Q4 and Full Year 2024 Earnings Supplemental February 14, 2025

Legal Disclosures This presentation contains, or incorporates by reference, not only historical information, but also forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve numerous risks and uncertainties. Our actual results may differ from our beliefs, expectations, estimates, projections and illustrations and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will,” “should,” “expect,” “target,” “believe,” “outlook,” “potential,” “continue,” “intend,” “seek,” “plan,” “goals,” “future,” “likely,” “may” and similar expressions or their negative forms, or by references to strategy, plans or intentions. The illustrative examples herein are forward-looking statements. By their nature, forward-looking statements speak only as of the date they are made, are not statements of historical facts or guarantees of future performance and are subject to risks, uncertainties, assumptions or changes in circumstances that are difficult to predict or quantify. Our expectations, beliefs and estimates are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that management's expectations, beliefs and estimates will prove to be correct or be achieved, and actual results may vary materially from what is expressed in or indicated by the forward-looking statements. These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2023, under the caption “Risk Factors,” and any subsequent Form 10-Q or other filings made with the SEC. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update or revise any such forward-looking statements, whether as a result of new information, future events or otherwise. This presentation is for informational purposes only and shall not constitute, or form a part of, an offer to sell or buy or the solicitation of an offer to sell or the solicitation of an offer to buy any securities. Financial data throughout this presentation is as of or for the quarter ended December 31, 2024, unless otherwise noted. Readers are advised that the financial information in this presentation is based on company data available at the time of this presentation and, in certain circumstances, may not have been audited by the company’s independent auditors. Due to rounding, figures in this presentation may not result in the totals presented. This presentation also includes non-GAAP financial measures, which should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with GAAP. Please refer to the Appendix of this presentation financial measures prepared ion accordance with GAAP to the most directly comparable non-GAAP financial measures. Please refer to Other Definitions in the Appendix of this presentation for definitions of capitalized terms not otherwise defined in this presentation.

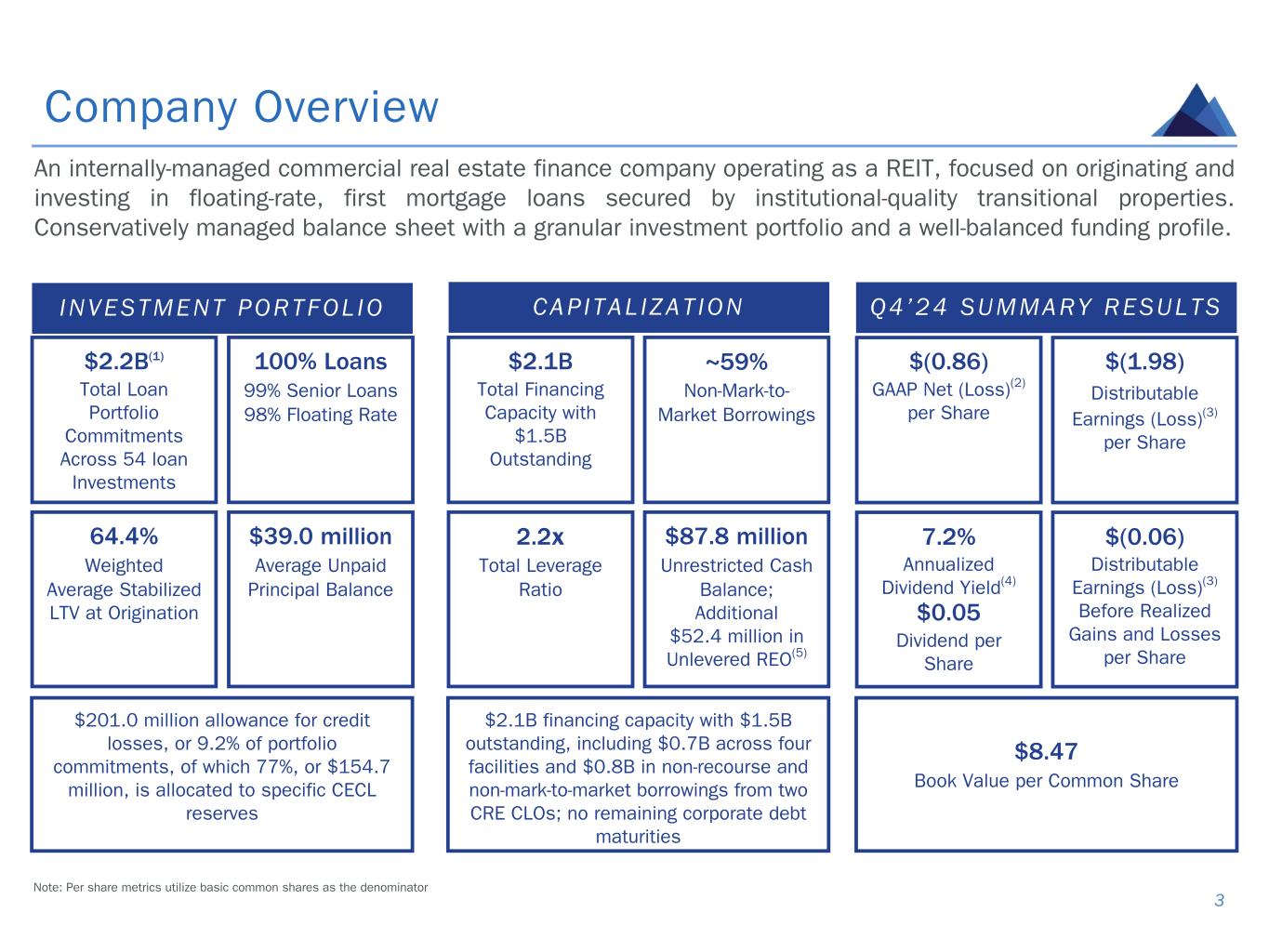

$(0.06) Distributable Earnings (Loss)(3) Before Realized Gains and Losses per Share Q4’24 SUMMARY RESULTSINVESTMENT PORTFOL IO 3 $2.2B(1) Total Loan Portfolio Commitments Across 54 loan Investments 100% Loans 99% Senior Loans 98% Floating Rate 64.4% Weighted Average Stabilized LTV at Origination ~59% Non-Mark-to- Market Borrowings 2.2x Total Leverage Ratio $2.1B Total Financing Capacity with $1.5B Outstanding $87.8 million Unrestricted Cash Balance; Additional $52.4 million in Unlevered REO(5) $39.0 million Average Unpaid Principal Balance Company Overview CAP ITAL IZAT ION $(1.98) Distributable Earnings (Loss)(3) per Share 7.2% Annualized Dividend Yield(4) $0.05 Dividend per Share $(0.86) GAAP Net (Loss)(2) per Share $201.0 million allowance for credit losses, or 9.2% of portfolio commitments, of which 77%, or $154.7 million, is allocated to specific CECL reserves $2.1B financing capacity with $1.5B outstanding, including $0.7B across four facilities and $0.8B in non-recourse and non-mark-to-market borrowings from two CRE CLOs; no remaining corporate debt maturities $8.47 Book Value per Common Share An internally-managed commercial real estate finance company operating as a REIT, focused on originating and investing in floating-rate, first mortgage loans secured by institutional-quality transitional properties. Conservatively managed balance sheet with a granular investment portfolio and a well-balanced funding profile. Note: Per share metrics utilize basic common shares as the denominator

