Pandemic 24 Retail – Pasadena, CA Office – Washington D.C. Student Housing – Louisville, KY Loan Structure Senior floating-rate Senior floating-rate Senior floating-rate Origination Date July 2018 October 2017 August 2017 Collateral Property 463k square foot retail center 192k square foot office property 271-unit student housing community Total Commitment $114 million $75 million $42 million Current UPB $114 million $54 million $42 million Cash Coupon L + 3.3% L + 4.1% L + 4.2% Stabilized LTV 56% 66% 73% • Strong overall credit performance of investment portfolio with collections of contractual interest payments of 100% through the October payment date, adjusted for certain loan modifications and two loans placed on nonaccrual status. • Our approach to loan modifications during the pandemic has been to work with our strong borrowers, whose business plans were delayed, by granting additional time and/or deferring interest in exchange borrowers making additional financial commitments to their assets. • During Q3’21, successfully resolved two nonaccrual loans with an aggregate principal balance of approx. $90.1 million. – The $22.0 million mixed use retail/office loan in NY was brought current by the borrower with all back interest paid. – The collateral hotel property securing a $68.1 million loan was sold, resulting in a write-off of $9.7 million, which had been mostly reserved for. A new $45.3 million senior loan was provided to the new ownership group, who invested meaningful equity capital into the property.

Financial Highlights and Capitalization

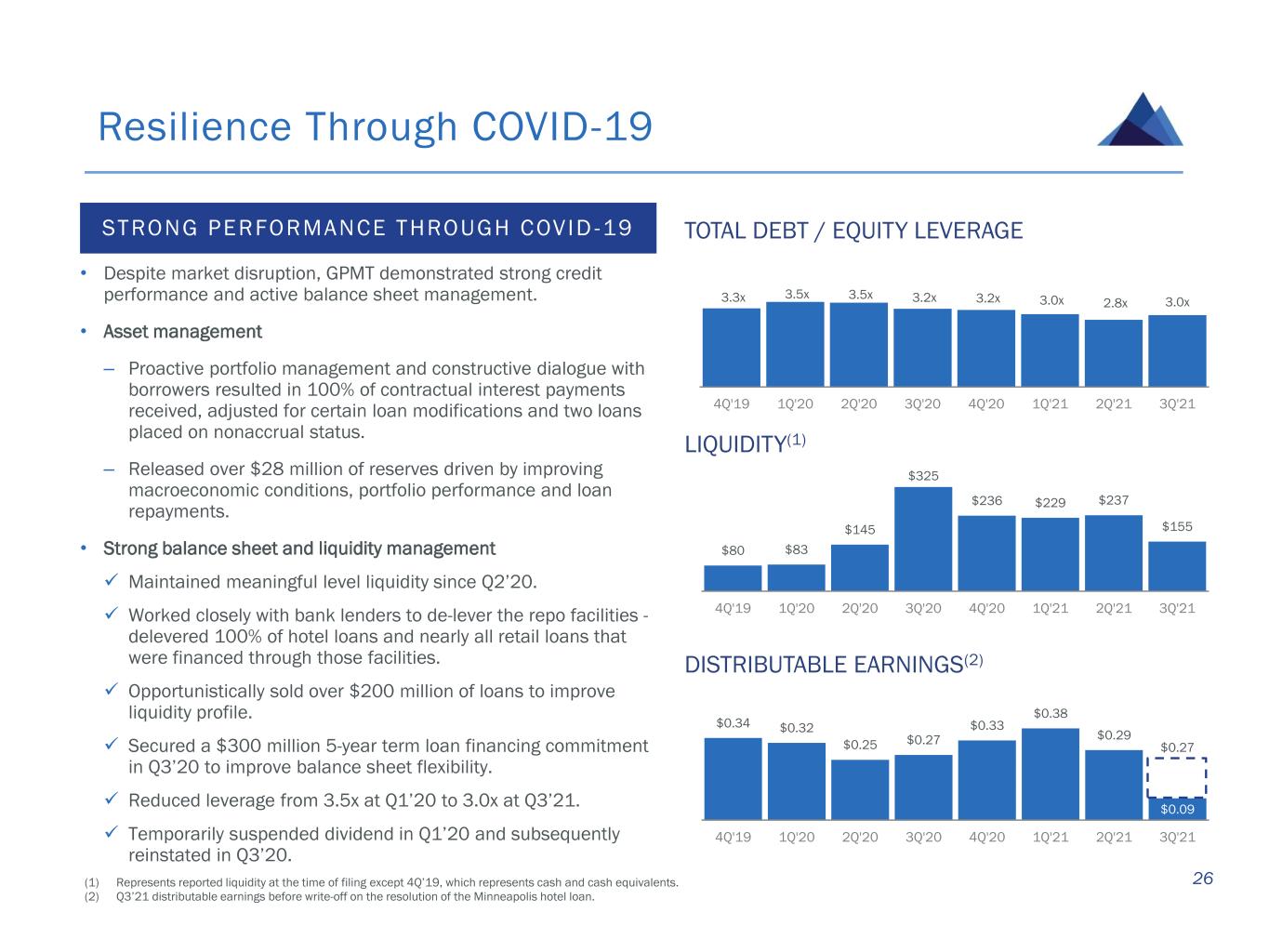

Resilience Through COVID-19 26 STRONG PERFORMANCE THROUGH COVID -19 • Despite market disruption, GPMT demonstrated strong credit performance and active balance sheet management. • Asset management – Proactive portfolio management and constructive dialogue with borrowers resulted in 100% of contractual interest payments received, adjusted for certain loan modifications and two loans placed on nonaccrual status. – Released over $28 million of reserves driven by improving macroeconomic conditions, portfolio performance and loan repayments. • Strong balance sheet and liquidity management ✓ Maintained meaningful level liquidity since Q2’20. ✓ Worked closely with bank lenders to de-lever the repo facilities - delevered 100% of hotel loans and nearly all retail loans that were financed through those facilities. ✓ Opportunistically sold over $200 million of loans to improve liquidity profile. ✓ Secured a $300 million 5-year term loan financing commitment in Q3’20 to improve balance sheet flexibility. ✓ Reduced leverage from 3.5x at Q1’20 to 3.0x at Q3’21. ✓ Temporarily suspended dividend in Q1’20 and subsequently reinstated in Q3’20. 3.3x 3.5x 3.5x 3.2x 3.2x 3.0x 2.8x 3.0x 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 2Q'21 3Q'21 TOTAL DEBT / EQUITY LEVERAGE LIQUIDITY(1) $0.34 $0.32 $0.25 $0.27 $0.33 $0.38 $0.29 $0.09 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 2Q'21 3Q'21 DISTRIBUTABLE EARNINGS(2) $80 $83 $145 $325 $236 $229 $237 $155 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 2Q'21 3Q'21 (1) Represents reported liquidity at the time of filing except 4Q’19, which represents cash and cash equivalents. (2) Q3’21 distributable earnings before write-off on the resolution of the Minneapolis hotel loan. $0.27

Proactive Financial Management 27 ✓ Match funding of assets and liabilities to minimize interest-rate risk and maturities ✓ Proven access to diverse sources of public and private debt and equity capital ✓ Emphasis on liability management with 75% non-mark-to-market borrowings(1) ✓ Focus on maintaining ample liquidity; currently holding approximately $186 million of cash(2) ✓ Active monitoring of pro forma interest coverage metrics and leverage ratios when making funding decisions; Target total net debt-to-equity leverage of 3.0x–3.5x ✓ GPMT management proactively took several prudent measures to fortify its balance sheet and liquidity position in response to the COVID-19 pandemic – Temporarily suspended its common stock dividend for Q1 and Q2 2020 – Proactively reduced repo borrowings by $100 million through cash and unencumbered collateral – Entered into margin holiday for a period of time with repo lenders representing $1.4 billion of outstanding balance – Opportunistically divested over $200 million of select loans to further improve liquidity – Entered into a $300 million strategic financing commitment in the form of a 5-year term loan facility, drew only $225 million GPMT MAINTAINS A CONSERVATIVE FINANCIAL POLICY (1) Estimated pro forma for the closing of recently priced CRE CLO GPMT 2021 FL-4 expected to close on or around November 16, 2021. (2) As of November 12, 2021.

