000170364412/312022Q2FALSE3 Bryant ParkSuite 2400A0.05199430.0500894349.300017036442022-01-012022-06-300001703644us-gaap:CommonStockMember2022-01-012022-06-300001703644us-gaap:SeriesAPreferredStockMember2022-01-012022-06-3000017036442022-08-04xbrli:shares00017036442022-06-30iso4217:USD00017036442021-12-310001703644us-gaap:CumulativePreferredStockMember2021-01-012021-12-31xbrli:pure0001703644us-gaap:CumulativePreferredStockMember2022-01-012022-06-300001703644us-gaap:CumulativePreferredStockMember2022-06-30iso4217:USDxbrli:shares0001703644us-gaap:CumulativePreferredStockMember2021-12-310001703644us-gaap:SeriesAPreferredStockMember2021-01-012021-12-310001703644us-gaap:SeriesAPreferredStockMember2021-12-310001703644us-gaap:SeriesAPreferredStockMember2022-06-300001703644us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-06-300001703644us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-3100017036442022-04-012022-06-3000017036442021-04-012021-06-3000017036442021-01-012021-06-300001703644us-gaap:CommonStockMember2020-12-310001703644us-gaap:PreferredStockMember2020-12-310001703644us-gaap:AdditionalPaidInCapitalMember2020-12-310001703644us-gaap:RetainedEarningsMember2020-12-310001703644us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2020-12-310001703644us-gaap:ParentMember2020-12-310001703644us-gaap:NoncontrollingInterestMember2020-12-3100017036442020-12-310001703644us-gaap:RetainedEarningsMember2021-01-012021-03-310001703644us-gaap:ParentMember2021-01-012021-03-3100017036442021-01-012021-03-310001703644us-gaap:CommonStockMember2021-01-012021-03-310001703644us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-310001703644us-gaap:CumulativePreferredStockMember2021-01-012021-03-310001703644us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2021-01-012021-03-310001703644us-gaap:NoncontrollingInterestMember2021-01-012021-03-310001703644us-gaap:CommonStockMember2021-03-310001703644us-gaap:PreferredStockMember2021-03-310001703644us-gaap:AdditionalPaidInCapitalMember2021-03-310001703644us-gaap:RetainedEarningsMember2021-03-310001703644us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2021-03-310001703644us-gaap:ParentMember2021-03-310001703644us-gaap:NoncontrollingInterestMember2021-03-3100017036442021-03-310001703644us-gaap:RetainedEarningsMember2021-04-012021-06-300001703644us-gaap:ParentMember2021-04-012021-06-300001703644us-gaap:CommonStockMember2021-04-012021-06-300001703644us-gaap:AdditionalPaidInCapitalMember2021-04-012021-06-300001703644us-gaap:CumulativePreferredStockMember2021-04-012021-06-300001703644us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2021-04-012021-06-300001703644us-gaap:CommonStockMember2021-06-300001703644us-gaap:PreferredStockMember2021-06-300001703644us-gaap:AdditionalPaidInCapitalMember2021-06-300001703644us-gaap:RetainedEarningsMember2021-06-300001703644us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2021-06-300001703644us-gaap:ParentMember2021-06-300001703644us-gaap:NoncontrollingInterestMember2021-06-3000017036442021-06-300001703644us-gaap:CommonStockMember2021-12-310001703644us-gaap:PreferredStockMember2021-12-310001703644us-gaap:AdditionalPaidInCapitalMember2021-12-310001703644us-gaap:RetainedEarningsMember2021-12-310001703644us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2021-12-310001703644us-gaap:ParentMember2021-12-310001703644us-gaap:NoncontrollingInterestMember2021-12-310001703644us-gaap:RetainedEarningsMember2022-01-012022-03-310001703644us-gaap:ParentMember2022-01-012022-03-3100017036442022-01-012022-03-310001703644us-gaap:PreferredStockMember2022-01-012022-03-310001703644us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310001703644us-gaap:CommonStockMember2022-01-012022-03-310001703644us-gaap:CumulativePreferredStockMember2022-01-012022-03-310001703644us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMemberus-gaap:CumulativePreferredStockMember2022-01-012022-03-310001703644us-gaap:ParentMemberus-gaap:CumulativePreferredStockMember2022-01-012022-03-310001703644us-gaap:SeriesAPreferredStockMember2022-01-012022-03-310001703644us-gaap:SeriesAPreferredStockMemberus-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2022-01-012022-03-310001703644us-gaap:SeriesAPreferredStockMemberus-gaap:ParentMember2022-01-012022-03-310001703644us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2022-01-012022-03-310001703644us-gaap:CommonStockMember2022-03-310001703644us-gaap:PreferredStockMember2022-03-310001703644us-gaap:AdditionalPaidInCapitalMember2022-03-310001703644us-gaap:RetainedEarningsMember2022-03-310001703644us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2022-03-310001703644us-gaap:ParentMember2022-03-310001703644us-gaap:NoncontrollingInterestMember2022-03-3100017036442022-03-310001703644us-gaap:RetainedEarningsMember2022-04-012022-06-300001703644us-gaap:ParentMember2022-04-012022-06-300001703644us-gaap:CommonStockMember2022-04-012022-06-300001703644us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001703644us-gaap:CumulativePreferredStockMember2022-04-012022-06-300001703644us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMemberus-gaap:CumulativePreferredStockMember2022-04-012022-06-300001703644us-gaap:ParentMemberus-gaap:CumulativePreferredStockMember2022-04-012022-06-300001703644us-gaap:SeriesAPreferredStockMember2022-04-012022-06-300001703644us-gaap:SeriesAPreferredStockMemberus-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2022-04-012022-06-300001703644us-gaap:SeriesAPreferredStockMemberus-gaap:ParentMember2022-04-012022-06-300001703644us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2022-04-012022-06-300001703644us-gaap:CommonStockMember2022-06-300001703644us-gaap:PreferredStockMember2022-06-300001703644us-gaap:AdditionalPaidInCapitalMember2022-06-300001703644us-gaap:RetainedEarningsMember2022-06-300001703644us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2022-06-300001703644us-gaap:ParentMember2022-06-300001703644us-gaap:NoncontrollingInterestMember2022-06-30gpmt:segment0001703644us-gaap:FirstMortgageMember2022-06-300001703644us-gaap:SecondMortgageMember2022-06-300001703644us-gaap:JuniorLoansMember2022-06-30gpmt:loan0001703644us-gaap:FirstMortgageMember2022-01-012022-06-300001703644us-gaap:SecondMortgageMember2022-01-012022-06-300001703644us-gaap:JuniorLoansMember2022-01-012022-06-300001703644us-gaap:FirstMortgageMember2021-12-310001703644us-gaap:SecondMortgageMember2021-12-310001703644us-gaap:JuniorLoansMember2021-12-310001703644us-gaap:FirstMortgageMember2021-01-012021-12-310001703644us-gaap:SecondMortgageMember2021-01-012021-12-310001703644us-gaap:JuniorLoansMember2021-01-012021-12-3100017036442021-01-012021-12-310001703644srt:OfficeBuildingMember2022-06-300001703644srt:OfficeBuildingMember2021-12-310001703644srt:MultifamilyMember2022-06-300001703644srt:MultifamilyMember2021-12-310001703644srt:HotelMember2022-06-300001703644srt:HotelMember2021-12-310001703644srt:RetailSiteMember2022-06-300001703644srt:RetailSiteMember2021-12-310001703644srt:IndustrialPropertyMember2022-06-300001703644srt:IndustrialPropertyMember2021-12-310001703644srt:OtherPropertyMember2022-06-300001703644srt:OtherPropertyMember2021-12-310001703644gpmt:UnitedStatesNortheasternRegionMember2022-06-300001703644gpmt:UnitedStatesNortheasternRegionMember2021-12-310001703644gpmt:UnitedStatesSouthwesternRegionMember2022-06-300001703644gpmt:UnitedStatesSouthwesternRegionMember2021-12-310001703644gpmt:UnitedStatesWesternRegionMember2022-06-300001703644gpmt:UnitedStatesWesternRegionMember2021-12-310001703644gpmt:UnitedStatesMidwesternRegionMember2022-06-300001