Granite Point Mortgage Trust Inc. Announces $590 million Refinancing of Legacy Funding Vehicles, Incremental $50 million Repayment of Term Loan Borrowings and Preliminary Financial Results for First Quarter 2022 NEW YORK, April 28, 2022 – Granite Point Mortgage Trust Inc. (NYSE: GPMT) (“GPMT,” “Granite Point” or the “Company”) today announced that it refinanced approximately $590 million of senior loans that had been previously financed through two of the Company’s legacy funding vehicles, GPMT 2018- FL1 CRE CLO and its term financing facility with Goldman Sachs, both of which had been significantly de-levered through loan repayments. These transactions generated approximately $180 million in net proceeds to the Company after repaying approximately $232 million of borrowings outstanding under those two legacy facilities. The Company today used a portion of the net proceeds to repay an additional $50 million of the remaining $100 million principal amount outstanding under its senior secured term loan facilities. “We are very excited to announce these actions, as we continue to execute on the strategic priorities we outlined for 2022 earlier in the year,” said Jack Taylor, President and Chief Executive Officer of Granite Point. “The refinancings released a substantial amount of capital on favorable terms, which we intend to use to make new loan investments, further repay higher cost corporate debt, and for other corporate purposes, as we continue to actively manage our balance sheet. This significant step is part of the ongoing actions we have been taking to improve the efficiency of our balance sheet. We expect these activities to improve our run-rate profitability by lowering our funding costs and generating additional income from new loan investments; and they should help reduce the impact of higher short-term interest rates on our earnings and better position us to benefit from rising rates in the second half of the year. Supported by the strong performance of our investment portfolio and positive credit migration, we believe Granite Point is well-positioned to create value for our stockholders.” The Company today also announced its preliminary unaudited financial results for the three months ended March 31, 2022, which are based on currently available information. Preliminary Unaudited Results for the Three Months Ended March 31, 2022 • For the three months ended March 31, 2022, the Company estimates its net income attributable to common stockholders to be in the range of $0.01 to $0.03 per basic share, inclusive of an estimated $(0.11) per basic share charge on early extinguishment of debt related to the $50 million partial repayment of term loan borrowings on February 16 and an estimated $(0.06) per basic share provision for credit losses, of which an estimated $(0.04) is related to the previously disclosed sale of the non-accrual Washington D.C. office loan. • For the three months ended March 31, 2022, the Company estimates Distributable Earnings to be in the range of $0.04 to $0.06 per basic share, inclusive of an estimated $(10.1) million, or $(0.19) per basic share, realized loss on the previously disclosed loan sale. The Company estimates Distributable Earnings before write-off to be in the range of $0.23 to $0.25 per basic share. • The Company estimates its book value per common share to be in the range of $16.37 to $16.41 as of March 31, 2022, inclusive of an estimated total allowance for loan losses of approximately $35.8 million, or $0.66 per common share, including the $14.1 million allowance for loan losses related to the Company’s one non-accrual loan, which is unchanged from the prior quarter. • During the three months ended March 31, 2022, the Company funded approximately $172.3 million of loan principal, and realized repayments, the loan sale and principal amortization of approximately $172.4 million, resulting in the total portfolio principal balance of approximately $3.8 billion, and approximately $4.2 billion including unfunded commitments as of March 31, 2022. • As of March 31, 2022, the average risk rating of the Company's investment portfolio was 2.5, weighted by total unpaid principal balance, as compared to 2.6 at December 31, 2021. As of March 31, 2022, approximately 83% of the Company’s loans, based on total UPB, were risk-rated 3 or