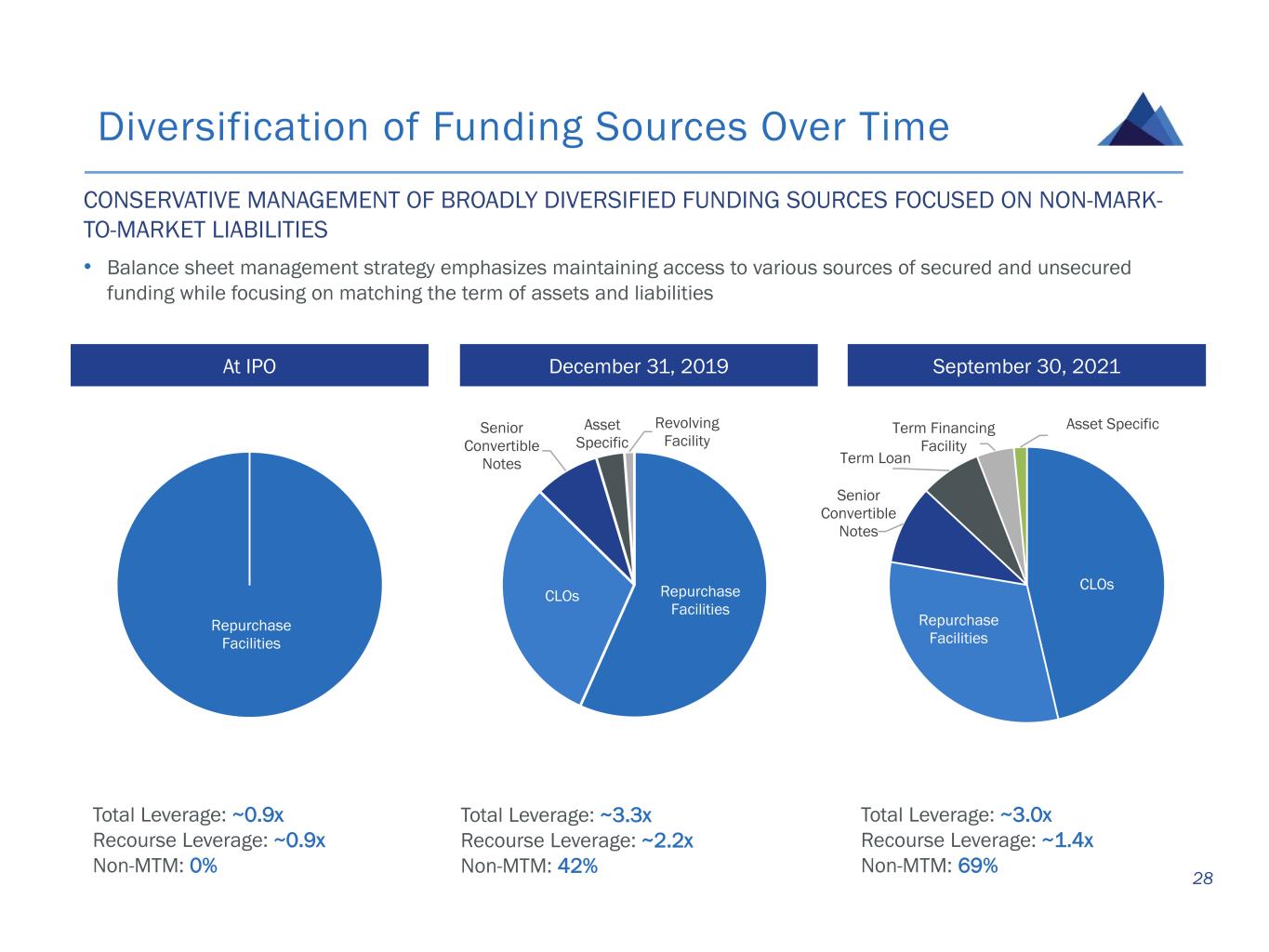

Diversification of Funding Sources Over Time 28 CONSERVATIVE MANAGEMENT OF BROADLY DIVERSIFIED FUNDING SOURCES FOCUSED ON NON-MARK- TO-MARKET LIABILITIES • Balance sheet management strategy emphasizes maintaining access to various sources of secured and unsecured funding while focusing on matching the term of assets and liabilities December 31, 2019 September 30, 2021At IPO Total Leverage: ~0.9x Recourse Leverage: ~0.9x Non-MTM: 0% Total Leverage: ~3.3x Recourse Leverage: ~2.2x Non-MTM: 42% Total Leverage: ~3.0x Recourse Leverage: ~1.4x Non-MTM: 69% Repurchase Facilities Repurchase Facilities CLOs Senior Convertible Notes Asset Specific Revolving Facility CLOs Repurchase Facilities Senior Convertible Notes Term Loan Term Financing Facility Asset Specific

Third Quarter 2021 Highlights 29(1) Represents Net Income Attributable to Common Stockholders; see definition in the appendix. (2) See definition and reconciliation to a GAAP measure in the appendix. FINANCIAL SUMMARY ▪ GAAP net income(1) of $18.6 million, or $0.34 per basic share, including a release of prior CECL reserves of $5.8 million, or approx. $0.11 per basic share. ▪ Distributable Earnings(2) of $5.1 million, or $0.09 per basic share, inclusive of a $(9.7) million, or $(0.18) per share, write-off on the resolution of the Minneapolis hotel loan. ▪ Declared a cash dividend of $0.25 per common share. ▪ Book value per common share of $17.33, inclusive of $(0.88) per share total allowance for credit losses. ▪ Allowance for credit losses as of September 30, 2021 of $47.4 million, or 1.16% of total loan commitments. PORTFOLIO ACTIVITY ▪ Closed on $311.7 million of loan commitments and funded $324.5 million in UPB, inclusive of $35.2 million funded on existing loan commitments. ▪ Received loan repayments and principal amortization of $290.5 million in UPB during the quarter, and a $9.7 million write-off. PORTFOLIO OVERVIEW ▪ Outstanding loan portfolio principal balance of $3.7 billion, and $4.1 billion in total commitments. ▪ Over 99% senior first mortgage loans and over 98% floating rate; no exposure to securities. ▪ Weighted average stabilized LTV of 63.3%(2) and weighted average yield at origination of LIBOR + 4.11%.(2) ▪ Approximately 74.0% of the portfolio is subject to a LIBOR floor of at least 1.00%; portfolio weighted average LIBOR floor of 1.30%. ▪ Deferred, and added to loan principal, $1.1 million of interest income, related to certain loans that had been previously modified. LIQUIDITY & CAPITALIZATION ▪ Repurchased in the open market 1.0 million common shares at an average price per share of $13.49. ▪ Ended Q3 with over $154 million in cash on hand. ▪ Extended the maturity of the Goldman Sachs repurchase facility to July 2023, and downsized the maximum facility size to $250 million, with an accordion feature to upsize it to $350 million.

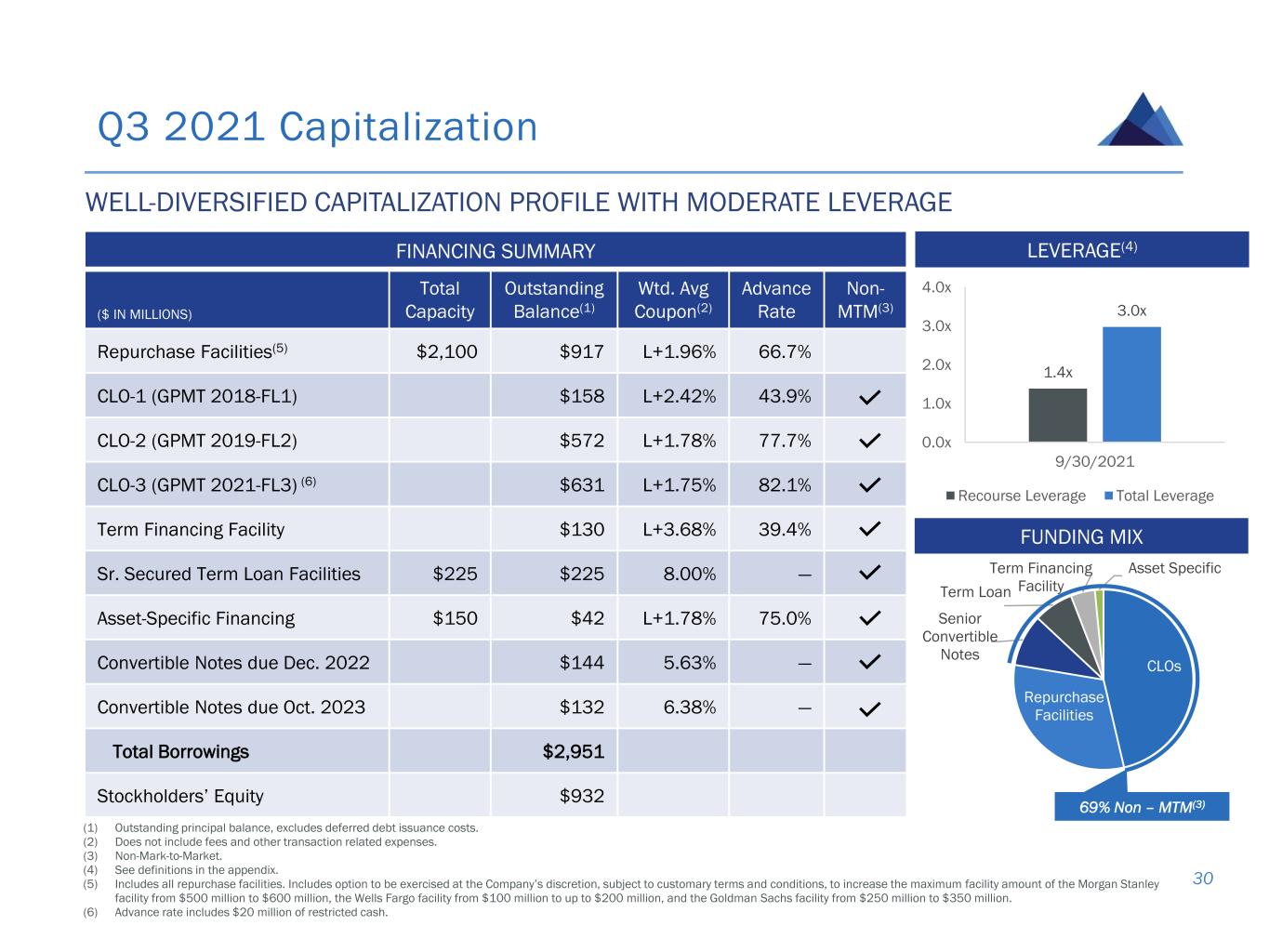

CLOs Repurchase Facilities Senior Convertible Notes Term Loan Term Financing Facility Asset Specific Q3 2021 Capitalization 30 (1) Outstanding principal balance, excludes deferred debt issuance costs. (2) Does not include fees and other transaction related expenses. (3) Non-Mark-to-Market. (4) See definitions in the appendix. (5) Includes all repurchase facilities. Includes option to be exercised at the Company’s discretion, subject to customary terms and conditions, to increase the maximum facility amount of the Morgan Stanley facility from $500 million to $600 million, the Wells Fargo facility from $100 million to up to $200 million, and the Goldman Sachs facility from $250 million to $350 million. (6) Advance rate includes $20 million of restricted cash. FINANCING SUMMARY ($ IN MILLIONS) Total Capacity Outstanding Balance(1) Wtd. Avg Coupon(2) Advance Rate Non- MTM(3) Repurchase Facilities(5) $2,100 $917 L+1.96% 66.7% CLO-1 (GPMT 2018-FL1) $158 L+2.42% 43.9% CLO-2 (GPMT 2019-FL2) $572 L+1.78% 77.7% CLO-3 (GPMT 2021-FL3) (6) $631 L+1.75% 82.1% Term Financing Facility $130 L+3.68% 39.4% Sr. Secured Term Loan Facilities $225 $225 8.00% — Asset-Specific Financing $150 $42 L+1.78% 75.0% Convertible Notes due Dec. 2022 $144 5.63% — Convertible Notes due Oct. 2023 $132 6.38% — Total Borrowings $2,951 Stockholders’ Equity $932 FUNDING MIX WELL-DIVERSIFIED CAPITALIZATION PROFILE WITH MODERATE LEVERAGE LEVERAGE(4) 1.4x 3.0x 0.0x 1.0x 2.0x 3.0x 4.0x 9/30/2021 Recourse Leverage Total Leverage 69% Non – MTM(3)