703644gpmt:UnitedStatesMidwesternRegionMember2021-12-310001703644gpmt:UnitedStatesSoutheasternRegionMember2022-06-300001703644gpmt:UnitedStatesSoutheasternRegionMember2021-12-310001703644us-gaap:CollateralPledgedMember2022-06-300001703644us-gaap:CollateralPledgedMember2021-12-310001703644us-gaap:FairValueMeasurementsNonrecurringMembergpmt:RiskRating5Member2022-01-012022-06-300001703644us-gaap:FairValueMeasurementsNonrecurringMembergpmt:RiskRating5Member2022-06-300001703644us-gaap:OtherLiabilitiesMember2022-04-012022-06-300001703644gpmt:NonAccrualLoanMember2022-04-012022-06-300001703644gpmt:FirstMortgageLoanMember2022-06-300001703644gpmt:MinneapolisMNMember2022-06-300001703644gpmt:NonAccrualLoanMember2022-06-300001703644us-gaap:SeniorLoansMember2022-06-300001703644gpmt:RiskRating1Member2022-06-300001703644gpmt:RiskRating1Member2021-12-310001703644gpmt:RiskRating2Member2022-06-300001703644gpmt:RiskRating2Member2021-12-310001703644gpmt:RiskRating3Member2022-06-300001703644gpmt:RiskRating3Member2021-12-310001703644gpmt:RiskRating4Member2022-06-300001703644gpmt:RiskRating4Member2021-12-310001703644gpmt:RiskRating5Member2022-06-300001703644gpmt:RiskRating5Member2021-12-310001703644us-gaap:LoansReceivableMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-06-300001703644us-gaap:LoansReceivableMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-310001703644gpmt:FinancingReceivableAllowanceforCreditLossMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-06-300001703644gpmt:FinancingReceivableAllowanceforCreditLossMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-310001703644gpmt:LoansReceivableNetMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-06-300001703644gpmt:LoansReceivableNetMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-310001703644gpmt:RestrictedCashAndCashEquivalentsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-06-300001703644gpmt:RestrictedCashAndCashEquivalentsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-310001703644us-gaap:OtherAssetsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-06-300001703644us-gaap:OtherAssetsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-310001703644us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberus-gaap:BorrowingsMember2022-06-300001703644us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberus-gaap:BorrowingsMember2021-12-310001703644us-gaap:OtherLiabilitiesMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-06-300001703644us-gaap:OtherLiabilitiesMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-310001703644gpmt:CollateralAssetsMembergpmt:GPMT2018FL1CRECLOMember2022-04-222022-04-220001703644gpmt:CollateralAssetsMembergpmt:GPMT2018FL1CRECLOMember2022-04-220001703644gpmt:CollateralAssetsMembergpmt:GPMT2021FL4CRECLOMember2022-06-300001703644gpmt:CollateralAssetsMembergpmt:GPMT2021FL4CRECLOMember2021-12-310001703644gpmt:GPMT2021FL4CRECLOMembergpmt:FinancingProvidedMember2022-06-300001703644gpmt:GPMT2021FL4CRECLOMembergpmt:FinancingProvidedMember2021-12-310001703644gpmt:GPMT2021FL3CRECLOMembergpmt:CollateralAssetsMember2022-06-300001703644gpmt:GPMT2021FL3CRECLOMembergpmt:CollateralAssetsMember2021-12-310001703644gpmt:GPMT2021FL3CRECLOMembergpmt:FinancingProvidedMember2022-06-300001703644gpmt:GPMT2021FL3CRECLOMembergpmt:FinancingProvidedMember2021-12-310001703644gpmt:CollateralAssetsMembergpmt:GPMT2019FL2CRECLOMember2022-06-300001703644gpmt:CollateralAssetsMembergpmt:GPMT2019FL2CRECLOMember2021-12-310001703644gpmt:GPMT2019FL2CRECLOMembergpmt:FinancingProvidedMember2022-06-300001703644gpmt:GPMT2019FL2CRECLOMembergpmt:FinancingProvidedMember2021-12-310001703644gpmt:CollateralAssetsMembergpmt:GPMT2018FL1CRECLOMember2022-06-300001703644gpmt:CollateralAssetsMembergpmt:GPMT2018FL1CRECLOMember2021-12-310001703644gpmt:GPMT2018FL1CRECLOMembergpmt:FinancingProvidedMember2022-06-300001703644gpmt:GPMT2018FL1CRECLOMembergpmt:FinancingProvidedMember2021-12-310001703644gpmt:CollateralAssetsMember2022-06-300001703644gpmt:CollateralAssetsMember2021-12-310001703644gpmt:FinancingProvidedMember2022-06-300001703644gpmt:FinancingProvidedMember2021-12-3100017036442022-04-222022-04-220001703644gpmt:LenderMorganStanleyBankMemberus-gaap:LoansReceivableMember2022-06-300001703644us-gaap:LoansReceivableMembergpmt:LenderGoldmanSachsBankMember2022-06-300001703644gpmt:LenderJPMorganChaseBankMemberus-gaap:LoansReceivableMember2022-06-300001703644gpmt:LenderCitibankMemberus-gaap:LoansReceivableMember2022-06-300001703644gpmt:LenderWellsFargoBankMemberus-gaap:LoansReceivableMember2022-06-300001703644gpmt:LenderCanadianImperialBankofCommerceMember2022-06-300001703644us-gaap:SecuredDebtMembergpmt:LenderCanadianImperialBankofCommerceMember2022-06-300001703644gpmt:LenderMorganStanleyBankMemberus-gaap:LoansReceivableMember2021-12-310001703644us-gaap:LoansReceivableMembergpmt:LenderGoldmanSachsBankMember2021-12-310001703644gpmt:LenderJPMorganChaseBankMemberus-gaap:LoansReceivableMember2021-12-310001703644gpmt:LenderCitibankMemberus-gaap:LoansReceivableMember2021-12-310001703644gpmt:LenderWellsFargoBankMemberus-gaap:LoansReceivableMember2021-12-310001703644gpmt:LenderCanadianImperialBankofCommerceMember2021-12-310001703644us-gaap:SecuredDebtMembergpmt:LenderCanadianImperialBankofCommerceMember2021-12-310001703644gpmt:LenderGoldmanSachsBankMember2021-12-310001703644us-gaap:RevolvingCreditFacilityMembergpmt:LenderGoldmanSachsBankMember2021-12-310001703644gpmt:MaturityWithinOneYearMember2022-06-300001703644gpmt:MaturityOneToTwoYearsMember2022-06-300001703644gpmt:MaturityTwoToThreeMember2022-06-300001703644gpmt:MaturityThreeToFourYearsMember2022-06-300001703644gpmt:LenderGoldmanSachsBankMember2022-06-300001703644gpmt:MaturityFourToFiveYearsMember2022-06-300001703644gpmt:MaturityOverFiveYearsMember2022-06-300001703644gpmt:MaturityWithinOneYearMember2021-12-310001703644gpmt:MaturityOneToTwoYearsMember2021-12-310001703644gpmt:MaturityTwoToThreeMember2021-12-310001703644gpmt:MaturityThreeToFourYearsMember2021-12-310001703644gpmt:MaturityFourToFiveYearsMember2021-12-310001703644gpmt:MaturityOverFiveYearsMember2021-12-310001703644gpmt:RepurchaseAgreementCounterpartyMorganStanleyBankMember2022-06-300001703644gpmt:RepurchaseAgreementCounterpartyMorganStanleyBankMember2022-01-012022-06-300001703644gpmt:RepurchaseAgreementCounterpartyMorganStanleyBankMember2021-12-310001703644gpmt:RepurchaseAgreementCounterpartyMorganStanleyBankMember2021-01-012021-12-310001703644gpmt:RepurchaseAgreementCounterpartyJPMorganChaseBankMember2022-06-300001703644gpmt:RepurchaseAgreementCounterpartyJPMorganChaseBankMember2022-01-012022-06-300001703644gpmt:RepurchaseAgreementCounterpartyJPMorganChaseBankMember2021-12-310001703644gpmt:RepurchaseAgreementCounterpartyJPMorganChaseBankMember2021-01-012021-12-310001703644gpmt:RepurchaseAgreementCounterpartyGoldmanSachsBankMember2022-06-300001703644gpmt:RepurchaseAgreementCounterpartyGoldmanSachsBankMember2022-01-012022-06-300001703644gpmt:RepurchaseAgreementCounterpartyGoldmanSachsBankMember2021-12-310001703644gpmt:RepurchaseAgreementCounterpartyGoldmanSachsBankMember2021-01-012021-12-310001703644gpmt:RepurchaseAgreementCounterpartyCitibankMember2022-06-300001703644gpmt:RepurchaseAgreementCounterpartyCitibankMember2022-01-012022-06-300001703644gpmt:RepurchaseAgreementCounterpartyCitibankMember2021-12-310001703644gpmt:RepurchaseAgreementCounterpartyCitibankMember2021-01-012021-12-310001703644gpmt:RepurchaseAgreementCounterpartyWellsFargoBankMember2022-06-300001703644gpmt:RepurchaseAgreementCounterpartyWellsFargoBankMember2022-01-012022-06-300001703644gpmt:RepurchaseAgreementCounterpartyWellsFargoBankMember2021-12-310001703644gpmt:RepurchaseAgreementCounterpartyWellsFargoBankMember2021-01-012021-12-310001703644srt:MaximumMember2022-06-300001703644srt:MinimumMember2022-06-300001703644us-gaap:PrivatePlacementMemberus-gaap:ConvertibleDebtMembergpmt:ConvertibleDebt2017IssuanceMember2017-12-310001703644us-gaap:OverAllotmentOptionMemberus-gaap:ConvertibleDebtMembergpmt:ConvertibleDebt2017IssuanceMember2018-01-310001703644gpmt:ConvertibleDebt2017IssuanceMember2018-01-012018-01-310001703644us-gaap:ConvertibleDebtMembergpmt:ConvertibleDebt2017IssuanceMember2017-12-310001703644gpmt:ConvertibleDebt2018IssuanceMemberus-gaap:PrivatePlacementMemberus-gaap:ConvertibleDebtMember2018-10-310001703644gpmt:ConvertibleDebt2018IssuanceMember2018-10-012018-10-310001703644gpmt:ConvertibleDebt2018IssuanceMemberus-gaap:ConvertibleDebtMember2018-10-310001703644us-gaap:ConvertibleDebtMember2022-06-300001703644us-gaap:ConvertibleDebtMember2021-12-310001703644gpmt:December2022ConvertibleSeniorNotesMember2022-06-300001703644gpmt:December2022ConvertibleSeniorNotesMember2021-12-310001703644gpmt:October2023ConvertibleSeniorNotesMember2022-06-300001703644gpmt:October2023ConvertibleSeniorNotesMember2021-12-310001703644gpmt:ConvertibleDebt2017IssuanceMember2022-01-012022-06-300001703644gpmt:ConvertibleDebt2018IssuanceMember2022-01-012022-06-300001703644gpmt:TermLoanMember2020-09-252020-09-250001703644gpmt:TermLoanMember2020-09-250001703644gpmt:TermLoanMember2020-09-2800017036442021-12-092021-12-090001703644gpmt:SeniorSecuredTermLoanFacilitiesMember2021-12-092021-12-0900017036442022-01-012022-02-160001703644gpmt:TermLoanMember2022-01-012022-02-160001703644gpmt:TermLoanMember2022-04-012022-06-3000017036442021-09-250001703644gpmt:TermLoanMember2021-09-250001703644gpmt:TermLoanMember2021-09-300001703644gpmt:TermLoanMember2021-09-302021-09-300001703644gpmt:TermLoanMember2021-10-040001703644gpmt:TermLoanMember2021-10-042021-10-040001703644gpmt:TermLoanMember2022-06-300001703644gpmt:TermLoanMember2021-12-310001703644gpmt:TermLoanMember2021-02-040001703644gpmt:RestrictedCashAndCashEquivalentsMember2022-06-300001703644gpmt:RestrictedCashAndCashEquivalentsMember2021-12-310001703644us-gaap:FairValueMeasurementsNonrecurringMembergpmt:LoanOneMembergpmt:RiskRating5Member2022-06-300001703644us-gaap:FairValueMeasurementsNonrecurringMembergpmt:RiskRating5Membergpmt:LoanTwoMember2022-06-300001703644us-gaap:UnfundedLoanCommitmentMember2022-06-300001703644us-gaap:SeriesAPreferredStockMember2021-11-302021-11-300001703644us-gaap:SeriesAPreferredStockMembergpmt:SubREITMember2021-01-310001703644us-gaap:SeriesAPreferredStockMember2021-01-310001703644us-gaap:SeriesAPreferredStockMembergpmt:SubREITMember2021-01-012021-01-310001703644gpmt:PublicOfferingMemberus-gaap:SeriesAPreferredStockMember2021-11-302021-11-300001703644gpmt:PublicOfferingMember2021-11-302021-11-300001703644us-gaap:OverAllotmentOptionMemberus-gaap:SeriesAPreferredStockMember2022-01-182022-02-080001703644us-gaap:SeriesAPreferredStockMember2021-11-300001703644us-gaap:SeriesAPreferredStockMember2021-11-302022-01-140001703644us-gaap:SeriesAPreferredStockMember2022-01-152022-04-150001703644us-gaap:CommonStockMember2022-06-162022-06-160001703644us-gaap:CommonStockMember2022-03-172022-03-170001703644us-gaap:CommonStockMember2021-12-162021-12-160001703644us-gaap:CommonStockMember2021-09-152021-09-150001703644us-gaap:CommonStockMember2021-06-152021-06-150001703644us-gaap:CommonStockMember2021-03-182021-03-180001703644us-gaap:CommonStockMember2021-01-012021-06-300001703644us-gaap:CommonStockMember2020-12-182020-12-180001703644us-gaap:CommonStockMember2020-09-282020-09-280001703644us-gaap:CommonStockMember2020-01-012020-06-3000017036442021-12-160001703644gpmt:ShareRepurchaseProgramMember2022-04-012022-06-300001703644gpmt:ShareRepurchaseProgramMember2022-01-012022-06-300001703644gpmt:ShareRepurchaseProgramMember2021-04-012021-06-300001703644gpmt:ShareRepurchaseProgramMember2021-01-012021-06-300001703644gpmt:RepurchasedSharesFromEmployeesMember2022-01-012022-06-300001703644gpmt:RepurchasedSharesFromEmployeesMember2021-01-012021-06-300001703644gpmt:RepurchasedSharesFromEmployeesMember2021-04-012021-06-300001703644gpmt:RepurchasedSharesFromEmployeesMember2022-04-012022-06-300001703644us-gaap:PreferredStockMember2022-06-162022-06-160001703644us-gaap:PreferredStockMember2022-03-172022-03-170001703644us-gaap:PreferredStockMember2021-12-162021-12-160001703644gpmt:A2022PlanMember2022-06-300001703644gpmt:A2017PlanMember2022-06-300001703644us-gaap:RestrictedStockMember2022-06-300001703644us-gaap:RestrictedStockMember2022-01-012022-06-300001703644us-gaap:RestrictedStockMember2022-04-012022-06-300001703644us-gaap:RestrictedStockMember2021-04-012021-06-300001703644us-gaap:RestrictedStockMember2021-01-012021-06-300001703644us-gaap:RestrictedStockUnitsRSUMember2022-06-300001703644us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-06-300001703644us-gaap:RestrictedStockUnitsRSUMember2022-04-012022-06-300001703644us-gaap:RestrictedStockUnitsRSUMember2021-04-012021-06-300001703644us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-06-300001703644us-gaap:PhantomShareUnitsPSUsMember2022-01-012022-06-300001703644us-gaap:PhantomShareUnitsPSUsMembersrt:MinimumMember2022-01-012022-06-300001703644srt:MaximumMemberus-gaap:PhantomShareUnitsPSUsMember2022-01-012022-06-300001703644us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:PhantomShareUnitsPSUsMember2022-01-012022-06-300001703644us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:PhantomShareUnitsPSUsMember2022-01-012022-06-300001703644us-gaap:PhantomShareUnitsPSUsMember2022-06-300001703644us-gaap:PhantomShareUnitsPSUsMember2022-04-012022-06-300001703644us-gaap:PhantomShareUnitsPSUsMember2021-01-012021-06-300001703644us-gaap:PhantomShareUnitsPSUsMember2021-04-012021-06-300001703644us-gaap:RestrictedStockMember2021-12-310001703644us-gaap:RestrictedStockUnitsRSUMember2021-12-310001703644us-gaap:PhantomShareUnitsPSUsMember2021-12-310001703644us-gaap:RestrictedStockMember2022-01-012022-03-310001703644us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-03-310001703644us-gaap:PhantomShareUnitsPSUsMember2022-01-012022-03-310001703644us-gaap:RestrictedStockMember2022-03-310001703644us-gaap:RestrictedStockUnitsRSUMember2022-03-310001703644us-gaap:PhantomShareUnitsPSUsMember2022-03-310001703644gpmt:YearOneMemberus-gaap:RestrictedStockMember2022-01-012022-06-300001703644gpmt:YearOneMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-06-300001703644gpmt:YearOneMemberus-gaap:PhantomShareUnitsPSUsMember2022-01-012022-06-300001703644gpmt:YearOneMember2022-01-012022-06-300001703644us-gaap:RestrictedStockMembergpmt:YearTwoMember2022-01-012022-06-300001703644gpmt:YearTwoMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-06-300001703644us-gaap:PhantomShareUnitsPSUsMembergpmt:YearTwoMember2022-01-012022-06-300001703644gpmt:YearTwoMember2022-01-012022-06-300001703644us-gaap:RestrictedStockMembergpmt:YearThreeMember2022-01-012022-06-300001703644gpmt:YearThreeMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-06-300001703644us-gaap:PhantomShareUnitsPSUsMembergpmt:YearThreeMember2022-01-012022-06-300001703644gpmt:YearThreeMember2022-01-012022-06-300001703644us-gaap:RestrictedStockMembergpmt:YearFourMember2022-01-012022-06-300001703644us-gaap:RestrictedStockUnitsRSUMembergpmt:YearFourMember2022-01-012022-06-300001703644us-gaap:PhantomShareUnitsPSUsMembergpmt:YearFourMember2022-01-012022-06-300001703644gpmt:YearFourMember2022-01-012022-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2022