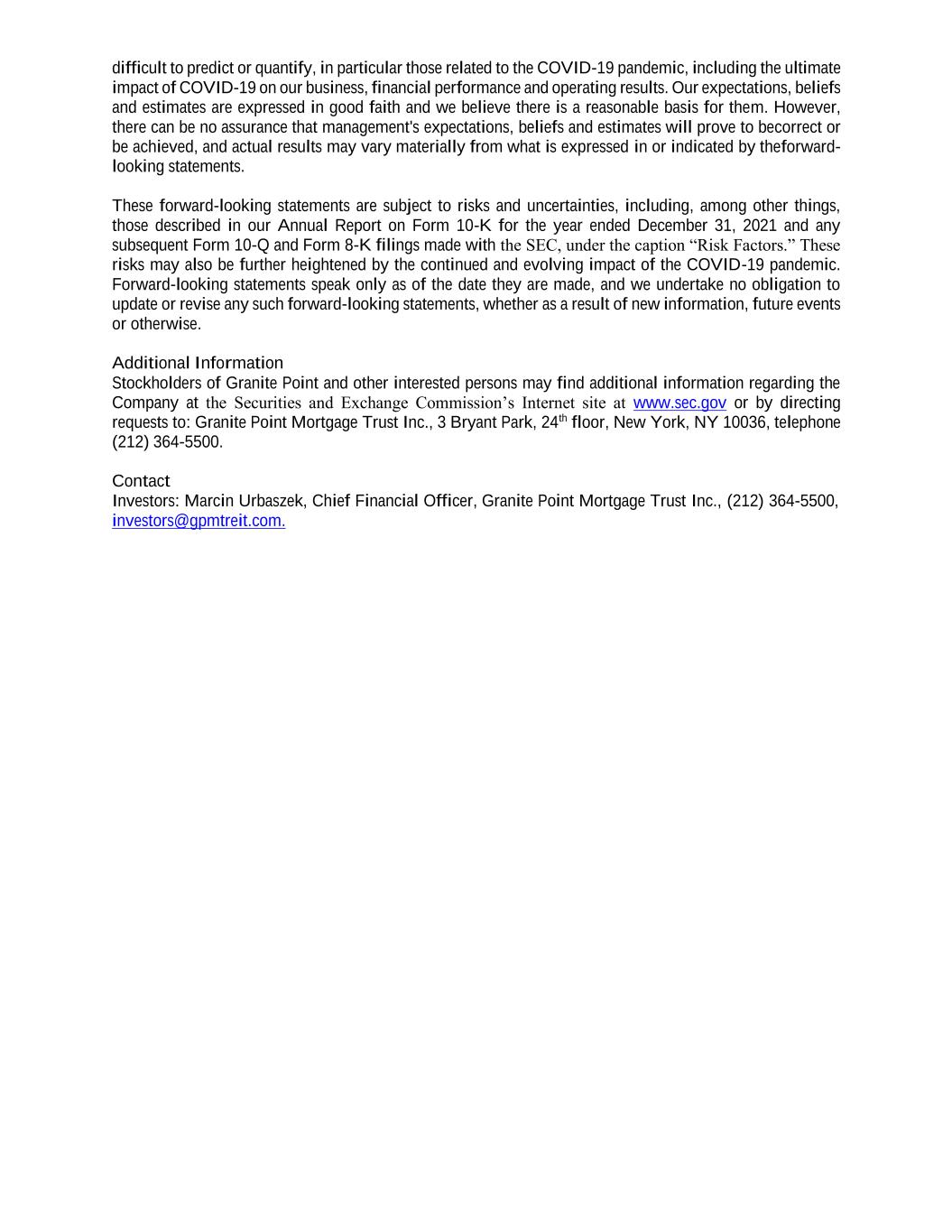

better, compared to approximately 79% as of December 31, 2021. • At March 31, 2022, the Company had approximately $148 million in unrestricted cash. The Company estimates its total debt-to-equity ratio as of March 31, 2022, to be approximately 2.5x. Post Quarter-End Update • The Company’s current forward pipeline consists of senior floating-rate loans with total commitments of over $200 million and initial fundings of over $170 million, which have either closed or are in the closing process, subject to fallout. • As mentioned above, the Company further reduced its borrowings under the senior secured term loan facilities to $50 million through an incremental $50 million repayment. The Company incurred a charge on early extinguishment of debt of approximately $(5.6) million, or $(0.10) per basic share, comprised of the prepayment penalty and a pro-rata charge-off of unamortized discount including transaction costs, which will be reflected in the Company’s Q2 2022 financial results. • In connection with the early repayment of approximately $129 million of borrowings outstanding under the term financing facility with Goldman Sachs, the Company recognized a charge-off of unamortized transaction costs of approximately $(1.8) million, or $(0.03) per basic share, which will be reflected in the Company’s Q2 2022 financial results. • As part of the above-mentioned refinancings, the Company increased borrowing capacity on its repurchase financing facility with Morgan Stanley to $600 million and extended its initial maturity to June 28, 2023. • As of April 28, 2022, the Company held approximately $225 million in cash. The preliminary estimates set forth herein are subject to finalization, including the completion of customary financial statement closing and review procedures for the three months ended March 31, 2022. As a result, the estimates set forth herein reflect the Company’s preliminary estimates with respect to such information, based on information currently available to management, and may vary from the Company’s final financial results as of and for the three months ended March 31, 2022, which we expect to release on May 10, 2022. Further, these preliminary estimates are not a comprehensive statement or estimate of the Company’s financial condition or operating results as of and for the three months ended March 31, 2022. These preliminary estimates should not be viewed as a substitute for complete, final interim financial statements prepared in accordance with GAAP and they are not necessarily indicative of the results to be achieved in any future period. Accordingly, you should not place undue reliance on these preliminary estimates. These preliminary estimates are based upon a number of assumptions. Additional items that may require adjustments to these preliminary estimates may be identified and could result in material changes to these preliminary estimates. Ernst & Young LLP, the Company’s independent registered public accounting firm, has not audited, reviewed, compiled or performed any procedures with respect to the preliminary estimates. Accordingly, Ernst & Young LLP does not express an opinion or provide any form of assurance with respect thereto. Non-GAAP Financial Measures Reconciliation of Estimated Net Income Attributable to Common Stockholders Per Basic Share to Estimated Distributable Earnings Per Basic Share The table below reconciles an estimated range of net income attributable to common stockholders per basic share, to an estimated range of Distributable Earnings per basic share for the three months ended March 31, 2022.

Three Months Ended March 31, 2022 (unaudited) Reconciliation of GAAP net income per share to Distributable Earnings(1) per share: Estimated GAAP net income per basic common share $0.01 to $0.03 Adjustments: Provision for credit losses 0.06 Loss on early extinguishment of debt 0.11 Non-cash equity compensation 0.04 Estimated Distributable Earnings(1) per basic common share before write-off $0.23 to $0.25 Write-off on loan sale (0.19) Estimated Distributable Earnings(1) per basic common share $0.04 to $0.06 (1) Distributable Earnings is a measure that is not prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). We believe providing Distributable Earnings on a supplemental basis to our net income (loss) and cash flow from operating activities, as determined in accordance with GAAP, is helpful to stockholders in assessing the overall run-rate operating performance of our business. We use Distributable Earnings to evaluate our performance, excluding the effects of certain transactions and GAAP adjustments we believe are not necessarily indicative of our current loan portfolio and operations. For reporting purposes, we define Distributable Earnings as net income (loss) attributable to our stockholders, computed in accordance with GAAP, excluding: (i) non-cash equity compensation expenses; (ii) depreciation and amortization; (iii) any unrealized gains (losses) or other similar non-cash items that are included in net income for the applicable reporting period (regardless of whether such items are included in other comprehensive income (loss) or in net income for such period); and (iv) certain non-cash items and one-time expenses. Distributable Earnings may also be adjusted from time to time for reporting purposes to exclude one-time events pursuant to changes in GAAP and certain other material non-cash income or expense items approved by a majority of our independent directors. The exclusion of depreciation and amortization from the calculation of Distributable Earnings only applies to debt investments related to real estate to the extent we foreclose upon the property or properties underlying such debt investments. Distributable Earnings does not represent net income (loss) or cash flow from operating activities and should not be considered as an alternative to GAAP net income (loss), or an indication of our GAAP cash flows from operations, a measure of our liquidity, or an indication of funds available for our cash needs. In addition, our methodology for calculating Distributable Earnings may differ from the methodologies employed by other companies to calculate the same or similar supplemental performance measures, and, accordingly, our reported Distributable Earnings may not be comparable to the Distributable Earnings reported by other companies. About Granite Point Mortgage Trust Inc. Granite Point Mortgage Trust Inc. is a Maryland corporation focused on directly originating, investing in and managing senior floating-rate commercial mortgage loans and other debt and debt-like commercial real estate investments. Granite Point is headquartered in New York, NY. Additional information is available at www.gpmtreit.com. Forward-Looking Statements This press release contains not only historical information, but also forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve numerous risks and uncertainties. Our actual results may differ from our beliefs, expectations, estimates and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will,” “should,” “expect,” “target,” “believe,” “outlook,” “potential,” “continue,” “intend,” “seek,” “plan,” “goals,” “future,” “likely,” “may” and similar expressions or their negative forms, or by references to strategy, plans or intentions. By their nature, forward-looking statements speak only as of the date they are made, are not statements of historical facts or guarantees of future performance and are subject to risks, uncertainties, assumptions or changes in circumstances that are

difficult to predict or quantify, in particular those related to the COVID-19 pandemic, including the ultimate impact of COVID-19 on our business, financial performance and operating results. Our expectations, beliefs and estimates are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that management's expectations, beliefs and estimates will prove to be correct or be achieved, and actual results may vary materially from what is expressed in or indicated by the forward- looking statements. These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2021 and any subsequent Form 10-Q and Form 8-K filings made with the SEC, under the caption “Risk Factors.” These risks may also be further heightened by the continued and evolving impact of the COVID-19 pandemic. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update or revise any such forward-looking statements, whether as a result of new information, future events or otherwise. Additional Information Stockholders of Granite Point and other interested persons may find additional information regarding the Company at the Securities and Exchange Commission’s Internet site at www.sec.gov or by directing requests to: Granite Point Mortgage Trust Inc., 3 Bryant Park, 24th floor, New York, NY 10036, telephone (212) 364-5500. Contact Investors: Marcin Urbaszek, Chief Financial Officer, Granite Point Mortgage Trust Inc., (212) 364-5500, investors@gpmtreit.com.