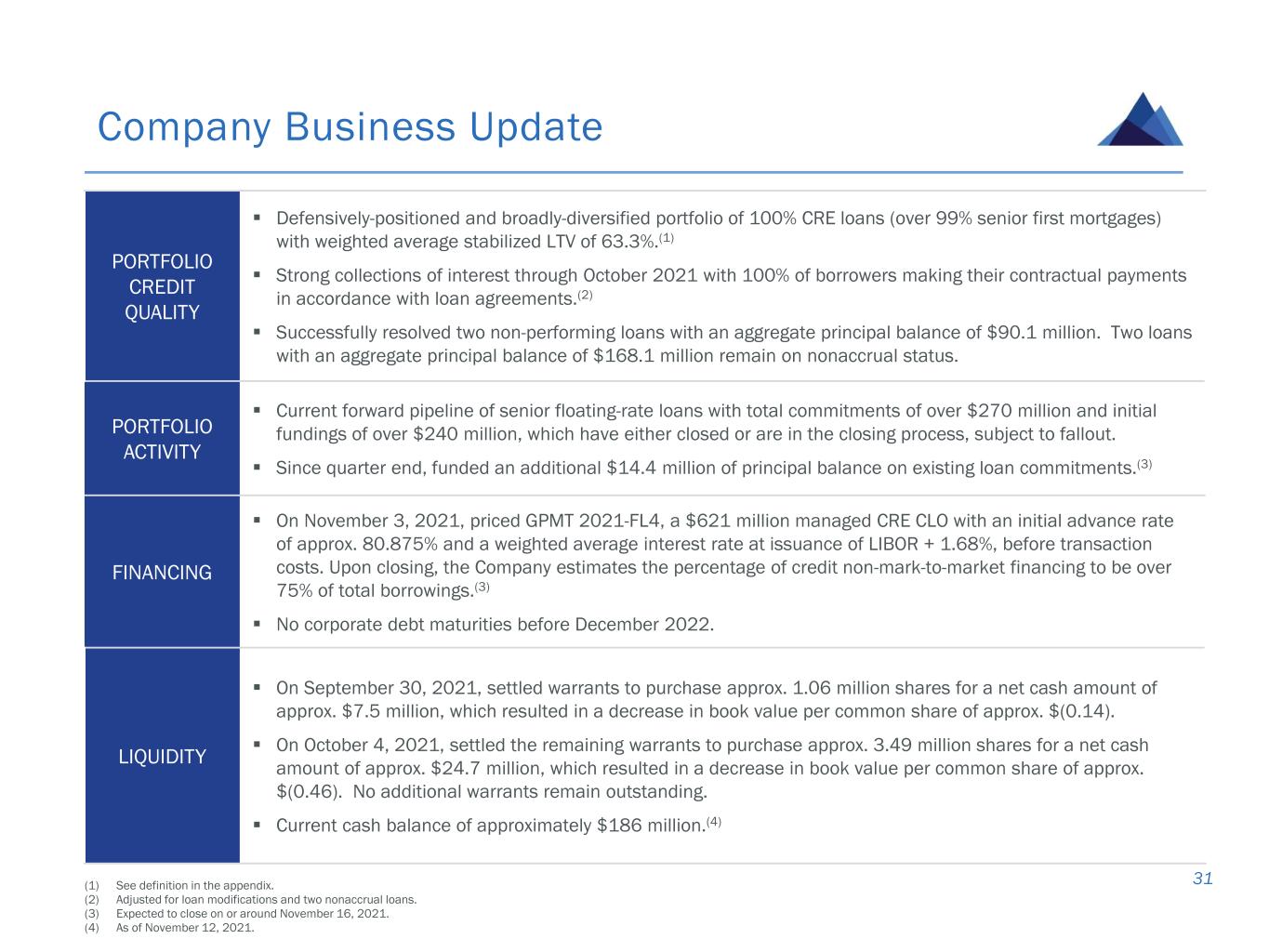

PORTFOLIO CREDIT QUALITY ▪ Defensively-positioned and broadly-diversified portfolio of 100% CRE loans (over 99% senior first mortgages) with weighted average stabilized LTV of 63.3%.(1) ▪ Strong collections of interest through October 2021 with 100% of borrowers making their contractual payments in accordance with loan agreements.(2) ▪ Successfully resolved two non-performing loans with an aggregate principal balance of $90.1 million. Two loans with an aggregate principal balance of $168.1 million remain on nonaccrual status. PORTFOLIO ACTIVITY ▪ Current forward pipeline of senior floating-rate loans with total commitments of over $270 million and initial fundings of over $240 million, which have either closed or are in the closing process, subject to fallout. ▪ Since quarter end, funded an additional $14.4 million of principal balance on existing loan commitments.(3) FINANCING ▪ On November 3, 2021, priced GPMT 2021-FL4, a $621 million managed CRE CLO with an initial advance rate of approx. 80.875% and a weighted average interest rate at issuance of LIBOR + 1.68%, before transaction costs. Upon closing, the Company estimates the percentage of credit non-mark-to-market financing to be over 75% of total borrowings.(3) ▪ No corporate debt maturities before December 2022. LIQUIDITY ▪ On September 30, 2021, settled warrants to purchase approx. 1.06 million shares for a net cash amount of approx. $7.5 million, which resulted in a decrease in book value per common share of approx. $(0.14). ▪ On October 4, 2021, settled the remaining warrants to purchase approx. 3.49 million shares for a net cash amount of approx. $24.7 million, which resulted in a decrease in book value per common share of approx. $(0.46). No additional warrants remain outstanding. ▪ Current cash balance of approximately $186 million.(4) Company Business Update 31(1) See definition in the appendix. (2) Adjusted for loan modifications and two nonaccrual loans. (3) Expected to close on or around November 16, 2021. (4) As of November 12, 2021.

Appendix

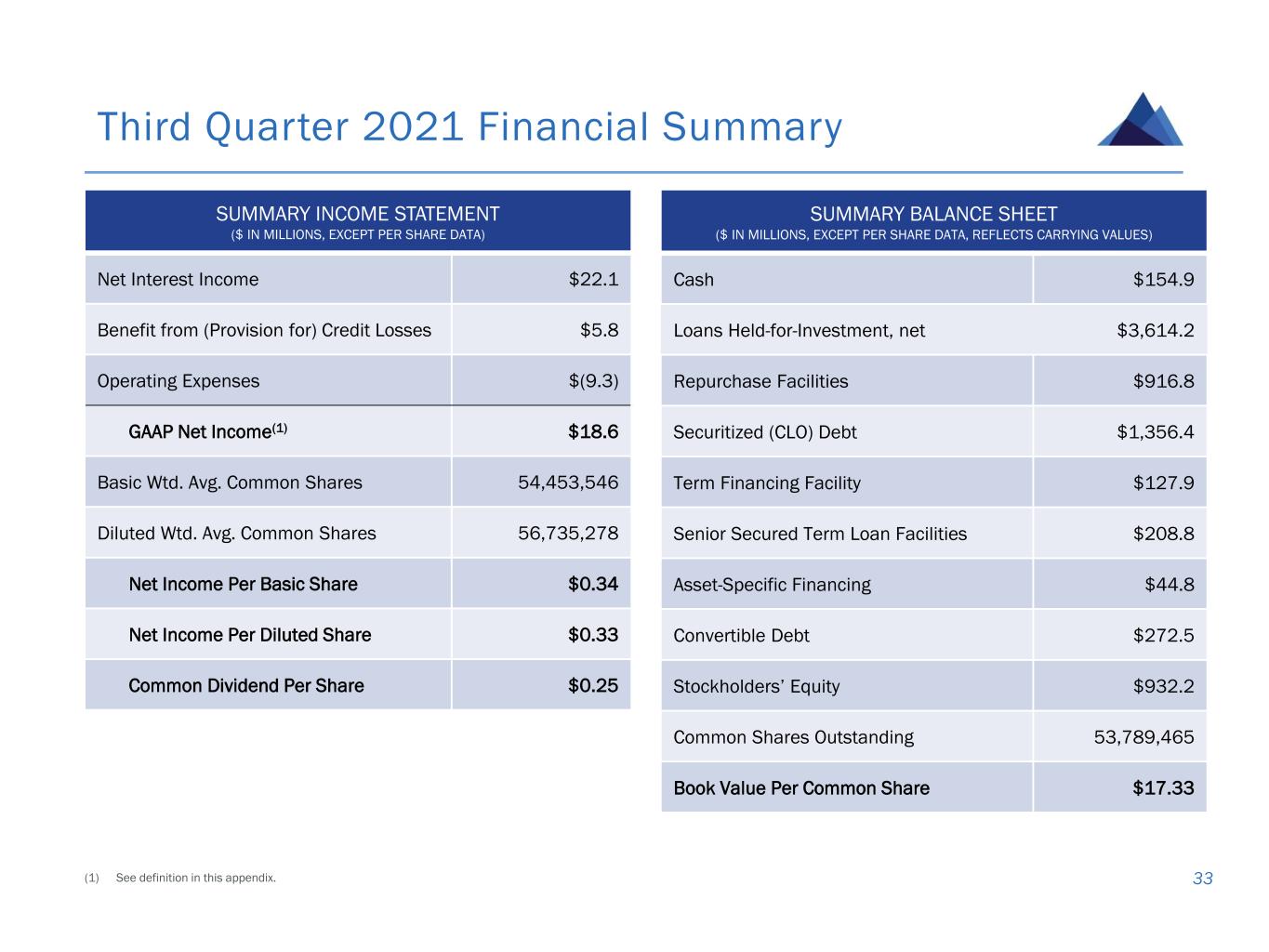

Third Quarter 2021 Financial Summary 33 SUMMARY INCOME STATEMENT ($ IN MILLIONS, EXCEPT PER SHARE DATA) Net Interest Income $22.1 Benefit from (Provision for) Credit Losses $5.8 Operating Expenses $(9.3) GAAP Net Income(1) $18.6 Basic Wtd. Avg. Common Shares 54,453,546 Diluted Wtd. Avg. Common Shares 56,735,278 Net Income Per Basic Share $0.34 Net Income Per Diluted Share $0.33 Common Dividend Per Share $0.25 (1) See definition in this appendix. SUMMARY BALANCE SHEET ($ IN MILLIONS, EXCEPT PER SHARE DATA, REFLECTS CARRYING VALUES) Cash $154.9 Loans Held-for-Investment, net $3,614.2 Repurchase Facilities $916.8 Securitized (CLO) Debt $1,356.4 Term Financing Facility $127.9 Senior Secured Term Loan Facilities $208.8 Asset-Specific Financing $44.8 Convertible Debt $272.5 Stockholders’ Equity $932.2 Common Shares Outstanding 53,789,465 Book Value Per Common Share $17.33