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-38124

GRANITE POINT MORTGAGE TRUST INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Maryland | | 61-1843143 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | |

3 Bryant Park, Suite 2400A | | |

| New York, | New York | | 10036 |

| (Address of principal executive offices) | | (Zip Code) |

(212) 364-5500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | GPMT | | NYSE |

| 7.00% Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock, par value $0.01 per share | | GPMTPrA | | NYSE |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

As of August 4, 2022, there were 52,350,989 shares of outstanding common stock, par value $0.01 per share, issued and outstanding.

GRANITE POINT MORTGAGE TRUST INC.

INDEX

| | | | | | | | |

| | Page |

| PART I - FINANCIAL INFORMATION | |

Item 1. | Financial Statements (unaudited) | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| PART II - OTHER INFORMATION | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements (unaudited)

GRANITE POINT MORTGAGE TRUST INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

| | | | | | | | | | | |

| June 30,

2022 | | December 31,

2021 |

| ASSETS | | | |

| Loans held-for-investment | $ | 3,877,294 | | | $ | 3,782,205 | |

| Allowance for credit losses | (47,280) | | | (40,897) | |

| Loans held-for-investment, net | 3,830,014 | | | 3,741,308 | |

| | | |

| | | |

| Cash and cash equivalents | 150,192 | | | 191,931 | |

| Restricted cash | 69,492 | | | 12,362 | |

| Accrued interest receivable | 11,455 | | | 10,716 | |

| | | |

| | | |

| | | |

| Other assets | 35,893 | | | 32,201 | |

Total Assets (1) | $ | 4,097,046 | | | $ | 3,988,518 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Liabilities | | | |

| Repurchase facilities | $ | 1,271,659 | | | $ | 677,285 | |

| Securitized debt obligations | 1,425,556 | | | 1,677,619 | |

| Asset-specific financings | 43,622 | | | 43,622 | |

| Term financing facility | — | | | 127,145 | |

| Convertible senior notes | 273,822 | | | 272,942 | |

| | | |

| | | |

| Senior secured term loan facilities | — | | | 139,880 | |

| Dividends payable | 17,008 | | | 14,406 | |

| Other liabilities | 20,545 | | | 21,436 | |

Total Liabilities (1) | 3,052,212 | | | 2,974,335 | |

| Commitments and Contingencies (see Note 10) | | | |

10.00% cumulative redeemable preferred stock, par value $0.01 per share; 50,000,000 shares authorized, and 1,000 shares issued and outstanding ($1,000,000 liquidation preference) | 1,000 | | | 1,000 | |

| Stockholders’ Equity | | | |

7.00% Series A cumulative redeemable preferred stock, par value $0.01 per share; 8,280,000 shares authorized, and 8,229,500 and 4,596,500 shares issued and outstanding, respectively; liquidation preference $25.00 per share | 82 | | | 46 | |

Common stock, par value $0.01 per share; 450,000,000 shares authorized, and 52,350,989 and 53,789,465 shares issued and outstanding, respectively | 524 | | | 538 | |

| Additional paid-in capital | 1,199,367 | | | 1,125,241 | |

| Cumulative earnings | 162,423 | | | 171,518 | |

| Cumulative distributions to stockholders | (318,687) | | | (284,285) | |

| Total Granite Point Mortgage Trust Inc. Stockholders’ Equity | 1,043,709 | | | 1,013,058 | |

| Non-controlling interests | 125 | | | 125 | |

| Total Equity | $ | 1,043,834 | | | $ | 1,013,183 | |

| Total Liabilities and Stockholders’ Equity | $ | 4,097,046 | | | $ | 3,988,518 | |

____________________

(1)The condensed consolidated balance sheets include assets of consolidated variable interest entities, or VIEs, that can only be used to settle obligations of these VIEs, and liabilities of the consolidated VIEs for which creditors do not have recourse to Granite Point Mortgage Trust Inc. At June 30, 2022, and December 31, 2021, assets of the VIEs totaled $1,851,063 and $2,266,044, respectively, and liabilities of the VIEs totaled $1,426,954 and $1,679,435, respectively. See Note 4 - Variable Interest Entities and Securitized Debt Obligations for additional information.

The accompanying notes are an integral part of these condensed consolidated financial statements.

GRANITE POINT MORTGAGE TRUST INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME

(in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30, | | June 30, |

| | 2022 | | 2021 | | 2022 | | 2021 | | |

| Interest income: | | | |

| Loans held-for-investment | $ | 49,056 | | | $ | 49,350 | | | $ | 96,354 | | | $ | 103,389 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Cash and cash equivalents | 223 | | | 103 | | | 246 | | | 203 | | | |

| Total interest income | 49,279 | | | 49,453 | | | 96,600 | | | 103,592 | | | |

| Interest expense: | | | | | | | | | |

| Repurchase facilities | 10,380 | | | 6,047 | | | 15,388 | | | 14,998 | | | |

| Securitized debt obligations | 10,844 | | | 7,129 | | | 20,576 | | | 11,746 | | | |

| Convertible senior notes | 4,572 | | | 4,544 | | | 9,118 | | | 9,062 | | | |

| Term financing facility | 340 | | | 2,633 | | | 1,713 | | | 4,755 | | | |

| Asset-specific financings | 322 | | | 668 | | | 604 | | | 1,545 | | | |

| | | | | | | | | | |

| Senior secured term loan facilities | 886 | | | 5,653 | | | 3,754 | | | 10,933 | | | |

| Total interest expense | 27,344 | | | 26,674 | | | 51,153 | | | 53,039 | | | |

| Net interest income | 21,935 | | | 22,779 | | | 45,447 | | | 50,553 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Other (loss) income: | | | | | | | | | |

| (Provision for) benefit from credit losses | (13,627) | | | 193 | | | (17,315) | | | 9,312 | | | |

| Loss on extinguishment of debt | (13,032) | | | — | | | (18,823) | | | — | | | |

| | | | | | | | | | |

| Fee income | 461 | | | — | | | 954 | | | — | | | |

| | | | | | | | | | |

| Total other (loss) income | (26,198) | | | 193 | | | (35,184) | | | 9,312 | | | |

| Expenses: | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Compensation and benefits | 5,770 | | | 5,017 | | | 11,586 | | | 10,477 | | | |

| Servicing expenses | 1,500 | | | 1,124 | | | 2,961 | | | 2,440 | | | |

| Other operating expenses | 2,185 | | | 2,564 | | | 4,799 | | | 4,691 | | | |

| | | | | | | | | | |

| Total expenses | 9,455 | | | 8,705 | | | 19,346 | | | 17,608 | | | |

| (Loss) income before income taxes | (13,718) | | | 14,267 | | | (9,083) | | | 42,257 | | | |

| Provision for (benefit from) income taxes | 13 | | | (2) | | | 12 | | | (3) | | | |

| Net (loss) income | (13,731) | | | 14,269 | | | (9,095) | | | 42,260 | | | |

| Dividends on preferred stock | 3,625 | | | 25 | | | 7,250 | | | 50 | | | |

| Net (loss) income attributable to common stockholders | $ | (17,356) | | | $ | 14,244 | | | $ | (16,345) | | | $ | 42,210 | | | |

| Basic (loss) earnings per weighted average common share | $ | (0.32) | | | $ | 0.26 | | | $ | (0.30) | | | $ | 0.77 | | | |

| Diluted (loss) earnings per weighted average common share | $ | (0.32) | | | $ | 0.24 | | | $ | (0.30) | | | $ | 0.71 | | | |

| | | | | | | | | | |

| Weighted average number of shares of common stock outstanding: | | | | | | | | | |

| Basic | 53,512,005 | | | 55,009,732 | | | 53,683,575 | | | 55,073,317 | | | |

| Diluted | 53,512,005 | | | 58,526,985 | | | 53,683,575 | | | 72,564,914 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Comprehensive (loss) income | $ | (17,356) | | | $ | 14,244 | | | $ | (16,345) | | | $ | 42,210 | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

GRANITE POINT MORTGAGE TRUST INC

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Preferred Stock | | | | | | | | | | | | | | |

| Shares | | Amount | | Shares | | Amount | | Additional Paid-in Capital | | | | Cumulative Earnings | | Cumulative Distributions to Stockholders | | Total Stockholders’ Equity | | Non-controlling Interests | | Total Equity |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2020 | 55,205,082 | | | 552 | | | — | | | — | | | 1,058,298 | | | | | 103,165 | | | (228,169) | | | 933,846 | | | — | | | 933,846 | |

| Net income | — | | | — | | | — | | | — | | | — | | | | | 27,991 | | | — | | | 27,991 | | | — | | | 27,991 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Restricted stock forfeiture | (97,425) | | | (1) | | | — | | | — | | | (918) | | | | | — | | | — | | | (919) | | | — | | | (919) | |

| | | | | | | | | | | | | | | | | | | | | |

Preferred dividends declared, $25.00 per share | — | | | — | | | — | | | — | | | — | | | | | — | | | (25) | | | (25) | | | — | | | (25) | |

| | | | | | | | | | | | | | | | | | | | | |

Common dividends declared, $0.25 per share | — | | | — | | | — | | | — | | | — | | | | | — | | | (14,008) | | | (14,008) | | | — | | | (14,008) | |

| | | | | | | | | | | | | | | | | | | | | |

| Contributions from non-controlling interests | — | | | — | | | — | | | — | | | — | | | | | — | | | — | | | — | | | 125 | | | 125 | |

| Non-cash equity award compensation | — | | | — | | | — | | | — | | | 1,887 | | | | | — | | | — | | | 1,887 | | | — | | | 1,887 | |

| Balance, March 31, 2021 | 55,107,657 | | | 551 | | | — | | | — | | | 1,059,267 | | | | | 131,156 | | | (242,202) | | | 948,772 | | | 125 | | | 948,897 | |

| Net income | — | | | — | | | — | | | — | | | — | | | | | 14,269 | | | — | | | 14,269 | | | — | | | 14,269 | |

| Restricted stock forfeiture | (17,628) | | | — | | | — | | | — | | | (275) | | | | | — | | | — | | | (275) | | | — | | | (275) | |

| Repurchase of common stock | (300,891) | | | (3) | | | — | | | — | | | (4,267) | | | | | — | | | — | | | (4,270) | | | — | | | (4,270) | |

Preferred dividends declared, $25.00 per share | — | | | — | | | — | | | — | | | — | | | | | — | | | (25) | | | (25) | | | — | | | (25) | |