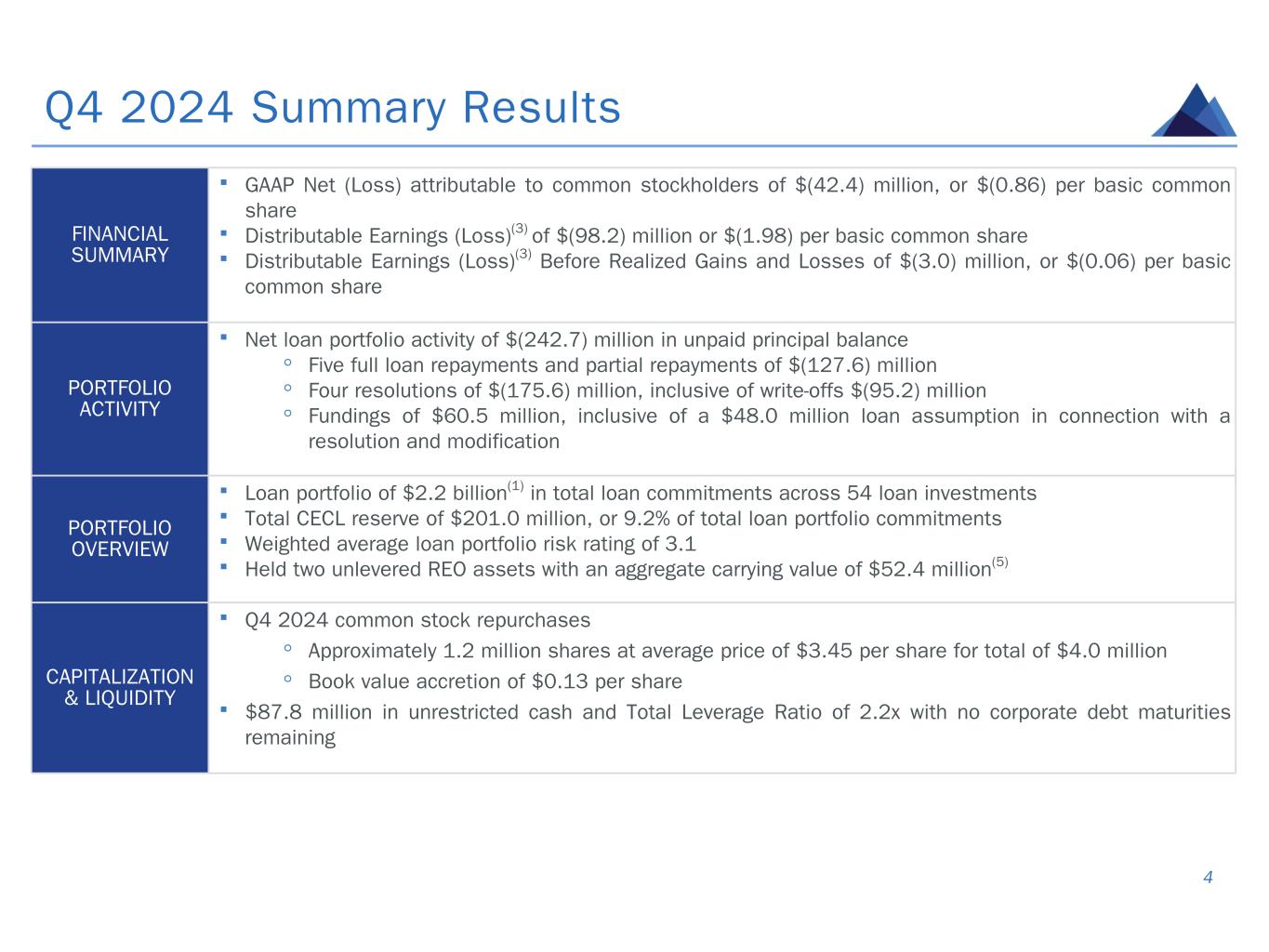

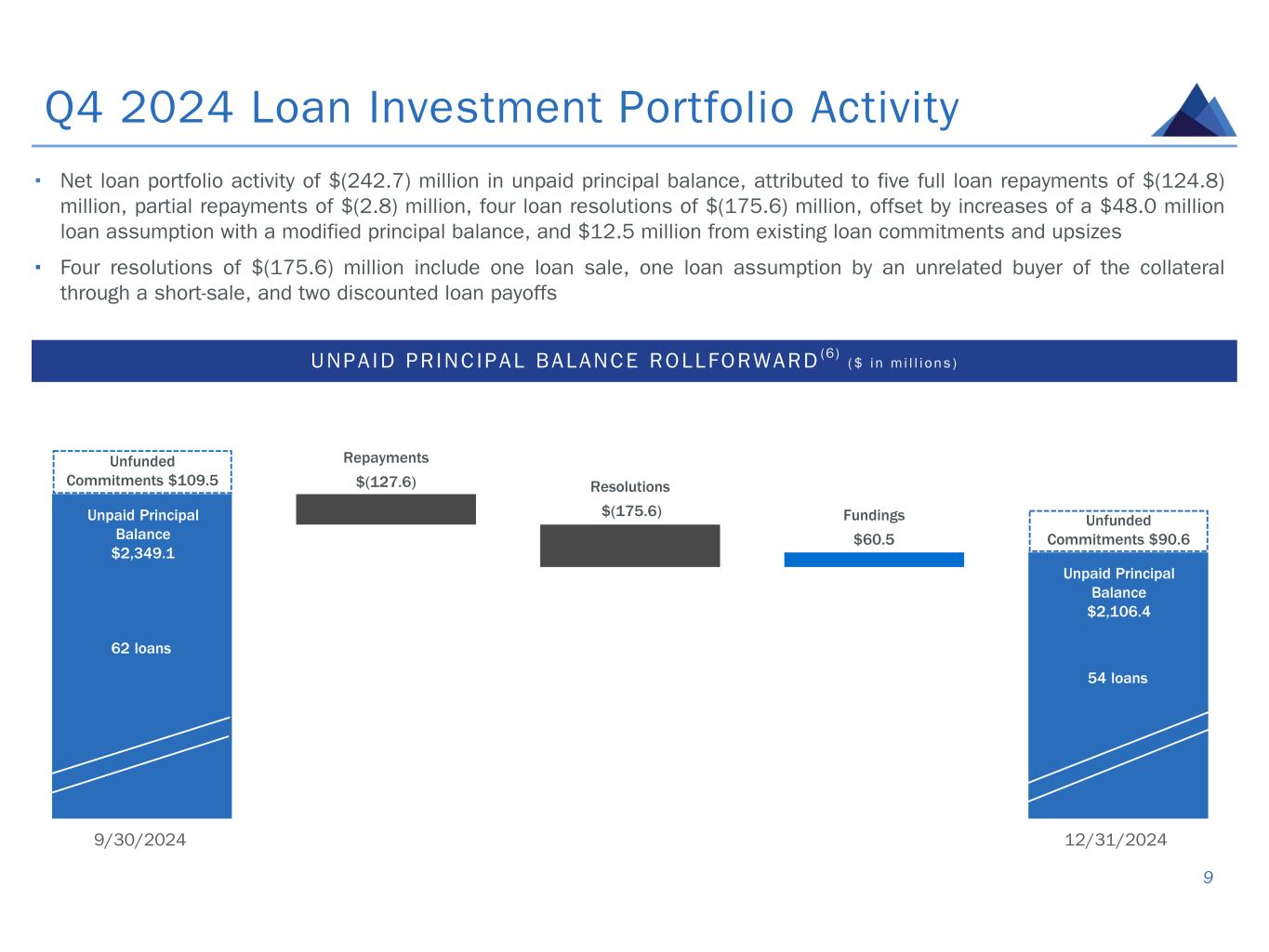

FINANCIAL SUMMARY ▪ GAAP Net (Loss) attributable to common stockholders of $(42.4) million, or $(0.86) per basic common share ▪ Distributable Earnings (Loss)(3) of $(98.2) million or $(1.98) per basic common share ▪ Distributable Earnings (Loss)(3) Before Realized Gains and Losses of $(3.0) million, or $(0.06) per basic common share PORTFOLIO ACTIVITY ▪ Net loan portfolio activity of $(242.7) million in unpaid principal balance ◦ Five full loan repayments and partial repayments of $(127.6) million ◦ Four resolutions of $(175.6) million, inclusive of write-offs $(95.2) million ◦ Fundings of $60.5 million, inclusive of a $48.0 million loan assumption in connection with a resolution and modification PORTFOLIO OVERVIEW ▪ Loan portfolio of $2.2 billion(1) in total loan commitments across 54 loan investments ▪ Total CECL reserve of $201.0 million, or 9.2% of total loan portfolio commitments ▪ Weighted average loan portfolio risk rating of 3.1 ▪ Held two unlevered REO assets with an aggregate carrying value of $52.4 million(5) CAPITALIZATION & LIQUIDITY ▪ Q4 2024 common stock repurchases ◦ Approximately 1.2 million shares at average price of $3.45 per share for total of $4.0 million ◦ Book value accretion of $0.13 per share ▪ $87.8 million in unrestricted cash and Total Leverage Ratio of 2.2x with no corporate debt maturities remaining Q4 2024 Summary Results 4

SUBSEQUENT EVENTS ▪ In January, took as REO an office property in Miami Beach, FL via a negotiated transaction with an expected net carrying value of approximately $71.0 million ◦ As of December 31, 2024, loan was on nonaccrual status with an unpaid principal balance of $71.3 million and risk rating of “5”. The Company expects to realize a write-off of approximately $(7.9) million, reserved for through previously recorded allowance for credit losses ▪ In February, resolved a loan secured by an office property in Boston, MA via a property sale ◦ As of December 31, 2024, loan was on nonaccrual status with an unpaid principal balance of $26.1 million and risk rating of “5”. The Company expects to realize a write-off of approximately $(16.6) million, reserved for through a previously recorded allowance for credit losses ▪ So far in Q1’25, funded about $2.9 million on existing loan commitments ▪ As of February 12, 2025, carried approximately $75.0 million in unrestricted cash Post-Q4 2024 Business Update 5

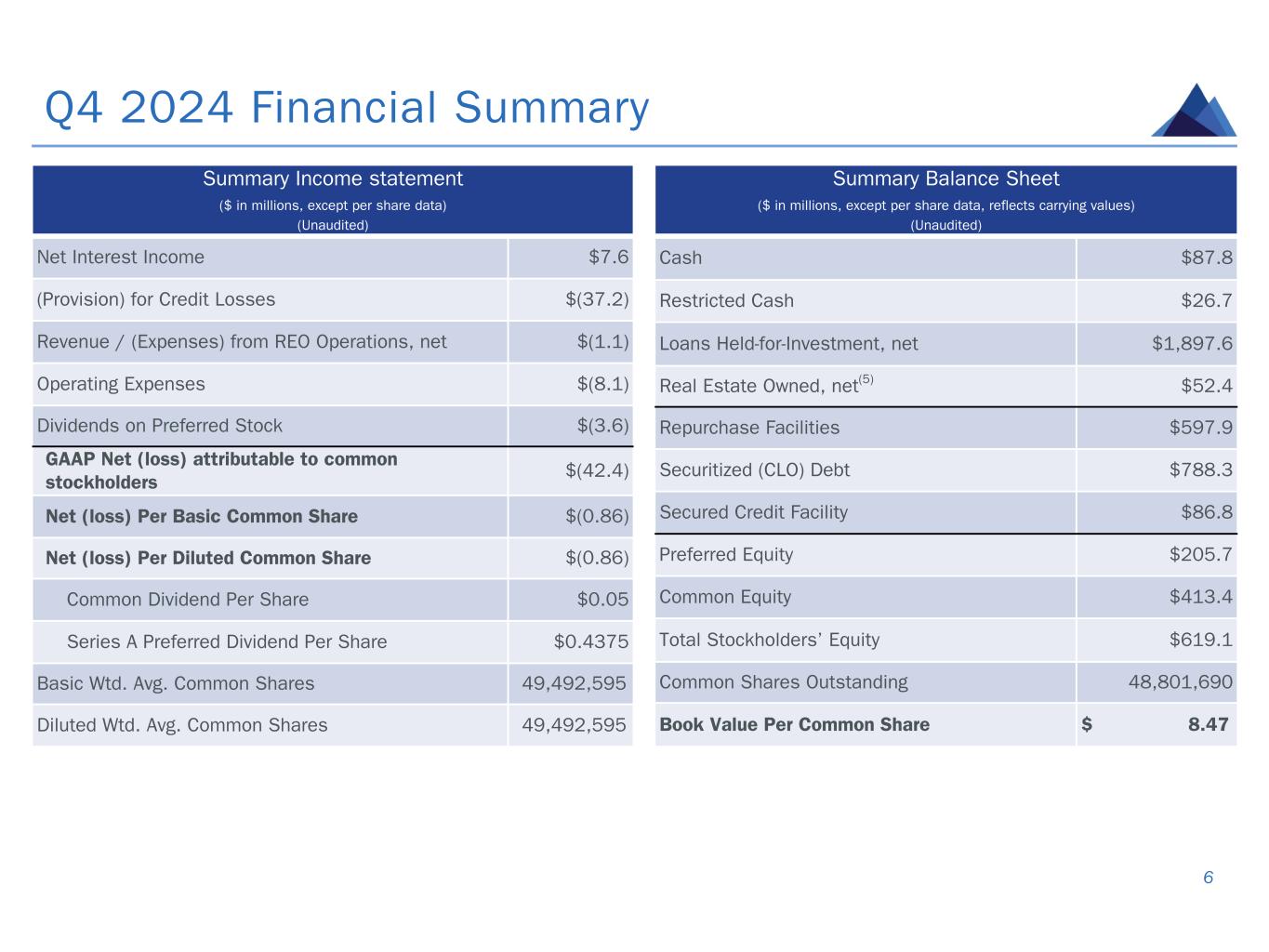

Summary Income statement ($ in millions, except per share data) (Unaudited) Net Interest Income $7.6 (Provision) for Credit Losses $(37.2) Revenue / (Expenses) from REO Operations, net $(1.1) Operating Expenses $(8.1) Dividends on Preferred Stock $(3.6) GAAP Net (loss) attributable to common stockholders $(42.4) Net (loss) Per Basic Common Share $(0.86) Net (loss) Per Diluted Common Share $(0.86) Common Dividend Per Share $0.05 Series A Preferred Dividend Per Share $0.4375 Basic Wtd. Avg. Common Shares 49,492,595 Diluted Wtd. Avg. Common Shares 49,492,595 Q4 2024 Financial Summary 6 Summary Balance Sheet ($ in millions, except per share data, reflects carrying values) (Unaudited) Cash $87.8 Restricted Cash $26.7 Loans Held-for-Investment, net $1,897.6 Real Estate Owned, net(5) $52.4 Repurchase Facilities $597.9 Securitized (CLO) Debt $788.3 Secured Credit Facility $86.8 Preferred Equity $205.7 Common Equity $413.4 Total Stockholders’ Equity $619.1 Common Shares Outstanding 48,801,690 Book Value Per Common Share $ 8.47

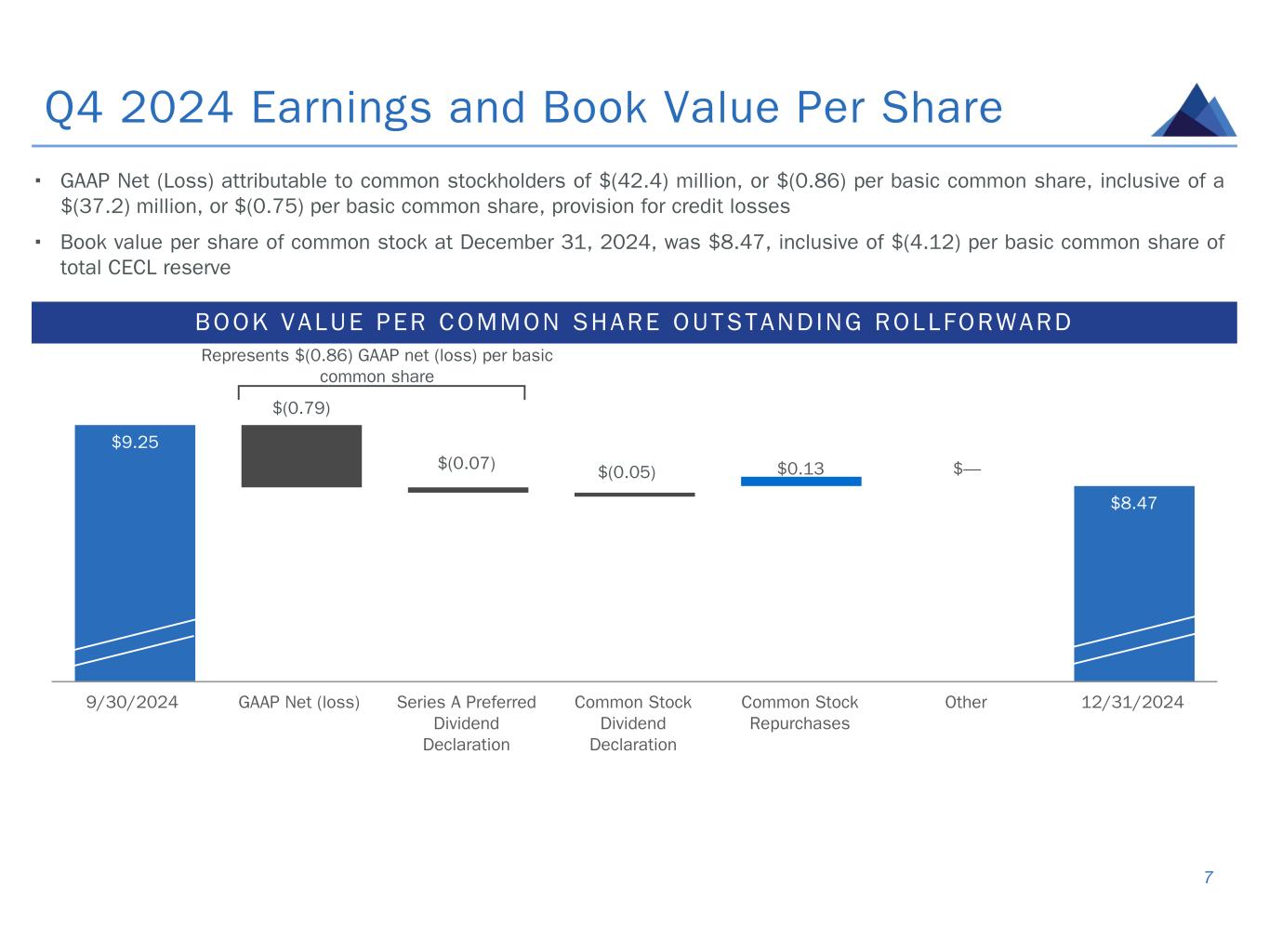

$9.25 $8.47 $0.13 $— 9/30/2024 GAAP Net (loss) Series A Preferred Dividend Declaration Common Stock Dividend Declaration Common Stock Repurchases Other 12/31/2024 Q4 2024 Earnings and Book Value Per Share ▪ GAAP Net (Loss) attributable to common stockholders of $(42.4) million, or $(0.86) per basic common share, inclusive of a $(37.2) million, or $(0.75) per basic common share, provision for credit losses ▪ Book value per share of common stock at December 31, 2024, was $8.47, inclusive of $(4.12) per basic common share of total CECL reserve 7 BOOK VALUE PER COMMON SHARE OUTSTANDING ROLLFORWARD $(0.79) $(0.07) $(0.05) Represents $(0.86) GAAP net (loss) per basic common share