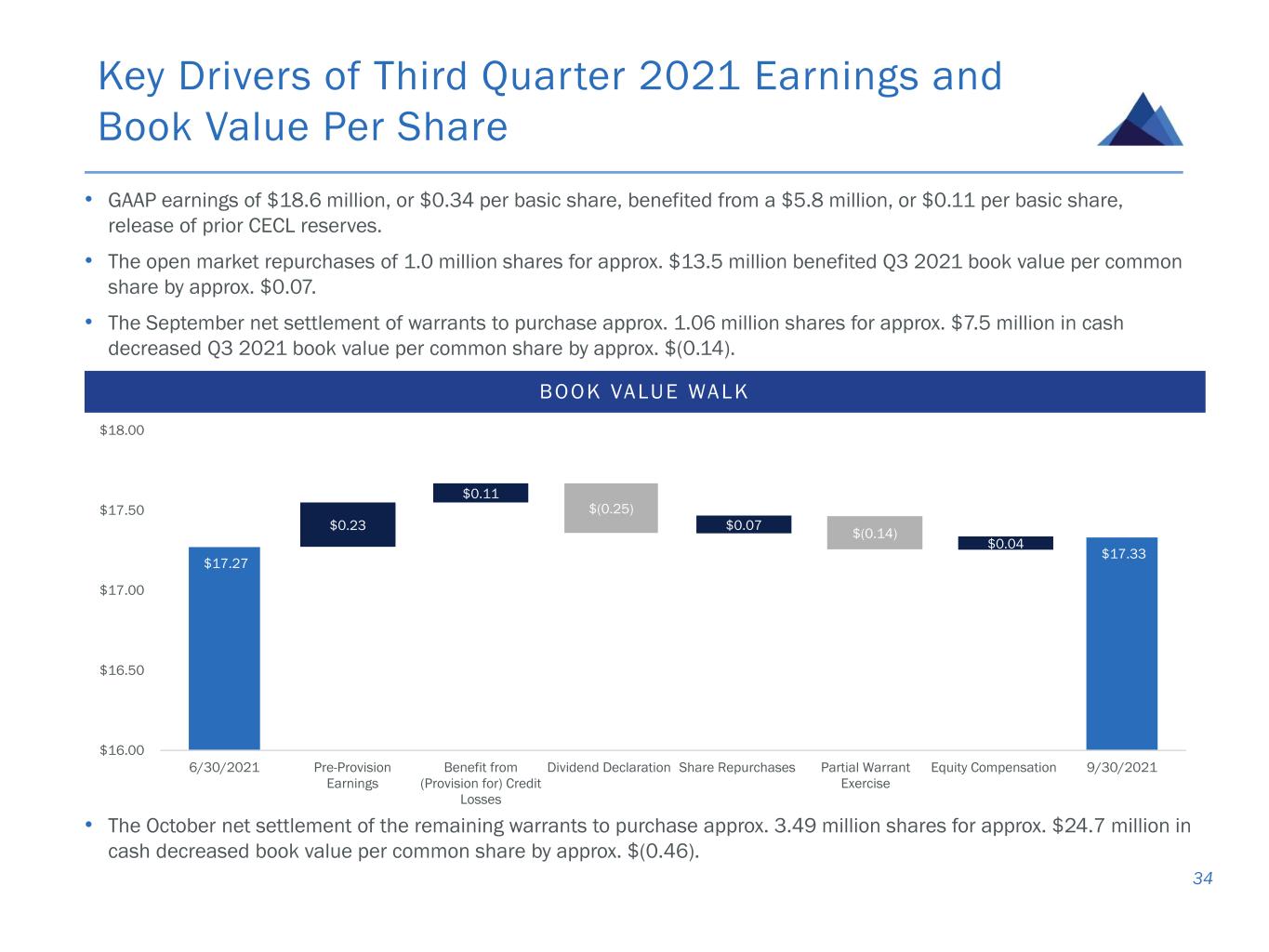

$17.27 $17.33 $16.00 $16.50 $17.00 $17.50 $18.00 6/30/2021 Pre-Provision Earnings Benefit from (Provision for) Credit Losses Dividend Declaration Share Repurchases Partial Warrant Exercise Equity Compensation 9/30/2021 $(0.25) $0.23 Key Drivers of Third Quarter 2021 Earnings and Book Value Per Share • GAAP earnings of $18.6 million, or $0.34 per basic share, benefited from a $5.8 million, or $0.11 per basic share, release of prior CECL reserves. • The open market repurchases of 1.0 million shares for approx. $13.5 million benefited Q3 2021 book value per common share by approx. $0.07. • The September net settlement of warrants to purchase approx. 1.06 million shares for approx. $7.5 million in cash decreased Q3 2021 book value per common share by approx. $(0.14). 34 BOOK VALUE WALK $0.11 $0.04 $0.07 $(0.14) • The October net settlement of the remaining warrants to purchase approx. 3.49 million shares for approx. $24.7 million in cash decreased book value per common share by approx. $(0.46).

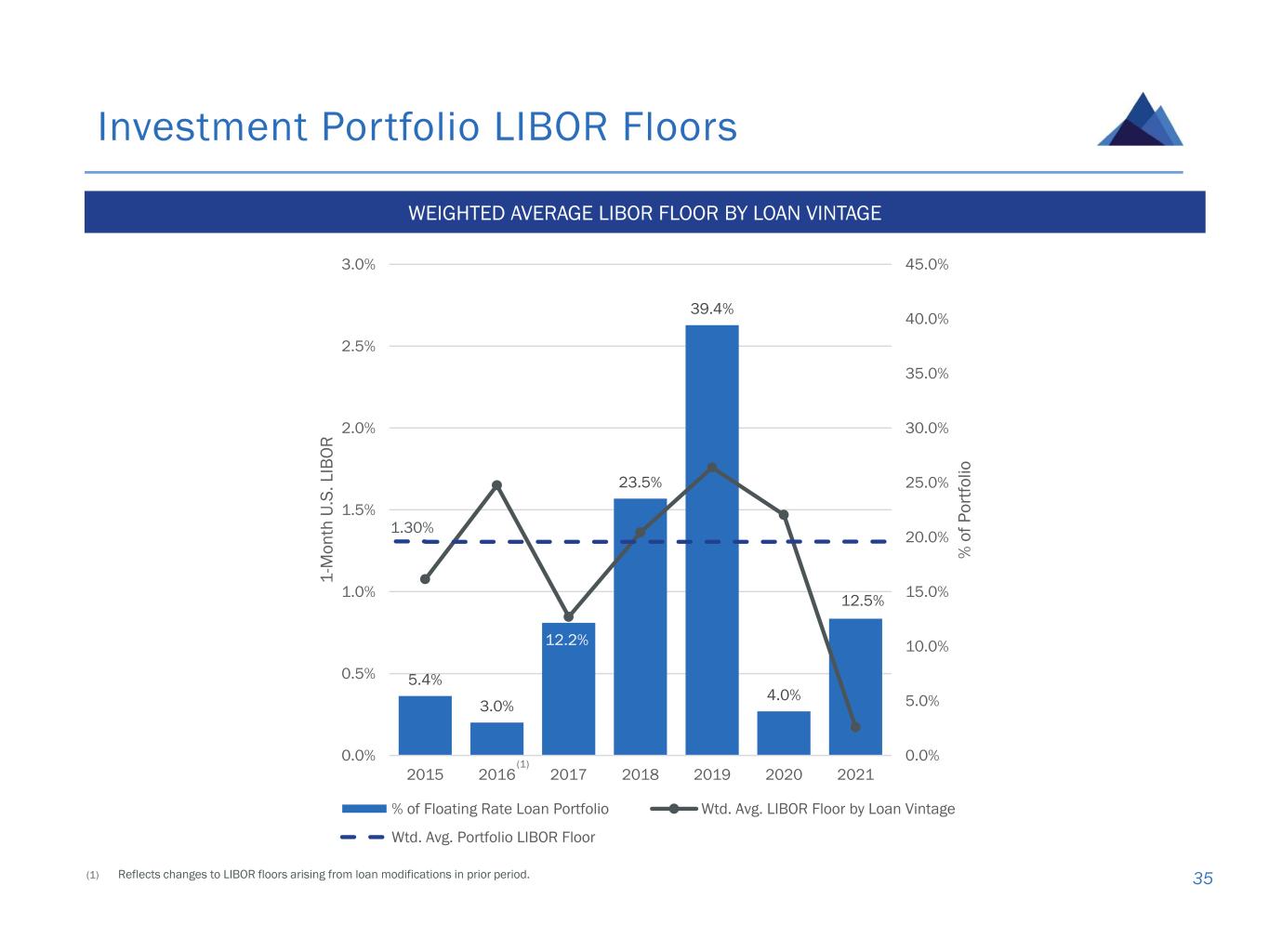

1.30% 5.4% 3.0% 12.2% 23.5% 39.4% 4.0% 12.5% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 2015 2016 2017 2018 2019 2020 2021 % o f P o rt fo li o 1 -M o n th U .S . L IB O R % of Floating Rate Loan Portfolio Wtd. Avg. LIBOR Floor by Loan Vintage Wtd. Avg. Portfolio LIBOR Floor Investment Portfolio LIBOR Floors 35 WEIGHTED AVERAGE LIBOR FLOOR BY LOAN VINTAGE (1) (1) Reflects changes to LIBOR floors arising from loan modifications in prior period.

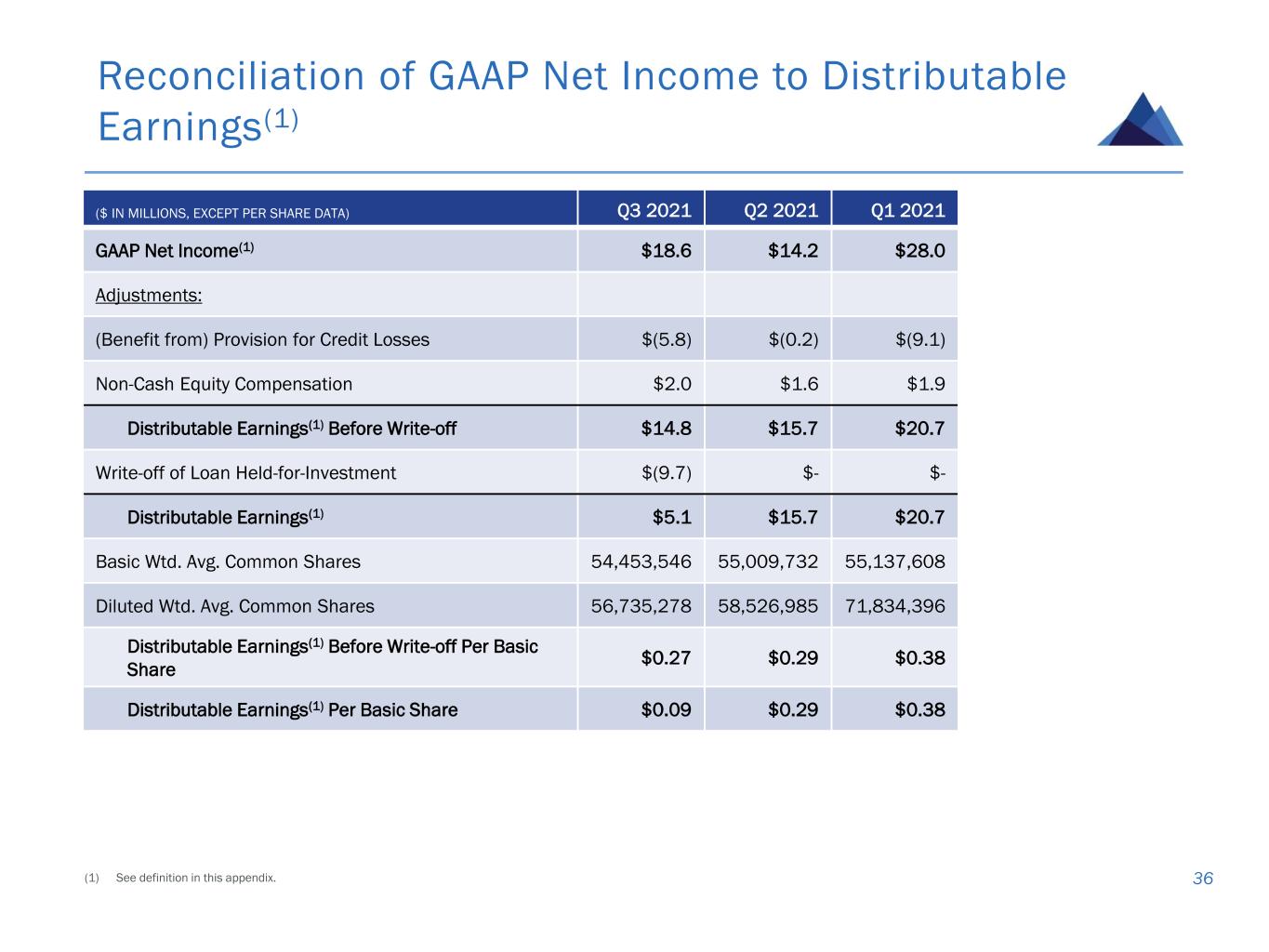

Reconciliation of GAAP Net Income to Distributable Earnings(1) 36 ($ IN MILLIONS, EXCEPT PER SHARE DATA) Q3 2021 Q2 2021 Q1 2021 GAAP Net Income(1) $18.6 $14.2 $28.0 Adjustments: (Benefit from) Provision for Credit Losses $(5.8) $(0.2) $(9.1) Non-Cash Equity Compensation $2.0 $1.6 $1.9 Distributable Earnings(1) Before Write-off $14.8 $15.7 $20.7 Write-off of Loan Held-for-Investment $(9.7) $- $- Distributable Earnings(1) $5.1 $15.7 $20.7 Basic Wtd. Avg. Common Shares 54,453,546 55,009,732 55,137,608 Diluted Wtd. Avg. Common Shares 56,735,278 58,526,985 71,834,396 Distributable Earnings(1) Before Write-off Per Basic Share $0.27 $0.29 $0.38 Distributable Earnings(1) Per Basic Share $0.09 $0.29 $0.38 (1) See definition in this appendix.