Common dividends declared, $0.25 per share | — | | | — | | | — | | | — | | | — | | | | | — | | | (13,939) | | | (13,939) | | | — | | | (13,939) | |

| | | | | | | | | | | | | | | | | | | | | |

| Non-cash equity award compensation | 1,048 | | | — | | | — | | | — | | | 1,639 | | | | | — | | | — | | | 1,639 | | | — | | | 1,639 | |

| Balance, June 30, 2021 | 54,790,186 | | | 548 | | | — | | | — | | | 1,056,364 | | | | | 145,425 | | | (256,166) | | | 946,171 | | | 125 | | | 946,296 | |

| | | | | | | | | | | | | | | | | | | | | |

GRANITE POINT MORTGAGE TRUST INC

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(in thousands, except share data) (Continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Preferred Stock | | | | | | | | | | | | | | |

| Shares | | Amount | | Shares | | Amount | | Additional Paid-in Capital | | | | Cumulative Earnings | | Cumulative Distributions to Stockholders | | Total Stockholders’ Equity | | Non-controlling Interests | | Total Equity |

| | | | | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2021 | 53,789,465 | | | 538 | | | 4,596,500 | | | 46 | | | 1,125,241 | | | | | 171,518 | | | (284,285) | | | 1,013,058 | | | 125 | | | 1,013,183 | |

| Net income | — | | | — | | | — | | | — | | | — | | | | | 4,636 | | | — | | | 4,636 | | | — | | | 4,636 | |

| | | | | | | | | | | | | | | | | | | | | |

| Issuance of preferred stock, net of offering costs | — | | | | | 3,633,000 | | | 36 | | | 87,485 | | | | | — | | | — | | | 87,521 | | | — | | | 87,521 | |

| Restricted stock forfeiture | (69,039) | | | — | | | — | | | — | | | (824) | | | | | — | | | — | | | (824) | | | — | | | (824) | |

| Restricted Stock Unit (RSU) forfeiture | — | | | — | | | — | | | — | | | (798) | | | | | — | | | — | | | (798) | | | — | | | (798) | |

Preferred dividends declared, $25.00 per share | — | | | — | | | — | | | — | | | — | | | | | — | | | (25) | | | (25) | | | — | | | (25) | |

Preferred dividends declared, $0.4375 per share | — | | | — | | | — | | | — | | | — | | | | | — | | | (3,600) | | | (3,600) | | | — | | | (3,600) | |

Common dividends declared, $0.25 per share | — | | | — | | | — | | | — | | | — | | | | | — | | | (13,770) | | | (13,770) | | | — | | | (13,770) | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Non-cash equity award compensation | 135,151 | | | 1 | | | — | | | — | | | 2,170 | | | | | — | | | — | | | 2,171 | | | — | | | 2,171 | |

| Balance, March 31, 2022 | 53,855,577 | | | 539 | | | 8,229,500 | | | 82 | | | 1,213,274 | | | | | 176,154 | | | (301,680) | | | 1,088,369 | | | 125 | | | 1,088,494 | |

| Net (loss) income | — | | | — | | | — | | | — | | | — | | | | | (13,731) | | | — | | | (13,731) | | | — | | | (13,731) | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Repurchase of common stock | (1,539,134) | | | (15) | | | — | | | — | | | (15,699) | | | | | — | | | — | | | (15,714) | | | — | | | (15,714) | |

| Restricted Stock Unit (RSU) forfeiture | — | | | — | | | — | | | — | | | (114) | | | | | — | | | — | | | (114) | | | — | | | (114) | |

Preferred dividends declared, $25.00 per share | — | | | — | | | — | | | — | | | — | | | | | — | | | (25) | | | (25) | | | — | | | (25) | |

Preferred dividends declared, $0.4375 per share | — | | | — | | | — | | | — | | | — | | | | | — | | | (3,600) | | | (3,600) | | | — | | | (3,600) | |

Common dividends declared, $0.25 per share | — | | | — | | | — | | | — | | | — | | | | | — | | | (13,382) | | | (13,382) | | | — | | | (13,382) | |

| Non-cash equity award compensation | 34,546 | | | — | | | — | | | — | | | 1,906 | | | | | — | | | — | | | 1,906 | | | — | | | 1,906 | |

| Balance, June 30, 2022 | 52,350,989 | | | 524 | | | 8,229,500 | | | 82 | | | 1,199,367 | | | | | 162,423 | | | (318,687) | | | 1,043,709 | | | 125 | | | 1,043,834 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

GRANITE POINT MORTGAGE TRUST INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) | | | | | | | | | | | | | | |

| | Six Months Ended |

| | June 30, |

| | 2022 | | 2021 | | |

| Cash Flows From Operating Activities: | | | |

| Net (loss) income | $ | (9,095) | | | $ | 42,260 | | | |

| Adjustments to reconcile net (loss) income to net cash provided by operating activities: | | | | | |

| Accretion of discounts and net deferred fees on loans held-for-investment and deferred interest capitalized to loans held-for-investment | (7,907) | | | (16,652) | | | |

| Amortization of deferred debt issuance costs | 7,520 | | | 5,636 | | | |

| Provision for (benefit from) credit losses | 17,315 | | | (9,312) | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Loss on extinguishment of debt | 11,307 | | | — | | | |

| Amortization of equity-based compensation | 4,077 | | | 3,526 | | | |

| Proceeds received from deferred interest capitalized to loans held-for-investment | 2,407 | | | — | | | |

| Net change in assets and liabilities: | | | | | |

| (Increase) decrease in accrued interest receivable | (739) | | | 2,239 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Decrease in other assets | 121 | | | 1,355 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Increase (decrease) in other liabilities | (2,226) | | | 1,670 | | | |

| | | | | | |

| Net cash provided by operating activities | 22,780 | | | 30,722 | | | |

| Cash Flows From Investing Activities: | | | | | |

| Originations, acquisitions and additional fundings of loans held-for-investment, net of deferred fees | (379,493) | | | (228,750) | | | |

| Proceeds from loan sales | 43,714 | | | — | | | |

| Proceeds from repayment of loans held-for-investment | 236,594 | | | 524,557 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Increase in other assets, due from servicer on repayments of loans held-for-investment | (689) | | | — | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Net cash (used in) provided by investing activities | (99,874) | | | 295,807 | | | |

| | | | | | |

| Cash Flows From Financing Activities: | | | | | |

| Proceeds from repurchase facilities | 677,175 | | | 82,931 | | | |

| Principal payments on repurchase facilities | (82,801) | | | (1,074,611) | | | |

| Proceeds from issuance of securitized debt obligations | — | | | 685,766 | | | |

| Principal payments on securitized debt obligations | (255,117) | | | (162,366) | | | |

| | | | | | |

| Repayment of senior secured term loan facilities | (150,000) | | | — | | | |

| | | | | | |

| Repayment of asset-specific financings | — | | | (40,323) | | | |

| | | | | | |

| | | | | | |

| Proceeds from term financing facility | — | | | 349,291 | | | |

| Repayment of term financing facility | (129,099) | | | (204,606) | | | |

| | | | | | |

| | | | | | |

| Payment of debt issuance costs | (5,943) | | | (8,353) | | | |

| | | | | | |

| Contributions from non-controlling interests | — | | | 125 | | | |

| | | | | | |

| Proceeds from issuance of preferred stock, net of offering costs | 87,521 | | | — | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Tax withholding on restricted stock and RSUs | (1,736) | | | (1,194) | | | |

| Repurchase of common stock | (15,714) | | | (4,270) | | | |

| Dividends paid on preferred stock | (4,343) | | | (50) | | | |

| Dividends paid on common stock | (27,458) | | | (39,032) | | | |

| Net cash provided by (used in) financing activities | 92,485 | | | (416,692) | | | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | 15,391 | | | (90,163) | | | |

| Cash, cash equivalents, and restricted cash at beginning of period | 204,293 | | | 329,193 | | | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 219,684 | | | $ | 239,030 | | | |

| Supplemental Disclosure of Cash Flow Information: | | | | | |

| Cash paid for interest | $ | 49,938 | | | $ | 53,505 | | | |

| Cash paid for taxes | $ | 420 | | | $ | 611 | | | |

| Noncash Activities: | | | | | |

| | | | | | |

| Dividends declared but not paid at end of period | $ | 17,007 | | | $ | 13,964 | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

GRANITE POINT MORTGAGE TRUST INC.

Notes to the Condensed Consolidated Financial Statements

Note 1. Organization and Operations

Granite Point Mortgage Trust Inc., or the Company, is an internally managed real estate finance company that focuses primarily on directly originating, investing in and managing senior floating-rate commercial mortgage loans and other debt and debt-like commercial real estate investments. These investments are capitalized by accessing a variety of funding sources, including borrowing under the Company’s bank credit facilities or other asset-specific financings, issuing commercial real estate collateralized loan obligations, or CRE CLOs, and issuing other forms of secured and unsecured debt and equity securities, depending on market conditions and the Company’s view of the most appropriate funding option available for the Company’s investments. The Company is not in the business of buying or trading securities, and the only securities it owns are the retained interests from its CRE CLOs. The Company’s investment objective is to preserve the Company’s stockholders’ capital while generating attractive risk-adjusted returns over the long term, primarily through dividends derived from current income produced by the Company’s investment portfolio. The Company’s common stock is listed on the New York Stock Exchange, or NYSE, under the symbol “GPMT”. The Company operates its business in a manner that is intended to permit it to maintain its exclusion from registration under the Investment Company Act of 1940, as amended, or the Investment Company Act. The Company operates its business as one segment. The Company was incorporated in Maryland on April 7, 2017, and commenced operations as a publicly traded company on June 28, 2017.