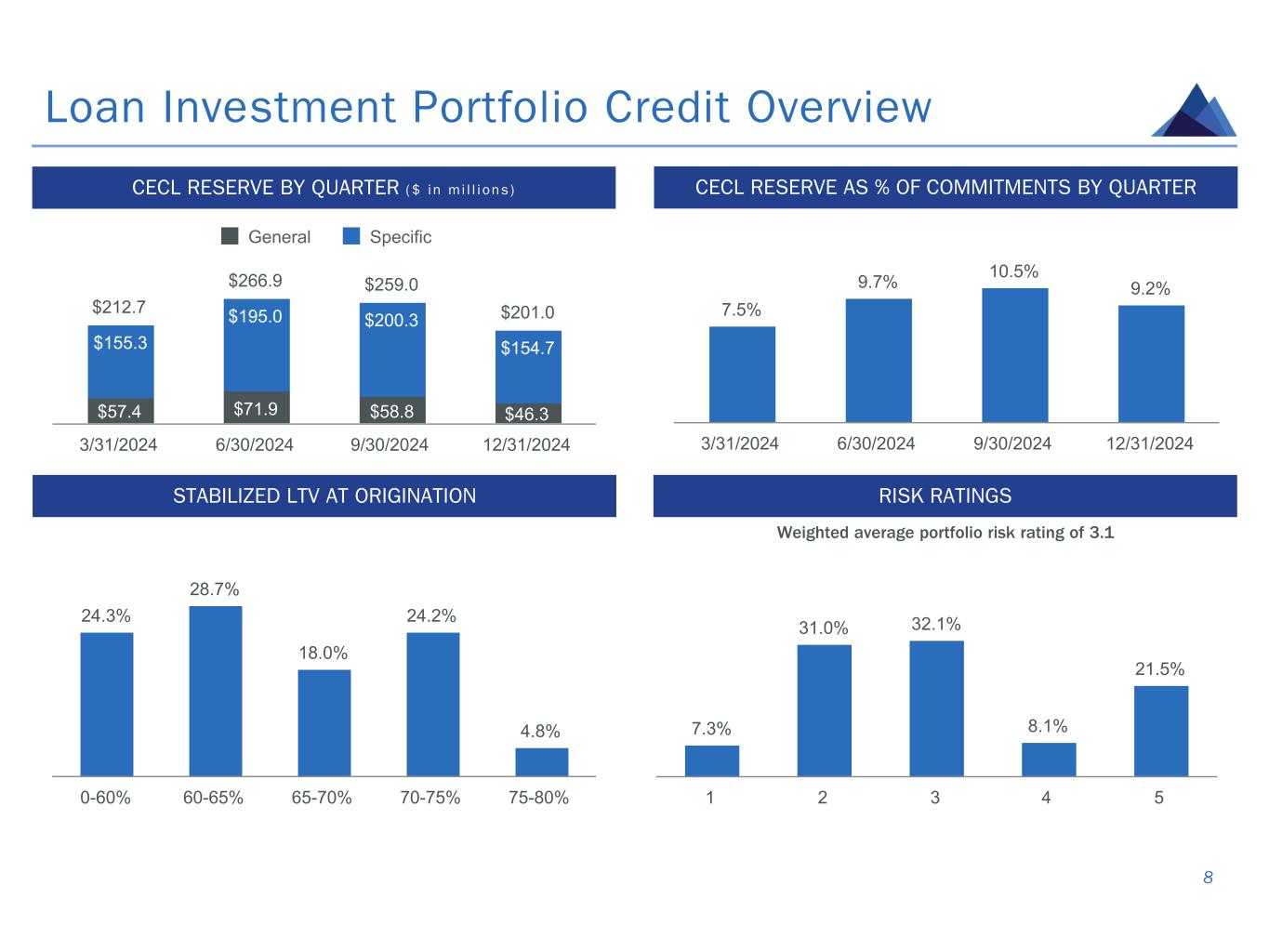

Loan Investment Portfolio Credit Overview 8 CECL RESERVE BY QUARTER ($ in mi l l i ons ) CECL RESERVE AS % OF COMMITMENTS BY QUARTER STABILIZED LTV AT ORIGINATION RISK RATINGS Weighted average portfolio risk rating of 3.1 $212.7 $266.9 $259.0 $201.0 $57.4 $71.9 $58.8 $46.3 $155.3 $195.0 $200.3 $154.7 General Specific 3/31/2024 6/30/2024 9/30/2024 12/31/2024 7.5% 9.7% 10.5% 9.2% 3/31/2024 6/30/2024 9/30/2024 12/31/2024 24.3% 28.7% 18.0% 24.2% 4.8% 0-60% 60-65% 65-70% 70-75% 75-80% 7.3% 31.0% 32.1% 8.1% 21.5% 1 2 3 4 5

9/30/2024 12/31/2024 Q4 2024 Loan Investment Portfolio Activity ▪ Net loan portfolio activity of $(242.7) million in unpaid principal balance, attributed to five full loan repayments of $(124.8) million, partial repayments of $(2.8) million, four loan resolutions of $(175.6) million, offset by increases of a $48.0 million loan assumption with a modified principal balance, and $12.5 million from existing loan commitments and upsizes ▪ Four resolutions of $(175.6) million include one loan sale, one loan assumption by an unrelated buyer of the collateral through a short-sale, and two discounted loan payoffs 9 UNPAID PR INCIPAL BALANCE ROLLFORWARD (6) ($ in mi l l i ons ) 62 loans 54 loans Repayments $(127.6) Resolutions $(175.6) Fundings $60.5 Unfunded Commitments $109.5 Unfunded Commitments $90.6 Unpaid Principal Balance $2,106.4 Unpaid Principal Balance $2,349.1

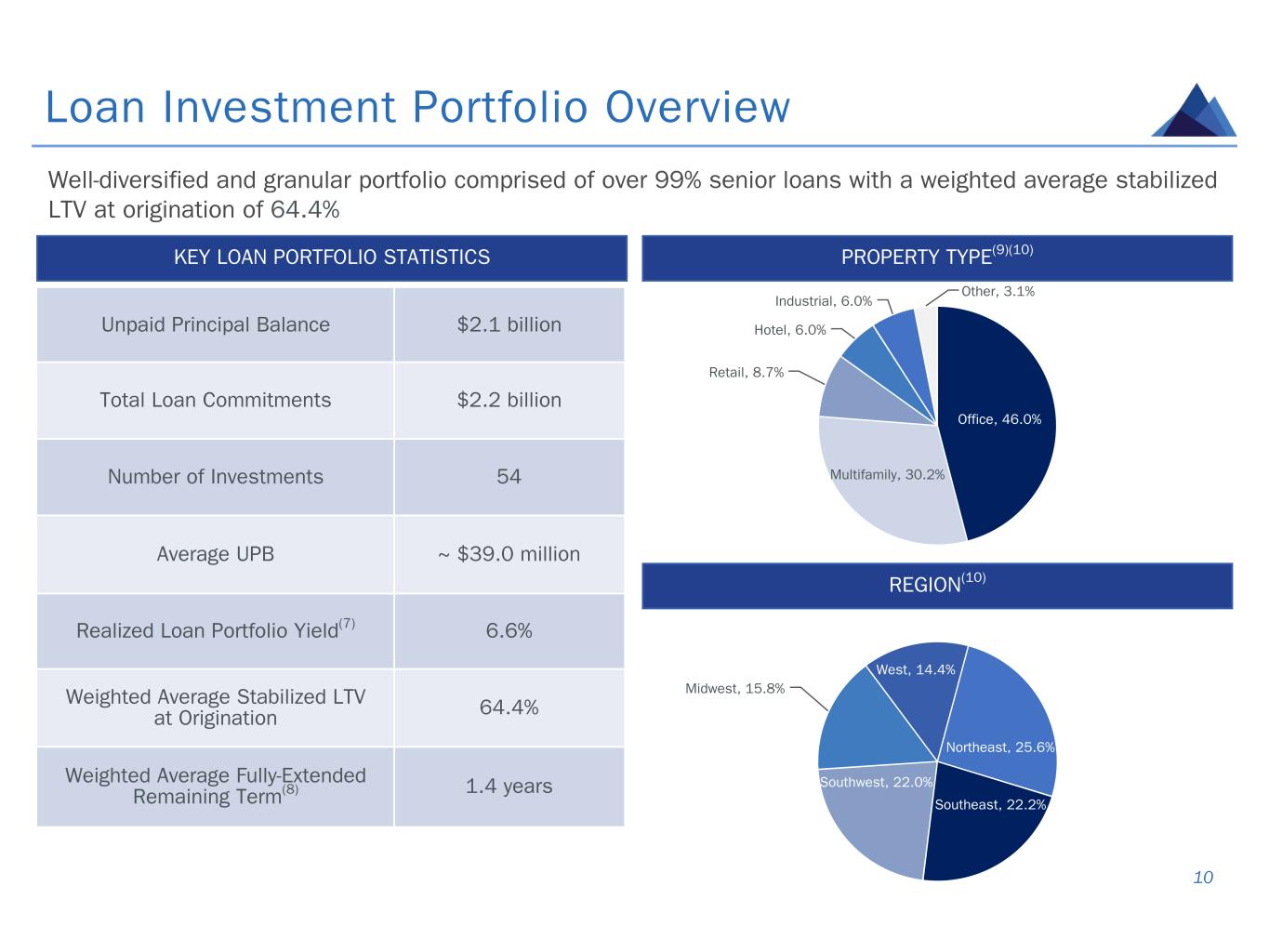

Loan Investment Portfolio Overview 10 Well-diversified and granular portfolio comprised of over 99% senior loans with a weighted average stabilized LTV at origination of 64.4% Unpaid Principal Balance $2.1 billion Total Loan Commitments $2.2 billion Number of Investments 54 Average UPB ~ $39.0 million Realized Loan Portfolio Yield(7) 6.6% Weighted Average Stabilized LTV at Origination 64.4% Weighted Average Fully-Extended Remaining Term(8) 1.4 years KEY LOAN PORTFOLIO STATISTICS PROPERTY TYPE(9)(10) REGION(10) Office, 46.0% Multifamily, 30.2% Retail, 8.7% Hotel, 6.0% Industrial, 6.0% Other, 3.1% Northeast, 25.6% Southeast, 22.2% Southwest, 22.0% Midwest, 15.8% West, 14.4%