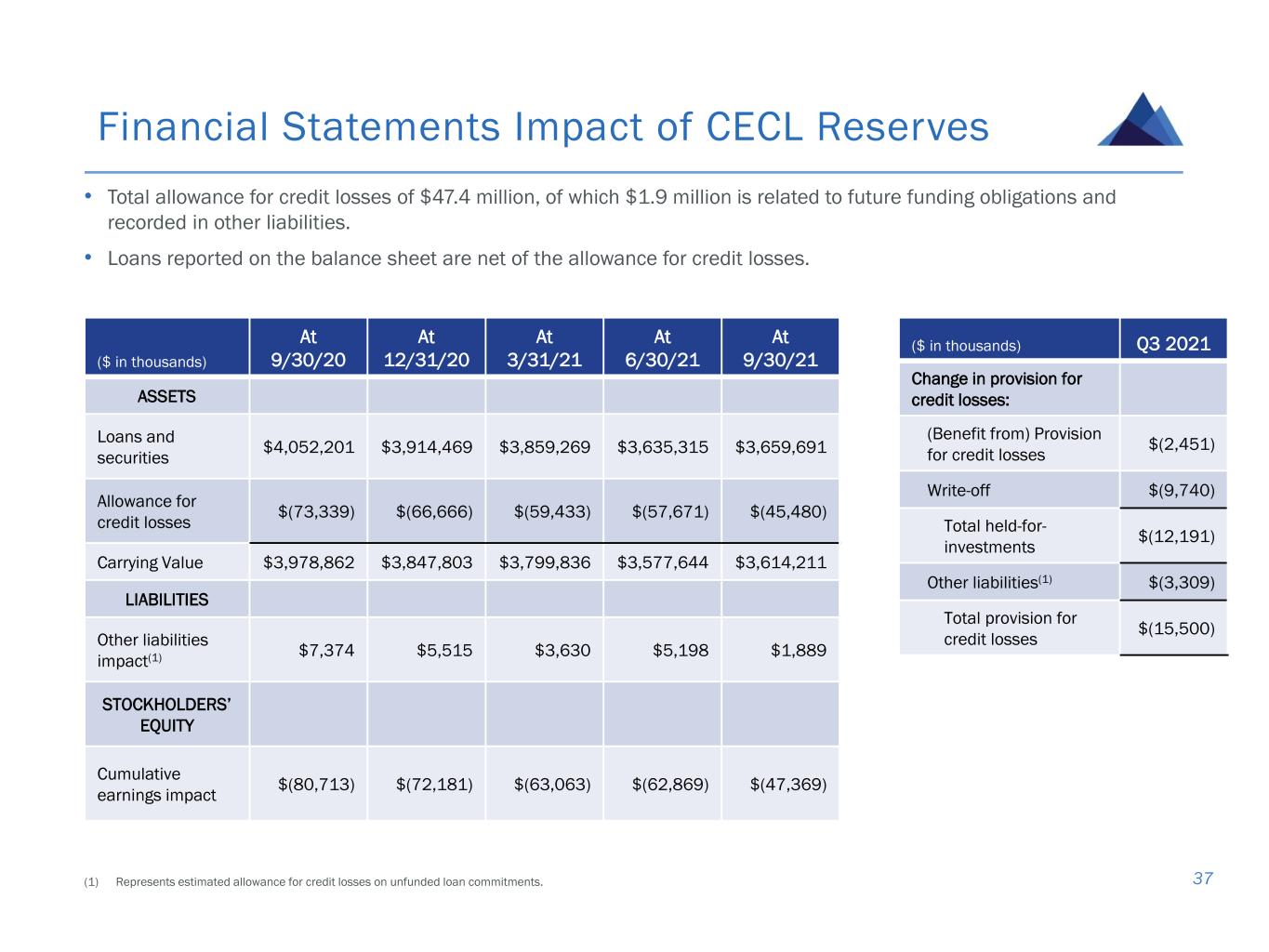

($ in thousands) At 9/30/20 At 12/31/20 At 3/31/21 At 6/30/21 At 9/30/21 ASSETS Loans and securities $4,052,201 $3,914,469 $3,859,269 $3,635,315 $3,659,691 Allowance for credit losses $(73,339) $(66,666) $(59,433) $(57,671) $(45,480) Carrying Value $3,978,862 $3,847,803 $3,799,836 $3,577,644 $3,614,211 LIABILITIES Other liabilities impact(1) $7,374 $5,515 $3,630 $5,198 $1,889 STOCKHOLDERS’ EQUITY Cumulative earnings impact $(80,713) $(72,181) $(63,063) $(62,869) $(47,369) Financial Statements Impact of CECL Reserves 37 • Total allowance for credit losses of $47.4 million, of which $1.9 million is related to future funding obligations and recorded in other liabilities. • Loans reported on the balance sheet are net of the allowance for credit losses. ($ in thousands) Q3 2021 Change in provision for credit losses: (Benefit from) Provision for credit losses $(2,451) Write-off $(9,740) Total held-for- investments $(12,191) Other liabilities(1) $(3,309) Total provision for credit losses $(15,500) (1) Represents estimated allowance for credit losses on unfunded loan commitments.

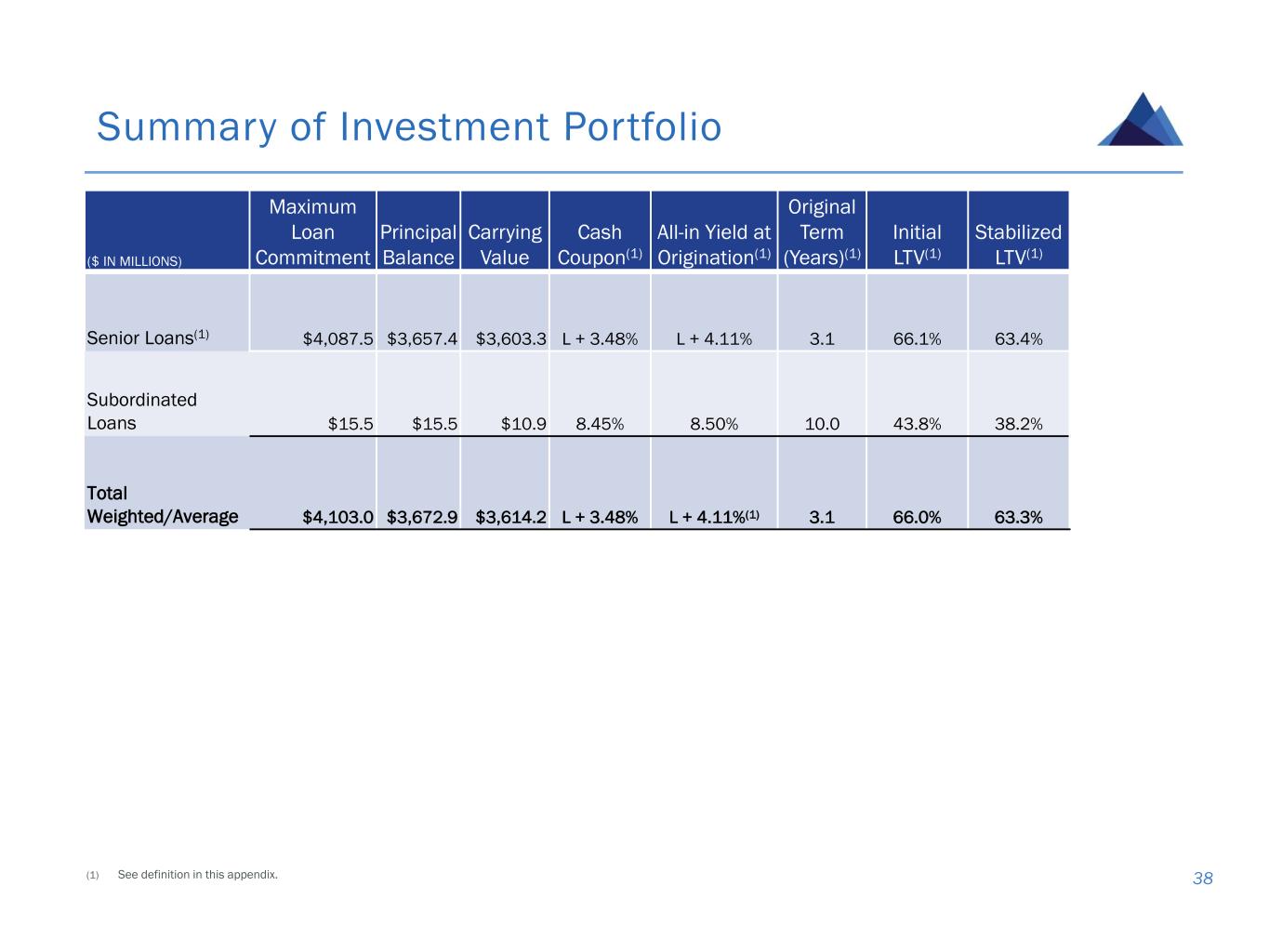

Summary of Investment Portfolio 38 ($ IN MILLIONS) Maximum Loan Commitment Principal Balance Carrying Value Cash Coupon(1) All-in Yield at Origination(1) Original Term (Years)(1) Initial LTV(1) Stabilized LTV(1) Senior Loans(1) $4,087.5 $3,657.4 $3,603.3 L + 3.48% L + 4.11% 3.1 66.1% 63.4% Subordinated Loans $15.5 $15.5 $10.9 8.45% 8.50% 10.0 43.8% 38.2% Total Weighted/Average $4,103.0 $3,672.9 $3,614.2 L + 3.48% L + 4.11%(1) 3.1 66.0% 63.3% (1) See definition in this appendix.