The Company has elected to be treated as a real estate investment trust, or REIT, as defined under the Internal Revenue Code of 1986, as amended, or the Code, for U.S. federal income tax purposes. As long as the Company continues to comply with a number of requirements under federal tax law and maintains its qualification as a REIT, the Company generally will not be subject to U.S. federal income taxes to the extent that the Company distributes its taxable income to its stockholders on an annual basis and does not engage in prohibited transactions. However, certain activities that the Company may perform may cause it to earn income which will not be qualifying income for REIT purposes. The Company has designated one of its subsidiaries as a taxable REIT subsidiary, or TRS, as defined in the Code, to engage in such activities.

Note 2. Basis of Presentation and Significant Accounting Policies

Consolidation and Basis of Presentation

The interim unaudited condensed consolidated financial statements of the Company have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission, or SEC. Certain information and note disclosures normally included in financial statements prepared in accordance with U.S. generally accepted accounting principles, or GAAP, have been condensed or omitted according to such SEC rules and regulations. However, management believes that the disclosures included in these interim condensed consolidated financial statements are adequate to make the information presented not misleading. The accompanying unaudited condensed consolidated financial statements should be read in conjunction with the financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021. In the opinion of management, all normal and recurring adjustments necessary to present fairly the financial condition of the Company at June 30, 2022, and results of operations for all periods presented, have been made. The results of operations for the three and six months ended June 30, 2022, should not be construed as indicative of the results to be expected for future periods or the full year.

The unaudited condensed consolidated financial statements of the Company include the accounts of all subsidiaries; inter-company accounts and transactions have been eliminated. Certain prior period amounts have been reclassified to conform to the current period presentation.

All entities in which the Company holds investments that are considered VIEs for financial reporting purposes were reviewed for consolidation under the applicable consolidation guidance. Whenever the Company has both the power to direct the activities of an entity that most significantly impact the entity’s performance, and the obligation to absorb losses or the right to receive benefits of the entity that could be significant, the Company consolidates the entity.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make a number of significant estimates. These include estimates of amount and timing of allowances for credit losses, fair value of certain assets and liabilities, and other estimates that affect the reported amounts of certain assets and liabilities as of the date of the condensed consolidated financial statements and the reported amounts of certain revenues and expenses during the reported period. It is likely that changes in these estimates (e.g., valuation changes to the underlying collateral of loans due to changes in market interest and capitalization rates, leasing, credit worthiness of major tenants, occupancy rates, availability of financing, exit plan, loan sponsorship, actions of other lenders, overall economic and capital markets conditions, the broader commercial real estate market, local geographic sub-markets or other factors) will occur in the near term.

GRANITE POINT MORTGAGE TRUST INC.

Notes to the Condensed Consolidated Financial Statements

As the novel coronavirus, or COVID-19, pandemic has evolved from its emergence in early 2020, so has its global impact, including contributing to significant volatility in financial markets. The longer-term macroeconomic effects continue to impact many industries, including those related to the collateral underlying certain of the Company’s loans. Moreover, with the potential for new strains of COVID-19 to emerge, governments and businesses may re-impose aggressive measures to help slow its spread in the future. For this reason, among others, as the COVID-19 pandemic continues, the potential global impacts are uncertain and difficult to assess. In addition, the pandemic continues to disrupt global supply chains and cause labor shortages and has added to broad inflationary pressures, all of which could negatively impact the Company’s borrowers’ ability to execute on the business plans on their properties and potentially affect their ability to perform under the terms of their loan agreements. In response to the inflationary pressures, the Federal Reserve has begun raising interest rates and has indicated it anticipates further interest rate increases. Such increases in interest rates may increase the Company’s interest expense, which may not be fully offset by any increases in interest income, and may also slow the pace of loan repayments and increase the number of borrowers who seek extension of term on their loans.

The Company believes the estimates and assumptions underlying its condensed consolidated financial statements are reasonable and supportable based on the information available as of June 30, 2022. However, uncertainty over the ultimate impact COVID-19, Federal Reserve actions and geopolitical uncertainty will have on the global and U.S. economies generally, and the Company’s business in particular, makes any estimates and assumptions as of June 30, 2022, inherently less certain than they would be absent the current and potential impacts of these factors. The Company’s actual results could ultimately differ from its estimates and such differences may be material.

Significant Accounting Policies

Included in Note 2 to the Consolidated Financial Statements of the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, is a summary of the Company’s significant accounting policies. Provided below is a summary of additional accounting policies that are significant to the Company’s condensed consolidated financial condition and results of operations for the three and six months ended June 30, 2022.

Recently Issued and/or Adopted Accounting Standards

Financial Instruments-Credit Losses (Topic 326): Troubled Debt Restructurings and Vintage Disclosures

In March 2022, the Financial Accounting Standards Board, or FASB, issued ASU 2022-02, Financial Instruments – Credit Losses (Topic 326): Troubled Debt Restructurings and Vintage Disclosures, or ASU 2022-02. The intention of ASU 2022-02 is to simplify the guidance surrounding loan modifications and restructurings and to eliminate the accounting guidance related to troubled debt restructurings, or TDR. The new guidance deviates from TDR guidance as disclosures are now based on whether a modification or restructuring with a borrower experiencing financial difficulty results in principal forgiveness, an interest rate reduction, a significant payment delay or term extension as opposed to simply a concession. The new guidance requires disclosure by class of financing receivables, of the types of modifications, the financial effects of those modifications and the performance of those modified receivables in the last twelve months. As it relates to ASC 326-20 the Company is now allowed to use any acceptable method to determine credit losses as a result of modification or restructuring with a borrower experiencing financial difficulty. ASU 2022-02 also requires disclosure of gross write-offs recorded in the current period, on a year-to-date basis, by year of origination in the vintage disclosures. ASU 2022-02 is effective for fiscal years beginning after December 15, 2022. Entities are able to early adopt these amendments and have the ability to early adopt the TDR enhancements separately from the vintage disclosures. The Company has not yet adopted this ASU and will continue to evaluate the effects of adoption.

Facilitation of the Effects of Reference Rate Reform on Financial Reporting

In March 2020, FASB issued ASU No. 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting, or ASU No. 2020-04, which provides optional expedients and exceptions for applying GAAP to debt instruments, derivatives, and other contracts that reference the London Interbank Offered Rate, or LIBOR, or other reference rates expected to be discontinued as a result of reference rate reform. This guidance is optional and may be elected through December 31, 2022, using a prospective application on all eligible contract modifications. The Company has loan agreements and debt agreements that incorporate LIBOR as a referenced interest rate. It is difficult to predict what effect, if any, the phase-out of LIBOR and the use of alternative benchmarks may have on the Company’s business or on the overall financial markets. The Company has not adopted any of the optional expedients or exceptions through June 30, 2022, but will continue to evaluate the possible adoption of any such expedients or exceptions.

GRANITE POINT MORTGAGE TRUST INC.

Notes to the Condensed Consolidated Financial Statements

Note 3. Loans Held-for-Investment, Net of Allowance for Credit Losses

The Company originates and acquires commercial real estate debt and related instruments generally to be held as long-term investments. These assets are classified as “loans held-for-investment” on the condensed consolidated balance sheets. Loans held-for-investment are reported at cost, net of any unamortized acquisition premiums or discounts, loan fees, origination costs and allowance for credit losses, as applicable.

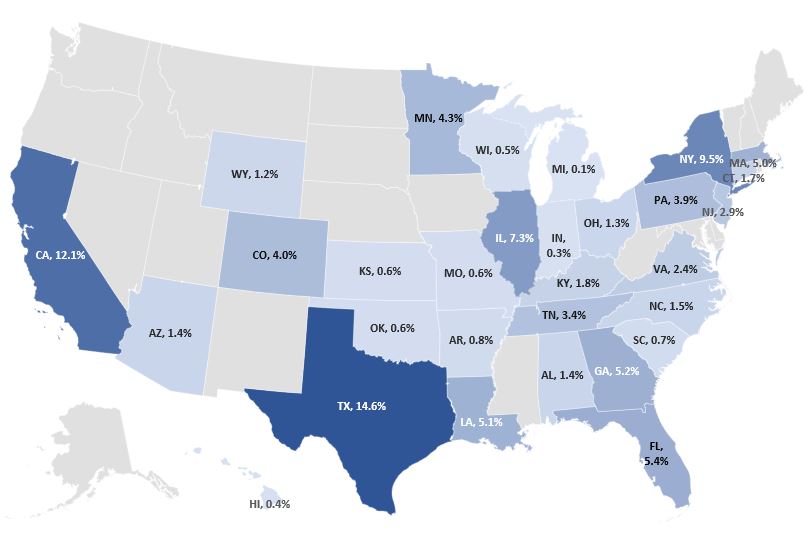

The following tables summarize the Company’s loans held-for-investment by asset type, property type and geographic location as of June 30, 2022, and December 31, 2021:

| | | | | | | | | | | | | | | | | | | | | | | |

| June 30,

2022 |

| (dollars in thousands) | Senior Loans (1) | | Mezzanine Loans | | B-Notes | | Total |

| Unpaid principal balance | $ | 3,875,237 | | | $ | 356 | | | $ | 13,886 | | | $ | 3,889,479 | |