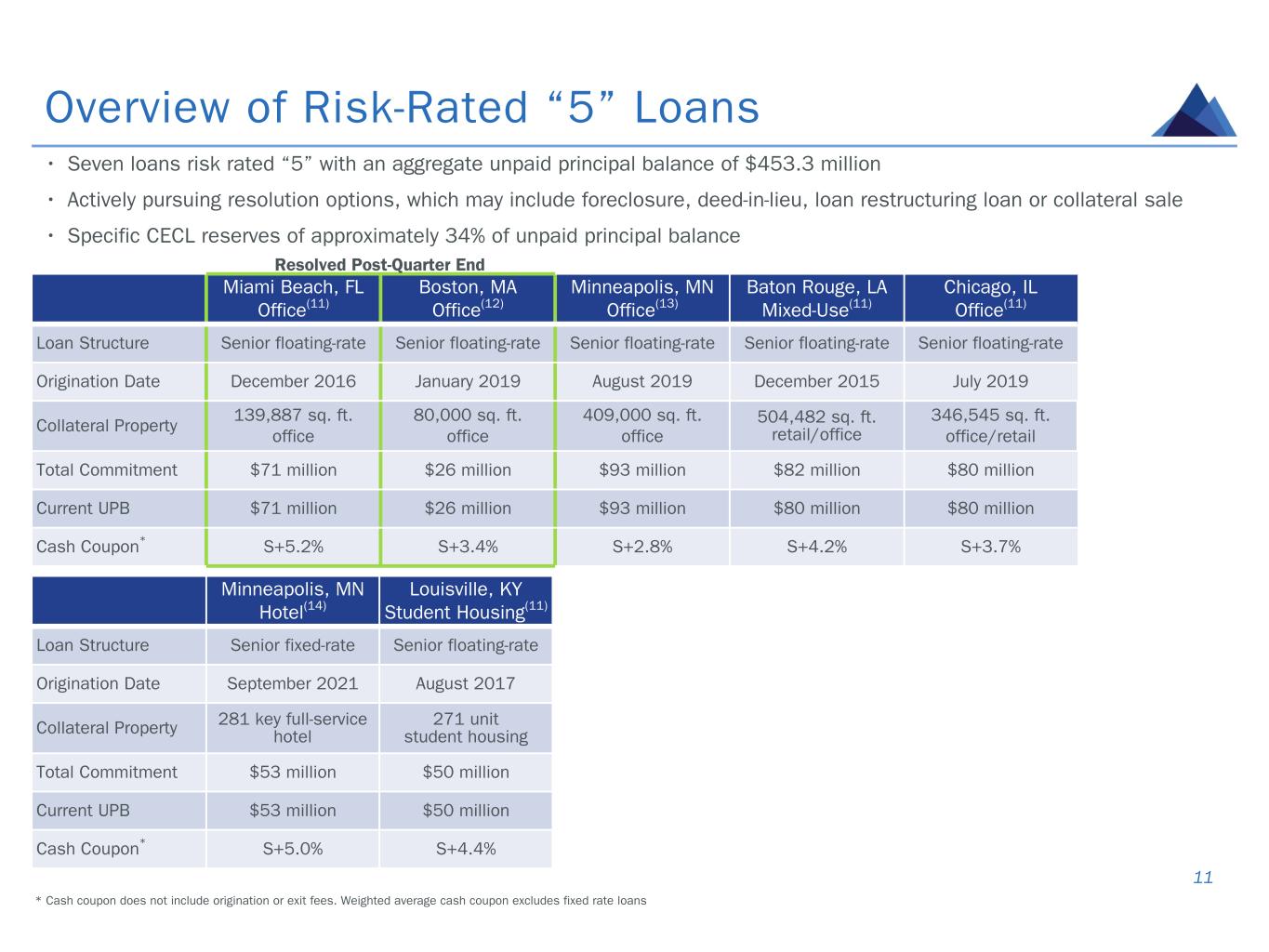

• Seven loans risk rated “5” with an aggregate unpaid principal balance of $453.3 million • Actively pursuing resolution options, which may include foreclosure, deed-in-lieu, loan restructuring loan or collateral sale • Specific CECL reserves of approximately 34% of unpaid principal balance Minneapolis, MN Hotel(14) Louisville, KY Student Housing(11) Loan Structure Senior fixed-rate Senior floating-rate Origination Date September 2021 August 2017 Collateral Property 281 key full-service hotel 271 unit student housing Total Commitment $53 million $50 million Current UPB $53 million $50 million Cash Coupon* S+5.0% S+4.4% Overview of Risk-Rated “5” Loans 11 Miami Beach, FL Office(11) Boston, MA Office(12) Minneapolis, MN Office(13) Baton Rouge, LA Mixed-Use(11) Chicago, IL Office(11) Loan Structure Senior floating-rate Senior floating-rate Senior floating-rate Senior floating-rate Senior floating-rate Origination Date December 2016 January 2019 August 2019 December 2015 July 2019 Collateral Property 139,887 sq. ft. office 80,000 sq. ft. office 409,000 sq. ft. office 504,482 sq. ft. retail/office 346,545 sq. ft. office/retail Total Commitment $71 million $26 million $93 million $82 million $80 million Current UPB $71 million $26 million $93 million $80 million $80 million Cash Coupon* S+5.2% S+3.4% S+2.8% S+4.2% S+3.7% Resolved Post-Quarter End * Cash coupon does not include origination or exit fees. Weighted average cash coupon excludes fixed rate loans

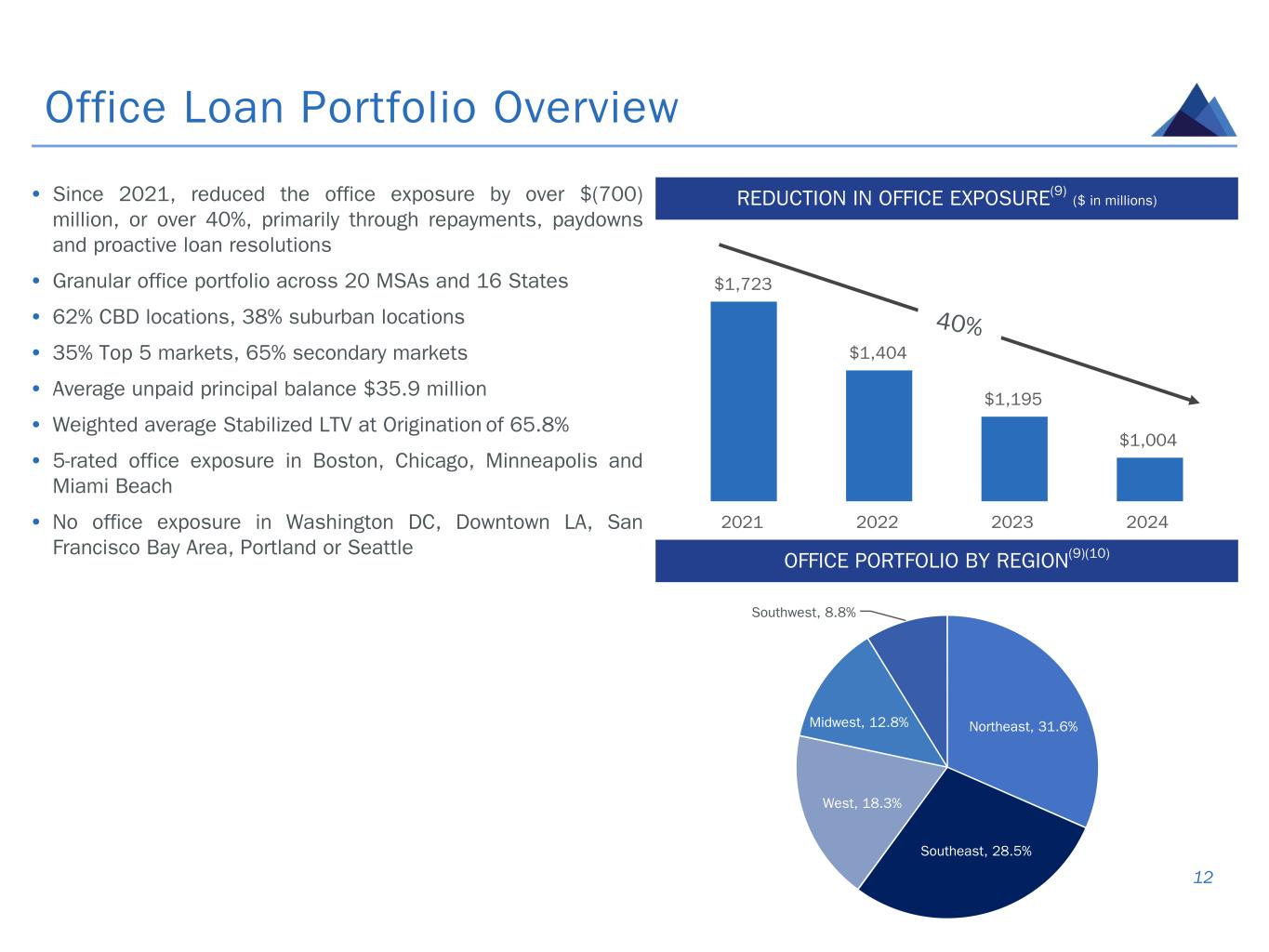

Office Loan Portfolio Overview 12 • Since 2021, reduced the office exposure by over $(700) million, or over 40%, primarily through repayments, paydowns and proactive loan resolutions • Granular office portfolio across 20 MSAs and 16 States • 62% CBD locations, 38% suburban locations • 35% Top 5 markets, 65% secondary markets • Average unpaid principal balance $35.9 million • Weighted average Stabilized LTV at Origination of 65.8% • 5-rated office exposure in Boston, Chicago, Minneapolis and Miami Beach • No office exposure in Washington DC, Downtown LA, San Francisco Bay Area, Portland or Seattle OFFICE PORTFOLIO BY REGION(9)(10) REDUCTION IN OFFICE EXPOSURE(9) ($ in millions) $1,723 $1,404 $1,195 $1,004 2021 2022 2023 2024 40% Northeast, 31.6% Southeast, 28.5% West, 18.3% Midwest, 12.8% Southwest, 8.8%

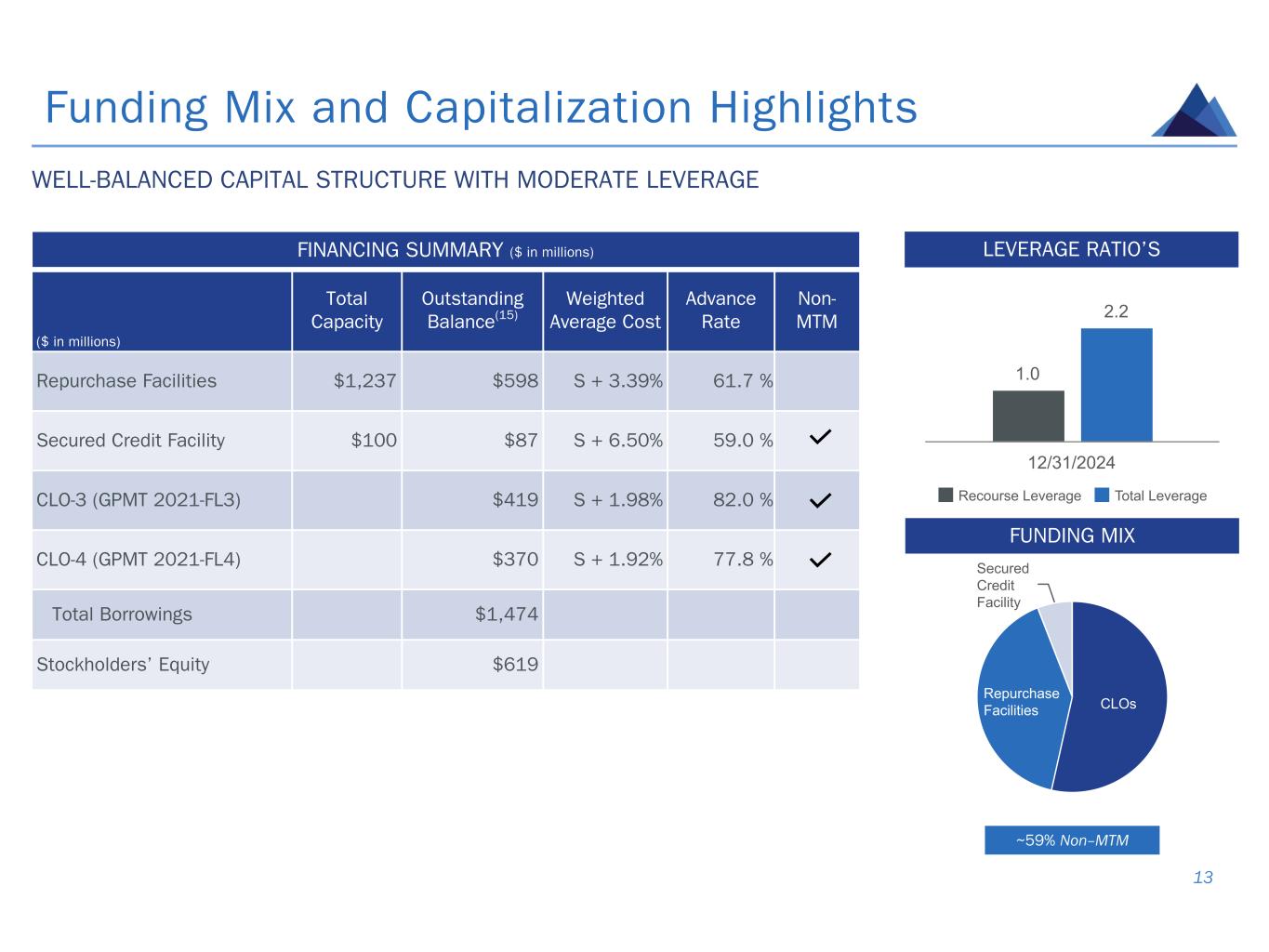

FINANCING SUMMARY ($ in millions) ($ in millions) Total Capacity Outstanding Balance(15) Weighted Average Cost Advance Rate Non- MTM Repurchase Facilities $1,237 $598 S + 3.39% 61.7 % Secured Credit Facility $100 $87 S + 6.50% 59.0 % CLO-3 (GPMT 2021-FL3) $419 S + 1.98% 82.0 % CLO-4 (GPMT 2021-FL4) $370 S + 1.92% 77.8 % Total Borrowings $1,474 Stockholders’ Equity $619 Funding Mix and Capitalization Highlights 13 FUNDING MIX WELL-BALANCED CAPITAL STRUCTURE WITH MODERATE LEVERAGE LEVERAGE RATIO’S ~59% Non–MTM 1.0 2.2 Recourse Leverage Total Leverage 12/31/2024 CLOs Repurchase Facilities Secured Credit Facility