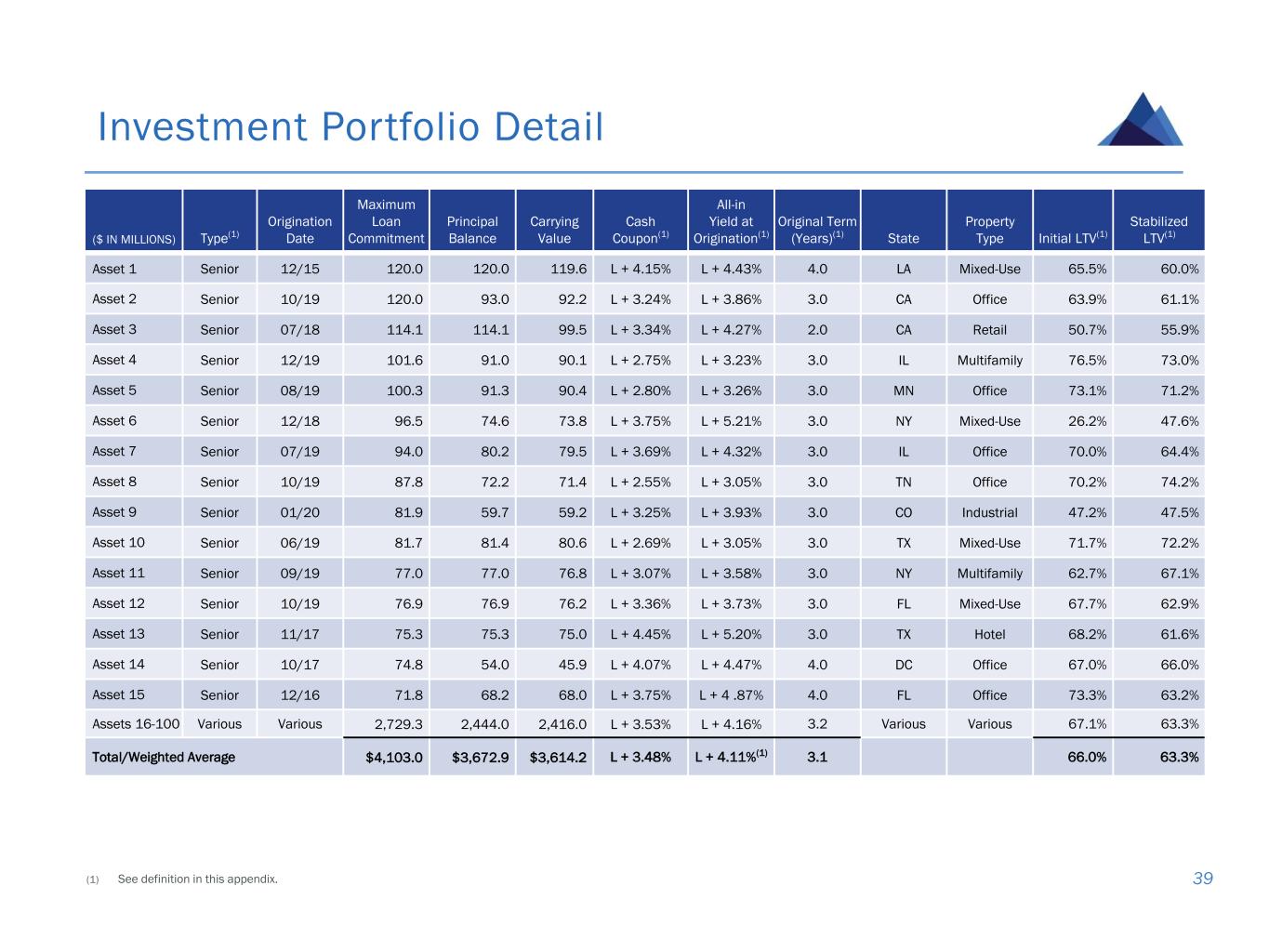

Investment Portfolio Detail 39 ($ IN MILLIONS) Type(1) Origination Date Maximum Loan Commitment Principal Balance Carrying Value Cash Coupon(1) All-in Yield at Origination(1) Original Term (Years)(1) State Property Type Initial LTV(1) Stabilized LTV(1) Asset 1 Senior 12/15 120.0 120.0 119.6 L + 4.15% L + 4.43% 4.0 LA Mixed-Use 65.5% 60.0% Asset 2 Senior 10/19 120.0 93.0 92.2 L + 3.24% L + 3.86% 3.0 CA Office 63.9% 61.1% Asset 3 Senior 07/18 114.1 114.1 99.5 L + 3.34% L + 4.27% 2.0 CA Retail 50.7% 55.9% Asset 4 Senior 12/19 101.6 91.0 90.1 L + 2.75% L + 3.23% 3.0 IL Multifamily 76.5% 73.0% Asset 5 Senior 08/19 100.3 91.3 90.4 L + 2.80% L + 3.26% 3.0 MN Office 73.1% 71.2% Asset 6 Senior 12/18 96.5 74.6 73.8 L + 3.75% L + 5.21% 3.0 NY Mixed-Use 26.2% 47.6% Asset 7 Senior 07/19 94.0 80.2 79.5 L + 3.69% L + 4.32% 3.0 IL Office 70.0% 64.4% Asset 8 Senior 10/19 87.8 72.2 71.4 L + 2.55% L + 3.05% 3.0 TN Office 70.2% 74.2% Asset 9 Senior 01/20 81.9 59.7 59.2 L + 3.25% L + 3.93% 3.0 CO Industrial 47.2% 47.5% Asset 10 Senior 06/19 81.7 81.4 80.6 L + 2.69% L + 3.05% 3.0 TX Mixed-Use 71.7% 72.2% Asset 11 Senior 09/19 77.0 77.0 76.8 L + 3.07% L + 3.58% 3.0 NY Multifamily 62.7% 67.1% Asset 12 Senior 10/19 76.9 76.9 76.2 L + 3.36% L + 3.73% 3.0 FL Mixed-Use 67.7% 62.9% Asset 13 Senior 11/17 75.3 75.3 75.0 L + 4.45% L + 5.20% 3.0 TX Hotel 68.2% 61.6% Asset 14 Senior 10/17 74.8 54.0 45.9 L + 4.07% L + 4.47% 4.0 DC Office 67.0% 66.0% Asset 15 Senior 12/16 71.8 68.2 68.0 L + 3.75% L + 4 .87% 4.0 FL Office 73.3% 63.2% Assets 16-100 Various Various 2,729.3 2,444.0 2,416.0 L + 3.53% L + 4.16% 3.2 Various Various 67.1% 63.3% Total/Weighted Average $4,103.0 $3,672.9 $3,614.2 L + 3.48% L + 4.11%(1) 3.1 66.0% 63.3% (1) See definition in this appendix.

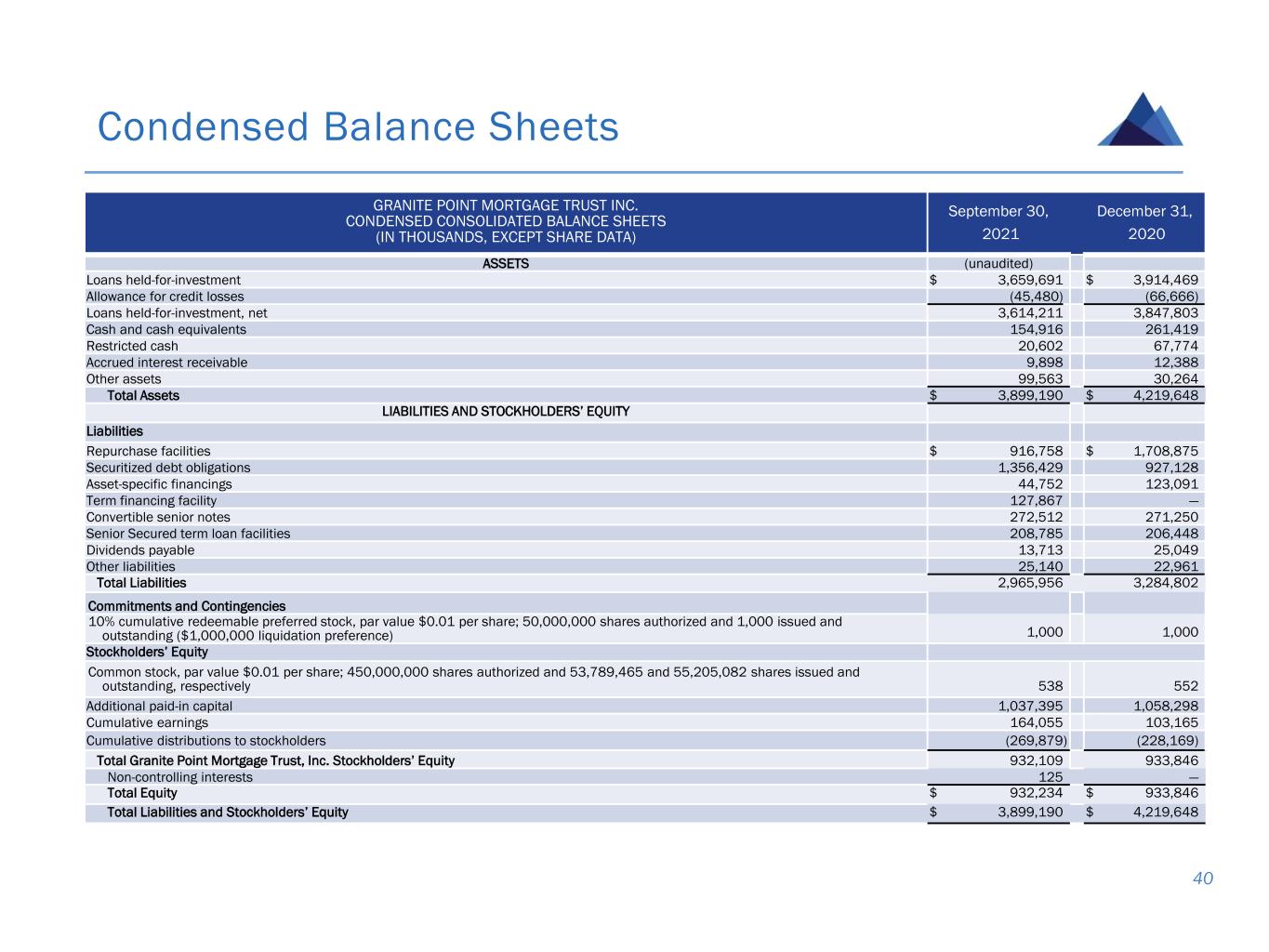

Condensed Balance Sheets 40 GRANITE POINT MORTGAGE TRUST INC. CONDENSED CONSOLIDATED BALANCE SHEETS (IN THOUSANDS, EXCEPT SHARE DATA) September 30, 2021 December 31, 2020 ASSETS (unaudited) Loans held-for-investment $ 3,659,691 $ 3,914,469 Allowance for credit losses (45,480) (66,666) Loans held-for-investment, net 3,614,211 3,847,803 Cash and cash equivalents 154,916 261,419 Restricted cash 20,602 67,774 Accrued interest receivable 9,898 12,388 Other assets 99,563 30,264 Total Assets $ 3,899,190 $ 4,219,648 LIABILITIES AND STOCKHOLDERS’ EQUITY Liabilities Repurchase facilities $ 916,758 $ 1,708,875 Securitized debt obligations 1,356,429 927,128 Asset-specific financings 44,752 123,091 Term financing facility 127,867 — Convertible senior notes 272,512 271,250 Senior Secured term loan facilities 208,785 206,448 Dividends payable 13,713 25,049 Other liabilities 25,140 22,961 Total Liabilities 2,965,956 3,284,802 Commitments and Contingencies 10% cumulative redeemable preferred stock, par value $0.01 per share; 50,000,000 shares authorized and 1,000 issued and outstanding ($1,000,000 liquidation preference) 1,000 1,000 Stockholders’ Equity Common stock, par value $0.01 per share; 450,000,000 shares authorized and 53,789,465 and 55,205,082 shares issued and outstanding, respectively 538 552 Additional paid-in capital 1,037,395 1,058,298 Cumulative earnings 164,055 103,165 Cumulative distributions to stockholders (269,879) (228,169) Total Granite Point Mortgage Trust, Inc. Stockholders’ Equity 932,109 933,846 Non-controlling interests 125 — Total Equity $ 932,234 $ 933,846 Total Liabilities and Stockholders’ Equity $ 3,899,190 $ 4,219,648