Unamortized (discount) premium | (55) | | | — | | | — | | | (55) | |

Unamortized net deferred origination fees | (12,130) | | | — | | | — | | | (12,130) | |

| Allowance for credit losses | (46,188) | | | (356) | | | (736) | | | (47,280) | |

| Carrying value | $ | 3,816,864 | | | $ | — | | | $ | 13,150 | | | $ | 3,830,014 | |

| Unfunded commitments | $ | 358,705 | | | $ | — | | | $ | — | | | $ | 358,705 | |

| Number of loans | 102 | | | 1 | | | 1 | | | 104 | |

| Weighted average coupon | 4.6 | % | | 13.0 | % | | 8.0 | % | | 4.6 | % |

Weighted average years to maturity (2) | 1.0 | | 3.4 | | 4.6 | | 1.0 |

| | | | | | | | | | | | | | | | | | | | | | | |

| December 31,

2021 |

| (dollars in thousands) | Senior Loans (1) | | Mezzanine Loans | | B-Notes | | Total |

| Unpaid principal balance | $ | 3,781,771 | | | $ | 1,048 | | | $ | 14,006 | | | $ | 3,796,825 | |

Unamortized (discount) premium | (70) | | | — | | | — | | | (70) | |

Unamortized net deferred origination fees | (14,550) | | | — | | | — | | | (14,550) | |

| Allowance for credit losses | (38,719) | | | (1,048) | | | (1,130) | | | (40,897) | |

| Carrying value | $ | 3,728,432 | | | $ | — | | | $ | 12,876 | | | $ | 3,741,308 | |

| Unfunded commitments | $ | 403,584 | | | $ | — | | | $ | — | | | $ | 403,584 | |

| Number of loans | 103 | | | 1 | | | 1 | | | 105 | |

| Weighted average coupon | 4.5 | % | | 13.0 | % | | 8.0 | % | | 4.5 | % |

Weighted average years to maturity (2) | 1.1 | | 3.9 | | 5.1 | | 1.1 |

____________________

(1)Loans primarily secured by a first priority lien on commercial real property and related personal property and also includes, when applicable, any companion subordinate loans.

(2)Based on contractual maturity date. Certain loans are subject to contractual extension options with such conditions stipulated in the applicable loan documents. Actual maturities may differ from contractual maturities stated herein as certain borrowers may have the right to prepay with or without paying a prepayment fee. The Company may also extend contractual maturities in connection with certain loan modifications.

GRANITE POINT MORTGAGE TRUST INC.

Notes to the Condensed Consolidated Financial Statements

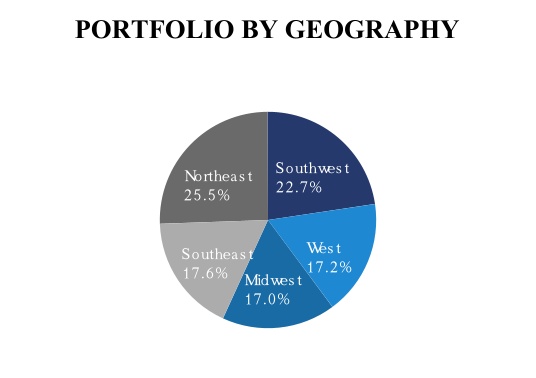

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | | June 30,

2022 | | December 31,

2021 |

| Property Type | | Carrying Value | | % of Loan Portfolio | | Carrying Value | | % of Loan Portfolio |

| Office | | $ | 1,663,577 | | | 43.4 | % | | $ | 1,703,951 | | | 45.5 | % |

| Multifamily | | 1,090,106 | | | 28.5 | % | | 1,061,434 | | | 28.4 | % |

| Hotel | | 460,432 | | | 12.0 | % | | 464,816 | | | 12.4 | % |

| Retail | | 347,287 | | | 9.1 | % | | 341,834 | | | 9.1 | % |

| Industrial | | 181,871 | | | 4.7 | % | | 118,564 | | | 3.2 | % |

| Other | | 86,741 | | | 2.3 | % | | 50,709 | | | 1.4 | % |

| Total | | $ | 3,830,014 | | | 100.0 | % | | $ | 3,741,308 | | | 100.0 | % |

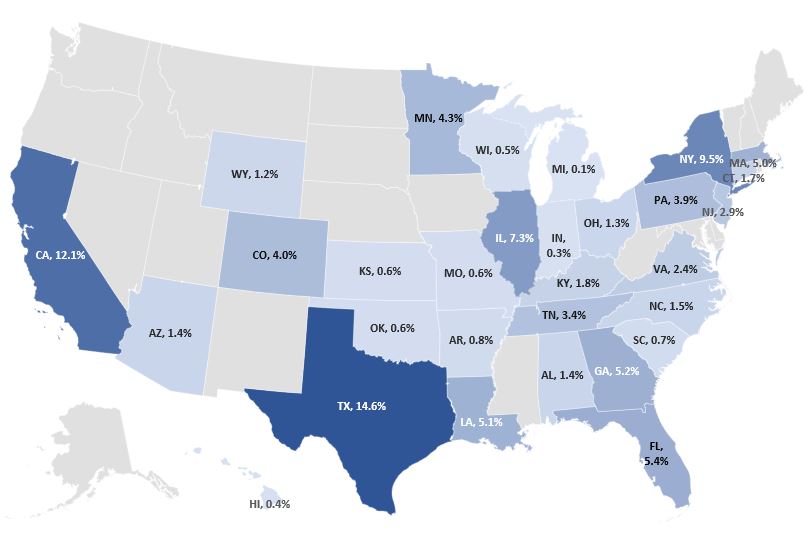

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | | June 30,

2022 | | December 31,

2021 |

| Geographic Location | | Carrying Value | | % of Loan Portfolio | | Carrying Value | | % of Loan Portfolio |

| Northeast | | $ | 976,965 | | | 25.5 | % | | $ | 917,029 | | | 24.5 | % |

| Southwest | | 869,316 | | | 22.7 | % | | 836,955 | | | 22.4 | % |

| West | | 660,173 | | | 17.2 | % | | 658,429 | | | 17.6 | % |

| Midwest | | 649,233 | | | 17.0 | % | | 637,784 | | | 17.0 | % |

| Southeast | | 674,327 | | | 17.6 | % | | 691,111 | | | 18.5 | % |

| | | | | | | | |

| Total | | $ | 3,830,014 | | | 100.0 | % | | $ | 3,741,308 | | | 100.0 | % |

At June 30, 2022, and December 31, 2021, the Company pledged loans held-for-investment with a carrying value, net of allowance for credit losses, of $3.6 billion and $3.7 billion, respectively, as collateral under repurchase facilities, a term financing facility, an asset-specific financing facility and securitized debt obligations. See Note 4 - Variable Interest Entities and Securitized Debt Obligations and Note 5 - Secured Financing Agreements.

The following table summarizes activity related to loans held-for-investment, net of allowance for credit losses, for the three and six months ended June 30, 2022, and 2021:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| (in thousands) | 2022 | | 2021 | | 2022 | | 2021 | | |

| Balance at beginning of period | $ | 3,750,470 | | | $ | 3,799,836 | | | $ | 3,741,308 | | | $ | 3,847,803 | | | |

| Originations, additional fundings, upsizing of loans and capitalized deferred interest | 212,245 | | | 197,838 | | | 385,110 | | | 239,615 | | | |

| | | | | | | | | |

| Repayments | (120,107) | | | (422,969) | | | (238,490) | | | (524,557) | | | |

| Loan sales | — | | | — | | | (43,714) | | | — | | | |

| Net discount accretion (premium amortization) | 7 | | | 4 | | | 16 | | | 11 | | | |

| Increase in net deferred origination fees | (2,318) | | | (2,305) | | | (4,558) | | | (2,339) | | | |

| Amortization of net deferred origination fees | 2,843 | | | 3,478 | | | 6,832 | | | 8,116 | | | |

| | | | | | | | | |

| (Provision for) benefit from credit losses | (13,126) | | | 1,762 | | | (16,490) | | | 8,995 | | | |

| Balance at end of period | $ | 3,830,014 | | | $ | 3,577,644 | | | $ | 3,830,014 | | | $ | 3,577,644 | | | |

Allowance for Credit Losses

Subsequent to the adoption of ASU 2016-13 on January 1, 2020, to estimate and recognize an allowance for credit losses on loans held-for-investment and the related unfunded commitments, the Company continues to use a third-party licensed probability-weighted analytical model. The Company employs quarterly updated macroeconomic forecasts, which reflect expectations for overall economic output, interest rates, values of real estate properties and other factors, including the ongoing impacts of the COVID-19 pandemic, geopolitical instability and the Federal Reserve monetary policy on the overall U.S. economy and commercial real estate markets generally. Significant inputs to the Company’s estimate of the allowance for credit

GRANITE POINT MORTGAGE TRUST INC.

Notes to the Condensed Consolidated Financial Statements

losses include loan specific factors such as debt service coverage ratio, or DSCR, loan to value ratio, or LTV, remaining contractual loan term, property type and others. As part of the quarterly review of the portfolio, the Company assesses the expected repayment date of each loan, which is used to determine the contractual term for purposes of computing the current expected credit loss, or CECL, reserve. In certain instances, for loans with unique risk and credit characteristics, the Company may instead elect to employ different methods to estimate an allowance for credit losses that also conform to ASU 2016-13 and related guidance.

As of June 30, 2022, the Company recognized an allowance for credit losses related to its loans held-for-investment of $47.3 million, which reflects a total increase in the provision for credit losses of $13.1 million for the three months ended June 30, 2022. The increase of $13.1 million includes a $4.0 million increase in the allowance for credit losses related to an office loan with an unpaid balance of $93.8 million that was individually assessed in accordance with ASU 2016-13 during the three months ended June 30, 2022, as further discussed below. The other loan that was individually assessed during the three months ended June 30, 2022, had been previously reserved for and there was no change in the reserve during the three months ended June 30, 2022. The remaining increase in the Company’s provision for credit losses was related to changes in the portfolio mix and implementing in its analysis a more conservative macroeconomic forecast driven by an elevated uncertainty for the macroeconomic outlook due to inflationary pressures, continuing supply chain disruptions, interest rate volatility and other factors, moderately offset by a recovery of $0.5 million on amounts previously written off.