Endnotes

Endnotes 1) Includes maximum loan commitments. Unpaid loan principal balance of $2.1 billion 2) Represents Net (loss) attributable to common stockholders 3) Non-GAAP measure. See slide 22 in the Appendix for a reconciliation to financial results prepared in accordance with GAAP 4) Dividend yield is based on annualized Q4 2024 dividend of $0.05 and a closing price of $2.79 on December 31, 2024 5) Includes $9.6 million in other assets and liabilities related to leases 6) Does not include unamortized premiums, unamortized net deferred origination fees and allowance for credit losses which, when included with the unpaid principal balances, represents the GAAP carrying value of the loans held-for-investment in the balance sheet. The GAAP carrying value as of September 30, 2024, was $2,083.6 million and as of December 31, 2024, was $1,897.6 million. The GAAP carrying value does not include accrued interest receivables, exit fee receivables and other receivables, which are reflected separately in the balance sheet. Unfunded commitments are not included in the unpaid principal balance or GAAP carrying value 7) Includes nonaccrual loans 8) Assumes all extension options are exercised and excludes four loans that have passed their maturity date and are not eligible for extension, if applicable 9) Mixed-use properties represented based on allocated loan amounts 10) Percentages are based off of carrying value 11) Loan was place on nonaccrual status in Q4 2023 12) Loan was placed on nonaccrual status in Q1 2024 13) Loan was placed on nonaccrual status in Q3 2022 14) Loan was placed on nonaccrual status in Q3 2024 15) Unpaid principal balance, excludes deferred debt issuance costs 15

Appendix

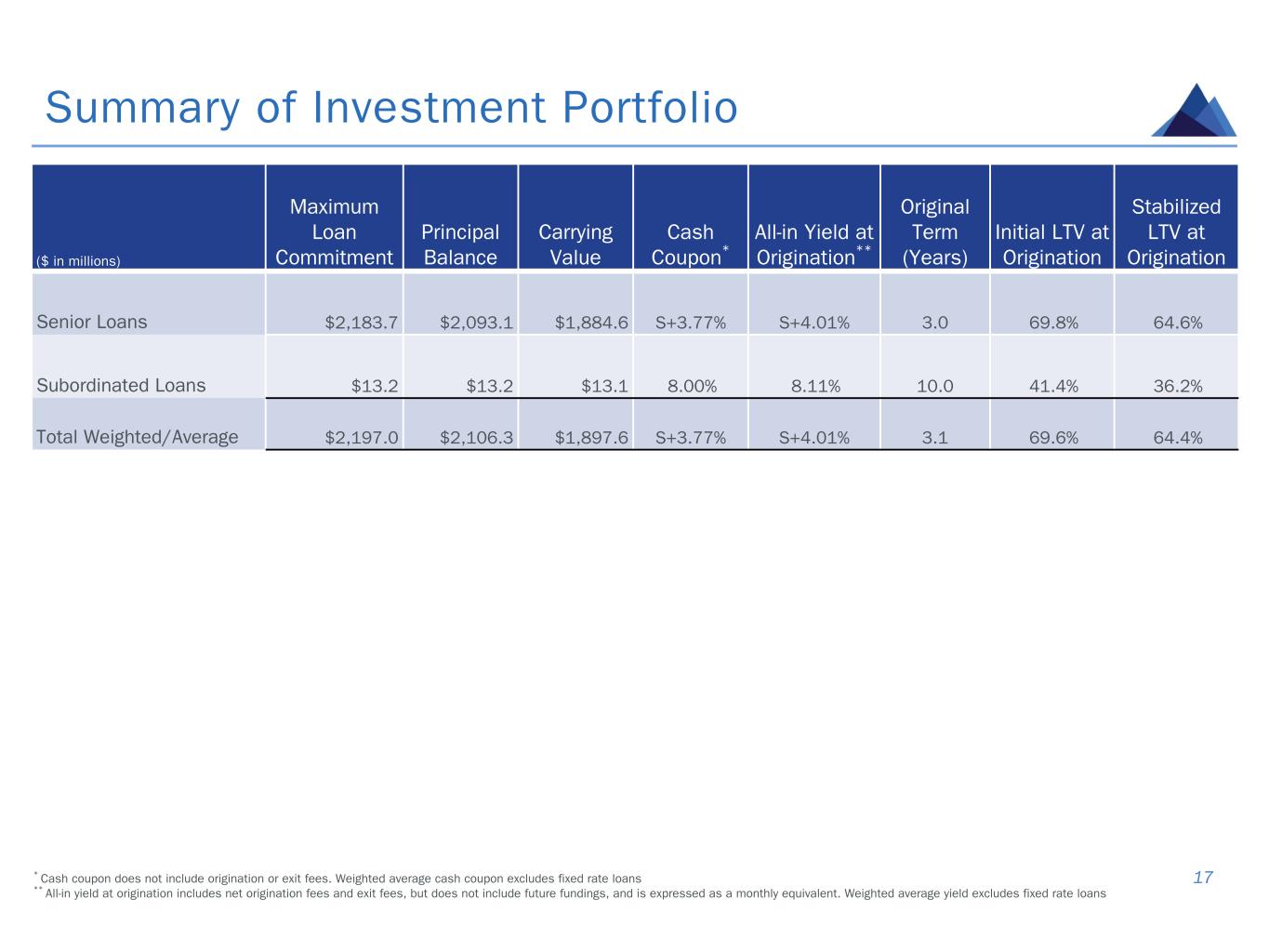

* Cash coupon does not include origination or exit fees. Weighted average cash coupon excludes fixed rate loans ** All-in yield at origination includes net origination fees and exit fees, but does not include future fundings, and is expressed as a monthly equivalent. Weighted average yield excludes fixed rate loans Summary of Investment Portfolio 17 ($ in millions) Maximum Loan Commitment Principal Balance Carrying Value Cash Coupon* All-in Yield at Origination** Original Term (Years) Initial LTV at Origination Stabilized LTV at Origination Senior Loans $2,183.7 $2,093.1 $1,884.6 S+3.77% S+4.01% 3.0 69.8% 64.6% Subordinated Loans $13.2 $13.2 $13.1 8.00% 8.11% 10.0 41.4% 36.2% Total Weighted/Average $2,197.0 $2,106.3 $1,897.6 S+3.77% S+4.01% 3.1 69.6% 64.4%

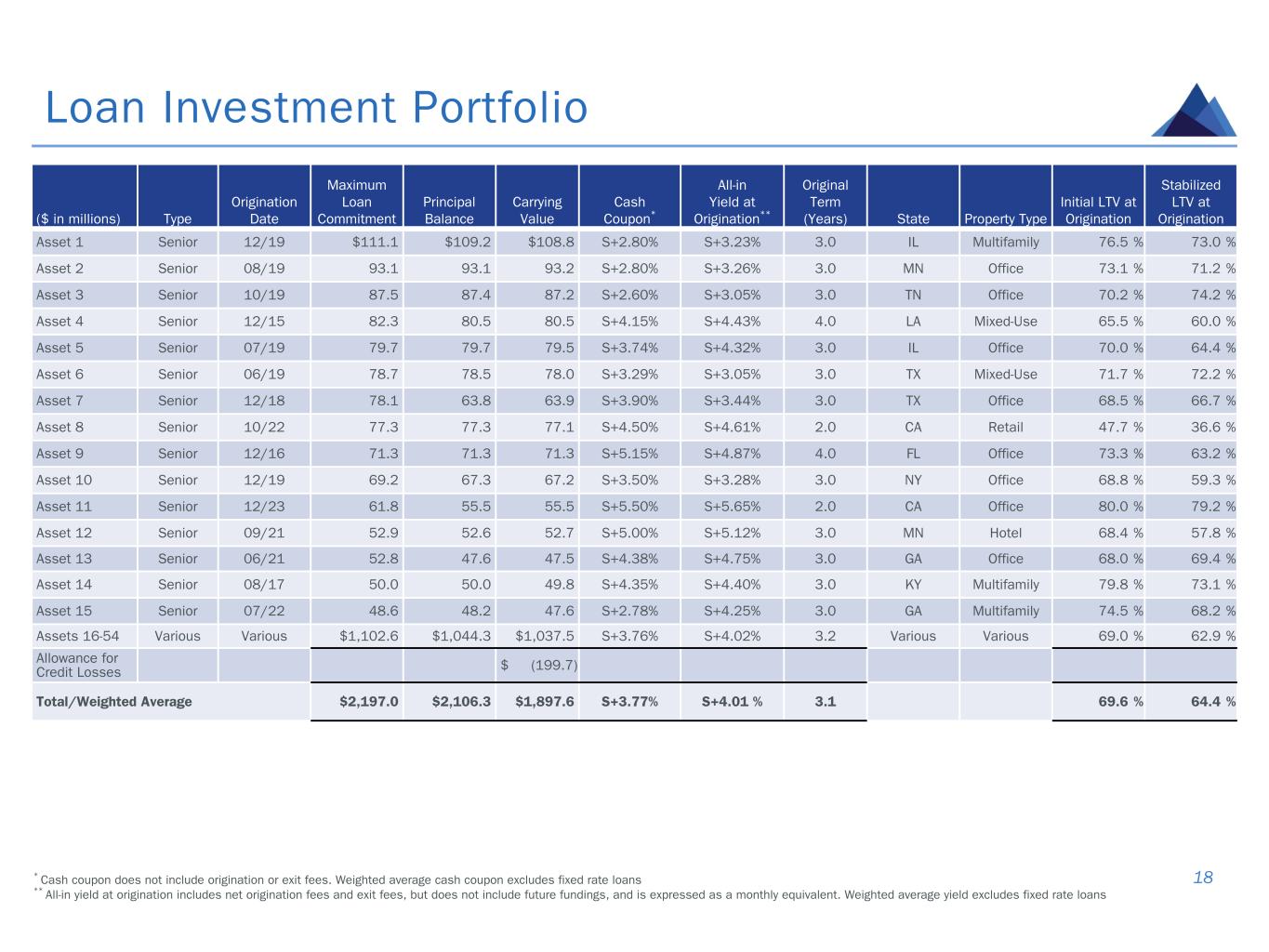

Loan Investment Portfolio 18 ($ in millions) Type Origination Date Maximum Loan Commitment Principal Balance Carrying Value Cash Coupon* All-in Yield at Origination** Original Term (Years) State Property Type Initial LTV at Origination Stabilized LTV at Origination Asset 1 Senior 12/19 $111.1 $109.2 $108.8 S+2.80% S+3.23% 3.0 IL Multifamily 76.5 % 73.0 % Asset 2 Senior 08/19 93.1 93.1 93.2 S+2.80% S+3.26% 3.0 MN Office 73.1 % 71.2 % Asset 3 Senior 10/19 87.5 87.4 87.2 S+2.60% S+3.05% 3.0 TN Office 70.2 % 74.2 % Asset 4 Senior 12/15 82.3 80.5 80.5 S+4.15% S+4.43% 4.0 LA Mixed-Use 65.5 % 60.0 % Asset 5 Senior 07/19 79.7 79.7 79.5 S+3.74% S+4.32% 3.0 IL Office 70.0 % 64.4 % Asset 6 Senior 06/19 78.7 78.5 78.0 S+3.29% S+3.05% 3.0 TX Mixed-Use 71.7 % 72.2 % Asset 7 Senior 12/18 78.1 63.8 63.9 S+3.90% S+3.44% 3.0 TX Office 68.5 % 66.7 % Asset 8 Senior 10/22 77.3 77.3 77.1 S+4.50% S+4.61% 2.0 CA Retail 47.7 % 36.6 % Asset 9 Senior 12/16 71.3 71.3 71.3 S+5.15% S+4.87% 4.0 FL Office 73.3 % 63.2 % Asset 10 Senior 12/19 69.2 67.3 67.2 S+3.50% S+3.28% 3.0 NY Office 68.8 % 59.3 % Asset 11 Senior 12/23 61.8 55.5 55.5 S+5.50% S+5.65% 2.0 CA Office 80.0 % 79.2 % Asset 12 Senior 09/21 52.9 52.6 52.7 S+5.00% S+5.12% 3.0 MN Hotel 68.4 % 57.8 % Asset 13 Senior 06/21 52.8 47.6 47.5 S+4.38% S+4.75% 3.0 GA Office 68.0 % 69.4 % Asset 14 Senior 08/17 50.0 50.0 49.8 S+4.35% S+4.40% 3.0 KY Multifamily 79.8 % 73.1 % Asset 15 Senior 07/22 48.6 48.2 47.6 S+2.78% S+4.25% 3.0 GA Multifamily 74.5 % 68.2 % Assets 16-54 Various Various $1,102.6 $1,044.3 $1,037.5 S+3.76% S+4.02% 3.2 Various Various 69.0 % 62.9 % Allowance for Credit Losses $ (199.7) Total/Weighted Average $2,197.0 $2,106.3 $1,897.6 S+3.77% S+4.01 % 3.1 69.6 % 64.4 % * Cash coupon does not include origination or exit fees. Weighted average cash coupon excludes fixed rate loans ** All-in yield at origination includes net origination fees and exit fees, but does not include future fundings, and is expressed as a monthly equivalent. Weighted average yield excludes fixed rate loans