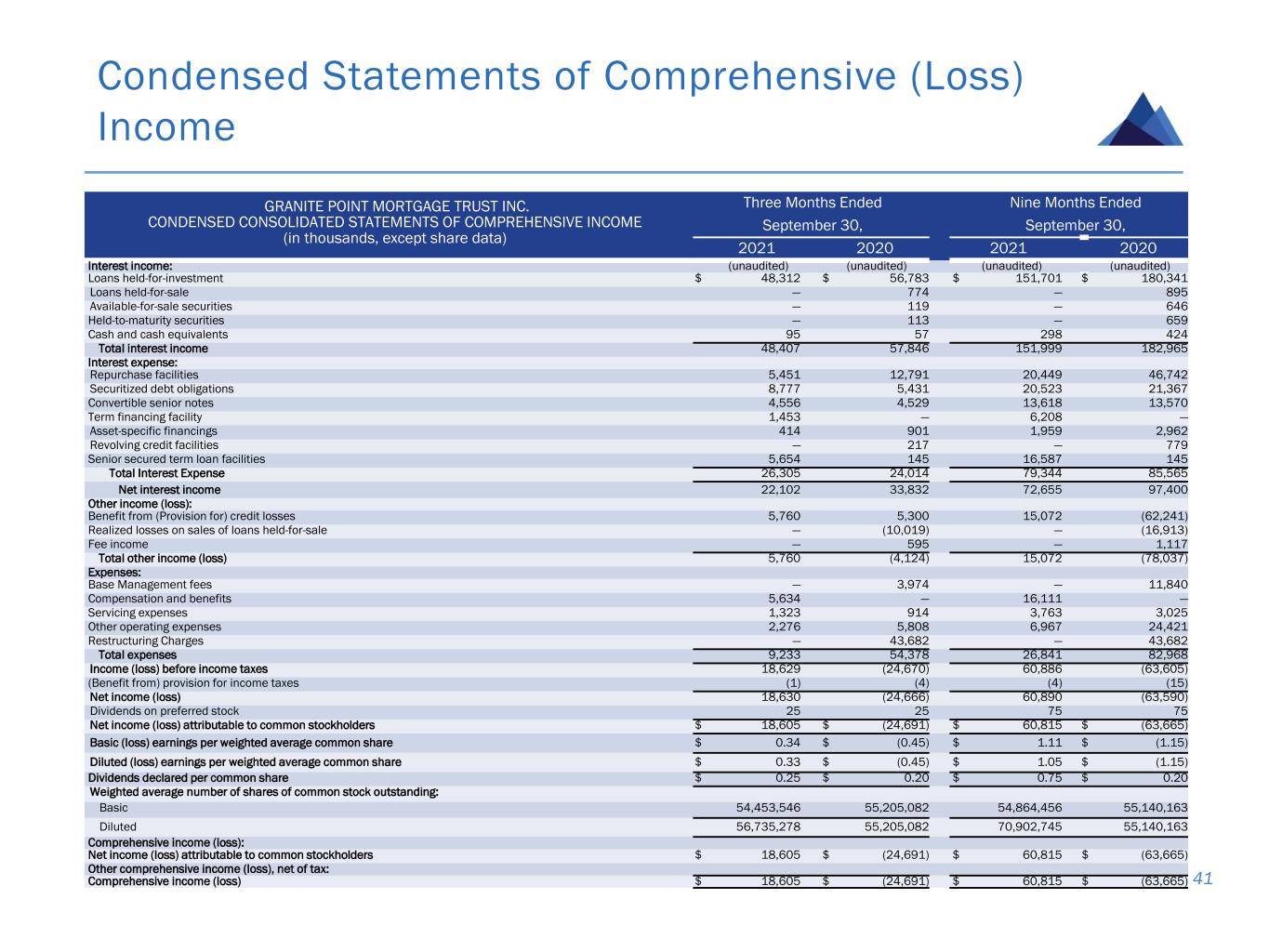

Condensed Statements of Comprehensive (Loss) Income 41 GRANITE POINT MORTGAGE TRUST INC. CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in thousands, except share data) Three Months Ended September 30, Nine Months Ended September 30, 2021 2020 2021 2020 Interest income: (unaudited) (unaudited) (unaudited) (unaudited) Loans held-for-investment $ 48,312 $ 56,783 $ 151,701 $ 180,341 Loans held-for-sale — 774 — 895 Available-for-sale securities — 119 — 646 Held-to-maturity securities — 113 — 659 Cash and cash equivalents 95 57 298 424 Total interest income 48,407 57,846 151,999 182,965 Interest expense: Repurchase facilities 5,451 12,791 20,449 46,742 Securitized debt obligations 8,777 5,431 20,523 21,367 Convertible senior notes 4,556 4,529 13,618 13,570 Term financing facility 1,453 — 6,208 — Asset-specific financings 414 901 1,959 2,962 Revolving credit facilities — 217 — 779 Senior secured term loan facilities 5,654 145 16,587 145 Total Interest Expense 26,305 24,014 79,344 85,565 Net interest income 22,102 33,832 72,655 97,400 Other income (loss): Benefit from (Provision for) credit losses 5,760 5,300 15,072 (62,241) Realized losses on sales of loans held-for-sale — (10,019) — (16,913) Fee income — 595 — 1,117 Total other income (loss) 5,760 (4,124) 15,072 (78,037) Expenses: Base Management fees — 3,974 — 11,840 Compensation and benefits 5,634 — 16,111 — Servicing expenses 1,323 914 3,763 3,025 Other operating expenses 2,276 5,808 6,967 24,421 Restructuring Charges — 43,682 — 43,682 Total expenses 9,233 54,378 26,841 82,968 Income (loss) before income taxes 18,629 (24,670) 60,886 (63,605) (Benefit from) provision for income taxes (1) (4) (4) (15) Net income (loss) 18,630 (24,666) 60,890 (63,590) Dividends on preferred stock 25 25 75 75 Net income (loss) attributable to common stockholders $ 18,605 $ (24,691) $ 60,815 $ (63,665) Basic (loss) earnings per weighted average common share $ 0.34 $ (0.45) $ 1.11 $ (1.15) Diluted (loss) earnings per weighted average common share $ 0.33 $ (0.45) $ 1.05 $ (1.15) Dividends declared per common share $ 0.25 $ 0.20 $ 0.75 $ 0.20 Weighted average number of shares of common stock outstanding: Basic 54,453,546 55,205,082 54,864,456 55,140,163 Diluted 56,735,278 55,205,082 70,902,745 55,140,163 Comprehensive income (loss): Net income (loss) attributable to common stockholders $ 18,605 $ (24,691) $ 60,815 $ (63,665) Other comprehensive income (loss), net of tax: Comprehensive income (loss) $ 18,605 $ (24,691) $ 60,815 $ (63,665)