The allowance for credit losses related to the Company’s loans held-for-investment is deducted from the amortized cost basis of related loans, while the allowance for credit losses related to off-balance sheet unfunded commitments on existing loans is recorded as a component of other liabilities on the Company’s condensed consolidated balance sheets. As of June 30, 2022, the Company recognized $2.8 million in other liabilities related to the allowance for credit losses on unfunded commitments and recorded a provision for credit losses of $1.0 million for the three months ended June 30, 2022. Changes in the provision for credit losses for both loans held-for-investment and their related unfunded commitments are recognized through net (loss) income on the Company’s condensed consolidated statements of comprehensive income.

The following table presents the changes for the three and six months ended June 30, 2022, and 2021 in the allowance for credit losses on loans held-for-investment:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| (in thousands) | 2022 | | 2021 | | 2022 | | 2021 | | |

| Balance at beginning of period | $ | 34,154 | | | $ | 59,433 | | | $ | 40,897 | | | $ | 66,666 | | | |

| Provision for (benefit from) credit losses | 13,638 | | | (1,762) | | | 17,002 | | | (8,995) | | | |

| Write-off | — | | | — | | | (10,107) | | | — | | | |

| Recoveries of amounts previously written off | (512) | | | — | | | (512) | | | — | | | |

| Balance at end of period | $ | 47,280 | | | $ | 57,671 | | | $ | 47,280 | | | $ | 57,671 | | | |

During the three months ended June 30, 2022, a first mortgage loan with a principal balance of $93.8 million was downgraded to a risk rating of “5” as a result of the continued adverse impact of the COVID-19 pandemic on leasing for the collateral property, an office building in downtown San Diego, CA (see “Loan Risk Ratings” below). The Company determined that the recovery of its loan principal is collateral-dependent. Accordingly, this loan was assessed individually, and the Company has elected to apply a practical expedient in accordance with ASU 2016-13. At June 30, 2022, the Company recorded an allowance for credit loss of $4.5 million on the unpaid principal balance of this loan based on the Company’s estimate of fair value using the estimated proceeds available from the sale of the collateral property less the estimated cost to sell the property. Additionally, as of June 30, 2022, the Company placed this loan on nonaccrual status.

During the six months ended June 30, 2022, the Company resolved a senior loan that had an outstanding unpaid principal balance of $54.0 million. The loan had been previously placed on nonaccrual status. The Company recognized a write-off of $10.1 million on the sale of the loan.

Generally, loans held-for-investment are placed on nonaccrual status when delinquent for more than 90 days or earlier when determined not to be probable of full collection. Interest income recognition is suspended when loans are placed on nonaccrual status. As of June 30, 2022, the Company has two senior loans with a total unpaid principal balance of $207.9 million and carrying value of $188.8 million that are held on nonaccrual status. No other loans were considered past due, and no other loans were held on nonaccrual status as of June 30, 2022.

GRANITE POINT MORTGAGE TRUST INC.

Notes to the Condensed Consolidated Financial Statements

The following table presents the carrying value of loans held-for-investment on nonaccrual status for the three and six months ended June 30, 2022, and 2021:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| (in thousands) | 2022 | | 2021 | | 2022 | | 2021 | | | | |

| Nonaccrual loan carrying value at beginning of period | $ | 99,527 | | | $ | 19,264 | | | $ | 145,370 | | | $ | 17,835 | | | | | |

| Addition of nonaccrual loan carrying value | $ | 89,312 | | | $ | 205,851 | | | $ | 89,323 | | | $ | 207,280 | | | | | |

| Removal of nonaccrual loan carrying value | $ | — | | | $ | — | | | $ | (45,854) | | | $ | — | | | | | |

| Nonaccrual loan carrying value at end of period | $ | 188,839 | | | $ | 225,115 | | | $ | 188,839 | | | $ | 225,115 | | | | | |

Loan Risk Ratings

The Company’s primary credit quality indicators are its risk ratings. The Company evaluates the credit quality of each loan at least quarterly by assessing the risk factors of each loan and assigning a risk rating based on a variety of factors. Risk factors include property type, geographic and local market dynamics, physical condition, leasing and tenant profile, projected cash flow, loan structure and exit plan, LTV, project sponsorship and other factors deemed necessary. Risk ratings are defined as follows:

1 –Lower Risk

2 –Average Risk

3 –Acceptable Risk

4 –Higher Risk: A loan that has exhibited material deterioration in cash flows and/or other credit factors, which, if negative trends continue, could be indicative of probability of principal loss.

5 –Loss Likely: A loan that has a significantly increased probability of principal loss.

The following table presents the number of loans, unpaid principal balance and carrying value by risk rating for loans held-for-investment as of June 30, 2022, and December 31, 2021:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | | June 30,

2022 | | December 31,

2021 |

| Risk Rating | | Number of Loans | | Unpaid Principal Balance | | Carrying Value | | Number of Loans | | Unpaid Principal Balance | | Carrying Value |

| 1 | | 8 | | | $ | 292,285 | | | $ | 291,458 | | | 9 | | | $ | 245,939 | | | $ | 245,042 | |

| 2 | | 59 | | | 2,083,389 | | | 2,060,713 | | | 58 | | | 2,002,008 | | | 1,983,615 | |

| 3 | | 27 | | | 869,253 | | | 861,050 | | | 25 | | | 747,631 | | | 739,343 | |

| 4 | | 8 | | | 436,641 | | | 427,954 | | | 11 | | | 633,153 | | | 627,938 | |

| 5 | | 2 | | | 207,911 | | | 188,839 | | | 2 | | | 168,094 | | | 145,370 | |

| Total | | 104 | | | $ | 3,889,479 | | | $ | 3,830,014 | | | 105 | | | $ | 3,796,825 | | | $ | 3,741,308 | |

As of June 30, 2022, the weighted average risk rating of the Company’s portfolio was 2.5, weighted by unpaid principal balance, versus 2.5 as of March 31, 2022, and 2.6 as of December 31, 2021. The portfolio risk rating was largely unchanged versus the period ended March 31, 2022, as changes in portfolio mix from new loan originations largely offset select ratings downgrades as of June 30, 2022. The moderate improvement in the portfolio’s weighted average risk rating as of June 30, 2022, as compared to the period ended December 31, 2021, reflects originations of new loans and improvement in the performance of the properties securing select loans within the Company’s loan portfolio, which were partially offset by risk rating downgrades of several loans experiencing delays in execution of business plan for the collateral properties.

GRANITE POINT MORTGAGE TRUST INC.

Notes to the Condensed Consolidated Financial Statements

The following table presents the carrying value of loans held-for-investment as of June 30, 2022, and December 31, 2021, by risk rating and year of origination:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2022 |

| (in thousands) | | Origination Year | | |

| Risk Rating | | 2022 | | 2021 | | 2020 | | 2019 | | 2018 | | 2017 | | Prior | | Total |

| 1 | | $ | — | | | $ | — | | | $ | — | | | $ | 201,471 | | | $ | 56,873 | | | $ | — | | | $ | 33,114 | | | $ | 291,458 | |

| 2 | | $ | 296,422 | | | $ | 583,416 | | | $ | 136,674 | | | $ | 673,879 | | | $ | 269,359 | | | $ | 13,150 | | | $ | 87,813 | | | $ | 2,060,713 | |

| 3 | | $ | — | | | $ | 47,860 | | | $ | 18,250 | | | $ | 280,228 | | | $ | 270,320 | | | $ | 152,935 | | | $ | 91,457 | | | $ | 861,050 | |

| 4 | | $ | — | | | $ | — | | | $ | — | | | $ | 91,113 | | | $ | 53,083 | | | $ | 166,176 | | | $ | 117,582 | | | $ | 427,954 | |

| 5 | | $ | — | | | $ | — | | | $ | — | | | $ | 89,312 | | | $ | 99,527 | | | $ | — | | | $ | — | | | $ | 188,839 | |

| Total | | $ | 296,422 | | | $ | 631,276 | | | $ | 154,924 | | | $ | 1,336,003 | | | $ | 749,162 | | | $ | 332,261 | | | $ | 329,966 | | | $ | 3,830,014 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2021 |

| (in thousands) | | Origination Year | | |

| Risk Rating | | 2021 | | 2020 | | 2019 | | 2018 | | 2017 | | 2016 | | Prior | | Total |

| 1 | | — | | | — | | | 136,138 | | | 75,592 | | | — | | | 33,312 | | | — | | | $ | 245,042 | |

| 2 | | 623,992 | | | 90,381 | | | 828,432 | | | 347,173 | | | 12,877 | | | 31,872 | | | 48,888 | | | $ | 1,983,615 | |

| 3 | | 45,062 | | | 59,186 | | | 147,214 | | | 242,662 | | | 153,732 | | | 68,012 | | | 23,475 | | | $ | 739,343 | |

| 4 | | — | | | — | | | 260,672 | | | 74,808 | | | 173,081 | | | — | | | 119,377 | | | $ | 627,938 | |

| 5 | | — | | | — | | | — | | | 99,515 | | | 45,855 | | | — | | | — | | | $ | 145,370 | |