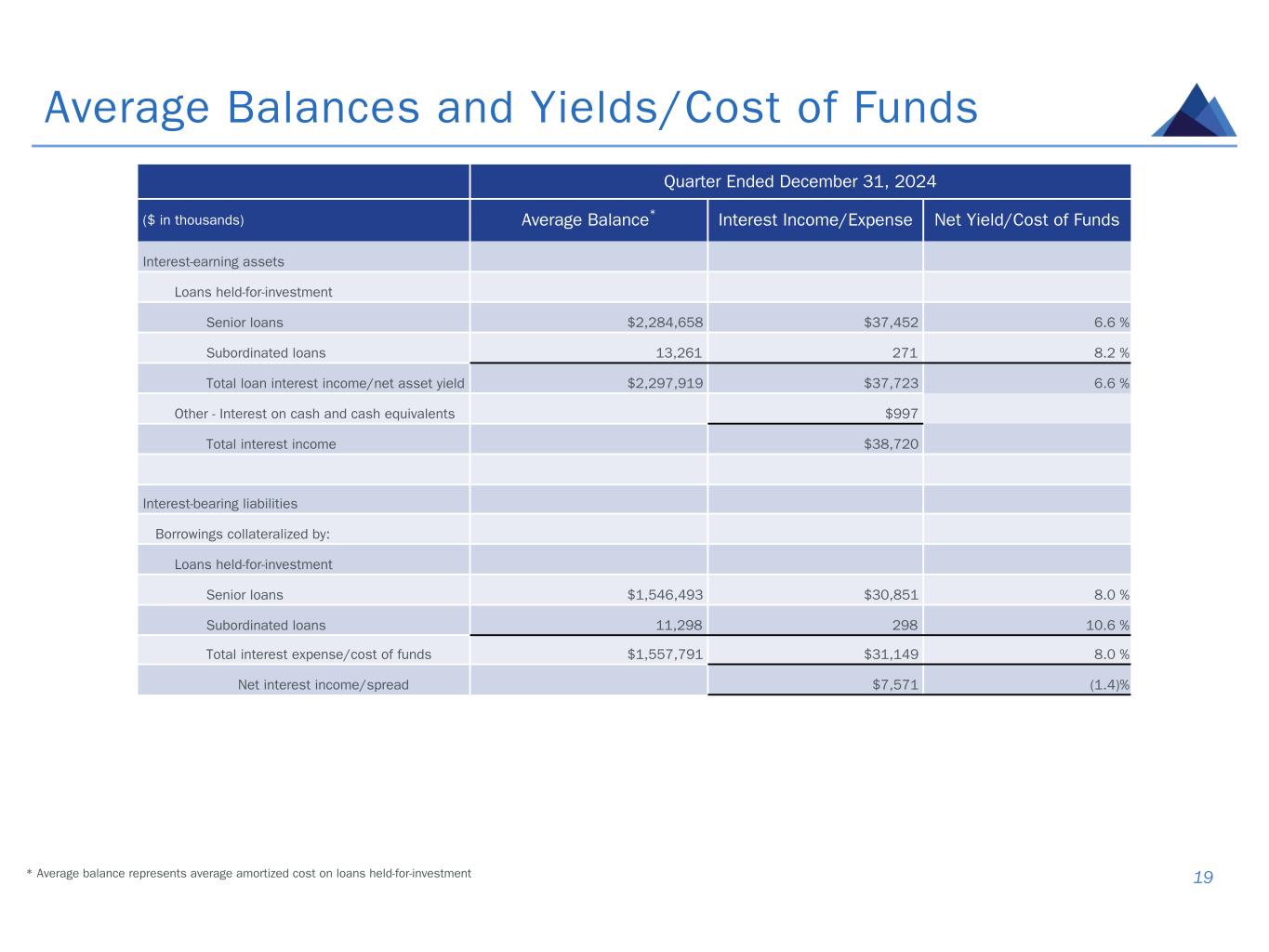

Average Balances and Yields/Cost of Funds 19 Quarter Ended December 31, 2024 ($ in thousands) Average Balance* Interest Income/Expense Net Yield/Cost of Funds Interest-earning assets Loans held-for-investment Senior loans $2,284,658 $37,452 6.6 % Subordinated loans 13,261 271 8.2 % Total loan interest income/net asset yield $2,297,919 $37,723 6.6 % Other - Interest on cash and cash equivalents $997 Total interest income $38,720 Interest-bearing liabilities Borrowings collateralized by: Loans held-for-investment Senior loans $1,546,493 $30,851 8.0 % Subordinated loans 11,298 298 10.6 % Total interest expense/cost of funds $1,557,791 $31,149 8.0 % Net interest income/spread $7,571 (1.4) % * Average balance represents average amortized cost on loans held-for-investment

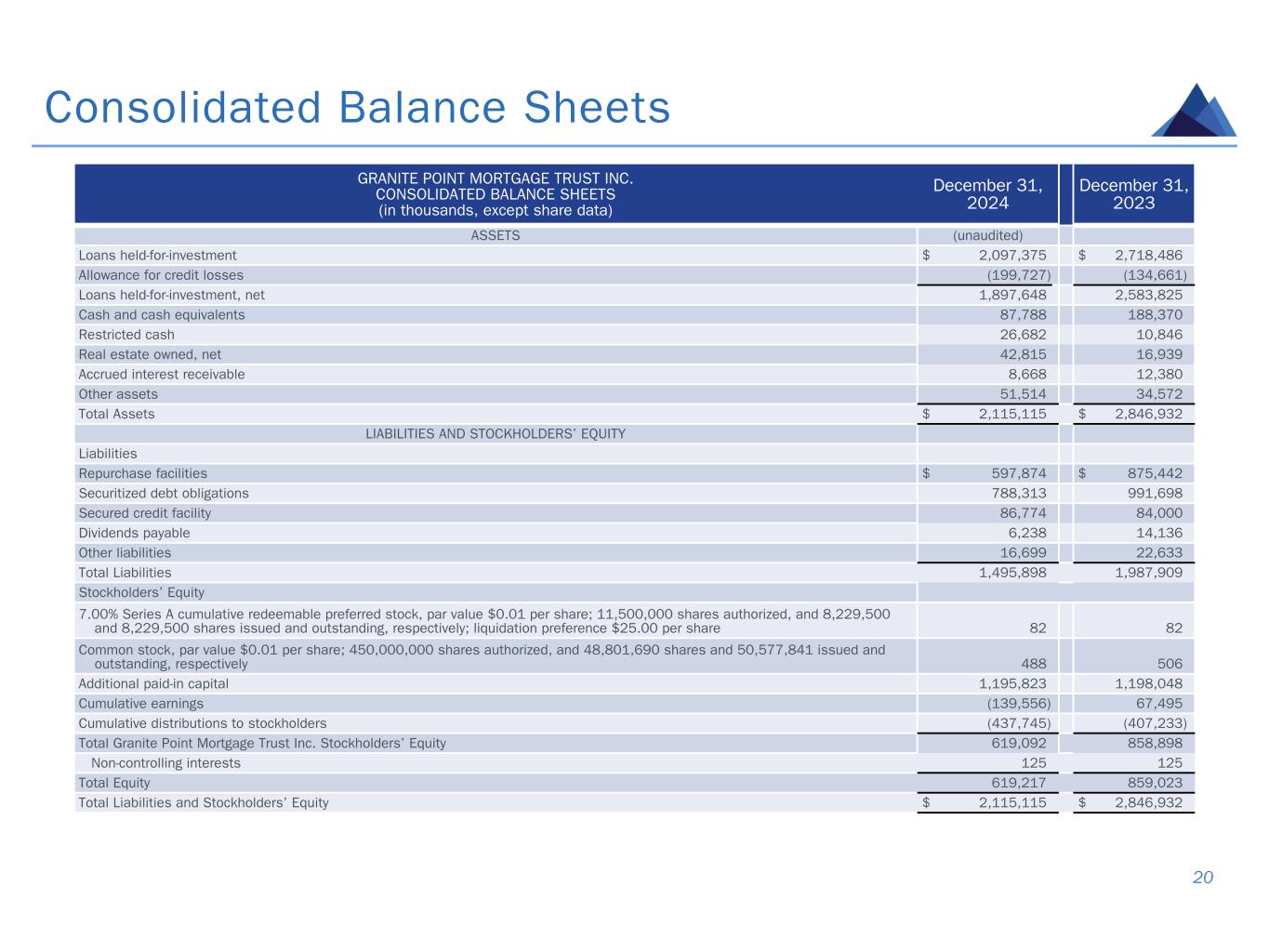

Consolidated Balance Sheets 20 GRANITE POINT MORTGAGE TRUST INC. CONSOLIDATED BALANCE SHEETS (in thousands, except share data) December 31, 2024 December 31, 2023 ASSETS (unaudited) Loans held-for-investment $ 2,097,375 $ 2,718,486 Allowance for credit losses (199,727) (134,661) Loans held-for-investment, net 1,897,648 2,583,825 Cash and cash equivalents 87,788 188,370 Restricted cash 26,682 10,846 Real estate owned, net 42,815 16,939 Accrued interest receivable 8,668 12,380 Other assets 51,514 34,572 Total Assets $ 2,115,115 $ 2,846,932 LIABILITIES AND STOCKHOLDERS’ EQUITY Liabilities Repurchase facilities $ 597,874 $ 875,442 Securitized debt obligations 788,313 991,698 Secured credit facility 86,774 84,000 Dividends payable 6,238 14,136 Other liabilities 16,699 22,633 Total Liabilities 1,495,898 1,987,909 Stockholders’ Equity 7.00% Series A cumulative redeemable preferred stock, par value $0.01 per share; 11,500,000 shares authorized, and 8,229,500 and 8,229,500 shares issued and outstanding, respectively; liquidation preference $25.00 per share 82 82 Common stock, par value $0.01 per share; 450,000,000 shares authorized, and 48,801,690 shares and 50,577,841 issued and outstanding, respectively 488 506 Additional paid-in capital 1,195,823 1,198,048 Cumulative earnings (139,556) 67,495 Cumulative distributions to stockholders (437,745) ) (407,233) Total Granite Point Mortgage Trust Inc. Stockholders’ Equity 619,092 858,898 Non-controlling interests 125 125 Total Equity 619,217 859,023 Total Liabilities and Stockholders’ Equity $ 2,115,115 $ 2,846,932

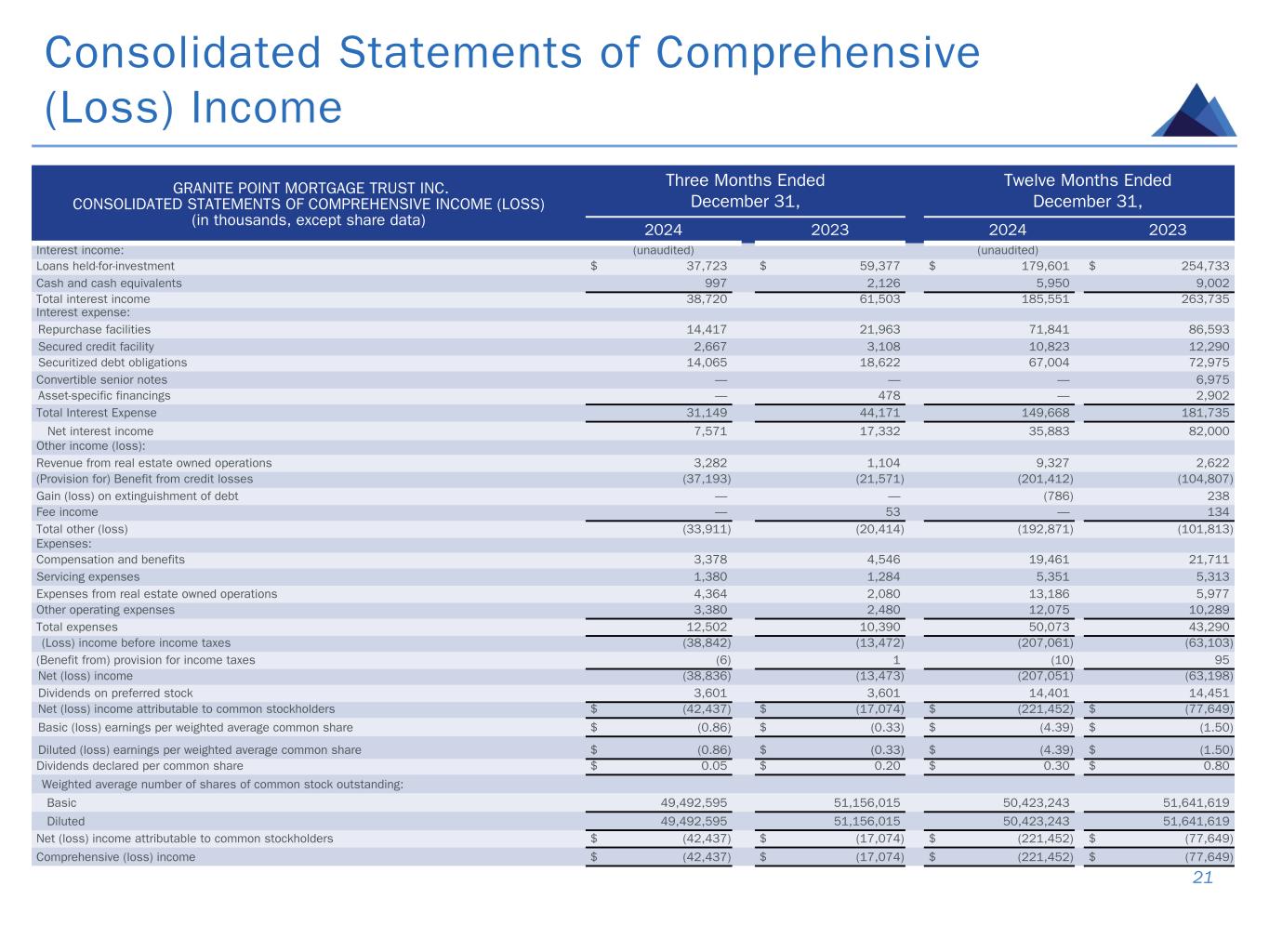

Consolidated Statements of Comprehensive (Loss) Income 21 GRANITE POINT MORTGAGE TRUST INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (in thousands, except share data) Three Months Ended December 31, Twelve Months Ended December 31, 2024 2023 2024 2023 Interest income: (unaudited) (unaudited) Loans held-for-investment $ 37,723 $ 59,377 $ 179,601 $ 254,733 Cash and cash equivalents 997 2,126 5,950 9,002 Total interest income 38,720 61,503 185,551 263,735 Interest expense: Repurchase facilities 14,417 21,963 71,841 86,593 Secured credit facility 2,667 3,108 10,823 12,290 Securitized debt obligations 14,065 18,622 67,004 72,975 Convertible senior notes — — — 6,975 Asset-specific financings — 478 — 2,902 Total Interest Expense 31,149 44,171 149,668 181,735 Net interest income 7,571 17,332 35,883 82,000 Other income (loss): Revenue from real estate owned operations 3,282 1,104 9,327 2,622 (Provision for) Benefit from credit losses (37,193) (21,571) (201,412) (104,807) Gain (loss) on extinguishment of debt — — (786) 238 Fee income — 53 — 134 Total other (loss) (33,911) (20,414) (192,871) (101,813) Expenses: Compensation and benefits 3,378 4,546 19,461 21,711 Servicing expenses 1,380 1,284 5,351 5,313 Expenses from real estate owned operations 4,364 2,080 13,186 5,977 Other operating expenses 3,380 2,480 12,075 10,289 Total expenses 12,502 10,390 50,073 43,290 (Loss) income before income taxes (38,842) (13,472) (207,061) (63,103) (Benefit from) provision for income taxes (6) 1 (10) 95 Net (loss) income (38,836) (13,473) (207,051) (63,198) Dividends on preferred stock 3,601 3,601 14,401 14,451 Net (loss) income attributable to common stockholders $ (42,437) $ (17,074) $ (221,452) $ (77,649) Basic (loss) earnings per weighted average common share $ (0.86) $ (0.33) $ (4.39) $ (1.50) Diluted (loss) earnings per weighted average common share $ (0.86) $ (0.33) $ (4.39) $ (1.50) Dividends declared per common share $ 0.05 $ 0.20 $ 0.30 $ 0.80 Weighted average number of shares of common stock outstanding: Basic 49,492,595 51,156,015 50,423,243 51,641,619 Diluted 49,492,595 51,156,015 50,423,243 51,641,619 Net (loss) income attributable to common stockholders $ (42,437) $ (17,074) $ (221,452) $ (77,649) Comprehensive (loss) income $ (42,437) $ (17,074) $ (221,452) $ (77,649)

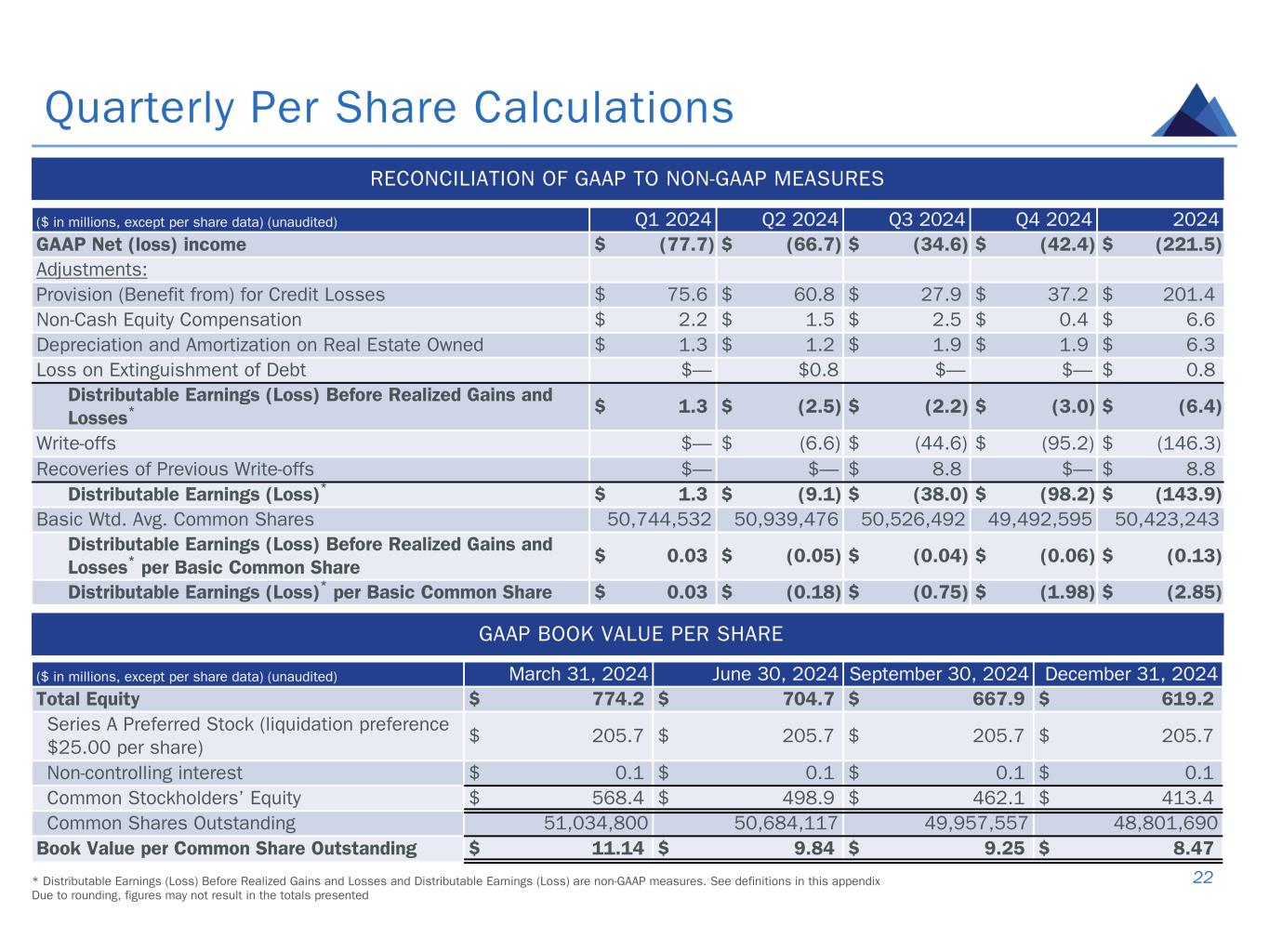

Quarterly Per Share Calculations 22 ($ in millions, except per share data) (unaudited) Q1 2024 Q2 2024 Q3 2024 Q4 2024 2024 GAAP Net (loss) income $ (77.7) $ (66.7) $ (34.6) $ (42.4) $ (221.5) Adjustments: Provision (Benefit from) for Credit Losses $ 75.6 $ 60.8 $ 27.9 $ 37.2 $ 201.4 Non-Cash Equity Compensation $ 2.2 $ 1.5 $ 2.5 $ 0.4 $ 6.6 Depreciation and Amortization on Real Estate Owned $ 1.3 $ 1.2 $ 1.9 $ 1.9 $ 6.3 Loss on Extinguishment of Debt $— $0.8 $— $— $ 0.8 Distributable Earnings (Loss) Before Realized Gains and Losses* $ 1.3 $ (2.5) $ (2.2) $ (3.0) $ (6.4) Write-offs $— $ (6.6) $ (44.6) $ (95.2) $ (146.3) Recoveries of Previous Write-offs $— $— $ 8.8 $— $ 8.8 Distributable Earnings (Loss)* $ 1.3 $ (9.1) $ (38.0) $ (98.2) $ (143.9) Basic Wtd. Avg. Common Shares 50,744,532 50,939,476 50,526,492 49,492,595 50,423,243 Distributable Earnings (Loss) Before Realized Gains and Losses* per Basic Common Share $ 0.03 $ (0.05) $ (0.04) $ (0.06) $ (0.13) Distributable Earnings (Loss)* per Basic Common Share $ 0.03 $ (0.18) $ (0.75) $ (1.98) $ (2.85) * Distributable Earnings (Loss) Before Realized Gains and Losses and Distributable Earnings (Loss) are non-GAAP measures. See definitions in this appendix Due to rounding, figures may not result in the totals presented GAAP BOOK VALUE PER SHARE ($ in millions, except per share data) (unaudited) March 31, 2024 June 30, 2024 September 30, 2024 December 31, 2024 Total Equity $ 774.2 $ 704.7 $ 667.9 $ 619.2 Series A Preferred Stock (liquidation preference $25.00 per share) $ 205.7 $ 205.7 $ 205.7 $ 205.7 Non-controlling interest $ 0.1 $ 0.1 $ 0.1 $ 0.1 Common Stockholders’ Equity $ 568.4 $ 498.9 $ 462.1 $ 413.4 Common Shares Outstanding 51,034,800 50,684,117 49,957,557 48,801,690 Book Value per Common Share Outstanding $ 11.14 $ 9.84 $ 9.25 $ 8.47 RECONCILIATION OF GAAP TO NON-GAAP MEASURES

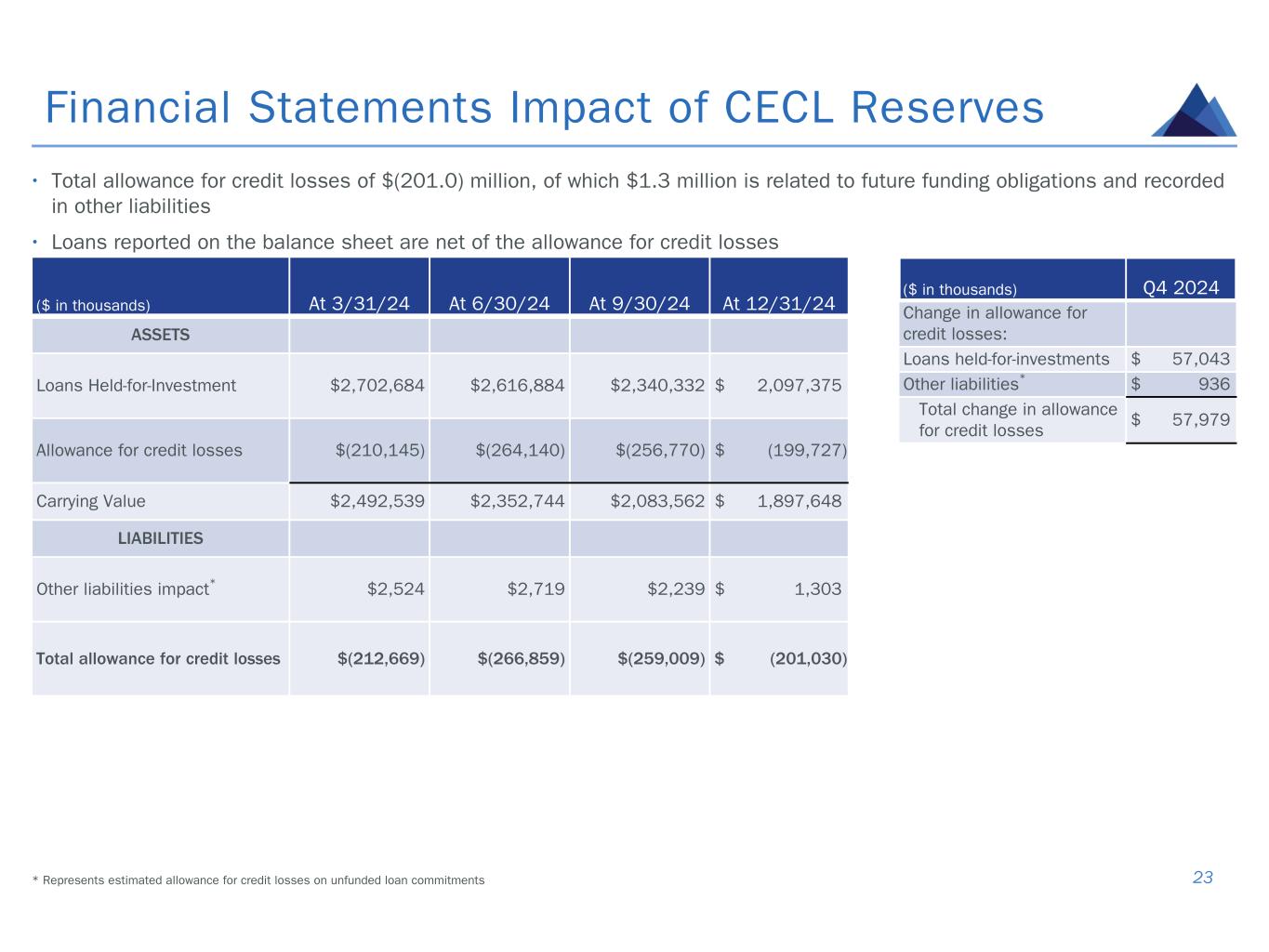

($ in thousands) At 3/31/24 At 6/30/24 At 9/30/24 At 12/31/24 ASSETS Loans Held-for-Investment $2,702,684 $2,616,884 $2,340,332 $ 2,097,375 Allowance for credit losses $(210,145) $(264,140) $(256,770) $ (199,727) Carrying Value $2,492,539 $2,352,744 $2,083,562 $ 1,897,648 LIABILITIES Other liabilities impact* $2,524 $2,719 $2,239 $ 1,303 Total allowance for credit losses $(212,669) $(266,859) $(259,009) $ (201,030) Financial Statements Impact of CECL Reserves 23 • Total allowance for credit losses of $(201.0) million, of which $1.3 million is related to future funding obligations and recorded in other liabilities • Loans reported on the balance sheet are net of the allowance for credit losses ($ in thousands) Q4 2024 Change in allowance for credit losses: Loans held-for-investments $ 57,043 Other liabilities* $ 936 Total change in allowance for credit losses $ 57,979 * Represents estimated allowance for credit losses on unfunded loan commitments

▪ Beginning with our Annual Report on Form 10-K for the year ended December 31, 2023, and for all subsequent reporting periods ending on or after December 31, 2023, we have elected to present Distributable Earnings (Loss), a non-GAAP measure, as a supplemental method of evaluating our operating performance. In order to maintain our status as a REIT, we are required to distribute at least 90% of our taxable income to stockholders, subject to certain distribution requirements. Distributable Earnings (Loss) is intended to over time serve as a general, though imperfect, proxy for our taxable income. As such, Distributable Earnings (Loss) is considered a key indicator of our ability to generate sufficient income to pay dividends on our common stock, which is the primary focus of income-oriented investors who comprise a meaningful segment of our stockholder base. We believe providing Distributable Earnings (Loss) on a supplemental basis to our net income (loss) and cash flow from operating activities, as determined in accordance with GAAP, is helpful to stockholders in assessing the overall operating performance of our business. ▪ For reporting purposes, we define Distributable Earnings (Loss) as net income (loss) attributable to our stockholders, computed in accordance with GAAP, excluding: (i) non-cash equity compensation expenses; (ii) depreciation and amortization; (iii) any unrealized gains (losses) or other similar non-cash items that are included in net income (loss) for the applicable reporting period (regardless of whether such items are included in other comprehensive income or in net income (loss) for such period); and (iv) certain non-cash items and one- time expenses. Distributable Earnings (Loss) may also be adjusted from time to time for reporting purposes to exclude one-time events pursuant to changes in GAAP and certain other material non-cash income or expense items approved by a majority of our independent directors. The exclusion of depreciation and amortization from the calculation of Distributable Earnings (Loss) only applies to debt investments related to real estate to the extent we foreclose upon the property or properties underlying such debt investments. Distributable Earnings (Loss) 24

▪ While Distributable Earnings (Loss) excludes the impact of the unrealized non-cash current provision for credit losses, we expect to only recognize such potential credit losses in Distributable Earnings (Loss) if and when such amounts are deemed non-recoverable. This is generally at the time a loan is repaid, or in the case of foreclosure, when the underlying asset is sold, but nonrecoverability may also be concluded if, in our determination, it is nearly certain that all amounts due will not be collected. The realized loss amount reflected in Distributable Earnings (Loss) will equal the difference between the cash received, or expected to be received, and the carrying value of the asset, and is reflective of our economic experience as it relates to the ultimate realization of the loan. During the three and twelve months ended December 31, 2024, we recorded provision for credit losses of $37.2 million and $201.4 million, respectively, which has been excluded from Distributable Earnings (Loss), consistent with other unrealized gains (losses) and other non-cash items pursuant to our existing policy for reporting Distributable earnings (Loss) referenced on slide 22. During the three and twelve months ended December 31, 2024, we recorded $1.9 million and $6.3 million, respectively, in depreciation and amortization on REO and related intangibles, which has been excluded from Distributable Earnings (loss) consistent with other unrealized gains (losses) and other non-cash items pursuant to our existing policy for reporting Distributable Earnings (Loss) referenced on slide 22. ▪ Distributable Earnings (Loss) does not represent Net (loss) income attributable to common stockholders or cash flow from operating activities and should not be considered as an alternative to GAAP Net (loss) income attributable to common stockholders, or an indication of our GAAP cash flows from operations, a measure of our liquidity, or an indication of funds available for our cash needs. In addition, our methodology for calculating Distributable Earnings (Loss) may differ from the methodologies employed by other companies to calculate the same or similar supplemental performance measures, and, accordingly, our reported Distributable Earnings (Loss) may not be comparable to the Distributable Earnings (loss) reported by other companies. ▪ We believe it is useful to our stockholders to present Distributable Earnings (Loss) Before Realized Gains and Losses, a non-GAAP measure, to reflect our run-rate operating results as (i) our operating results are mainly comprised of net interest income earned on our loan investments net of our operating expenses, which comprise our ongoing operations, (ii) it helps our stockholders in assessing the overall run-rate operating performance of our business, and (iii) it has been a useful reference related to our common dividend as it is one of the factors we and our Board of Directors consider when declaring the dividend. We believe that our stockholders use Distributable Earnings (Loss) and Distributable Earnings (Loss) Before Realized Gains and Losses, or a comparable supplemental performance measure, to evaluate and compare the performance of our company and our peers. Distributable Earnings (Loss) (cont’d) 25

Other Definitions 26 Realized Loan Portfolio Yield ▪ Provided for illustrative purposes only. Calculations of realized loan portfolio yield are based on a number of assumptions (some or all of which may not occur) and are expressed as monthly equivalent yields that include net origination fees and exit fees and exclude future fundings and any potential or completed loan amendments or modifications Fundings ▪ Increases in a loan’s principal balance, including new originations, fundings on loan commitments, upsizings, capitalized deferred interest, paid-in-kind (PIK) interest and short-sales with loan assumptions Net (loss) Attributable to Common Stockholders ▪ GAAP net (loss) attributable to our common stockholders after deducting dividends attributable to our cumulative redeemable preferred stock Initial LTV at Origination ▪ The initial loan amount (plus any financing that is pari passu with or senior to such loan) divided by the as is appraised value (as determined in conformance with USPAP) as of the date the loan was originated set forth in the original appraisal Stabilized LTV at Origination ▪ The fully funded loan amount (plus any financing that is pari passu with or senior to such loan), including all contractually provided for future fundings, divided by the as stabilized value (as determined in conformance with USPAP) set forth in the original appraisal. As stabilized value may be based on certain assumptions, such as future construction completion, projected re-tenanting, payment of tenant improvement or leasing commissions allowances or free or abated rent periods, or increased tenant occupancies Non-MTM ▪ Non-mark-to-market Original Term (Years) ▪ The term of the loan through the initial maturity date at origination. Does not include any extension options and has not been updated to reflect any subsequent extensions or modifications, if applicable Recourse Leverage Ratio ▪ Borrowings outstanding on repurchase facilities and secured credit facility, less cash, divided by total stockholders’ equity

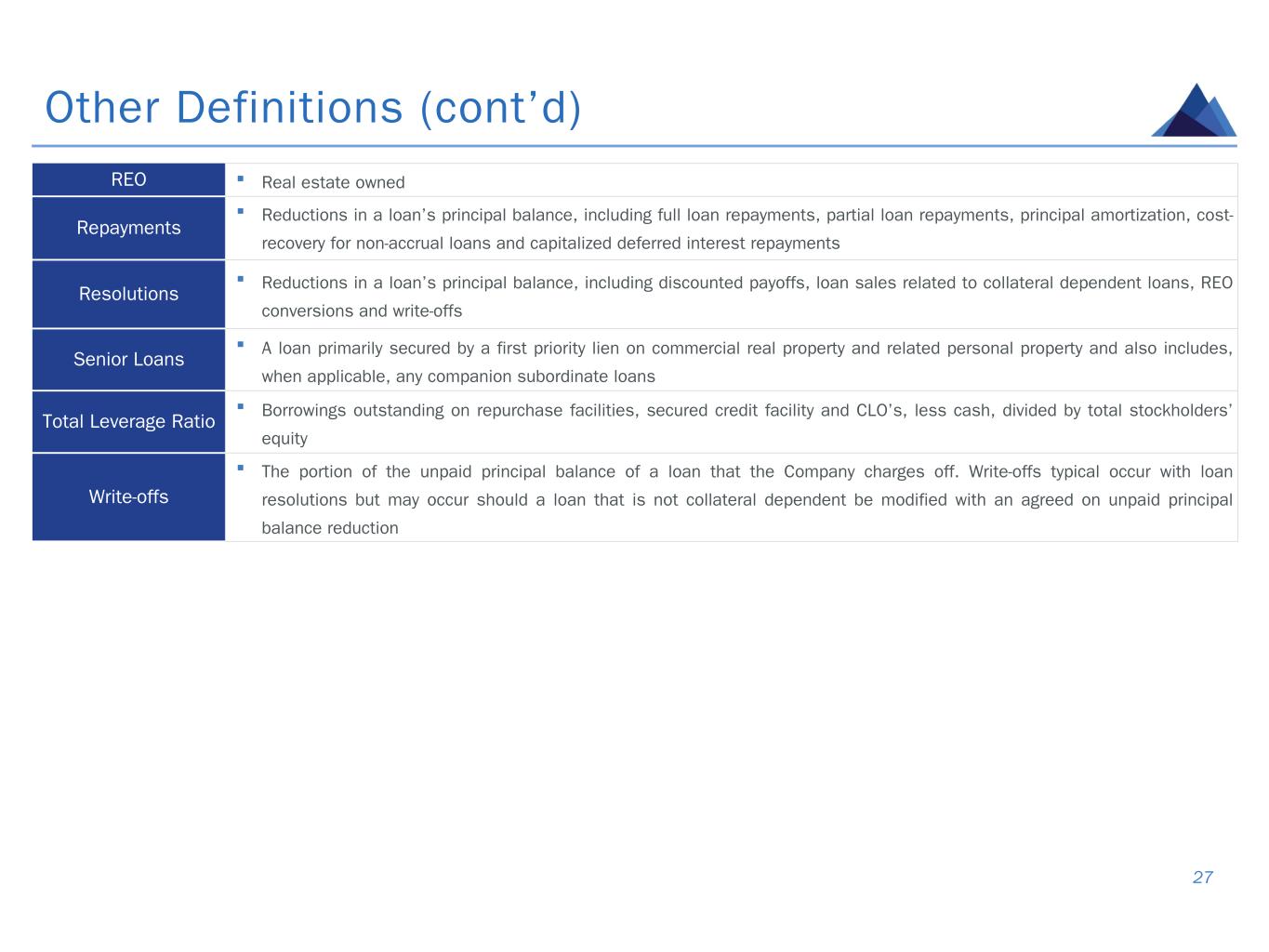

Other Definitions (cont’d) 27 REO ▪ Real estate owned Repayments ▪ Reductions in a loan’s principal balance, including full loan repayments, partial loan repayments, principal amortization, cost- recovery for non-accrual loans and capitalized deferred interest repayments Resolutions ▪ Reductions in a loan’s principal balance, including discounted payoffs, loan sales related to collateral dependent loans, REO conversions and write-offs Senior Loans ▪ A loan primarily secured by a first priority lien on commercial real property and related personal property and also includes, when applicable, any companion subordinate loans Total Leverage Ratio ▪ Borrowings outstanding on repurchase facilities, secured credit facility and CLO’s, less cash, divided by total stockholders’ equity Write-offs ▪ The portion of the unpaid principal balance of a loan that the Company charges off. Write-offs typical occur with loan resolutions but may occur should a loan that is not collateral dependent be modified with an agreed on unpaid principal balance reduction

Company Information 28 Granite Point Mortgage Trust Inc. is an internally-managed real estate finance company that focuses primarily on directly originating, investing in and managing senior floating rate commercial mortgage loans and other debt and debt-like commercial real estate investments. Granite Point was incorporated in Maryland on April 7, 2017, and has elected to be treated as a real estate investment trust for U.S. federal income tax purposes. For more information regarding Granite Point, visit www.gpmtreit.com Contact Information: Corporate Headquarters: 3 Bryant Park, 24th Floor New York, NY 10036 212-364-5500 New York Stock Exchange: Symbol: GPMT Investor Relations: Chris Petta Investor Relations 212-364-5500 Investors@gpmtreit.com Transfer Agent: Equiniti Trust Company P.0. Box 64856 St. Paul, MN 55164-0856 800-468-9716 www.shareowneronline.com JMP Securities Steven DeLaney (212) 906-3517 Keefe, Bruyette & Woods Jade Rahmani (212) 887-3882 Raymond James Stephen Laws (901) 579-4868 UBS Doug Harter (212) 882-0080 Analyst Coverage:* *No report of any analyst is incorporated by reference herein and any such report represents the sole views of such analyst