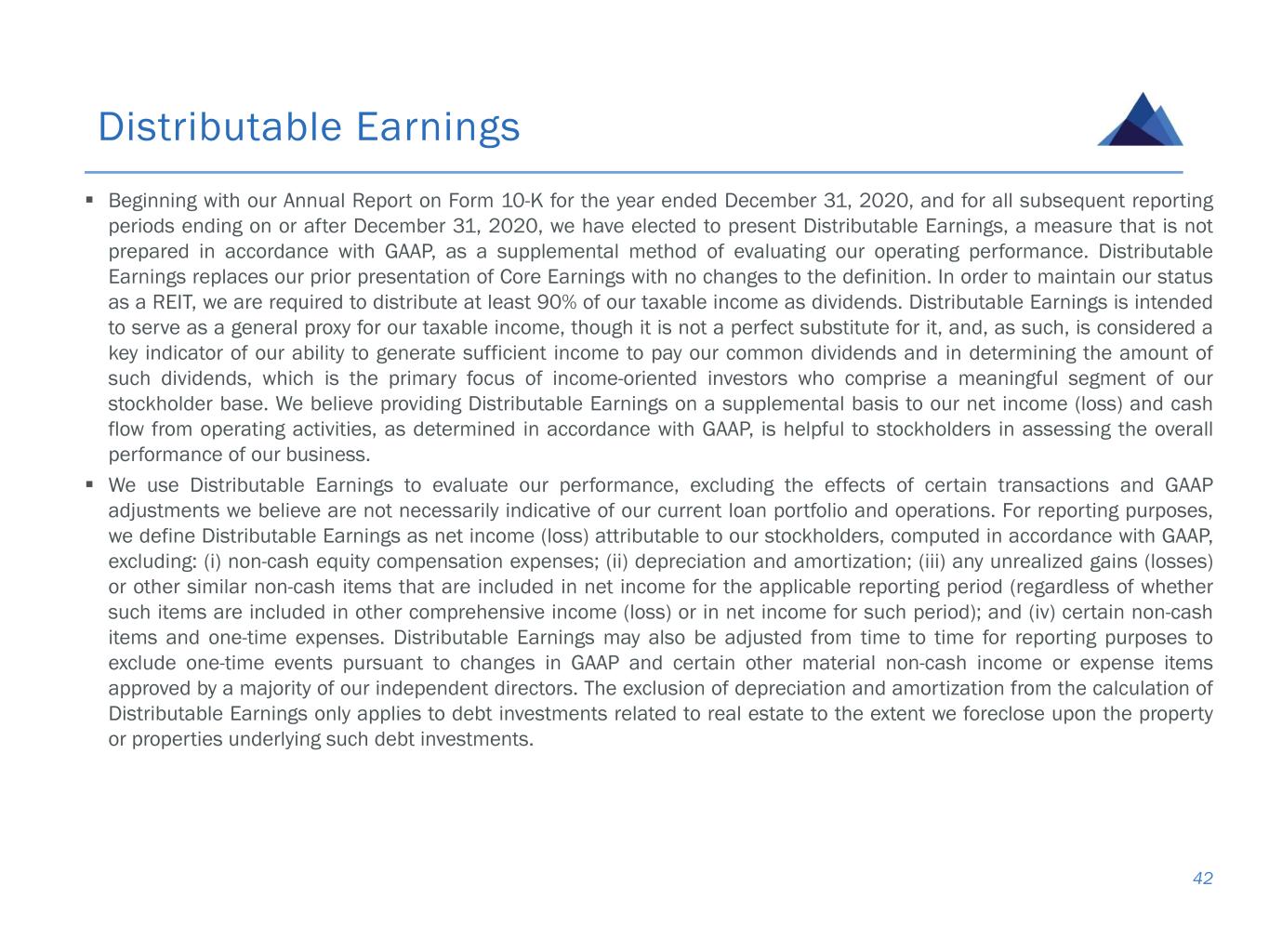

▪ Beginning with our Annual Report on Form 10-K for the year ended December 31, 2020, and for all subsequent reporting periods ending on or after December 31, 2020, we have elected to present Distributable Earnings, a measure that is not prepared in accordance with GAAP, as a supplemental method of evaluating our operating performance. Distributable Earnings replaces our prior presentation of Core Earnings with no changes to the definition. In order to maintain our status as a REIT, we are required to distribute at least 90% of our taxable income as dividends. Distributable Earnings is intended to serve as a general proxy for our taxable income, though it is not a perfect substitute for it, and, as such, is considered a key indicator of our ability to generate sufficient income to pay our common dividends and in determining the amount of such dividends, which is the primary focus of income-oriented investors who comprise a meaningful segment of our stockholder base. We believe providing Distributable Earnings on a supplemental basis to our net income (loss) and cash flow from operating activities, as determined in accordance with GAAP, is helpful to stockholders in assessing the overall performance of our business. ▪ We use Distributable Earnings to evaluate our performance, excluding the effects of certain transactions and GAAP adjustments we believe are not necessarily indicative of our current loan portfolio and operations. For reporting purposes, we define Distributable Earnings as net income (loss) attributable to our stockholders, computed in accordance with GAAP, excluding: (i) non-cash equity compensation expenses; (ii) depreciation and amortization; (iii) any unrealized gains (losses) or other similar non-cash items that are included in net income for the applicable reporting period (regardless of whether such items are included in other comprehensive income (loss) or in net income for such period); and (iv) certain non-cash items and one-time expenses. Distributable Earnings may also be adjusted from time to time for reporting purposes to exclude one-time events pursuant to changes in GAAP and certain other material non-cash income or expense items approved by a majority of our independent directors. The exclusion of depreciation and amortization from the calculation of Distributable Earnings only applies to debt investments related to real estate to the extent we foreclose upon the property or properties underlying such debt investments. Distributable Earnings 42

▪ While Distributable Earnings excludes the impact of the unrealized non-cash current provision for credit losses, we expect to only recognize such potential credit losses in Distributable Earnings if and when such amounts are deemed non- recoverable. This is generally at the time a loan is repaid, or in the case of foreclosure, when the underlying asset is sold, but non-recoverability may also be concluded if, in our determination, it is nearly certain that all amounts due will not be collected. The realized loss amount reflected in Distributable Earnings will equal the difference between the cash received, or expected to be received, and the carrying value of the asset, and is reflective of our economic experience as it relates to the ultimate realization of the loan. During the nine months ended September 30, 2021, we recorded a $15.1 million benefit from provision for credit losses, which has been excluded from Distributable Earnings consistent with other unrealized gains (losses) and other non-cash items pursuant to our existing policy for reporting Distributable Earnings referenced above. During the nine months ended September 30, 2021, we recorded a $9.7 million realized loss on a loan held-for-investment, which has been included in Distributable Earnings, consistent with not collecting all amounts due at the time a loan was repaid pursuant to our existing policy for reporting Distributable Earnings referenced above. ▪ Distributable Earnings does not represent net income (loss) or cash flow from operating activities and should not be considered as an alternative to GAAP net income (loss), or an indication of our GAAP cash flows from operations, a measure of our liquidity, or an indication of funds available for our cash needs. In addition, our methodology for calculating Distributable Earnings may differ from the methodologies employed by other companies to calculate the same or similar supplemental performance measures, and, accordingly, our reported Distributable Earnings may not be comparable to the Distributable Earnings reported by other companies. Distributable Earnings (cont’d) 43

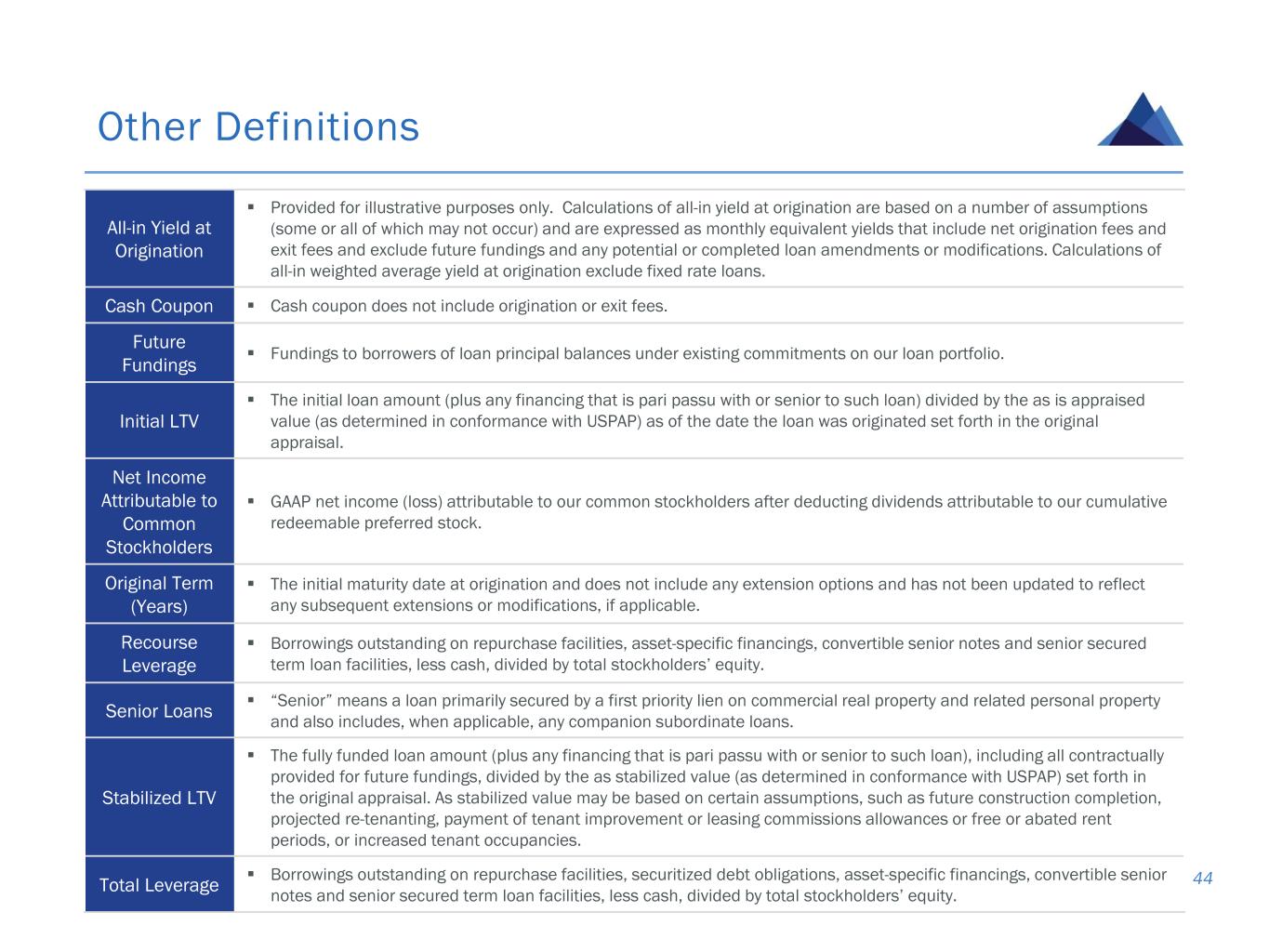

Other Definitions 44 All-in Yield at Origination ▪ Provided for illustrative purposes only. Calculations of all-in yield at origination are based on a number of assumptions (some or all of which may not occur) and are expressed as monthly equivalent yields that include net origination fees and exit fees and exclude future fundings and any potential or completed loan amendments or modifications. Calculations of all-in weighted average yield at origination exclude fixed rate loans. Cash Coupon ▪ Cash coupon does not include origination or exit fees. Future Fundings ▪ Fundings to borrowers of loan principal balances under existing commitments on our loan portfolio. Initial LTV ▪ The initial loan amount (plus any financing that is pari passu with or senior to such loan) divided by the as is appraised value (as determined in conformance with USPAP) as of the date the loan was originated set forth in the original appraisal. Net Income Attributable to Common Stockholders ▪ GAAP net income (loss) attributable to our common stockholders after deducting dividends attributable to our cumulative redeemable preferred stock. Original Term (Years) ▪ The initial maturity date at origination and does not include any extension options and has not been updated to reflect any subsequent extensions or modifications, if applicable. Recourse Leverage ▪ Borrowings outstanding on repurchase facilities, asset-specific financings, convertible senior notes and senior secured term loan facilities, less cash, divided by total stockholders’ equity. Senior Loans ▪ “Senior” means a loan primarily secured by a first priority lien on commercial real property and related personal property and also includes, when applicable, any companion subordinate loans. Stabilized LTV ▪ The fully funded loan amount (plus any financing that is pari passu with or senior to such loan), including all contractually provided for future fundings, divided by the as stabilized value (as determined in conformance with USPAP) set forth in the original appraisal. As stabilized value may be based on certain assumptions, such as future construction completion, projected re-tenanting, payment of tenant improvement or leasing commissions allowances or free or abated rent periods, or increased tenant occupancies. Total Leverage ▪ Borrowings outstanding on repurchase facilities, securitized debt obligations, asset-specific financings, convertible senior notes and senior secured term loan facilities, less cash, divided by total stockholders’ equity.

Company Information 45 Granite Point Mortgage Trust Inc. is an internally-managed real estate finance company that focuses primarily on directly originating, investing in and managing senior floating rate commercial mortgage loans and other debt and debt-like commercial real estate investments. Granite Point was incorporated in Maryland on April 7, 2017 and has elected to be treated as a real estate investment trust for U.S. federal income tax purposes. For more information regarding Granite Point, visit www.gpmtreit.com. Contact Information: Corporate Headquarters: 3 Bryant Park, 24th Floor New York, NY 10036 212-364-5500 New York Stock Exchange: Symbol: GPMT Investor Relations: Marcin Urbaszek Chief Financial Officer 212-364-5500 Investors@gpmtreit.com Transfer Agent: Equiniti Trust Company P.0. Box 64856 St. Paul, MN 55164-0856 800-468-9716 www.shareowneronline.com Credit Suisse Douglas Harter 212-538-5983 JMP Securities Steven DeLaney 212-906-3517 Keefe, Bruyette & Woods Jade Rahmani 212-887-3882 Raymond James Stephen Laws 901-579-4868 Analyst Coverage: